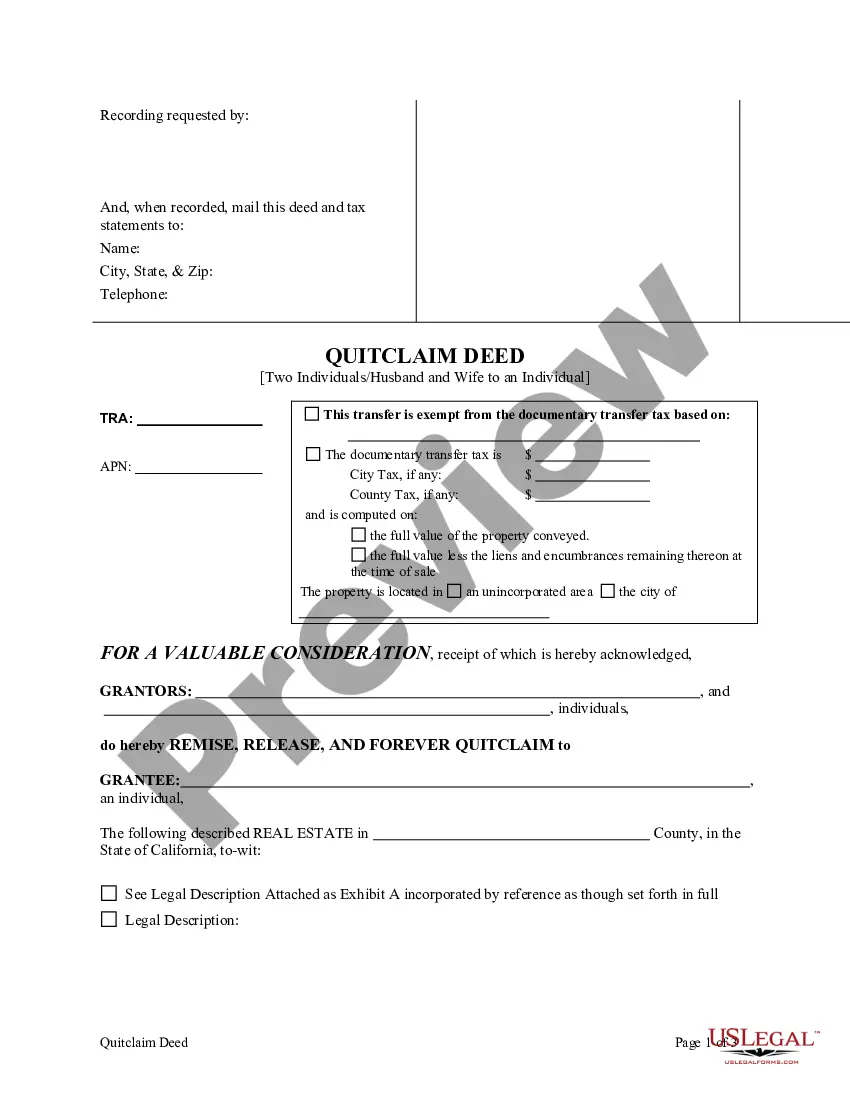

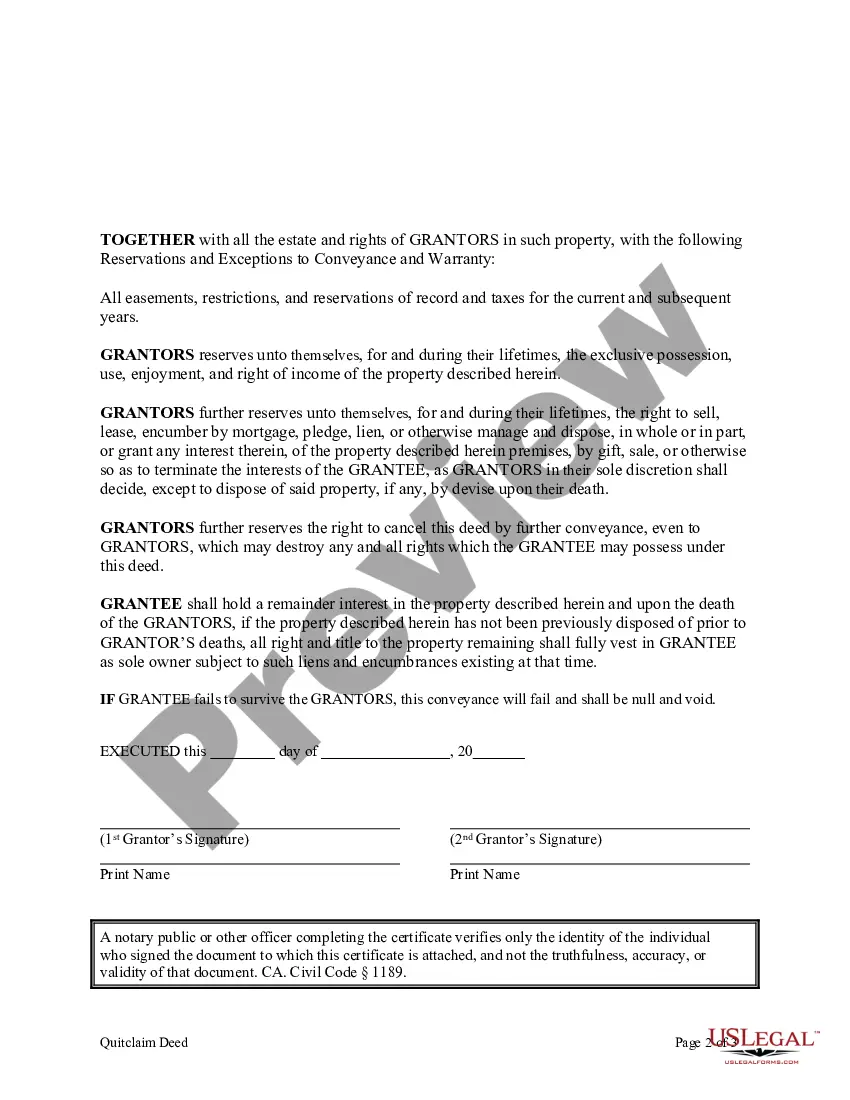

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantors are two individuals or husband and wife and the Grantee is an individual. Grantors convey the property to Grantee subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantee is required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

Alameda California Enhanced Life Estate or Lady Bird Quitclaim Deed is a legal document that allows two individuals, typically a husband and wife, to transfer their property to an individual while retaining the right to live in the property for the remainder of their lives or the life of the surviving spouse. This type of deed provides certain advantages, including avoiding probate and potential tax benefits. The Alameda California Enhanced Life Estate or Lady Bird Quitclaim Deed is also commonly referred to as a "transfer on death" deed or a "revocable transfer on death" deed. These variations of the deed allow individuals to name a beneficiary who will inherit the property after the owners' passing without the need for probate. This type of deed provides flexibility as the owners can sell or mortgage the property without the consent of the beneficiary, maintaining full control during their lifetime. It is important to note that this deed is only applicable to real estate in the Alameda County area of California. The Alameda California Enhanced Life Estate or Lady Bird Quitclaim Deed protects the individuals' ownership interests while ensuring a seamless transfer of the property to the designated beneficiary. It can be especially useful for estate planning purposes, allowing the owners to simplify the distribution of their assets and avoid potential disagreements and delays that may arise during probate. In summary, the Alameda California Enhanced Life Estate or Lady Bird Quitclaim Deed provides a streamlined method for individuals, particularly married couples, to transfer their property to an individual while retaining the right to occupy and use the property until death. This type of deed offers benefits such as avoiding probate and potential tax advantages.Alameda California Enhanced Life Estate or Lady Bird Quitclaim Deed is a legal document that allows two individuals, typically a husband and wife, to transfer their property to an individual while retaining the right to live in the property for the remainder of their lives or the life of the surviving spouse. This type of deed provides certain advantages, including avoiding probate and potential tax benefits. The Alameda California Enhanced Life Estate or Lady Bird Quitclaim Deed is also commonly referred to as a "transfer on death" deed or a "revocable transfer on death" deed. These variations of the deed allow individuals to name a beneficiary who will inherit the property after the owners' passing without the need for probate. This type of deed provides flexibility as the owners can sell or mortgage the property without the consent of the beneficiary, maintaining full control during their lifetime. It is important to note that this deed is only applicable to real estate in the Alameda County area of California. The Alameda California Enhanced Life Estate or Lady Bird Quitclaim Deed protects the individuals' ownership interests while ensuring a seamless transfer of the property to the designated beneficiary. It can be especially useful for estate planning purposes, allowing the owners to simplify the distribution of their assets and avoid potential disagreements and delays that may arise during probate. In summary, the Alameda California Enhanced Life Estate or Lady Bird Quitclaim Deed provides a streamlined method for individuals, particularly married couples, to transfer their property to an individual while retaining the right to occupy and use the property until death. This type of deed offers benefits such as avoiding probate and potential tax advantages.