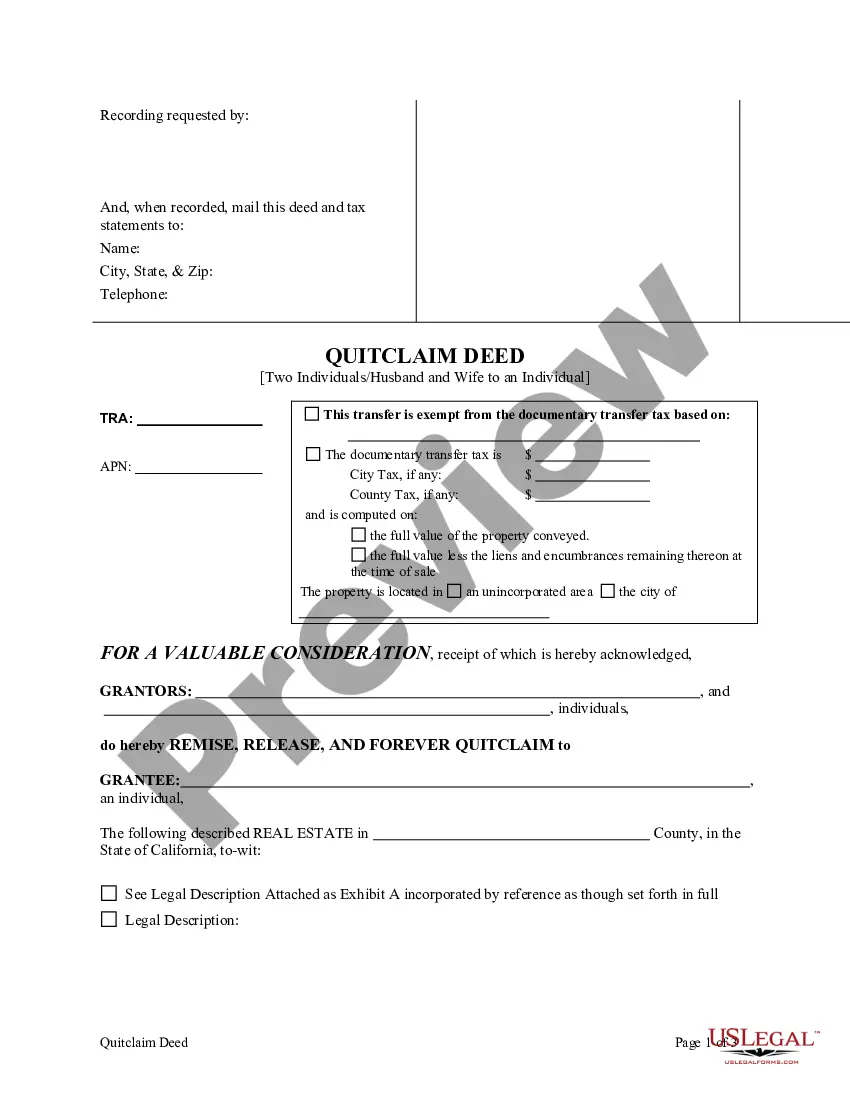

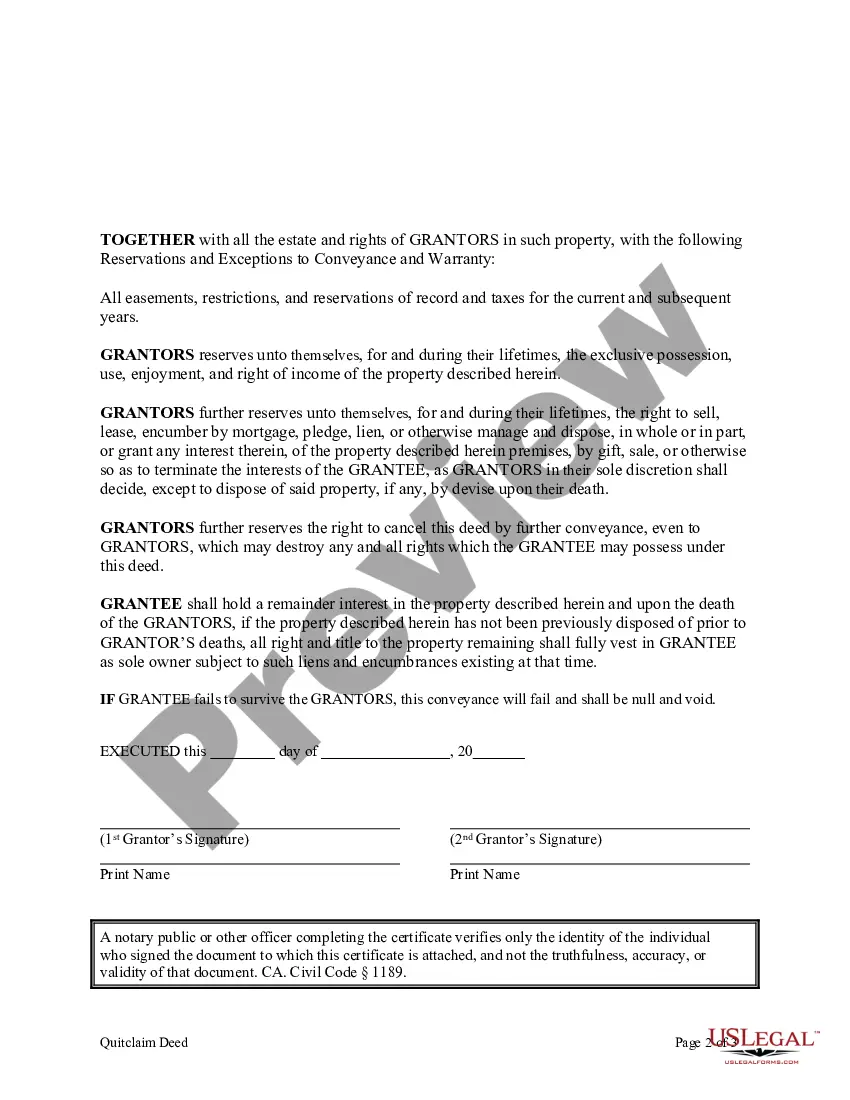

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantors are two individuals or husband and wife and the Grantee is an individual. Grantors convey the property to Grantee subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantee is required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

— Understanding Stockton California Enhanced Life Estate: The Stockton California Enhanced Life Estate is a legal arrangement that allows two individuals, specifically a husband and wife, to convey their property to another individual while retaining certain rights to the property during their lifetime. This estate planning tool, also known as the Lady Bird Quitclaim Deed, offers various advantages in terms of asset protection, avoiding probate, and maintaining control over the property. Unlike a traditional Quitclaim Deed, the Enhanced Life Estate empowers the couple to transfer their property to another person (the "grantee"), but with the unique feature of retaining a life estate interest. This means the original homeowners continue to have full access, use, and control of the property until they pass away, ensuring their comfort and security in their own home. The Enhanced Life Estate Deed is highly beneficial for those seeking to transfer property to their desired beneficiaries without the need to go through probate. By utilizing this deed, both spouses can ensure their chosen individual receives the property immediately after their passing, bypassing the potentially lengthy and costly probate process. Different Types of Stockton California Enhanced Life Estate or Lady Bird Quitclaim Deed: 1. Traditional Enhanced Life Estate Deed: This is the standard form of the Stockton California Enhanced Life Estate Deed where two individuals, typically a husband and wife, transfer their property to an individual while retaining a life estate interest. 2. Enhanced Life Estate Deed with Reserved Powers: In some cases, the couple may choose to include specific reserved powers within the Enhanced Life Estate Deed. These powers could allow the original homeowners to mortgage, sell, or lease the property during their lifetime, further optimizing their control and flexibility. 3. Enhanced Life Estate Deed with Remainder Interest: This type of Enhanced Life Estate Deed designates a specific individual as the remainder man. The remainder man gains ownership of the property only upon the passing of both original homeowners. Until then, the couple retains full rights and control over the property. 4. Joint Tenancy Enhanced Life Estate Deed: In situations where the property is jointly owned by the couple, utilizing a Joint Tenancy Enhanced Life Estate Deed ensures that the surviving spouse becomes the sole owner without the involvement of probate. By utilizing the Stockton California Enhanced Life Estate or Lady Bird Quitclaim Deed, individuals and couples can efficiently plan for the distribution of their property while retaining control over their assets during their lifetime. It is advisable to seek guidance from a qualified attorney to ensure compliance with local laws and personalize the deed according to one's specific needs and goals.— Understanding Stockton California Enhanced Life Estate: The Stockton California Enhanced Life Estate is a legal arrangement that allows two individuals, specifically a husband and wife, to convey their property to another individual while retaining certain rights to the property during their lifetime. This estate planning tool, also known as the Lady Bird Quitclaim Deed, offers various advantages in terms of asset protection, avoiding probate, and maintaining control over the property. Unlike a traditional Quitclaim Deed, the Enhanced Life Estate empowers the couple to transfer their property to another person (the "grantee"), but with the unique feature of retaining a life estate interest. This means the original homeowners continue to have full access, use, and control of the property until they pass away, ensuring their comfort and security in their own home. The Enhanced Life Estate Deed is highly beneficial for those seeking to transfer property to their desired beneficiaries without the need to go through probate. By utilizing this deed, both spouses can ensure their chosen individual receives the property immediately after their passing, bypassing the potentially lengthy and costly probate process. Different Types of Stockton California Enhanced Life Estate or Lady Bird Quitclaim Deed: 1. Traditional Enhanced Life Estate Deed: This is the standard form of the Stockton California Enhanced Life Estate Deed where two individuals, typically a husband and wife, transfer their property to an individual while retaining a life estate interest. 2. Enhanced Life Estate Deed with Reserved Powers: In some cases, the couple may choose to include specific reserved powers within the Enhanced Life Estate Deed. These powers could allow the original homeowners to mortgage, sell, or lease the property during their lifetime, further optimizing their control and flexibility. 3. Enhanced Life Estate Deed with Remainder Interest: This type of Enhanced Life Estate Deed designates a specific individual as the remainder man. The remainder man gains ownership of the property only upon the passing of both original homeowners. Until then, the couple retains full rights and control over the property. 4. Joint Tenancy Enhanced Life Estate Deed: In situations where the property is jointly owned by the couple, utilizing a Joint Tenancy Enhanced Life Estate Deed ensures that the surviving spouse becomes the sole owner without the involvement of probate. By utilizing the Stockton California Enhanced Life Estate or Lady Bird Quitclaim Deed, individuals and couples can efficiently plan for the distribution of their property while retaining control over their assets during their lifetime. It is advisable to seek guidance from a qualified attorney to ensure compliance with local laws and personalize the deed according to one's specific needs and goals.