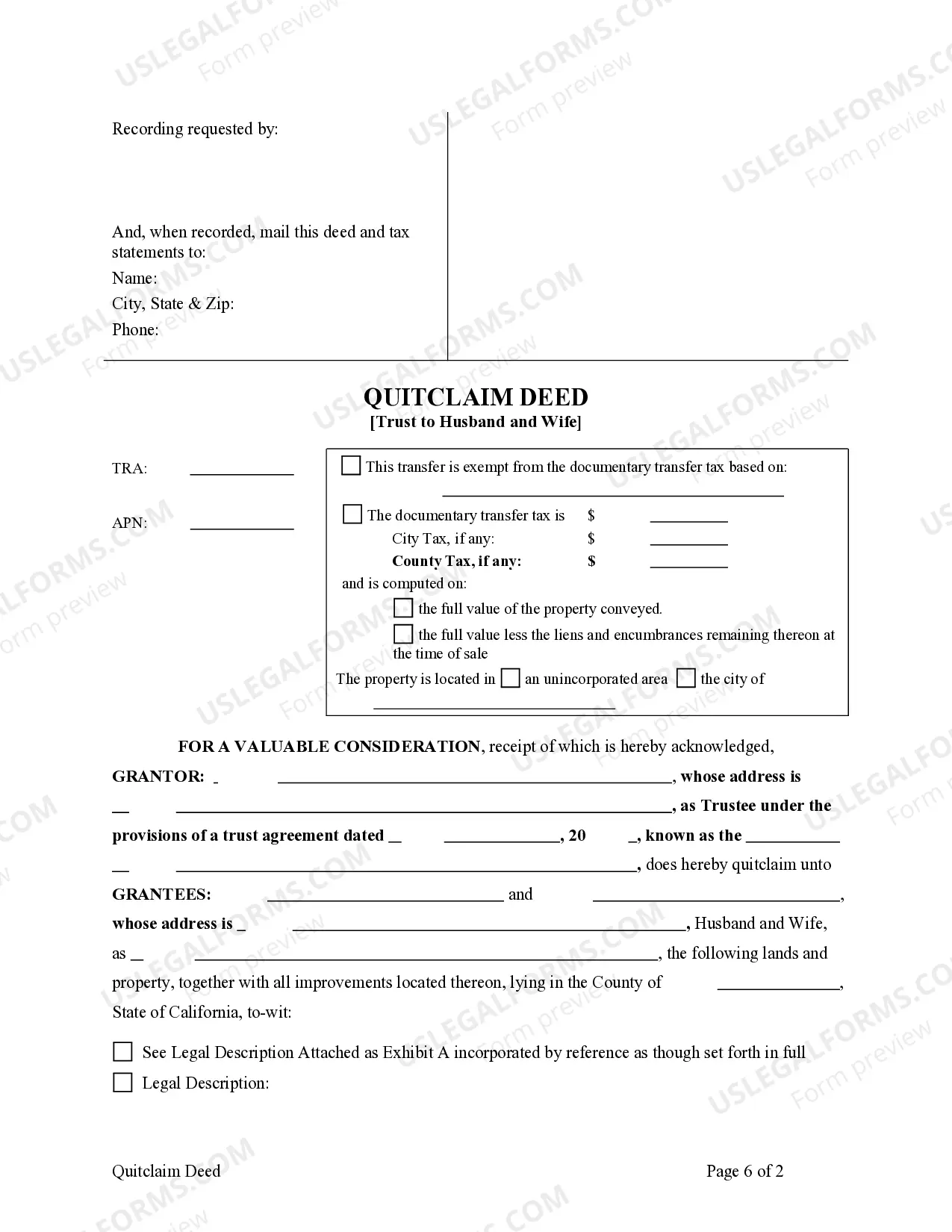

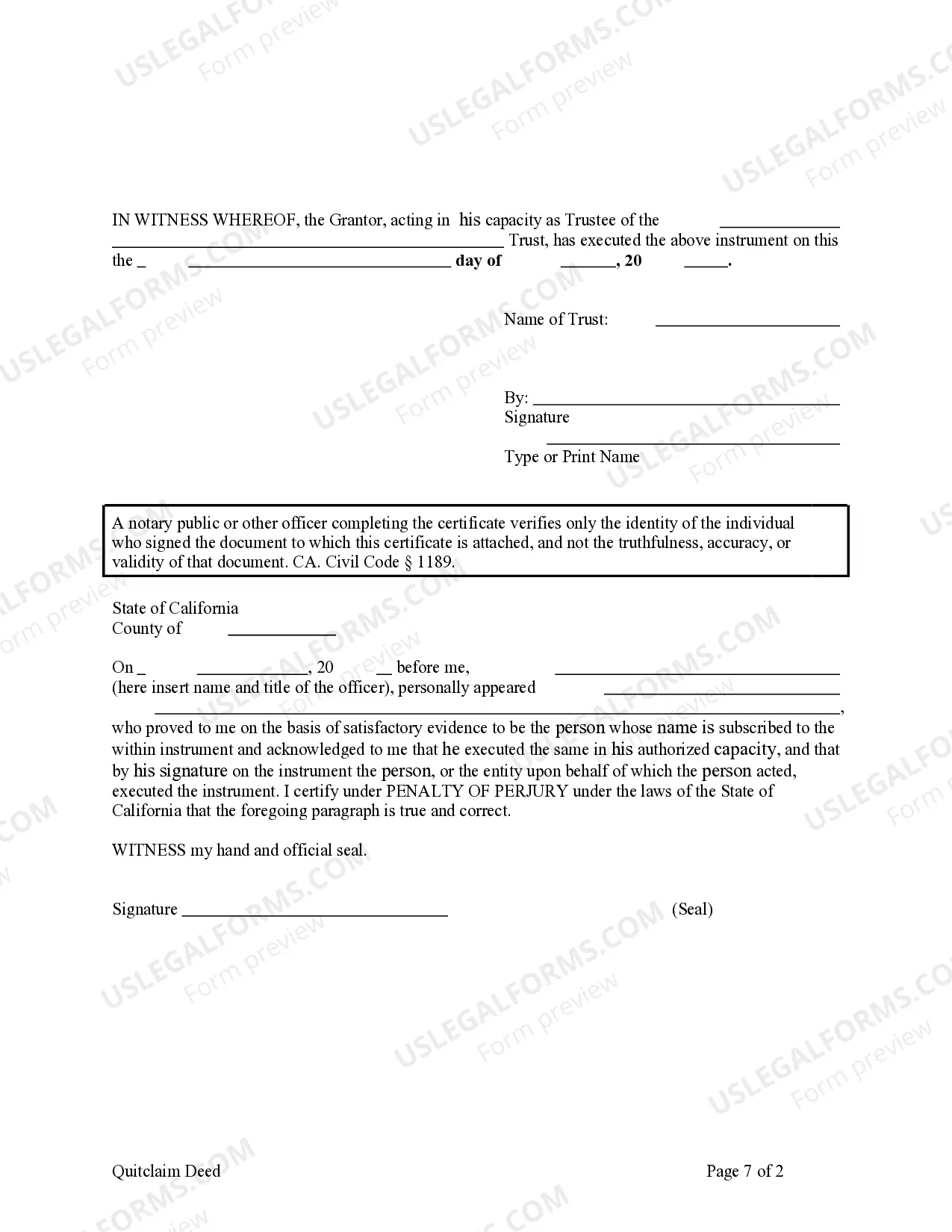

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

The Alameda California Quitclaim Deed — Trust to Husband and Wife is a legal document that allows one party (the granter) to transfer their interest in a property to another party (the grantees) who are married spouses. This type of deed is commonly used in Alameda County, California, and provides a reliable method for transferring property ownership between spouses. The quitclaim deed operates on the principle of "as is" transfer, meaning the granter does not guarantee their ownership interest but simply releases their claim or interest in the property to the grantees. This type of deed can be an effective way for spouses to transfer property without going through a lengthy court process. The key aspect of the Alameda California Quitclaim Deed — Trust to Husband and Wife is that it is executed within the framework of a trust. A trust is a legal arrangement that allows a third party (the trustee) to hold and manage assets on behalf of the beneficiaries (in this case, the husband and wife). By incorporating a trust, the property can be protected and managed in line with the trust's provisions. Different types of Alameda California Quitclaim Deed — Trust to Husband and Wife include the following: 1. Revocable Trust Quitclaim Deed: In this type of quitclaim deed, the trust established is revocable, meaning the granter has the ability to modify or revoke the trust during their lifetime. This flexibility allows for adaptability according to the changing circumstances of the spouses. 2. Irrevocable Trust Quitclaim Deed: In contrast to the revocable trust, this type of quitclaim deed creates an irrevocable trust. Once the property is transferred, the granter relinquishes all rights and control over the trust assets. This form of trust is often used for estate planning purposes, providing asset protection and potential tax advantages. 3. Joint Tenancy with Right of Survivorship Quitclaim Deed: This type of quitclaim deed establishes joint ownership between the husband and wife, with the right of survivorship. In the event of one spouse's passing, their share automatically transfers to the surviving spouse. This method can avoid probate and simplify the transfer of property upon death. 4. Tenancy in Common Quitclaim Deed: Unlike joint tenancy, the tenancy in common quitclaim deed allows each spouse to have separate ownership interests in the property. Each spouse can designate their share to their chosen beneficiaries in their will, preventing the automatic transfer upon death. In summary, the Alameda California Quitclaim Deed — Trust to Husband and Wife is a legal document that permits the transfer of property ownership between spouses, utilizing the framework of a trust. It offers various types of deeds such as revocable or irrevocable trusts, joint tenancy with the right of survivorship, and tenancy in common. These deed options provide flexibility and can serve different estate planning needs of married couples.The Alameda California Quitclaim Deed — Trust to Husband and Wife is a legal document that allows one party (the granter) to transfer their interest in a property to another party (the grantees) who are married spouses. This type of deed is commonly used in Alameda County, California, and provides a reliable method for transferring property ownership between spouses. The quitclaim deed operates on the principle of "as is" transfer, meaning the granter does not guarantee their ownership interest but simply releases their claim or interest in the property to the grantees. This type of deed can be an effective way for spouses to transfer property without going through a lengthy court process. The key aspect of the Alameda California Quitclaim Deed — Trust to Husband and Wife is that it is executed within the framework of a trust. A trust is a legal arrangement that allows a third party (the trustee) to hold and manage assets on behalf of the beneficiaries (in this case, the husband and wife). By incorporating a trust, the property can be protected and managed in line with the trust's provisions. Different types of Alameda California Quitclaim Deed — Trust to Husband and Wife include the following: 1. Revocable Trust Quitclaim Deed: In this type of quitclaim deed, the trust established is revocable, meaning the granter has the ability to modify or revoke the trust during their lifetime. This flexibility allows for adaptability according to the changing circumstances of the spouses. 2. Irrevocable Trust Quitclaim Deed: In contrast to the revocable trust, this type of quitclaim deed creates an irrevocable trust. Once the property is transferred, the granter relinquishes all rights and control over the trust assets. This form of trust is often used for estate planning purposes, providing asset protection and potential tax advantages. 3. Joint Tenancy with Right of Survivorship Quitclaim Deed: This type of quitclaim deed establishes joint ownership between the husband and wife, with the right of survivorship. In the event of one spouse's passing, their share automatically transfers to the surviving spouse. This method can avoid probate and simplify the transfer of property upon death. 4. Tenancy in Common Quitclaim Deed: Unlike joint tenancy, the tenancy in common quitclaim deed allows each spouse to have separate ownership interests in the property. Each spouse can designate their share to their chosen beneficiaries in their will, preventing the automatic transfer upon death. In summary, the Alameda California Quitclaim Deed — Trust to Husband and Wife is a legal document that permits the transfer of property ownership between spouses, utilizing the framework of a trust. It offers various types of deeds such as revocable or irrevocable trusts, joint tenancy with the right of survivorship, and tenancy in common. These deed options provide flexibility and can serve different estate planning needs of married couples.