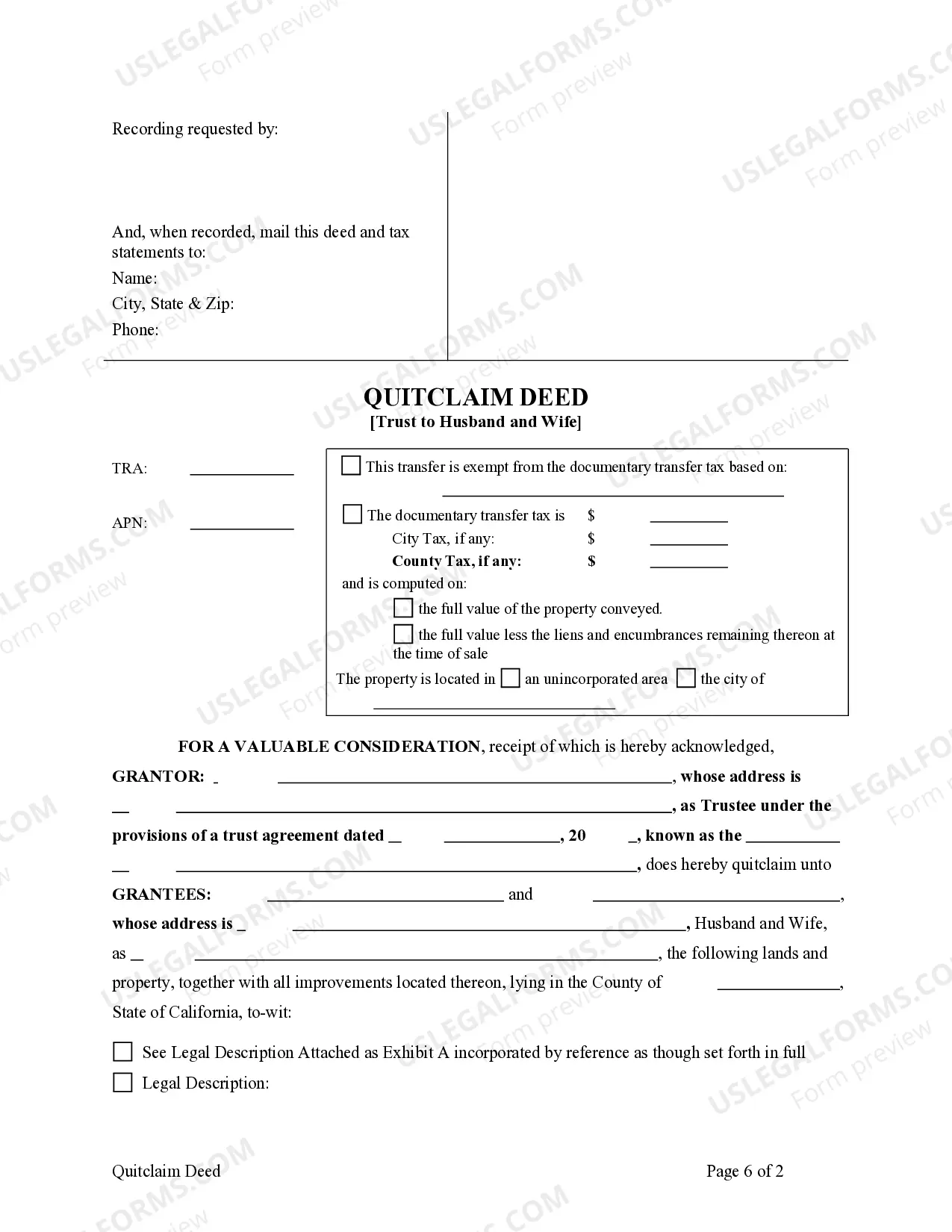

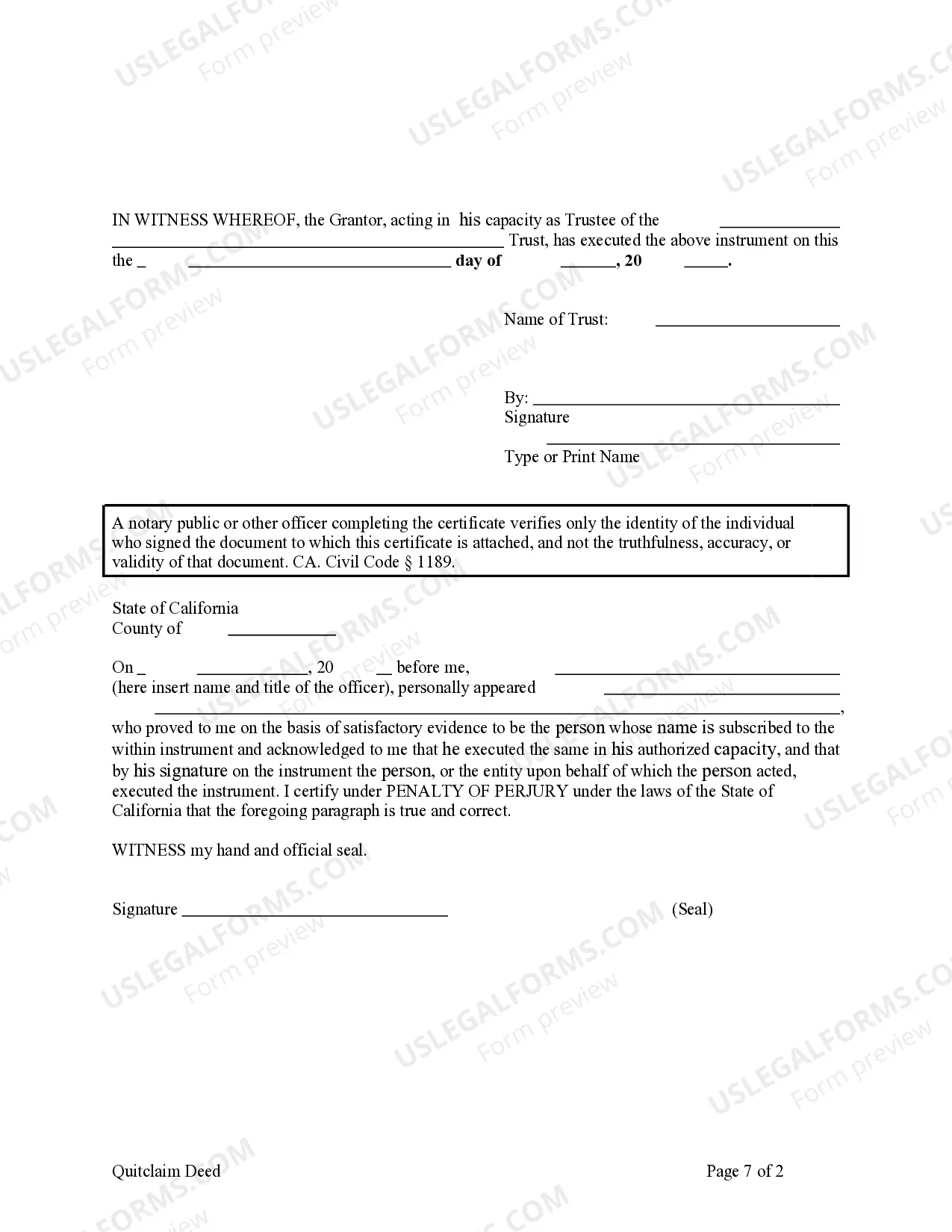

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

Title: Understanding the Contra Costa California Quitclaim Deed — Trust to Husband and Wife Introduction: In Contra Costa County, California, a Quitclaim Deed — Trust to Husband and Wife provides a legal framework for transferring real estate ownership between spouses while maintaining trust arrangements. This article aims to delve into the intricacies of this deed, explain its purpose, and shed light on its variations. 1. What is a Quitclaim Deed — Trust to Husband and Wife? The Quitclaim Deed — Trust to Husband and Wife is a legal document used to transfer property ownership from one spouse to both, establishing them as joint owners. This deed can be particularly useful for estate planning purposes or to add a spouse's name to a property's title. 2. The Purpose of a Quitclaim Deed — Trust to Husband and Wife: i. Estate Planning: By creating a trust, couples can ensure smooth property ownership transition after death, avoiding potential complications such as probate. ii. Asset Protection: Placing property into a trust protects it from individual creditors while still allowing the couple to jointly benefit from it. iii. Joint Ownership: When spouses acquire joint ownership through this deed, both individuals have equal rights and responsibilities over the property. 3. Different Types of Contra Costa California Quitclaim Deed — Trust to Husband and Wife: While the basic concept remains the same, a Quitclaim Deed — Trust to Husband and Wife can vary based on specific circumstances. Here are a few variations: i. Inter Vivos Trust: This type of trust takes effect during the lifetime of the trustees (spouses creating the trust) and allows them to retain control over the property while alive. It offers great flexibility in terms of revocability or amendment. ii. Testamentary Trust: Created within a will, a testamentary trust only takes effect after the death of the trustees. This trust ensures the property passes to the surviving spouse, protecting their interests and allowing for future disposition based on the trust or's instructions. iii. Revocable Trust: This type of trust can be modified or terminated by the trustees during their lifetime. This flexibility is beneficial if spouses anticipate changes in their circumstances or wish to add or remove assets from the trust. iv. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be easily modified or revoked. Once established, the trustees relinquish their control over the property, providing certain tax and creditor protection benefits. Conclusion: To ensure a smooth, documented transfer of property ownership between spouses in Contra Costa County, California, a Quitclaim Deed — Trust to Husband and Wife is a valuable tool. Understanding the various types of these deeds enables couples to choose the most suitable option based on their estate planning objectives. Seek legal guidance to ensure compliance with local regulations and personalized advice tailored to your specific situation.Title: Understanding the Contra Costa California Quitclaim Deed — Trust to Husband and Wife Introduction: In Contra Costa County, California, a Quitclaim Deed — Trust to Husband and Wife provides a legal framework for transferring real estate ownership between spouses while maintaining trust arrangements. This article aims to delve into the intricacies of this deed, explain its purpose, and shed light on its variations. 1. What is a Quitclaim Deed — Trust to Husband and Wife? The Quitclaim Deed — Trust to Husband and Wife is a legal document used to transfer property ownership from one spouse to both, establishing them as joint owners. This deed can be particularly useful for estate planning purposes or to add a spouse's name to a property's title. 2. The Purpose of a Quitclaim Deed — Trust to Husband and Wife: i. Estate Planning: By creating a trust, couples can ensure smooth property ownership transition after death, avoiding potential complications such as probate. ii. Asset Protection: Placing property into a trust protects it from individual creditors while still allowing the couple to jointly benefit from it. iii. Joint Ownership: When spouses acquire joint ownership through this deed, both individuals have equal rights and responsibilities over the property. 3. Different Types of Contra Costa California Quitclaim Deed — Trust to Husband and Wife: While the basic concept remains the same, a Quitclaim Deed — Trust to Husband and Wife can vary based on specific circumstances. Here are a few variations: i. Inter Vivos Trust: This type of trust takes effect during the lifetime of the trustees (spouses creating the trust) and allows them to retain control over the property while alive. It offers great flexibility in terms of revocability or amendment. ii. Testamentary Trust: Created within a will, a testamentary trust only takes effect after the death of the trustees. This trust ensures the property passes to the surviving spouse, protecting their interests and allowing for future disposition based on the trust or's instructions. iii. Revocable Trust: This type of trust can be modified or terminated by the trustees during their lifetime. This flexibility is beneficial if spouses anticipate changes in their circumstances or wish to add or remove assets from the trust. iv. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be easily modified or revoked. Once established, the trustees relinquish their control over the property, providing certain tax and creditor protection benefits. Conclusion: To ensure a smooth, documented transfer of property ownership between spouses in Contra Costa County, California, a Quitclaim Deed — Trust to Husband and Wife is a valuable tool. Understanding the various types of these deeds enables couples to choose the most suitable option based on their estate planning objectives. Seek legal guidance to ensure compliance with local regulations and personalized advice tailored to your specific situation.