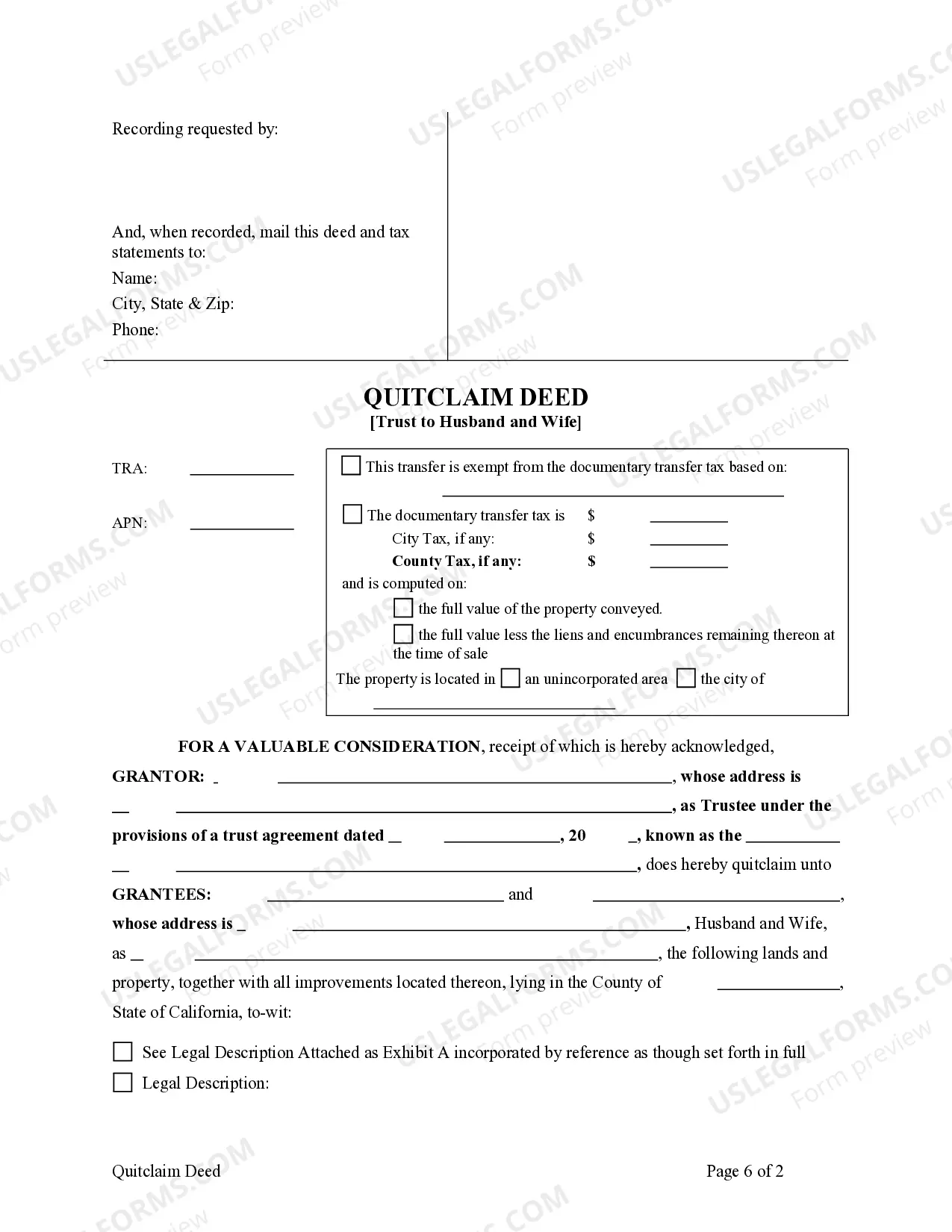

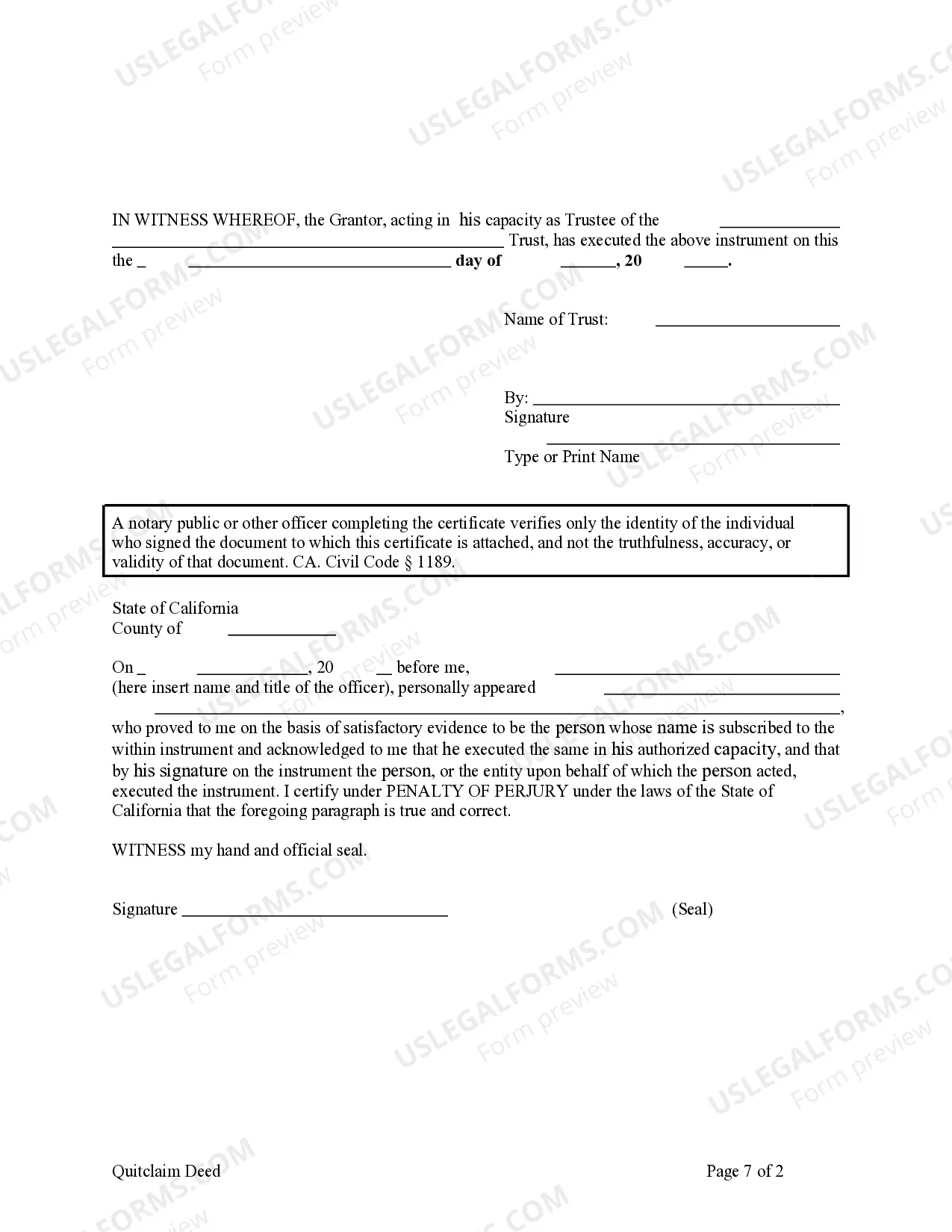

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

A Garden Grove California Quitclaim Deed — Trust to Husband and Wife is a legal document that transfers ownership of a property from a trust to a married couple. This type of deed is commonly used when a property is being transferred between spouses who have established a trust. It is important to note that this type of deed is specific to Garden Grove, California, and may have slight variations in other jurisdictions. The purpose of a quitclaim deed is to transfer the interest or title of a property from the trust to the husband and wife, without making any warranties or guarantees about the property's title. It simply conveys whatever interest the trust holds in the property to the couple. This means that if there are any issues or claims against the property, they will not be resolved or addressed through this type of deed. There are different variations of Garden Grove California Quitclaim Deed — Trust to Husband and Wife that may be used depending on specific circumstances or preferences. These variations include: 1. Joint Tenancy Quitclaim Deed: This type of deed is used when the property is owned by the trust as joint tenants, meaning both spouses have an equal and undivided interest in the property. In the event of one spouse's death, the surviving spouse automatically inherits the deceased spouse's share. 2. Tenants in Common Quitclaim Deed: This variation is used when the property is owned by the trust as tenants in common. With this type of ownership, each spouse has a separate and distinct share of the property, which can be unequal if desired. In the event of one spouse's death, their share of the property passes according to their will or estate plan. 3. Community Property with Right of Survivorship Quitclaim Deed: This type of deed is commonly used in community property states like California. It allows the married couple to own the property as community property while also including the right of survivorship. In the event of one spouse's death, the surviving spouse automatically inherits the deceased spouse's share. It is crucial to consult a qualified real estate attorney or legal professional when executing a Garden Grove California Quitclaim Deed — Trust to Husband and Wife or any other legal document, as specific laws and requirements may vary. A legal professional can provide guidance, ensure the deed is executed correctly, and handle any necessary filings or recordings with the appropriate authorities.