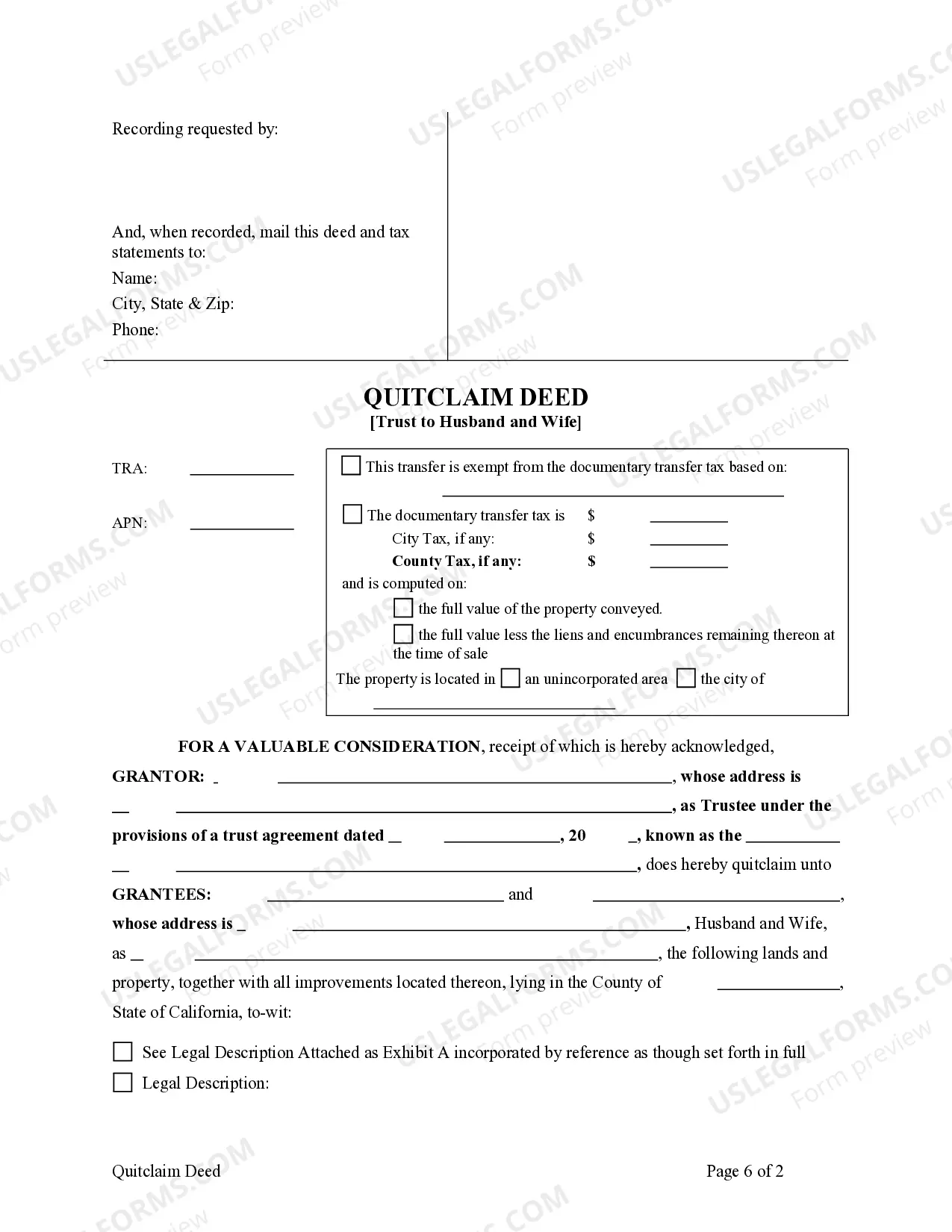

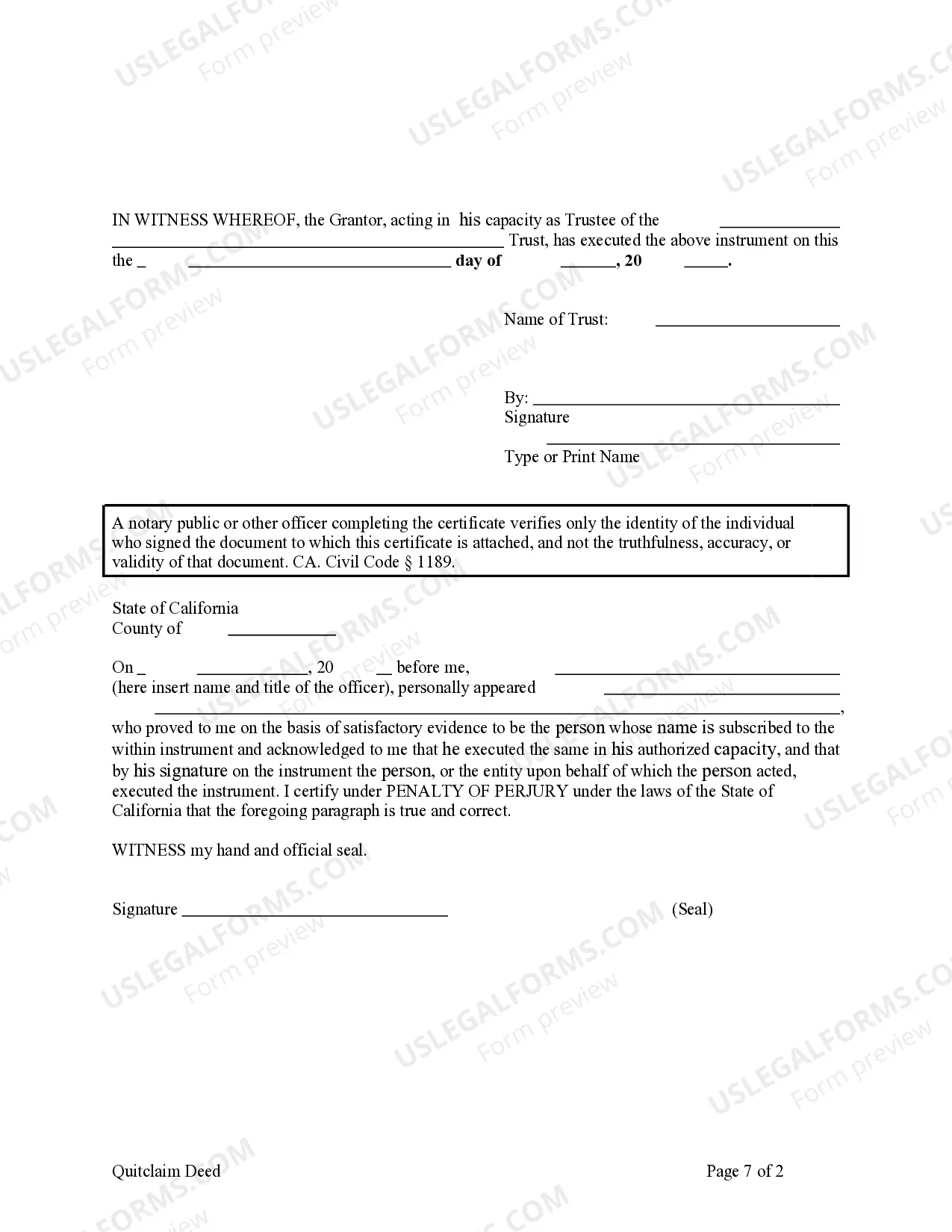

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

A Quitclaim Deed is a legal document used in real estate transactions to transfer ownership or interest in a property from one party (granter) to another (grantee). Inglewood, California, offers a specific type of Quitclaim Deed known as the Inglewood California Quitclaim Deed — Trust to Husband and Wife. This specific deed is designed to transfer property ownership to a married couple, who wish to hold the property in trust. The Inglewood California Quitclaim Deed — Trust to Husband and Wife provides a simplified process for transferring property between spouses. By creating a trust, the couple can benefit from various legal advantages, such as asset protection, tax benefits, and efficient transfer of ownership upon death. This type of deed allows the couple to maintain joint ownership while also establishing the property as an asset held in trust. Different types of Inglewood California Quitclaim Deed — Trust to Husband and Wife may include variations based on the specific needs and circumstances of the couple. Here are a few examples: 1. Inglewood California Quitclaim Deed — Trust to Husband and Wife with Survivorship: This type of deed establishes joint ownership between spouses, with the provision that upon the death of one spouse, the surviving spouse automatically assumes full ownership of the property. This arrangement bypasses the need for probate and ensures a seamless transfer of ownership. 2. Inglewood California Quitclaim Deed — Trust to Husband and Wife for Estate Planning: Designed specifically for estate planning purposes, this deed allows the couple to transfer ownership of the property into a trust, ensuring efficient distribution of assets upon the death of one or both spouses. This type of deed can help minimize estate taxes and simplify the legal process for heirs. 3. Inglewood California Quitclaim Deed — Trust to Husband and Wife for Credit Protection: This variation of the deed aims to protect the property from potential creditors. By placing the property in a trust, the couple can create a legal barrier, preventing creditors from seizing the property to satisfy debts owed by one spouse. Regardless of the specific type of Inglewood California Quitclaim Deed — Trust to Husband and Wife, it is important to consult with a qualified real estate attorney who can guide you through the process, ensure compliance with legal requirements, and address any unique circumstances.A Quitclaim Deed is a legal document used in real estate transactions to transfer ownership or interest in a property from one party (granter) to another (grantee). Inglewood, California, offers a specific type of Quitclaim Deed known as the Inglewood California Quitclaim Deed — Trust to Husband and Wife. This specific deed is designed to transfer property ownership to a married couple, who wish to hold the property in trust. The Inglewood California Quitclaim Deed — Trust to Husband and Wife provides a simplified process for transferring property between spouses. By creating a trust, the couple can benefit from various legal advantages, such as asset protection, tax benefits, and efficient transfer of ownership upon death. This type of deed allows the couple to maintain joint ownership while also establishing the property as an asset held in trust. Different types of Inglewood California Quitclaim Deed — Trust to Husband and Wife may include variations based on the specific needs and circumstances of the couple. Here are a few examples: 1. Inglewood California Quitclaim Deed — Trust to Husband and Wife with Survivorship: This type of deed establishes joint ownership between spouses, with the provision that upon the death of one spouse, the surviving spouse automatically assumes full ownership of the property. This arrangement bypasses the need for probate and ensures a seamless transfer of ownership. 2. Inglewood California Quitclaim Deed — Trust to Husband and Wife for Estate Planning: Designed specifically for estate planning purposes, this deed allows the couple to transfer ownership of the property into a trust, ensuring efficient distribution of assets upon the death of one or both spouses. This type of deed can help minimize estate taxes and simplify the legal process for heirs. 3. Inglewood California Quitclaim Deed — Trust to Husband and Wife for Credit Protection: This variation of the deed aims to protect the property from potential creditors. By placing the property in a trust, the couple can create a legal barrier, preventing creditors from seizing the property to satisfy debts owed by one spouse. Regardless of the specific type of Inglewood California Quitclaim Deed — Trust to Husband and Wife, it is important to consult with a qualified real estate attorney who can guide you through the process, ensure compliance with legal requirements, and address any unique circumstances.