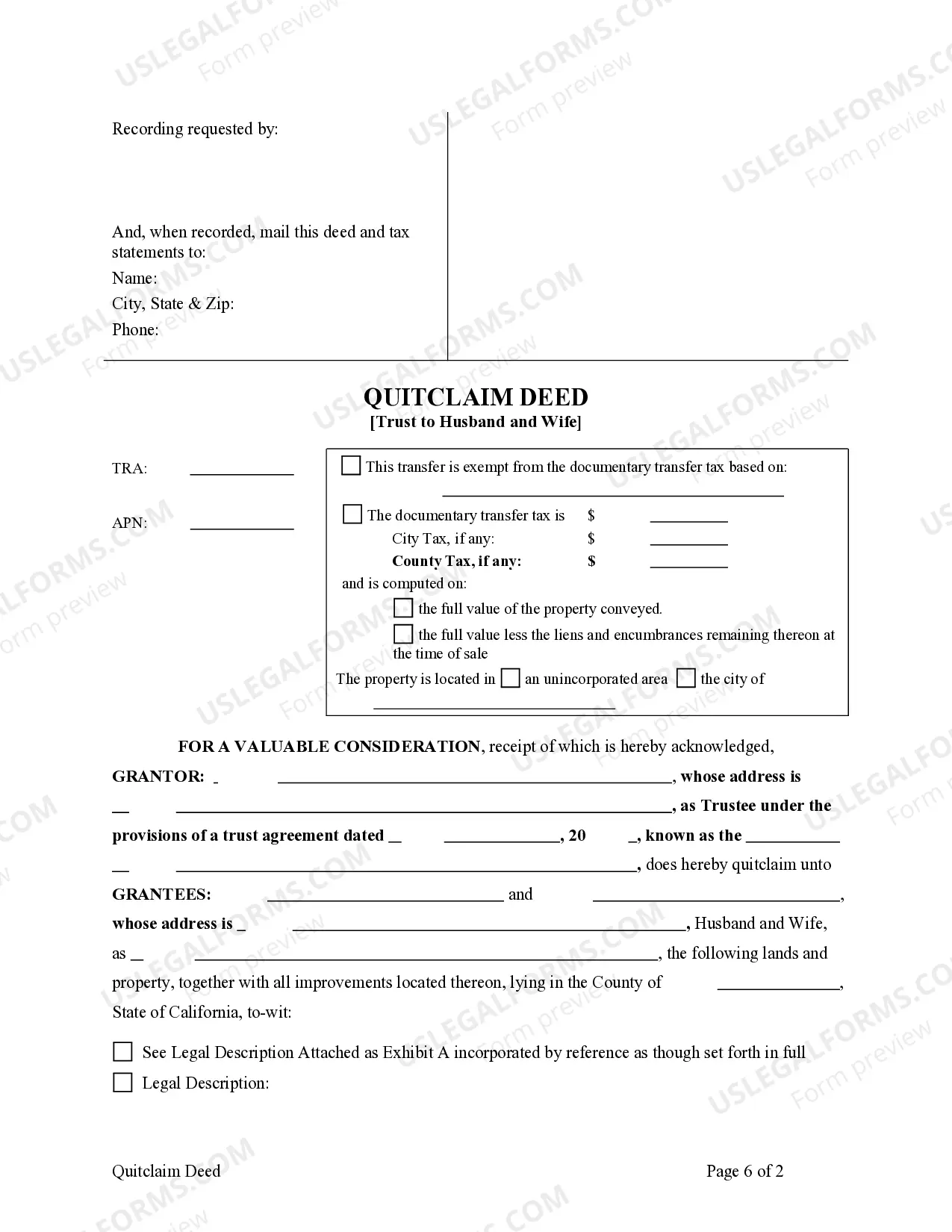

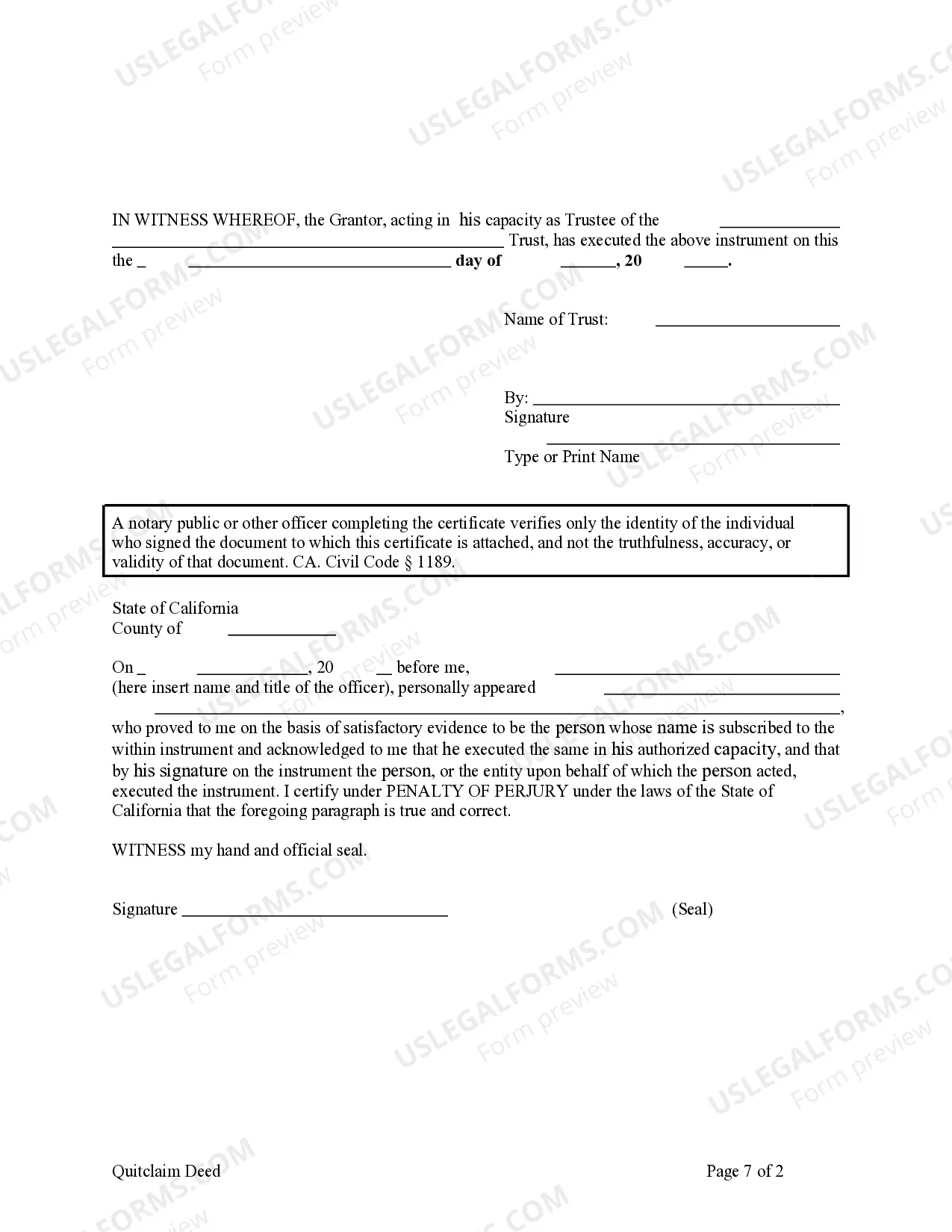

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

An Irvine California Quitclaim Deed — Trust to Husband and Wife is a legal document that allows a married couple to transfer property ownership between themselves using a quitclaim deed, while also establishing a trust for the property. This type of quitclaim deed is commonly used in Irvine, California, and provides various benefits for couples looking to transfer property rights and protect their assets. A quitclaim deed is a legal instrument used to transfer ownership rights of a property from one party (the granter) to another (the grantee). In the case of an Irvine California Quitclaim Deed — Trust to Husband and Wife, this transfer occurs between spouses while establishing a trust for the property. The trust is designed to protect the property, outline how it will be managed, and specify the beneficiaries in case of the couple's death. Some common types of Irvine California Quitclaim Deed — Trust to Husband and Wife include: 1. Joint Tenancy with Right of Survivorship: This type of quitclaim deed allows the couple to hold equal ownership rights to the property, and in the event of one spouse's death, the surviving spouse automatically receives full ownership. 2. Tenancy by the Entirety: This form of quitclaim deed is available specifically for married couples. It provides the highest level of protection against individual debts or claims. If one spouse has creditors or legal issues, the property cannot be seized or attached to satisfy those debts as long as both spouses are alive and married. 3. Community Property with Right of Survivorship: This type of quitclaim deed is suitable for married couples living in community property states like California. It ensures that both spouses have an equal share of the property, and in the event of one spouse's death, the survivor automatically inherits the deceased spouse's share. Utilizing an Irvine California Quitclaim Deed — Trust to Husband and Wife allows couples to establish clear guidelines for the property's management and succession while also providing asset protection. In order to create a valid and enforceable quitclaim deed, it is recommended to consult with a real estate attorney or a qualified professional well-versed in the specific laws of Irvine, California.An Irvine California Quitclaim Deed — Trust to Husband and Wife is a legal document that allows a married couple to transfer property ownership between themselves using a quitclaim deed, while also establishing a trust for the property. This type of quitclaim deed is commonly used in Irvine, California, and provides various benefits for couples looking to transfer property rights and protect their assets. A quitclaim deed is a legal instrument used to transfer ownership rights of a property from one party (the granter) to another (the grantee). In the case of an Irvine California Quitclaim Deed — Trust to Husband and Wife, this transfer occurs between spouses while establishing a trust for the property. The trust is designed to protect the property, outline how it will be managed, and specify the beneficiaries in case of the couple's death. Some common types of Irvine California Quitclaim Deed — Trust to Husband and Wife include: 1. Joint Tenancy with Right of Survivorship: This type of quitclaim deed allows the couple to hold equal ownership rights to the property, and in the event of one spouse's death, the surviving spouse automatically receives full ownership. 2. Tenancy by the Entirety: This form of quitclaim deed is available specifically for married couples. It provides the highest level of protection against individual debts or claims. If one spouse has creditors or legal issues, the property cannot be seized or attached to satisfy those debts as long as both spouses are alive and married. 3. Community Property with Right of Survivorship: This type of quitclaim deed is suitable for married couples living in community property states like California. It ensures that both spouses have an equal share of the property, and in the event of one spouse's death, the survivor automatically inherits the deceased spouse's share. Utilizing an Irvine California Quitclaim Deed — Trust to Husband and Wife allows couples to establish clear guidelines for the property's management and succession while also providing asset protection. In order to create a valid and enforceable quitclaim deed, it is recommended to consult with a real estate attorney or a qualified professional well-versed in the specific laws of Irvine, California.