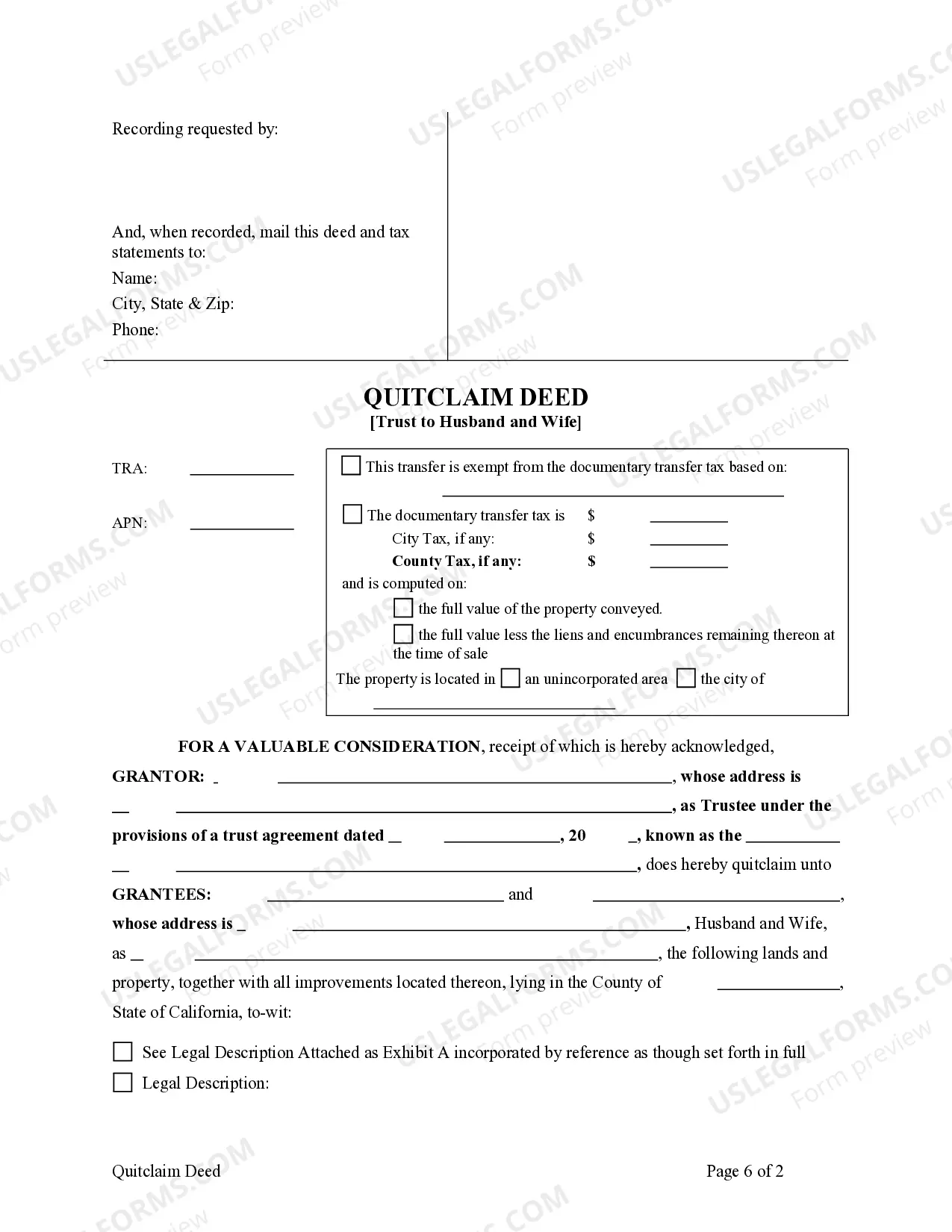

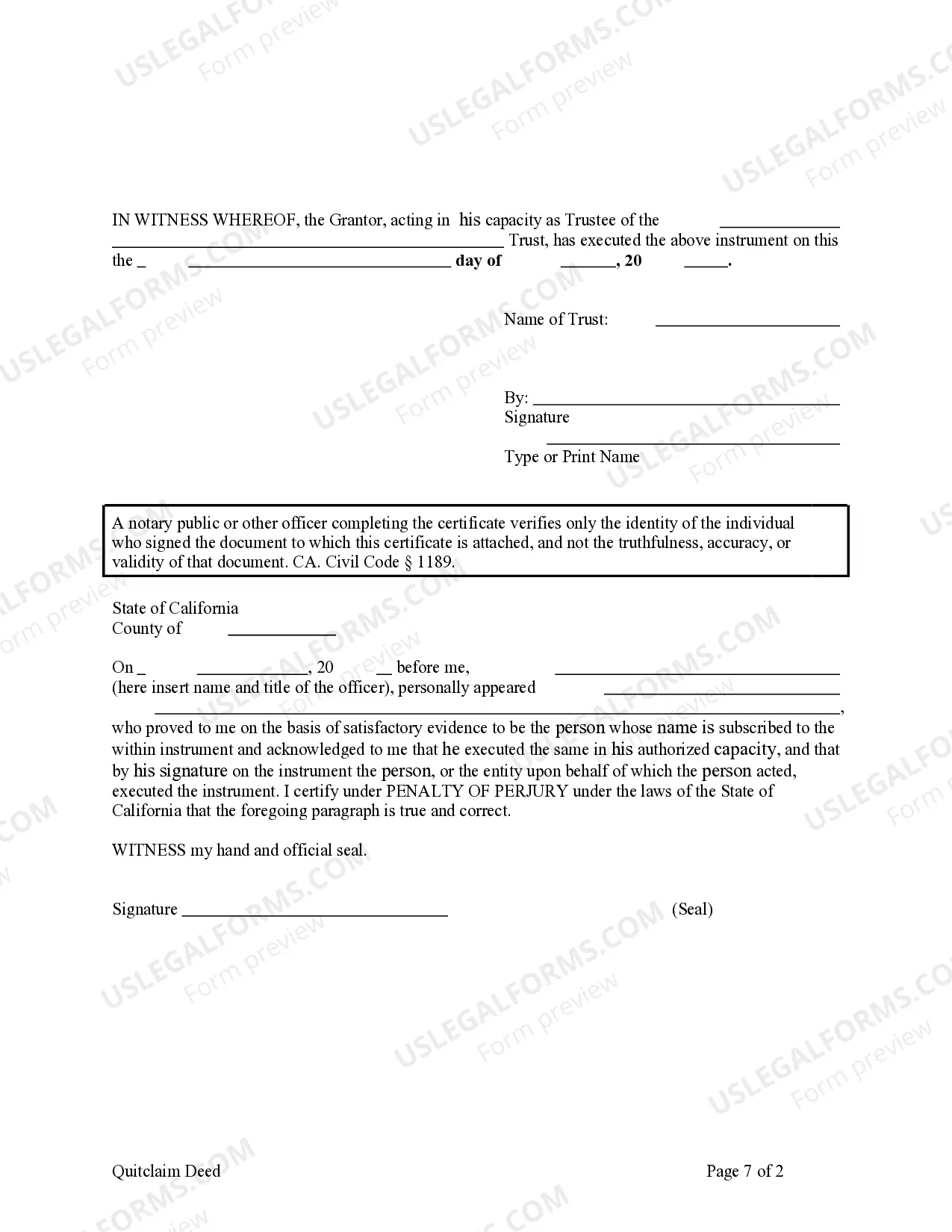

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

When it comes to real estate transactions, a Quitclaim Deed is a commonly used legal document that can transfer ownership of a property from one party to another. In Los Angeles, California, there is a specific type of Quitclaim Deed known as the "Quitclaim Deed — Trust to Husband and Wife." This particular deed is designed for situations where a property is being transferred to both spouses, who hold the property in a trust. A Quitclaim Deed — Trust to Husband and Wife is a legally binding document that allows an individual or entity, typically referred to as the granter, to transfer their interest in a property to a trust held by a husband and wife, also known as the grantees. The trust itself is a legal entity that holds the property for the benefit of the couple, providing them with various advantages, such as avoiding probate and facilitating estate planning. By transferring the property to a trust held by a husband and wife, both parties assume joint ownership and control over the property. This joint ownership can provide certain tax benefits, as well as streamline the management and transfer of the property in the future. The Quitclaim Deed — Trust to Husband and Wife outlines the specific terms of the transfer, including the legal description of the property, the names of the husband and wife, and the trustee(s) responsible for managing the trust. In Los Angeles, there may be variations or additional types of Quitclaim Deed — Trust to Husband and Wife, depending on specific circumstances. Some of these variations may include the "Marital Property Quitclaim Deed — Trust to Husband and Wife," which is used when a property is considered marital property, and both spouses share an equal interest. Another type is the "Joint Tenant Quitclaim Deed — Trust to Husband and Wife," which is used when the couple intends to hold the property as joint tenants, with the right of survivorship. It is important to note that while a Quitclaim Deed transfers the granter's interest in the property, it does not guarantee that the property is free from liens or encumbrances. It is advisable for both parties involved in the transaction to seek legal advice and conduct a thorough title search to ensure a smooth transfer of ownership. In conclusion, the Los Angeles California Quitclaim Deed — Trust to Husband and Wife is a specialized legal document used for transferring property ownership from a granter to a trust held by a married couple. This type of deed allows for joint ownership, potential tax advantages, and helps facilitate efficient estate planning. Different variations of this deed may exist, such as the Marital Property Quitclaim Deed — Trust to Husband and Wife or the Joint Tenant Quitclaim Deed — Trust to Husband and Wife, depending on specific circumstances. Seek professional legal guidance when considering such a transaction to ensure a proper transfer of ownership.When it comes to real estate transactions, a Quitclaim Deed is a commonly used legal document that can transfer ownership of a property from one party to another. In Los Angeles, California, there is a specific type of Quitclaim Deed known as the "Quitclaim Deed — Trust to Husband and Wife." This particular deed is designed for situations where a property is being transferred to both spouses, who hold the property in a trust. A Quitclaim Deed — Trust to Husband and Wife is a legally binding document that allows an individual or entity, typically referred to as the granter, to transfer their interest in a property to a trust held by a husband and wife, also known as the grantees. The trust itself is a legal entity that holds the property for the benefit of the couple, providing them with various advantages, such as avoiding probate and facilitating estate planning. By transferring the property to a trust held by a husband and wife, both parties assume joint ownership and control over the property. This joint ownership can provide certain tax benefits, as well as streamline the management and transfer of the property in the future. The Quitclaim Deed — Trust to Husband and Wife outlines the specific terms of the transfer, including the legal description of the property, the names of the husband and wife, and the trustee(s) responsible for managing the trust. In Los Angeles, there may be variations or additional types of Quitclaim Deed — Trust to Husband and Wife, depending on specific circumstances. Some of these variations may include the "Marital Property Quitclaim Deed — Trust to Husband and Wife," which is used when a property is considered marital property, and both spouses share an equal interest. Another type is the "Joint Tenant Quitclaim Deed — Trust to Husband and Wife," which is used when the couple intends to hold the property as joint tenants, with the right of survivorship. It is important to note that while a Quitclaim Deed transfers the granter's interest in the property, it does not guarantee that the property is free from liens or encumbrances. It is advisable for both parties involved in the transaction to seek legal advice and conduct a thorough title search to ensure a smooth transfer of ownership. In conclusion, the Los Angeles California Quitclaim Deed — Trust to Husband and Wife is a specialized legal document used for transferring property ownership from a granter to a trust held by a married couple. This type of deed allows for joint ownership, potential tax advantages, and helps facilitate efficient estate planning. Different variations of this deed may exist, such as the Marital Property Quitclaim Deed — Trust to Husband and Wife or the Joint Tenant Quitclaim Deed — Trust to Husband and Wife, depending on specific circumstances. Seek professional legal guidance when considering such a transaction to ensure a proper transfer of ownership.