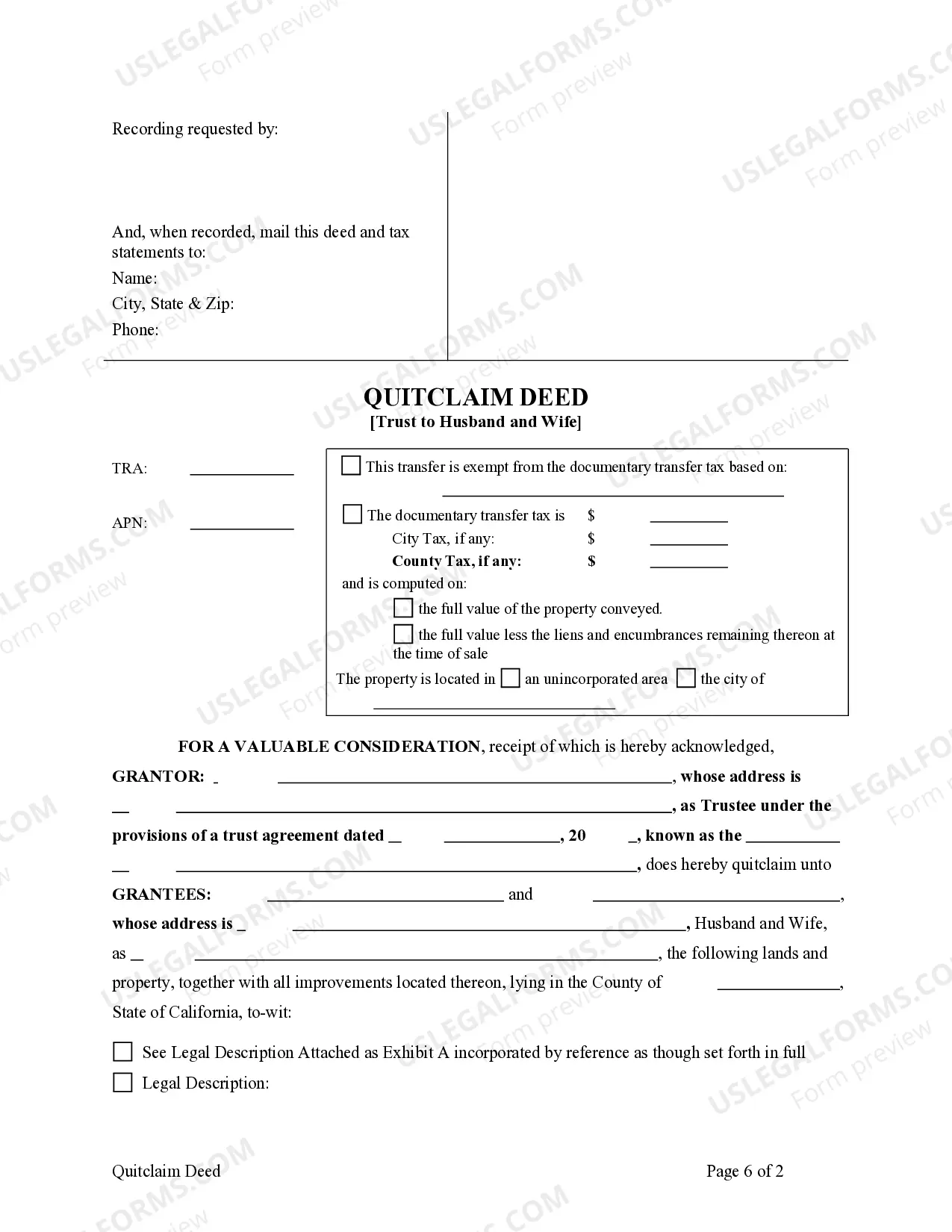

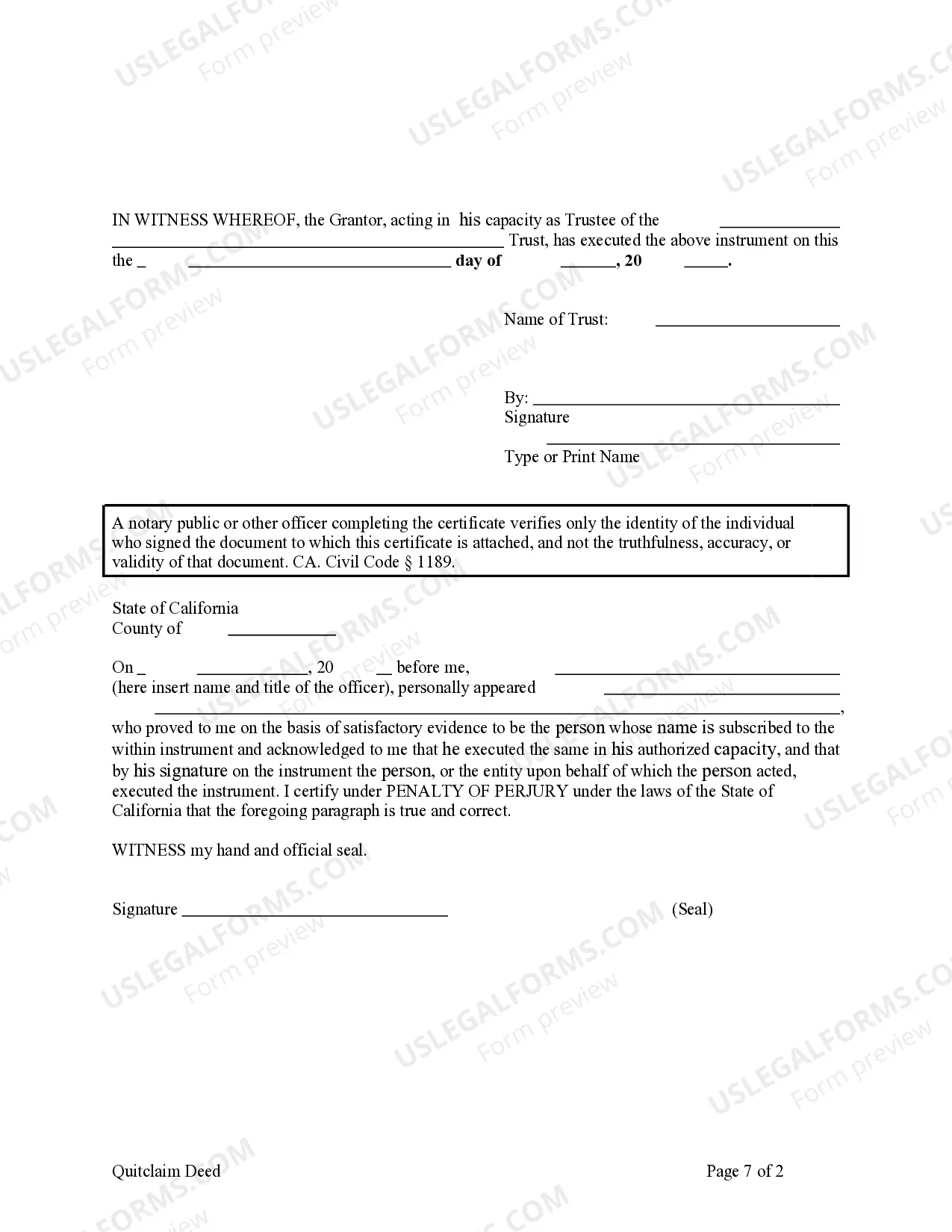

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

A Norwalk California Quitclaim Deed — Trust to Husband and Wife is a legal document that transfers the ownership of a property from a trust to a married couple. This type of deed enables the trust to release any interest it holds in the property and grants complete ownership rights to the husband and wife. It is essential in cases where a property held by a trust needs to be transferred to the couple as joint tenants. The Norwalk California Quitclaim Deed — Trust to Husband and Wife serves as proof of the transfer, ensuring that the property ownership is legally and officially transferred to the couple. This type of deed eliminates any claims or encumbrances associated with the trust, allowing the couple to assume full control and responsibility for the property. The Norwalk California Quitclaim Deed — Trust to Husband and Wife can have variations depending on the specific circumstances. Some common types or variations include: 1. Norwalk California Quitclaim Deed — Trust to Husband and Wife with Survivorship Rights: This type of deed ensures that if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property without going through the probate process. 2. Norwalk California Quitclaim Deed — Trust to Husband and Wife with Community Property Rights: This variation specifies that the property is considered community property, subject to the laws governing community property states. In the event of divorce, community property is typically divided equally between the spouses. 3. Norwalk California Quitclaim Deed — Trust to Husband and Wife as Tenants in Common: This type of deed allows the couple to hold the property as tenants in common, wherein each spouse has a distinct share of ownership. In case of the death of one spouse, their share is passed to their chosen beneficiaries according to their will or estate plan. It is crucial to consult with an experienced real estate attorney or legal professional to determine the most suitable variation of the Norwalk California Quitclaim Deed — Trust to Husband and Wife based on individual circumstances. Proper execution of this document ensures the smooth transfer of property and protects the interests of all parties involved.A Norwalk California Quitclaim Deed — Trust to Husband and Wife is a legal document that transfers the ownership of a property from a trust to a married couple. This type of deed enables the trust to release any interest it holds in the property and grants complete ownership rights to the husband and wife. It is essential in cases where a property held by a trust needs to be transferred to the couple as joint tenants. The Norwalk California Quitclaim Deed — Trust to Husband and Wife serves as proof of the transfer, ensuring that the property ownership is legally and officially transferred to the couple. This type of deed eliminates any claims or encumbrances associated with the trust, allowing the couple to assume full control and responsibility for the property. The Norwalk California Quitclaim Deed — Trust to Husband and Wife can have variations depending on the specific circumstances. Some common types or variations include: 1. Norwalk California Quitclaim Deed — Trust to Husband and Wife with Survivorship Rights: This type of deed ensures that if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property without going through the probate process. 2. Norwalk California Quitclaim Deed — Trust to Husband and Wife with Community Property Rights: This variation specifies that the property is considered community property, subject to the laws governing community property states. In the event of divorce, community property is typically divided equally between the spouses. 3. Norwalk California Quitclaim Deed — Trust to Husband and Wife as Tenants in Common: This type of deed allows the couple to hold the property as tenants in common, wherein each spouse has a distinct share of ownership. In case of the death of one spouse, their share is passed to their chosen beneficiaries according to their will or estate plan. It is crucial to consult with an experienced real estate attorney or legal professional to determine the most suitable variation of the Norwalk California Quitclaim Deed — Trust to Husband and Wife based on individual circumstances. Proper execution of this document ensures the smooth transfer of property and protects the interests of all parties involved.