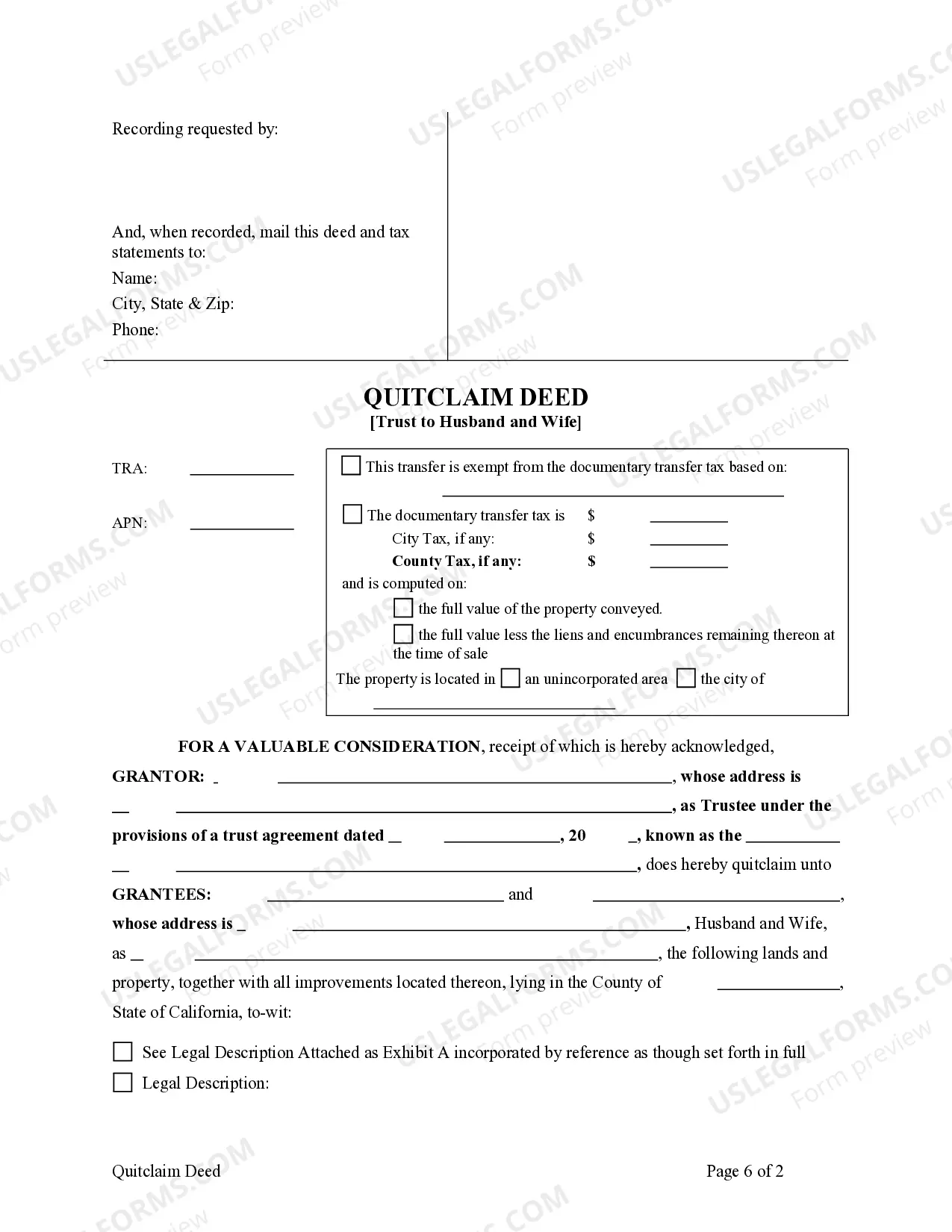

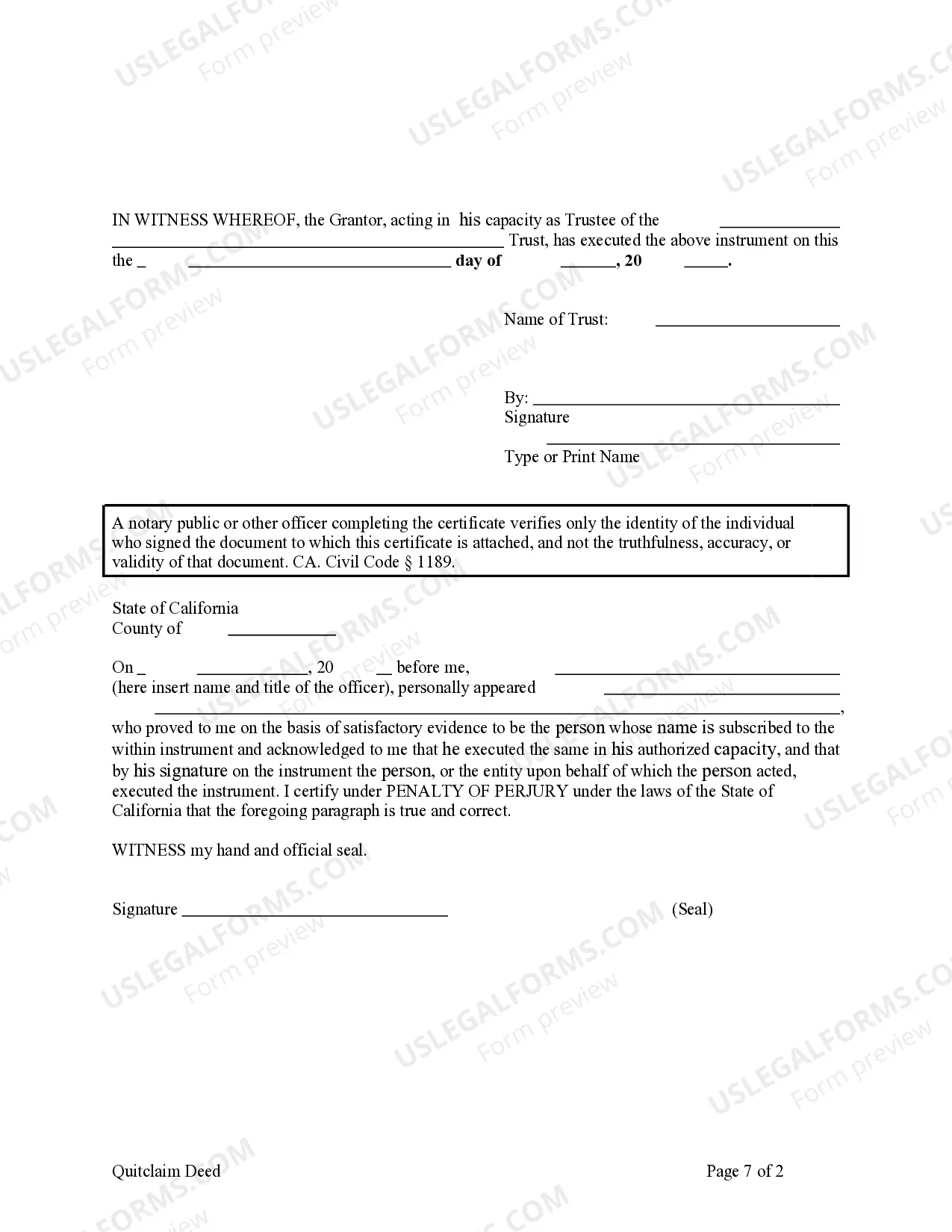

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

A Sacramento, California Quitclaim Deed — Trust to Husband and Wife is a legal document that transfers any ownership or interest in a property from one party to another, specifically to a married couple. This type of deed is commonly used when a couple wishes to transfer property between themselves, such as when purchasing a house together or when restructuring their assets within a trust. A Quitclaim Deed is a type of conveyance that allows parties to transfer interest in a property, without providing any warranty or guarantee as to the status of the title. It simply conveys whatever interest the granter (the person transferring the property) holds in the property, if any. This means that in a Quitclaim Deed, the granter does not guarantee that they actually own the property, nor do they guarantee that there are no liens or encumbrances on the property. In the case of a Sacramento, California Quitclaim Deed — Trust to Husband and Wife, it specifically refers to a Deed that is executed within the context of a trust arrangement between a husband and wife. This type of trust can be established for various reasons, such as for estate planning purposes, to protect assets, or to facilitate property management and ownership between spouses. There might be different variations or types of Sacramento, California Quitclaim Deed — Trust to Husband and Wife, depending on specific circumstances or legal requirements. Some additional types or variations of this Quitclaim Deed could include: 1. Revocable Living Trust Quitclaim Deed to Husband and Wife: This type of Quitclaim Deed is executed within the framework of a revocable living trust, allowing the husband and wife to transfer property while maintaining flexibility and control over the trust assets. 2. Irrevocable Trust Quitclaim Deed to Husband and Wife: Unlike a revocable living trust, an irrevocable trust is one where the terms of the trust cannot be altered or revoked without the permission of the beneficiaries. This type of Quitclaim Deed may be used when the couple wants to transfer property into an irrevocable trust. 3. Trustee's Quitclaim Deed to Husband and Wife: In certain cases, the trustee of a trust may execute a Quitclaim Deed as a means to transfer property to a husband and wife who are both beneficiaries of the trust. It is essential to consult with a qualified attorney or legal professional in Sacramento, California, to ensure that the appropriate type of quitclaim deed is used depending on the specific circumstances and goals of the parties involved.