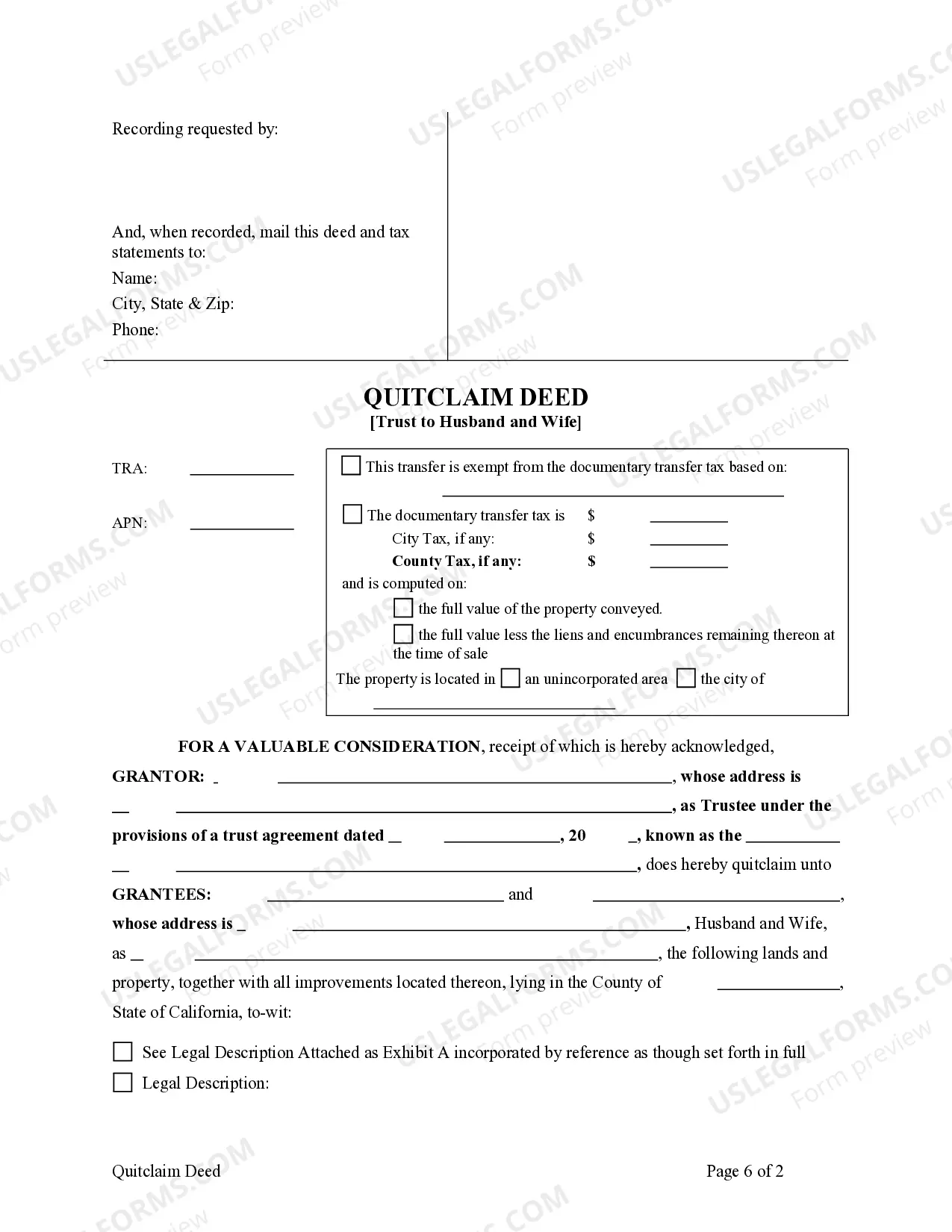

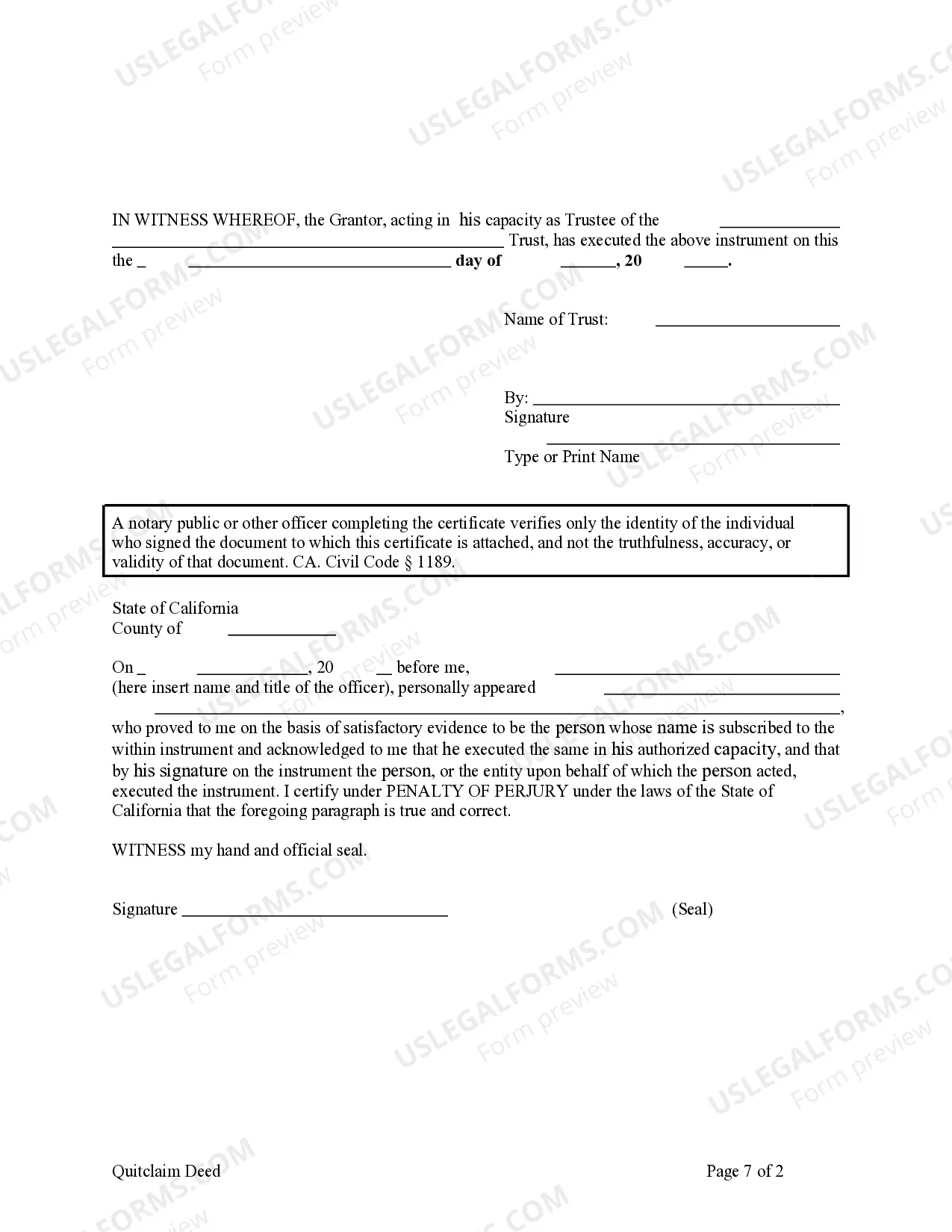

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

A San Jose California Quitclaim Deed — Trust to Husband and Wife is a legal document that transfers ownership of property from a trust to a married couple. It is often used when couples want to change the ownership of property held in a trust to joint ownership. The quitclaim deed is a type of deed used for transferring real estate ownership without providing any guarantees or warranties about the property. It is different from a warranty deed, which guarantees the property's title. However, the quitclaim deed is commonly used when there is a preexisting relationship of trust between the parties involved, such as a married couple. The purpose of the trust in this context is to hold the property and ensure its proper management and distribution. The trust is usually created with the assistance of an attorney and serves as a legal entity that holds ownership of the property on behalf of the trust beneficiaries. By transferring the property to the trust, the couple is able to bypass probate proceedings, simplify estate planning, and protect their assets. There may be different variations of the San Jose California Quitclaim Deed — Trust to Husband and Wife based on specific circumstances or preferences. Some common types include: 1. Revocable Living Trust: This type of trust allows the couple to retain control over the property during their lifetime. They can make changes or revoke the trust if desired, ensuring flexibility in managing their assets. 2. Irrevocable Trust: In contrast to a revocable trust, an irrevocable trust cannot be easily altered or revoked by the trust or (the couple). Once the property is transferred to the irrevocable trust, it becomes the trust's asset and is no longer under the direct control of the couple. This type of trust may offer additional asset protection or tax benefits. 3. Testamentary Trust: This type of trust goes into effect upon the death of one or both spouses. It allows the couple to dictate the terms of property distribution and management after their passing, ensuring their wishes are followed. When completing a San Jose California Quitclaim Deed — Trust to Husband and Wife, it is crucial to accurately identify the parties involved, including the trust name and the names of the husband and wife. The legal description of the property being transferred should be provided in the deed, along with any relevant restrictions or encumbrances. It is highly recommended consulting with a real estate attorney or a professional knowledgeable in trust law to ensure the proper completion and execution of the quitclaim deed. This will help avoid any complications or disputes related to property ownership and protect the rights and interests of the couple.A San Jose California Quitclaim Deed — Trust to Husband and Wife is a legal document that transfers ownership of property from a trust to a married couple. It is often used when couples want to change the ownership of property held in a trust to joint ownership. The quitclaim deed is a type of deed used for transferring real estate ownership without providing any guarantees or warranties about the property. It is different from a warranty deed, which guarantees the property's title. However, the quitclaim deed is commonly used when there is a preexisting relationship of trust between the parties involved, such as a married couple. The purpose of the trust in this context is to hold the property and ensure its proper management and distribution. The trust is usually created with the assistance of an attorney and serves as a legal entity that holds ownership of the property on behalf of the trust beneficiaries. By transferring the property to the trust, the couple is able to bypass probate proceedings, simplify estate planning, and protect their assets. There may be different variations of the San Jose California Quitclaim Deed — Trust to Husband and Wife based on specific circumstances or preferences. Some common types include: 1. Revocable Living Trust: This type of trust allows the couple to retain control over the property during their lifetime. They can make changes or revoke the trust if desired, ensuring flexibility in managing their assets. 2. Irrevocable Trust: In contrast to a revocable trust, an irrevocable trust cannot be easily altered or revoked by the trust or (the couple). Once the property is transferred to the irrevocable trust, it becomes the trust's asset and is no longer under the direct control of the couple. This type of trust may offer additional asset protection or tax benefits. 3. Testamentary Trust: This type of trust goes into effect upon the death of one or both spouses. It allows the couple to dictate the terms of property distribution and management after their passing, ensuring their wishes are followed. When completing a San Jose California Quitclaim Deed — Trust to Husband and Wife, it is crucial to accurately identify the parties involved, including the trust name and the names of the husband and wife. The legal description of the property being transferred should be provided in the deed, along with any relevant restrictions or encumbrances. It is highly recommended consulting with a real estate attorney or a professional knowledgeable in trust law to ensure the proper completion and execution of the quitclaim deed. This will help avoid any complications or disputes related to property ownership and protect the rights and interests of the couple.