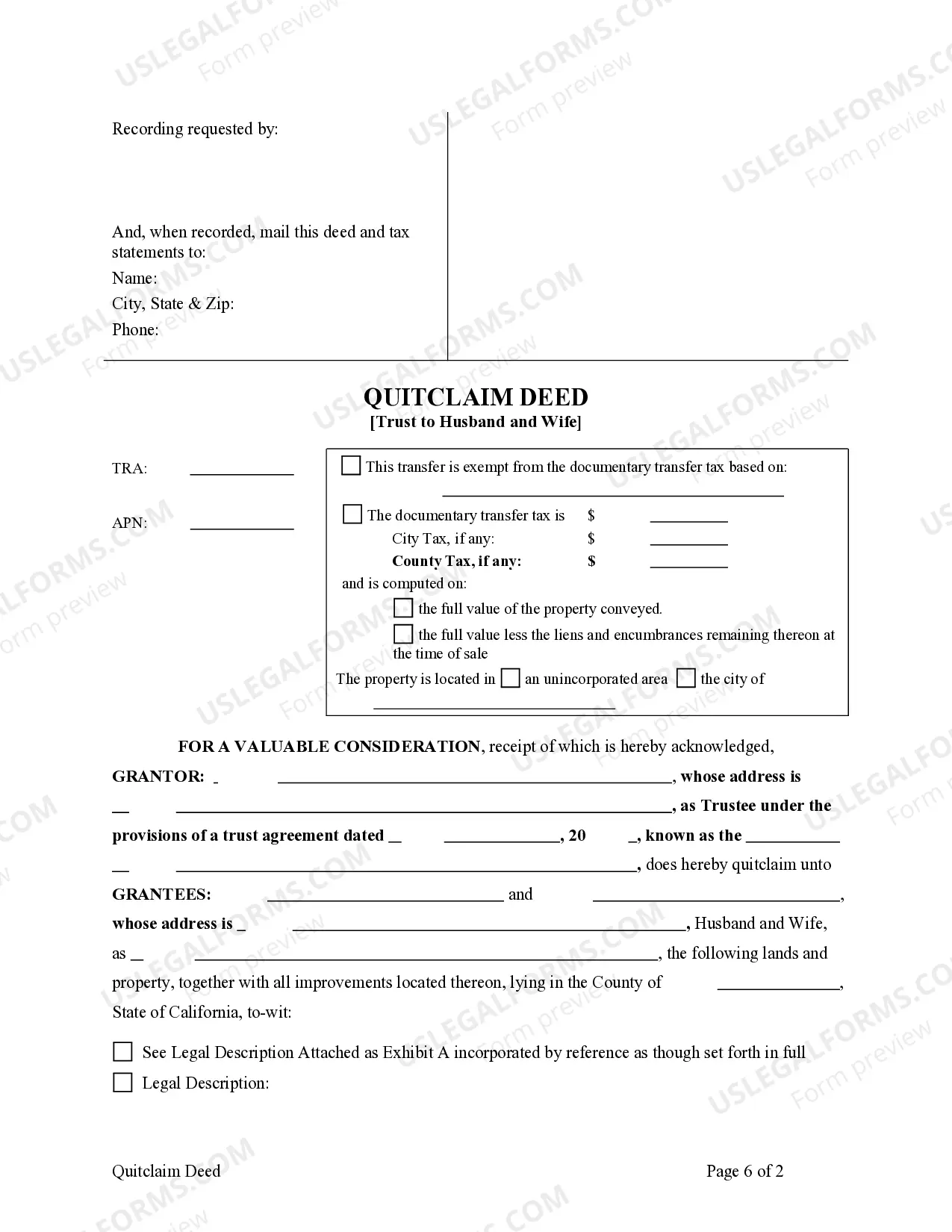

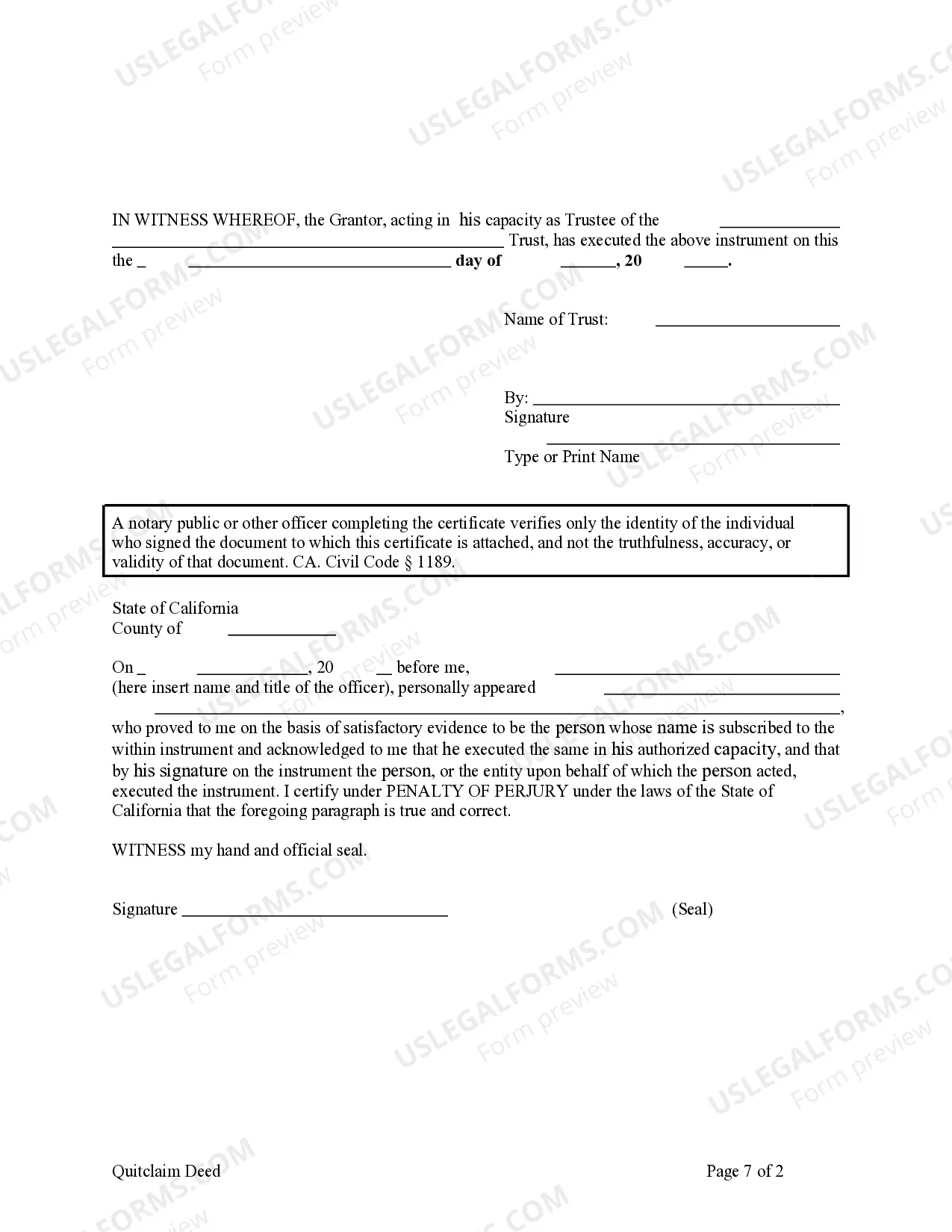

This form is a Quitclaim Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and quitclaims the described property to grantees. Grantees take the property as community property with the right of survivorship, community property, joint tenants with the right of survivorship, or tenants in common. This deed complies with all state statutory laws.

A Thousand Oaks California Quitclaim Deed — Trust to Husband and Wife is a legal document used to transfer ownership of real estate property from a trust to a married couple in Thousand Oaks, California. This type of deed is commonly used when a property is held in a trust and the trustees (the owners of the property) wish to transfer the property to themselves as individuals, specifically, to them as a married couple. A quitclaim deed is a type of deed that transfers any interest the granter (the person transferring the property) may have in the property to the grantee (the person receiving the property). Unlike a warranty deed, a quitclaim deed does not provide any guarantee or warranty of ownership and only transfers the interest the granter may hold at the time of the transfer. However, in the case of a trust transfer, the granter is usually the trustee of the trust, ensuring a smoother transfer process. In the context of Thousand Oaks, California, there may be different variations of the Quitclaim Deed — Trust to Husband and Wife, depending on specific circumstances or requirements. These variations can include: 1. Joint Tenancy with Rights of Survivorship: This type of quitclaim deed allows the property to be held as joint tenants by the husband and wife. If one spouse passes away, the surviving spouse automatically inherits the deceased spouse's interest in the property. 2. Community Property: In California, a married couple may hold property as community property, which means they share equal ownership and have the right of survivorship. The quitclaim deed transferring the property to the husband and wife would reflect this arrangement. 3. Tenancy in Common: This type of quitclaim deed allows the property to be owned by the husband and wife as tenants in common. Each spouse has a distinct and separate share of the property, and if one spouse passes away, their share will be transferred according to their estate plan or intestate succession laws. When executing a Thousand Oaks California Quitclaim Deed — Trust to Husband and Wife, it is important to consult with an experienced real estate attorney or a qualified legal professional to ensure that the deed is drafted accurately, in compliance with California laws, and meets the specific needs of the trustees. Additionally, it is advisable to have the deed recorded with the County Recorder's Office to provide notice of the transfer and establish a legal record of the ownership change.A Thousand Oaks California Quitclaim Deed — Trust to Husband and Wife is a legal document used to transfer ownership of real estate property from a trust to a married couple in Thousand Oaks, California. This type of deed is commonly used when a property is held in a trust and the trustees (the owners of the property) wish to transfer the property to themselves as individuals, specifically, to them as a married couple. A quitclaim deed is a type of deed that transfers any interest the granter (the person transferring the property) may have in the property to the grantee (the person receiving the property). Unlike a warranty deed, a quitclaim deed does not provide any guarantee or warranty of ownership and only transfers the interest the granter may hold at the time of the transfer. However, in the case of a trust transfer, the granter is usually the trustee of the trust, ensuring a smoother transfer process. In the context of Thousand Oaks, California, there may be different variations of the Quitclaim Deed — Trust to Husband and Wife, depending on specific circumstances or requirements. These variations can include: 1. Joint Tenancy with Rights of Survivorship: This type of quitclaim deed allows the property to be held as joint tenants by the husband and wife. If one spouse passes away, the surviving spouse automatically inherits the deceased spouse's interest in the property. 2. Community Property: In California, a married couple may hold property as community property, which means they share equal ownership and have the right of survivorship. The quitclaim deed transferring the property to the husband and wife would reflect this arrangement. 3. Tenancy in Common: This type of quitclaim deed allows the property to be owned by the husband and wife as tenants in common. Each spouse has a distinct and separate share of the property, and if one spouse passes away, their share will be transferred according to their estate plan or intestate succession laws. When executing a Thousand Oaks California Quitclaim Deed — Trust to Husband and Wife, it is important to consult with an experienced real estate attorney or a qualified legal professional to ensure that the deed is drafted accurately, in compliance with California laws, and meets the specific needs of the trustees. Additionally, it is advisable to have the deed recorded with the County Recorder's Office to provide notice of the transfer and establish a legal record of the ownership change.