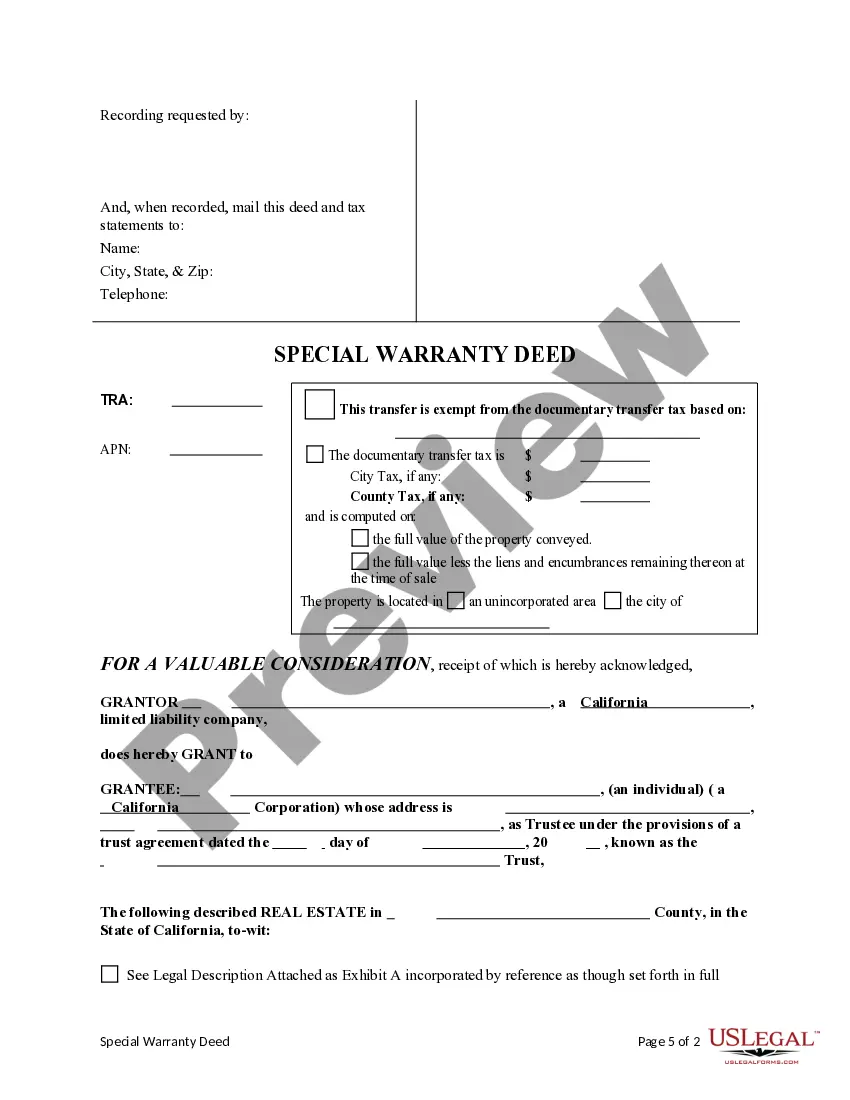

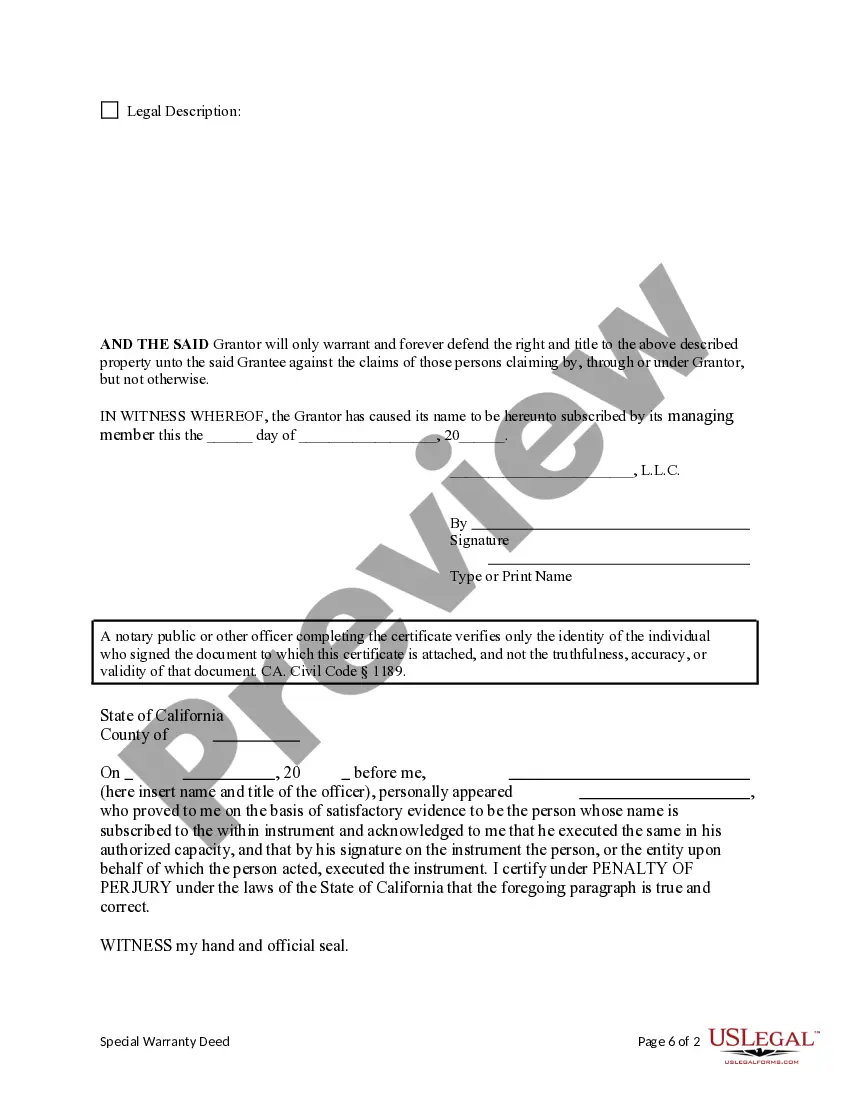

This form is a Special Warranty Deed where the Grantor is a limited liability company and the Grantee is a Trust. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

A Burbank California Special Warranty Deed — Limited Liability Company to a Trust is a legal document that transfers real estate ownership rights from a Limited Liability Company (LLC) to a Trust. This type of deed provides certain guarantees to the grantee (the trust), protecting the property from any past claims or conflicts that may arise. The Special Warranty Deed assures the granter (LLC) warrants the title only against claims that may have occurred during its ownership period. This means that any issues arising from previous ownership are not included in the warranty. However, this form of deed still provides a level of protection to the grantee by assuring that the LLC has taken appropriate action to ensure a clear title. There are a few variations of Burbank California Special Warranty Deeds — Limited Liability Company to a Trust, including: 1. Individual Trustee to Trust: This type of deed is commonly used when an individual trustee transfers the property owned by an LLC to a trust. 2. Corporate Trustee to Trust: In cases where a trustee is a corporation acting on behalf of an LLC, this type of deed is utilized to transfer the property to a trust. 3. Multiple Members of an LLC to a Trust: When multiple members of an LLC collectively transfer ownership to a trust, this variation is employed to formalize the transaction. The purpose of executing a Burbank California Special Warranty Deed — Limited Liability Company to a Trust is to properly transfer property ownership while providing some level of warranty against previous claims. It ensures that the trust receiving the property has a valid and clear title, reducing potential conflicts and protecting both parties involved. If you intend to engage in such a transaction, it is crucial to consult with a qualified real estate attorney or legal professional to understand the specific requirements, implications, and legalities associated with your unique circumstances.A Burbank California Special Warranty Deed — Limited Liability Company to a Trust is a legal document that transfers real estate ownership rights from a Limited Liability Company (LLC) to a Trust. This type of deed provides certain guarantees to the grantee (the trust), protecting the property from any past claims or conflicts that may arise. The Special Warranty Deed assures the granter (LLC) warrants the title only against claims that may have occurred during its ownership period. This means that any issues arising from previous ownership are not included in the warranty. However, this form of deed still provides a level of protection to the grantee by assuring that the LLC has taken appropriate action to ensure a clear title. There are a few variations of Burbank California Special Warranty Deeds — Limited Liability Company to a Trust, including: 1. Individual Trustee to Trust: This type of deed is commonly used when an individual trustee transfers the property owned by an LLC to a trust. 2. Corporate Trustee to Trust: In cases where a trustee is a corporation acting on behalf of an LLC, this type of deed is utilized to transfer the property to a trust. 3. Multiple Members of an LLC to a Trust: When multiple members of an LLC collectively transfer ownership to a trust, this variation is employed to formalize the transaction. The purpose of executing a Burbank California Special Warranty Deed — Limited Liability Company to a Trust is to properly transfer property ownership while providing some level of warranty against previous claims. It ensures that the trust receiving the property has a valid and clear title, reducing potential conflicts and protecting both parties involved. If you intend to engage in such a transaction, it is crucial to consult with a qualified real estate attorney or legal professional to understand the specific requirements, implications, and legalities associated with your unique circumstances.