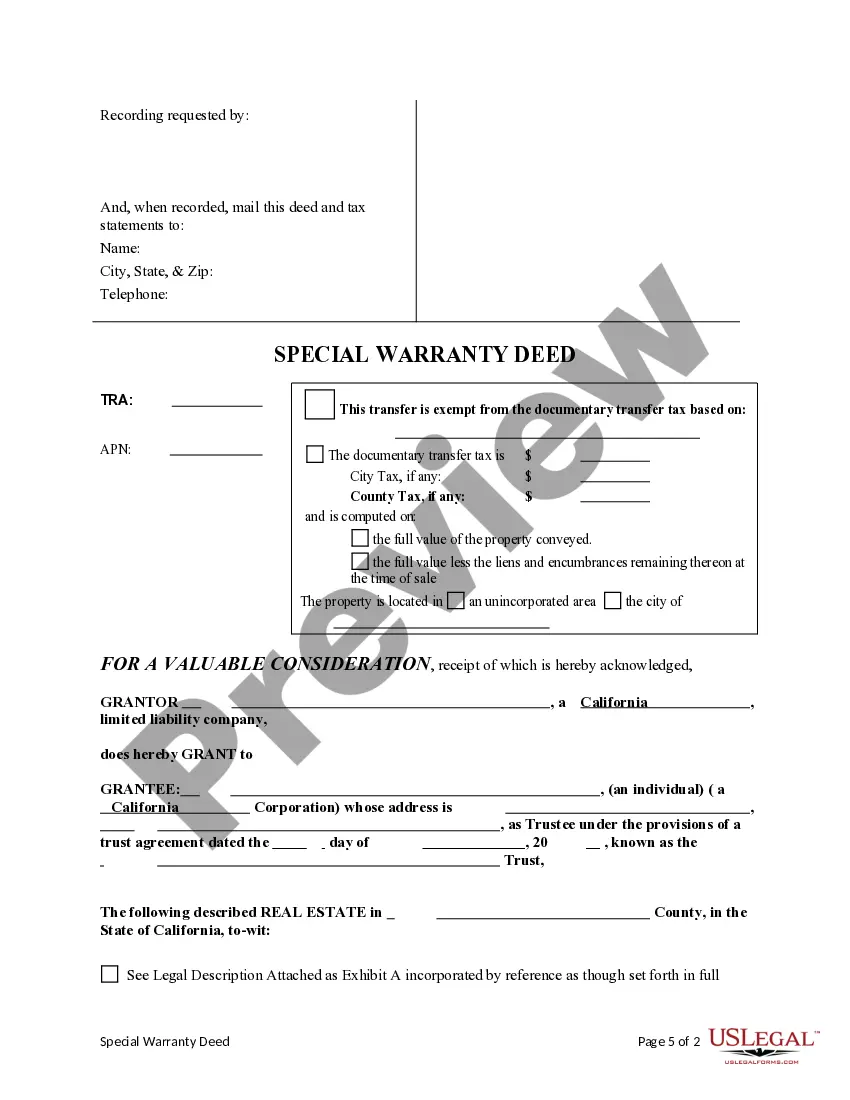

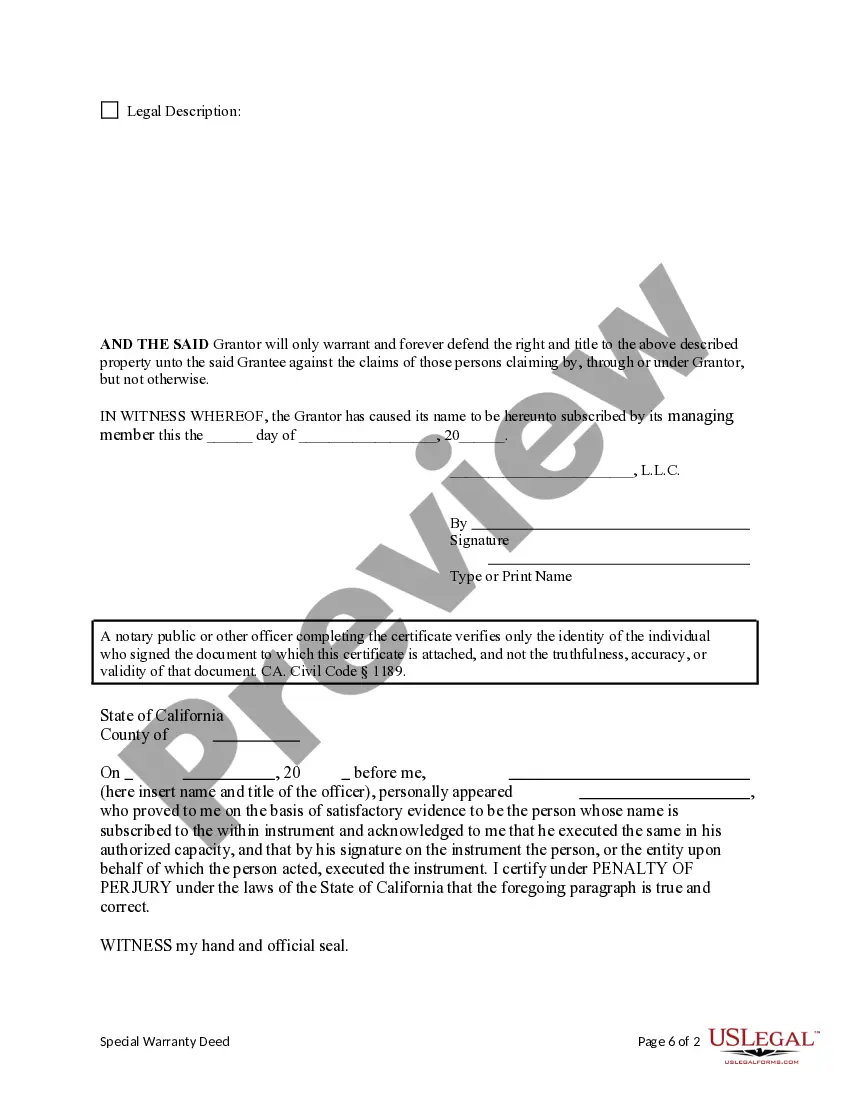

This form is a Special Warranty Deed where the Grantor is a limited liability company and the Grantee is a Trust. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

A Special Warranty Deed is a legal document used in real estate transactions that conveys ownership of property from a Limited Liability Company (LLC) to a Trust in Sunnyvale, California. This type of deed provides certain protections to the grantee (the Trust) by guaranteeing that the property's title is free from any encumbrances or claims made by the LLC or its previous owners. The Sunnyvale California Special Warranty Deed — LLC to Trust is essential for individuals or entities who wish to transfer property from an LLC to a Trust while ensuring a limited level of warranty. This means that the LLC only warrants against any title defects or claims that may have occurred during its period of ownership. It does not cover any defects or claims that might have existed prior to the LLC's ownership. It is important to mention that there may be different types of Sunnyvale California Special Warranty Deed — LLC to Trust based on specific circumstances or variations in the language used in the deed. Some possible variations include: 1. Sunnyvale California Special Warranty Deed — LLC to Revocable Living Trust: This type of deed involves transferring property from an LLC to a revocable living trust. Revocable living trusts are commonly used for estate planning purposes, allowing individuals to maintain control over their assets while providing a smooth transfer of ownership upon their passing. 2. Sunnyvale California Special Warranty Deed — LLC to Irrevocable Trust: In this case, the LLC transfers property to an irrevocable trust, which typically cannot be altered or revoked without the consent of the beneficiaries or as stipulated in the trust agreement. Irrevocable trusts offer various benefits such as asset protection and estate tax planning. 3. Sunnyvale California Special Warranty Deed — LLC to Testamentary Trust: This type of deed involves transferring property from an LLC to a testamentary trust, which is created under a person's will and takes effect upon their death. Testamentary trusts are commonly used to ensure the proper distribution of assets according to the wishes outlined in a will. 4. Sunnyvale California Special Warranty Deed — LLC to Special Needs Trust: This variation applies when a person with special needs or disabilities requires specific asset management. The LLC transfers the property to a special needs trust, which helps ensure that the individual can maintain eligibility for government benefits while still receiving necessary support from the trust. By utilizing a Sunnyvale California Special Warranty Deed — Limited Liability Company to a Trust, the transfer of property from an LLC to a Trust in Sunnyvale, California can be properly documented and protected. It is crucial to consult with legal professionals and experts well-versed in real estate and estate planning to ensure the deed accurately reflects the intentions of all parties involved and complies with relevant state laws.A Special Warranty Deed is a legal document used in real estate transactions that conveys ownership of property from a Limited Liability Company (LLC) to a Trust in Sunnyvale, California. This type of deed provides certain protections to the grantee (the Trust) by guaranteeing that the property's title is free from any encumbrances or claims made by the LLC or its previous owners. The Sunnyvale California Special Warranty Deed — LLC to Trust is essential for individuals or entities who wish to transfer property from an LLC to a Trust while ensuring a limited level of warranty. This means that the LLC only warrants against any title defects or claims that may have occurred during its period of ownership. It does not cover any defects or claims that might have existed prior to the LLC's ownership. It is important to mention that there may be different types of Sunnyvale California Special Warranty Deed — LLC to Trust based on specific circumstances or variations in the language used in the deed. Some possible variations include: 1. Sunnyvale California Special Warranty Deed — LLC to Revocable Living Trust: This type of deed involves transferring property from an LLC to a revocable living trust. Revocable living trusts are commonly used for estate planning purposes, allowing individuals to maintain control over their assets while providing a smooth transfer of ownership upon their passing. 2. Sunnyvale California Special Warranty Deed — LLC to Irrevocable Trust: In this case, the LLC transfers property to an irrevocable trust, which typically cannot be altered or revoked without the consent of the beneficiaries or as stipulated in the trust agreement. Irrevocable trusts offer various benefits such as asset protection and estate tax planning. 3. Sunnyvale California Special Warranty Deed — LLC to Testamentary Trust: This type of deed involves transferring property from an LLC to a testamentary trust, which is created under a person's will and takes effect upon their death. Testamentary trusts are commonly used to ensure the proper distribution of assets according to the wishes outlined in a will. 4. Sunnyvale California Special Warranty Deed — LLC to Special Needs Trust: This variation applies when a person with special needs or disabilities requires specific asset management. The LLC transfers the property to a special needs trust, which helps ensure that the individual can maintain eligibility for government benefits while still receiving necessary support from the trust. By utilizing a Sunnyvale California Special Warranty Deed — Limited Liability Company to a Trust, the transfer of property from an LLC to a Trust in Sunnyvale, California can be properly documented and protected. It is crucial to consult with legal professionals and experts well-versed in real estate and estate planning to ensure the deed accurately reflects the intentions of all parties involved and complies with relevant state laws.