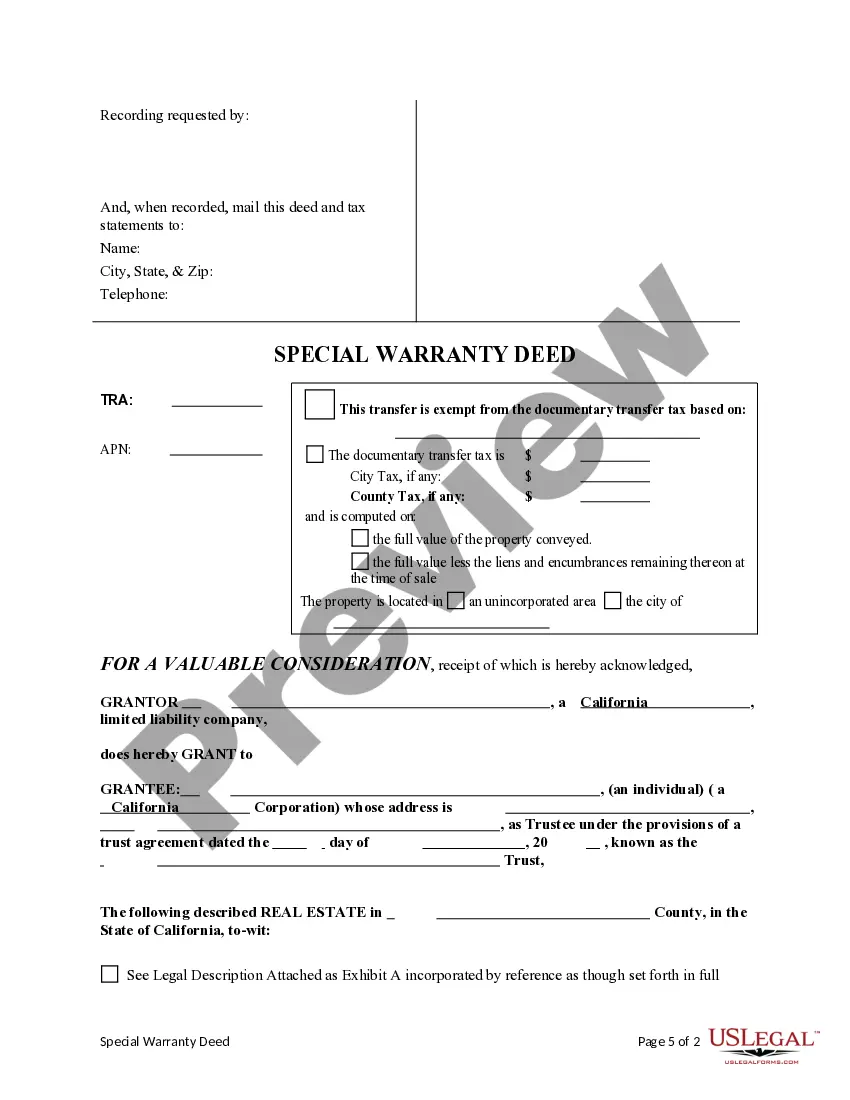

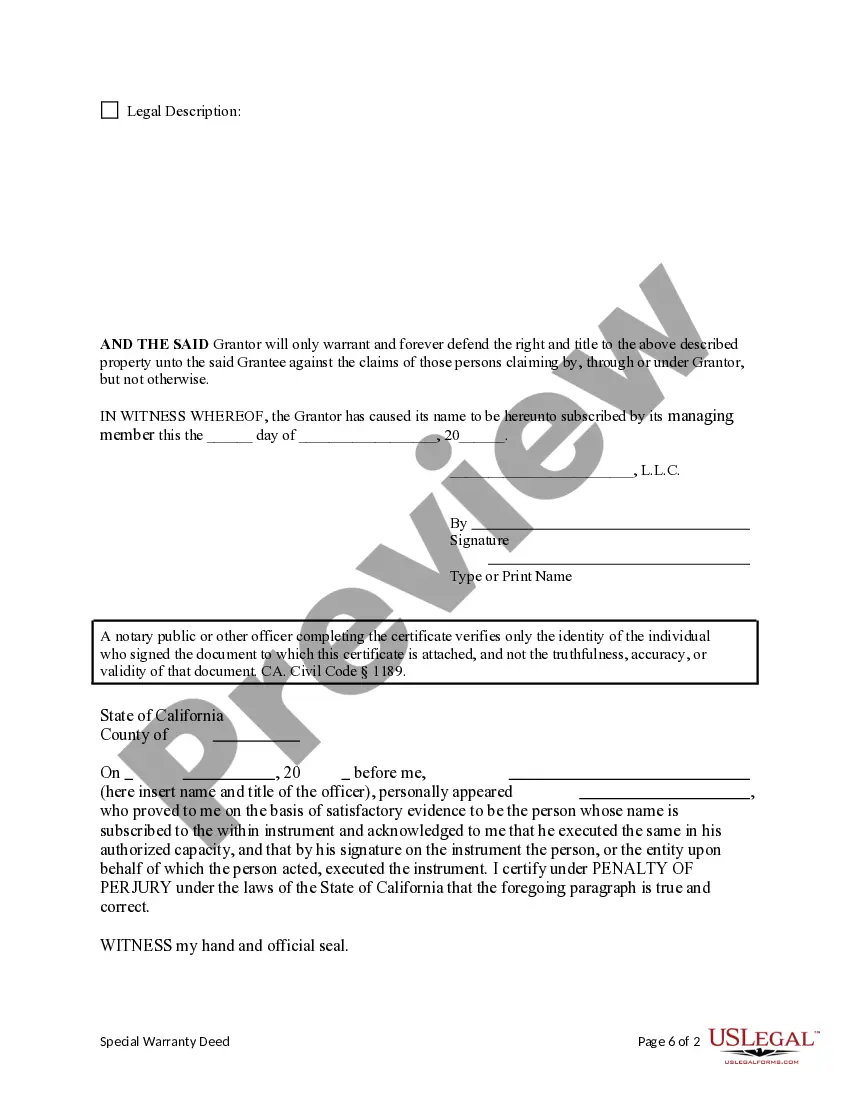

This form is a Special Warranty Deed where the Grantor is a limited liability company and the Grantee is a Trust. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

A Thousand Oaks California Special Warranty Deed — Limited Liability Company to a Trust is a legal document that transfers ownership of a property from a Limited Liability Company (LLC) to a trust. This type of deed provides certain protections and warranties for the buyer (trustee), which differ from a general warranty deed or a quitclaim deed. The Special Warranty Deed includes a limited warranty, which means that the LLC guarantees that it has not done anything to impair the title of the property during the time it held ownership. This warranty covers any defects or encumbrances that may have occurred under the LLC's ownership, but it does not extend to previous owners. It basically ensures that the LLC is warranting the title against any actions taken by the LLC itself. A Special Warranty Deed is often used when transferring property from an LLC to a trust for estate planning purposes or to protect the property from creditors. It can also be used when transferring a property from an LLC to an individual or entity who wishes to hold the property in a trust. The specific types of Thousand Oaks California Special Warranty Deed — Limited Liability Company to a Trust can vary depending on the specific circumstances and requirements of the parties involved. Some common variations include: 1. Irrevocable Trust Special Warranty Deed: This is a type of special warranty deed where the trust created is irrevocable, meaning that the terms of the trust cannot be modified or revoked without the consent of the beneficiaries or a court order. 2. Revocable Trust Special Warranty Deed: In this case, the special warranty deed transfers the property from the LLC to a revocable trust, which allows the granter (original owner) to retain control and make changes to the trust terms during their lifetime. 3. Asset Protection Trust Special Warranty Deed: This type of special warranty deed is commonly used for asset protection purposes, where the LLC transfers the property to a trust specifically designed to shield the property from potential creditors or legal disputes. 4. Family Trust Special Warranty Deed: This variation involves transferring the property from the LLC to a trust established for the benefit of family members, allowing for centralized management and potential estate planning advantages. It is crucial to consult with a qualified attorney or real estate professional when dealing with any type of trust or deed transfer to ensure compliance with applicable laws and to protect the interests of all parties involved.A Thousand Oaks California Special Warranty Deed — Limited Liability Company to a Trust is a legal document that transfers ownership of a property from a Limited Liability Company (LLC) to a trust. This type of deed provides certain protections and warranties for the buyer (trustee), which differ from a general warranty deed or a quitclaim deed. The Special Warranty Deed includes a limited warranty, which means that the LLC guarantees that it has not done anything to impair the title of the property during the time it held ownership. This warranty covers any defects or encumbrances that may have occurred under the LLC's ownership, but it does not extend to previous owners. It basically ensures that the LLC is warranting the title against any actions taken by the LLC itself. A Special Warranty Deed is often used when transferring property from an LLC to a trust for estate planning purposes or to protect the property from creditors. It can also be used when transferring a property from an LLC to an individual or entity who wishes to hold the property in a trust. The specific types of Thousand Oaks California Special Warranty Deed — Limited Liability Company to a Trust can vary depending on the specific circumstances and requirements of the parties involved. Some common variations include: 1. Irrevocable Trust Special Warranty Deed: This is a type of special warranty deed where the trust created is irrevocable, meaning that the terms of the trust cannot be modified or revoked without the consent of the beneficiaries or a court order. 2. Revocable Trust Special Warranty Deed: In this case, the special warranty deed transfers the property from the LLC to a revocable trust, which allows the granter (original owner) to retain control and make changes to the trust terms during their lifetime. 3. Asset Protection Trust Special Warranty Deed: This type of special warranty deed is commonly used for asset protection purposes, where the LLC transfers the property to a trust specifically designed to shield the property from potential creditors or legal disputes. 4. Family Trust Special Warranty Deed: This variation involves transferring the property from the LLC to a trust established for the benefit of family members, allowing for centralized management and potential estate planning advantages. It is crucial to consult with a qualified attorney or real estate professional when dealing with any type of trust or deed transfer to ensure compliance with applicable laws and to protect the interests of all parties involved.