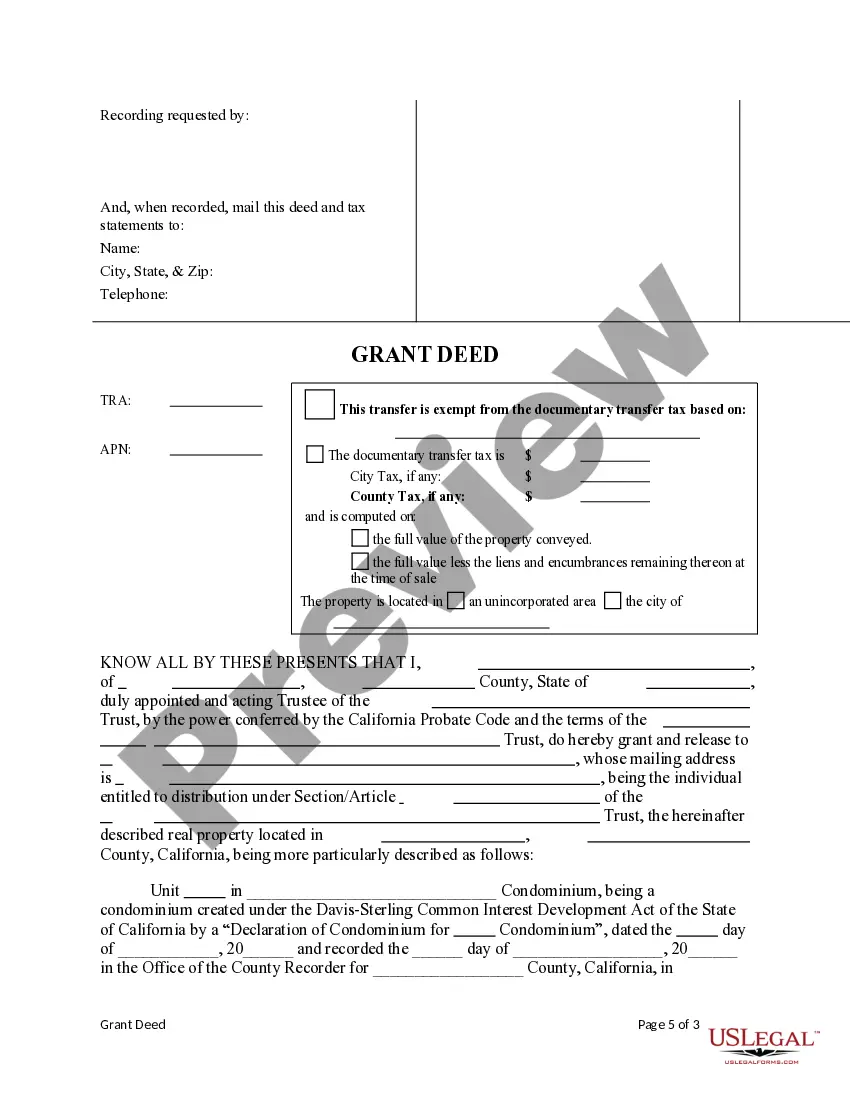

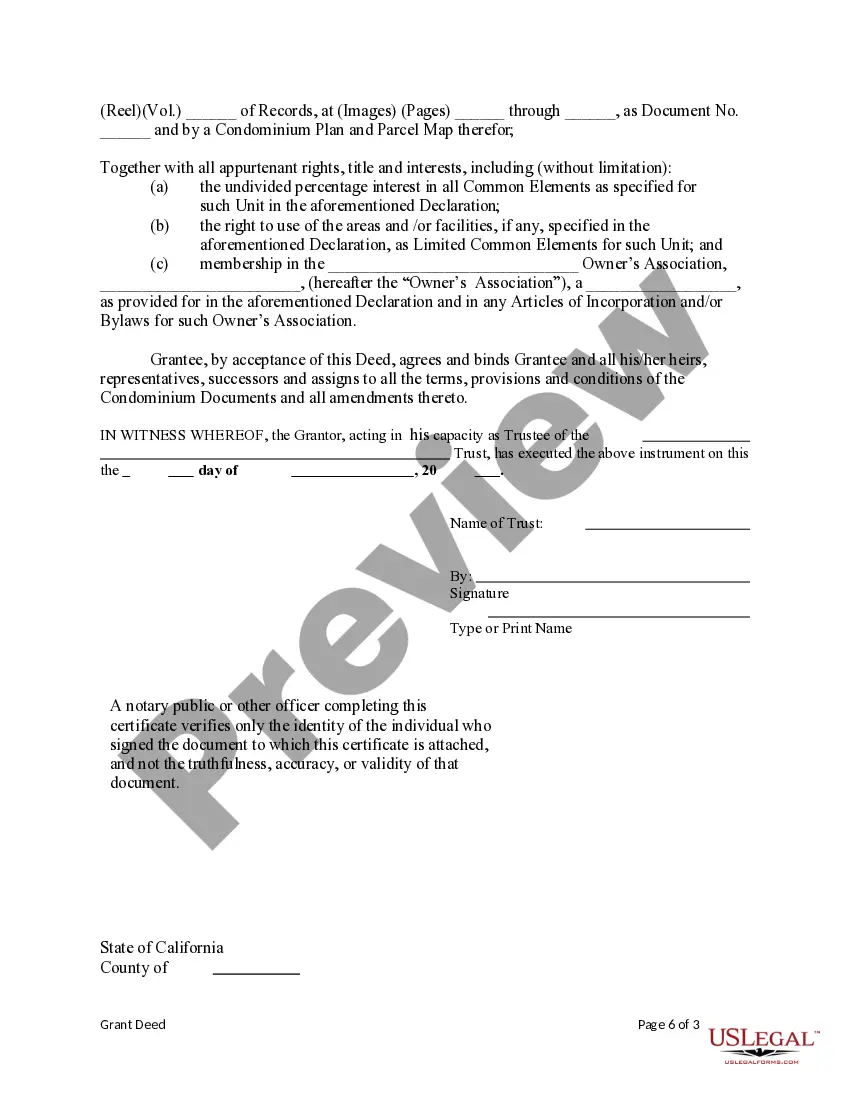

This form is a Grant Deed for Distribution of Trust property - a condominium- from the Trustee to an Individual Beneficiary. Grantor conveys and grants the described property to the Grantee. This deed complies with all state statutory laws.

Long Beach California Grant Deed for Distribution of a Condominium - Trustee to an Individual

Description

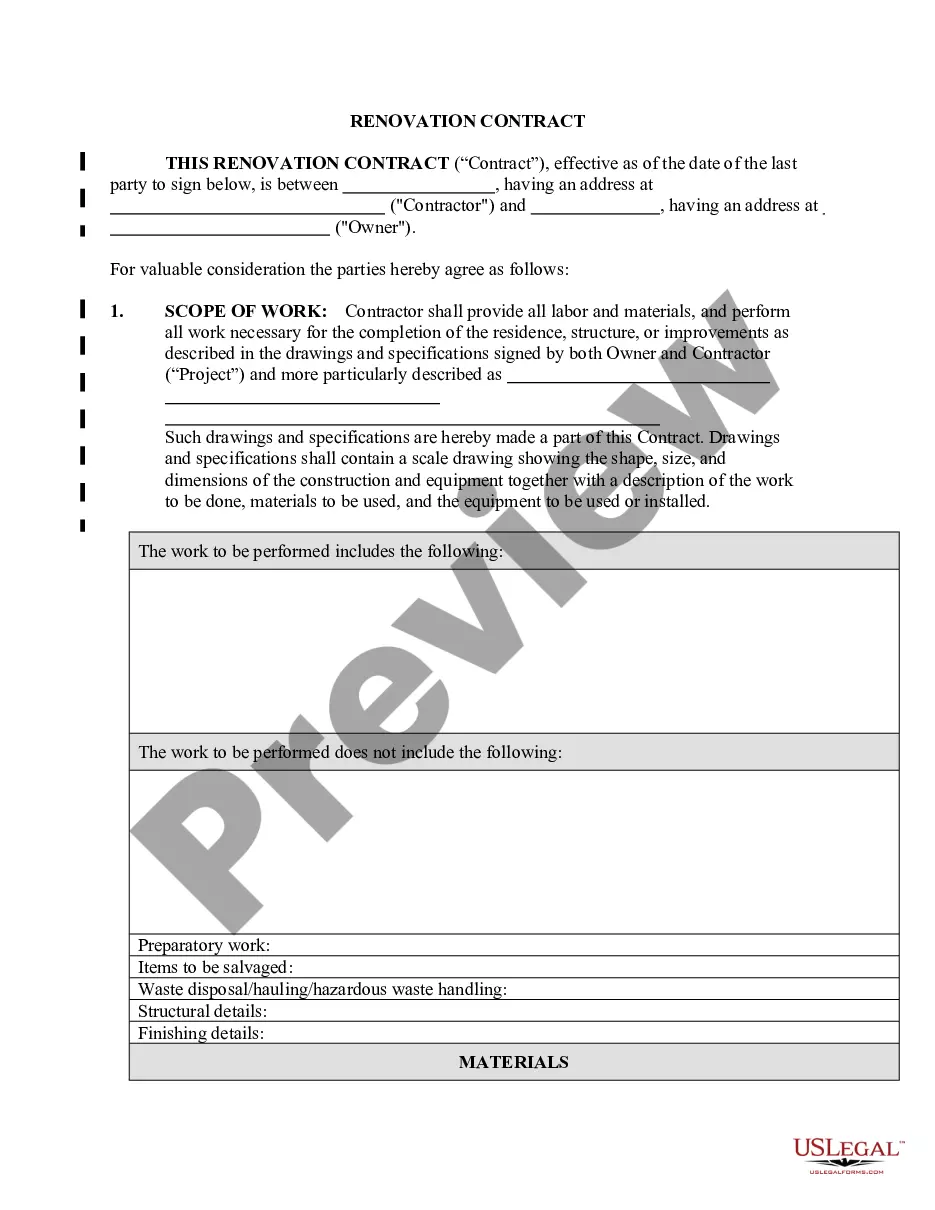

How to fill out California Grant Deed For Distribution Of A Condominium - Trustee To An Individual?

Regardless of the social or occupational rank, filling out law-related documents is a regrettable requirement in today’s workplace.

Frequently, it’s nearly unfeasible for someone lacking any legal background to generate such documents independently, primarily due to the intricate language and legal nuances they entail.

This is precisely where US Legal Forms can come to the rescue.

Be sure the form you select is localized to your area as the regulations of one state or county do not apply to another.

Review the form and read a brief description (if available) of situations for which the document may be applicable. If the selected one does not meet your requirements, you can restart and search for the desired form.

- Our service boasts an extensive collection of over 85,000 readily available state-specific forms suited for nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to expedite their tasks with our DIY forms.

- Whether you require the Long Beach California Grant Deed for Distribution of a Condominium - Trustee to an Individual or any other document suitable for your state or county, US Legal Forms has everything readily accessible.

- Here’s how you can obtain the Long Beach California Grant Deed for Distribution of a Condominium - Trustee to an Individual in just a few minutes using our reliable service.

- If you are already a customer, you can go ahead and Log In to your account to access the appropriate form.

- However, if you are unfamiliar with our platform, please follow these steps before acquiring the Long Beach California Grant Deed for Distribution of a Condominium - Trustee to an Individual.

Form popularity

FAQ

The difference between a deed and a deed of trust is the type of ownership interest each document conveys. A deed is a full ownership interest. A deed of trust is a security interest.

A grant deed is a transaction between two people or entities without securing the property as collateral. A deed of trust is used by mortgage companies when a homeowner takes out a loan against the property.

What is a trust deed. A trust deed is a voluntary agreement between you and the people you owe money to (also called your creditors). You agree to pay a regular amount of money towards your debts and at the end of a fixed time the rest of your debts will be written off.

Both types of legal documents serve the same function of transferring ownership of real property. The fundamental difference between quitclaim deeds and grant deeds is the level of protection and warranty provided to the grantee.

A trust transfer deed is the instrument that effectuates the transfer of ownership of your real-estate from you, as an individual, to your trust. The process of creating and then recording a trust transfer deed is how your property becomes a trust asset (thereby avoiding probate, among other benefits).

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

Step 1: Locate the Current Deed for the Property.Step 2: Determine What Type of Deed to Fill Out for Your Situation.Step 3: Determine How New Owners Will Take Title. Step 4: Fill Out the New Deed (Do Not Sign)Step 5: Grantor(s) Sign in Front of a Notary.Step 6: Fill Out the Preliminary Change of Ownership Report (PCOR)

California doesn't require the inclusion of the date, or of money paid, or of a notarization of the transferor's signature on the grant deed, and a grant deed is valid even if it's not recorded in the local land records.

Prior to payment of the debt, the lender was entitled to possession of the property. Use of the deed of trust with power of sale was developed to get around some of the restrictions of the mortgage and the required judicial foreclosure, a time consuming lawsuit.

Grant Deeds are used to transfer title of real property. This is done at the time of purchase and can be later recorded to add or remove individual's names after purchase.