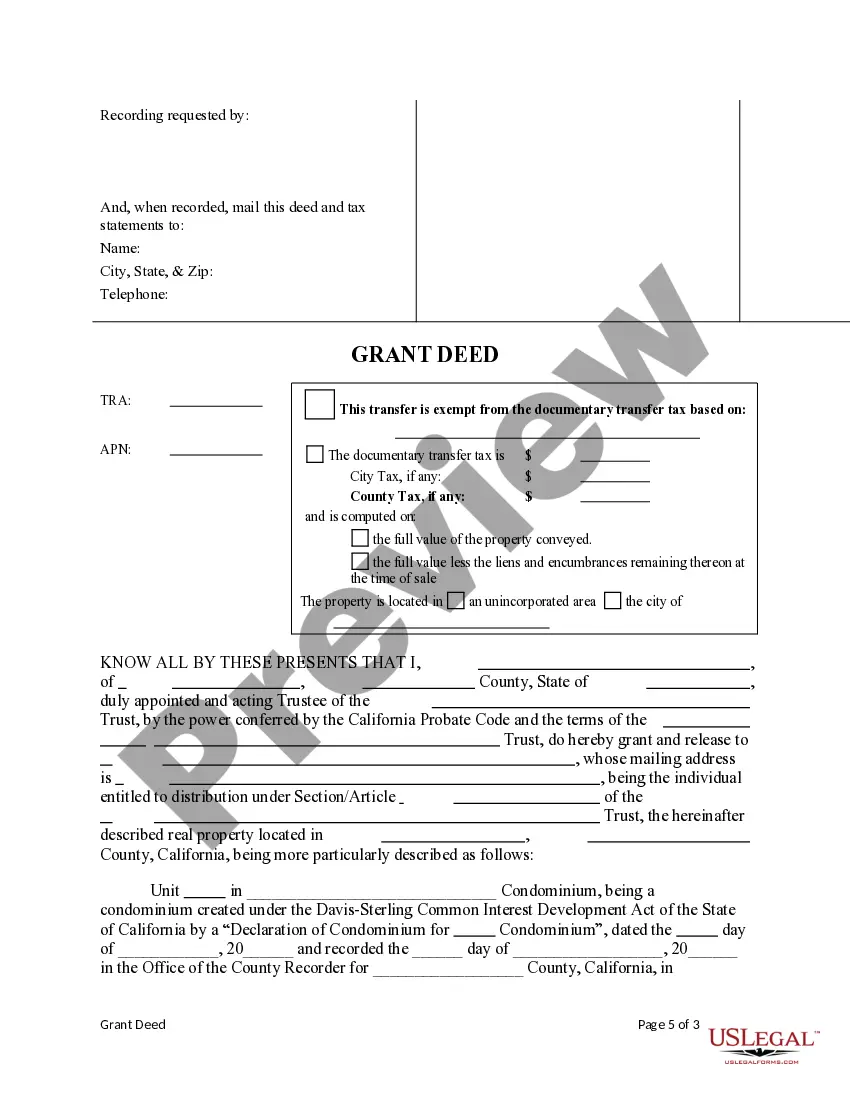

This form is a Grant Deed for Distribution of Trust property - a condominium- from the Trustee to an Individual Beneficiary. Grantor conveys and grants the described property to the Grantee. This deed complies with all state statutory laws.

The Orange California Grant Deed for Distribution of a Condominium — Trustee to an Individual is a legal document that transfers ownership of a condo unit from a trustee to an individual. It ensures the orderly distribution of property and protects the rights of both parties involved in the transaction. This type of grant deed is specifically designed for the conveyance of condominium properties located in Orange, California. It is important to note that there may be various types of Orange California Grant Deeds for Distribution of a Condominium — Trustee to an Individual, each addressing different circumstances or requirements. Some common variations include: 1. Joint Tenancy Grant Deed: This type of grant deed is used when two or more individuals are co-owners of the condo unit and hold equal shares. It allows them to transfer their interests to an individual trustee, who can then distribute the property to an individual beneficiary. 2. Tenants in Common Grant Deed: In this scenario, multiple individuals own shares of the condo unit proportional to their contribution or interest. A trustee can distribute these interests to individual beneficiaries according to the terms outlined in the grant deed. 3. Life Estate Grant Deed: This grant deed is often used when the beneficiary has a life estate interest in the condominium. The trustee holds the property until the beneficiary's death, at which point it is distributed to the designated individual. 4. Survivorship Deed: This type of grant deed allows for the transfer of ownership to an individual beneficiary upon the death of the original owner, without the need for probate. It ensures a smooth transition of the condo unit's ownership. A successful Orange California Grant Deed for Distribution of a Condominium — Trustee to an Individual requires careful drafting and adherence to state and local laws. It is recommended to consult with a qualified attorney or real estate professional to ensure the deed accurately reflects the intentions and desires of all parties involved.