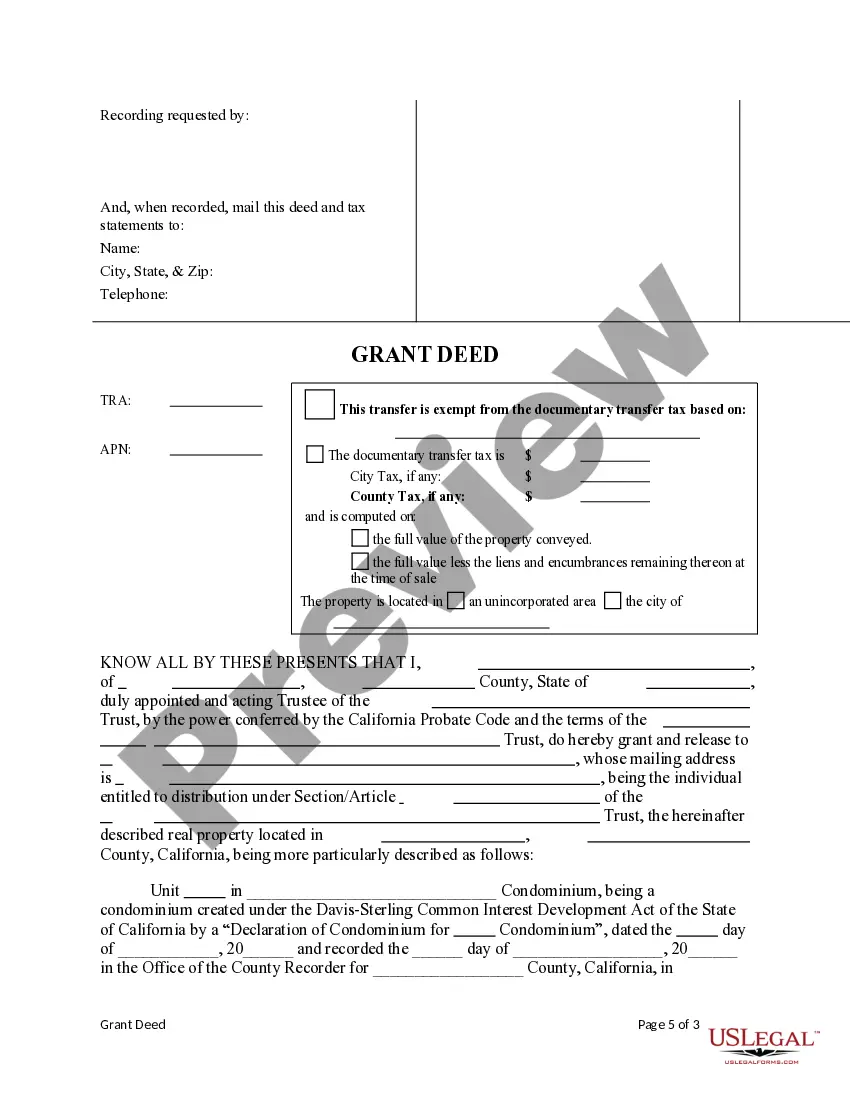

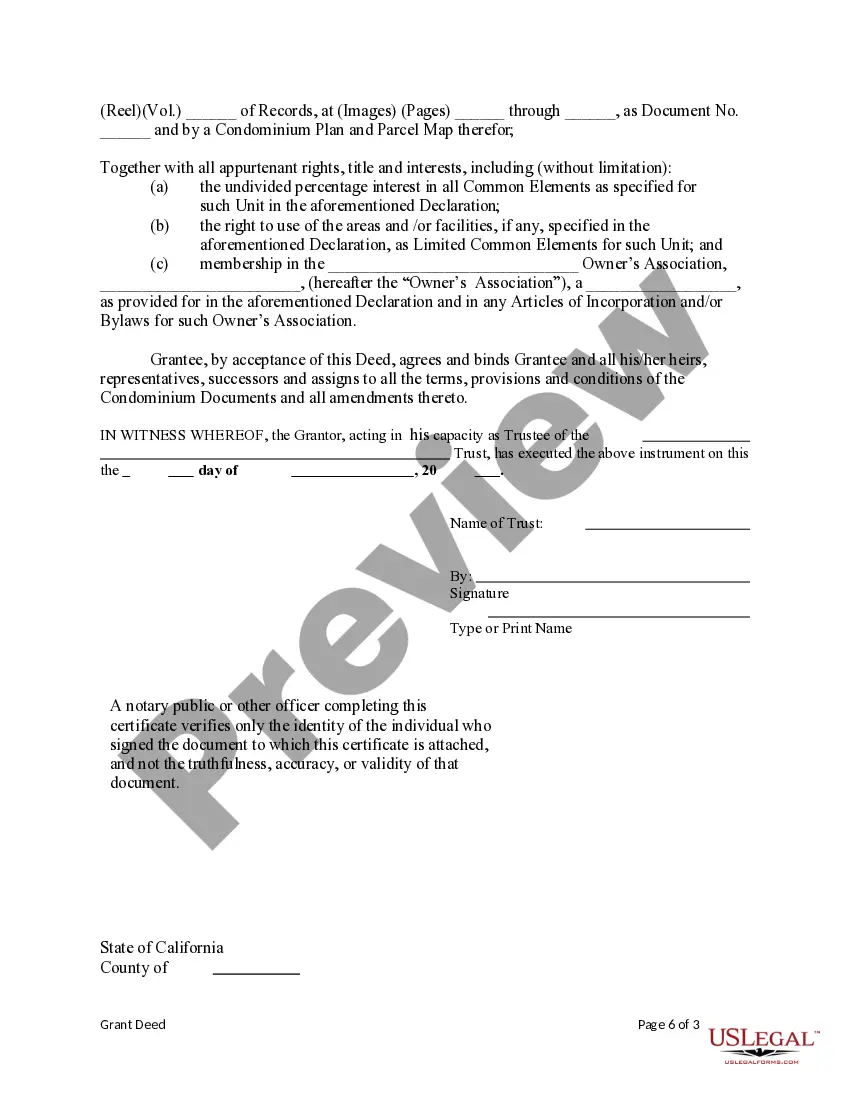

This form is a Grant Deed for Distribution of Trust property - a condominium- from the Trustee to an Individual Beneficiary. Grantor conveys and grants the described property to the Grantee. This deed complies with all state statutory laws.

San Diego California Grant Deed for Distribution of a Condominium - Trustee to an Individual

Description

How to fill out California Grant Deed For Distribution Of A Condominium - Trustee To An Individual?

Do you require a reliable and affordable provider of legal forms to purchase the San Diego California Grant Deed for the Transfer of a Condominium - Trustee to an Individual? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish rules for living together with your partner or a set of forms to facilitate your separation or divorce through the legal system, we have you covered. Our platform provides over 85,000 current legal document templates for both personal and business purposes. All the templates we offer are tailored and designed based on the requirements of specific states and areas.

To obtain the form, you must Log In to your account, find the desired form, and click the Download button adjacent to it. Please note that you can download your previously acquired form templates at any moment in the My documents section.

Are you unfamiliar with our platform? No problem. You can easily set up an account, but first, ensure that you do the following.

Now you can create your account. Then select the subscription plan and proceed with the payment. After the payment is processed, download the San Diego California Grant Deed for the Transfer of a Condominium - Trustee to an Individual in any available format. You can return to the site whenever you need and redownload the form at no additional cost.

Locating current legal forms has never been simpler. Give US Legal Forms a try today, and put an end to wasting your precious time researching legal documents online.

- Check if the San Diego California Grant Deed for the Transfer of a Condominium - Trustee to an Individual meets the regulations of your state and locality.

- Review the form's details (if available) to determine who and what the form is designed for.

- Restart the search if the form does not fit your particular needs.

Form popularity

FAQ

Yes, a grant deed needs to be recorded in California to ensure it is legally recognized. Recording a grant deed, especially for the San Diego California Grant Deed for Distribution of a Condominium - Trustee to an Individual, protects your interests in the property. It provides public notice of the transfer and establishes a chain of title. Using a reliable platform like US Legal Forms can simplify this process, ensuring that your deed is completed correctly and filed with the appropriate authorities.

The strongest form of deed is generally considered to be a grant deed. In San Diego, California, a grant deed for distribution of a condominium from a trustee to an individual establishes clear ownership and provides certain promises, like assurance that the property has not been sold to anyone else. This type of deed is vital for ensuring that the transfer of ownership is secure and recognized by law.

A grant deed serves as evidence of ownership but does not guarantee it. It can confirm that the seller has transferred their interest in the property, but you should verify if any clouds on title exist. In the case of a San Diego California Grant Deed for Distribution of a Condominium - Trustee to an Individual, ensuring clear ownership is crucial for preventing disputes in the future.

To fill out a California grant deed, you need to include details such as the names of the granter and grantee, a legal description of the property, and any relevant signatures. Ensure you also include a statement assuring that the granter holds clear title. For those dealing with a San Diego California Grant Deed for Distribution of a Condominium - Trustee to an Individual, ulegalforms can provide templates and guidance to simplify the process.

The primary purpose of a trustee deed is to execute the transfer of property to a beneficiary following a trust arrangement. This type of deed clarifies the relationship between the trustee and the beneficiary while ensuring that property rights are protected. It plays a vital role in the San Diego California Grant Deed for Distribution of a Condominium - Trustee to an Individual, ensuring a smooth and legal transition of ownership.

One disadvantage of a grant deed is that it may not fully protect against claims made by third parties if the title has hidden defects. Additionally, a grant deed does not guarantee against future liens or encumbrances. Therefore, it is essential to understand these limitations when working with a San Diego California Grant Deed for Distribution of a Condominium - Trustee to an Individual.

A trustee grant deed is a legal document used when a trustee conveys property to an individual. It ensures that the property's title is clear and that the trustee has the authority to distribute the property. This deed is particularly relevant in situations involving the San Diego California Grant Deed for Distribution of a Condominium - Trustee to an Individual, simplifying the transfer process between the trustee and the beneficiary.

A grant deed transfers ownership of property and guarantees that the seller holds title without liens, while a trustee's deed transfers property from a trustee to a beneficiary. The main distinction lies in their purpose. In the context of a San Diego California Grant Deed for Distribution of a Condominium - Trustee to an Individual, understanding this difference can help clarify the roles of parties involved in property transactions.

Yes, grant deeds are public records in California. This means anyone can access these documents, which detail the transfer of property ownership. In the context of the San Diego California Grant Deed for Distribution of a Condominium - Trustee to an Individual, you can find information about the transaction, the involved parties, and any conditions tied to the deed. Using reliable platforms like US Legal Forms can help you navigate these records easily and ensure you have the correct documentation for your needs.