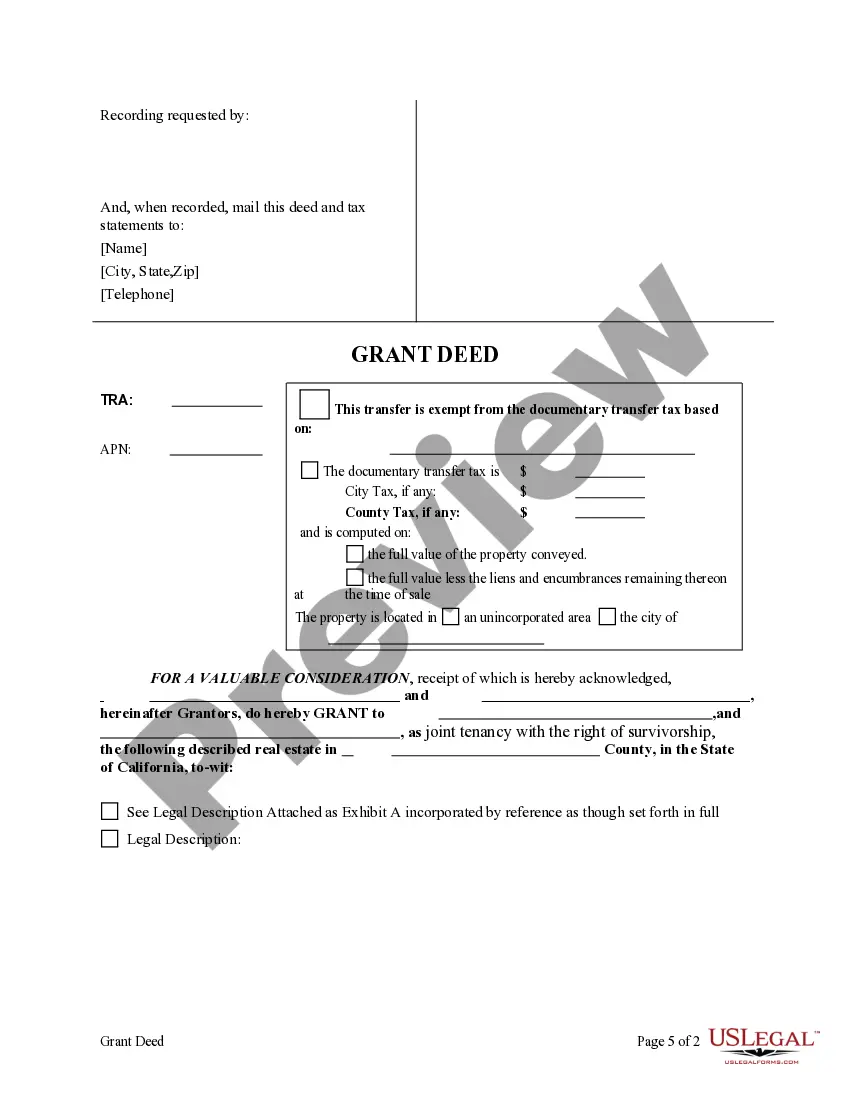

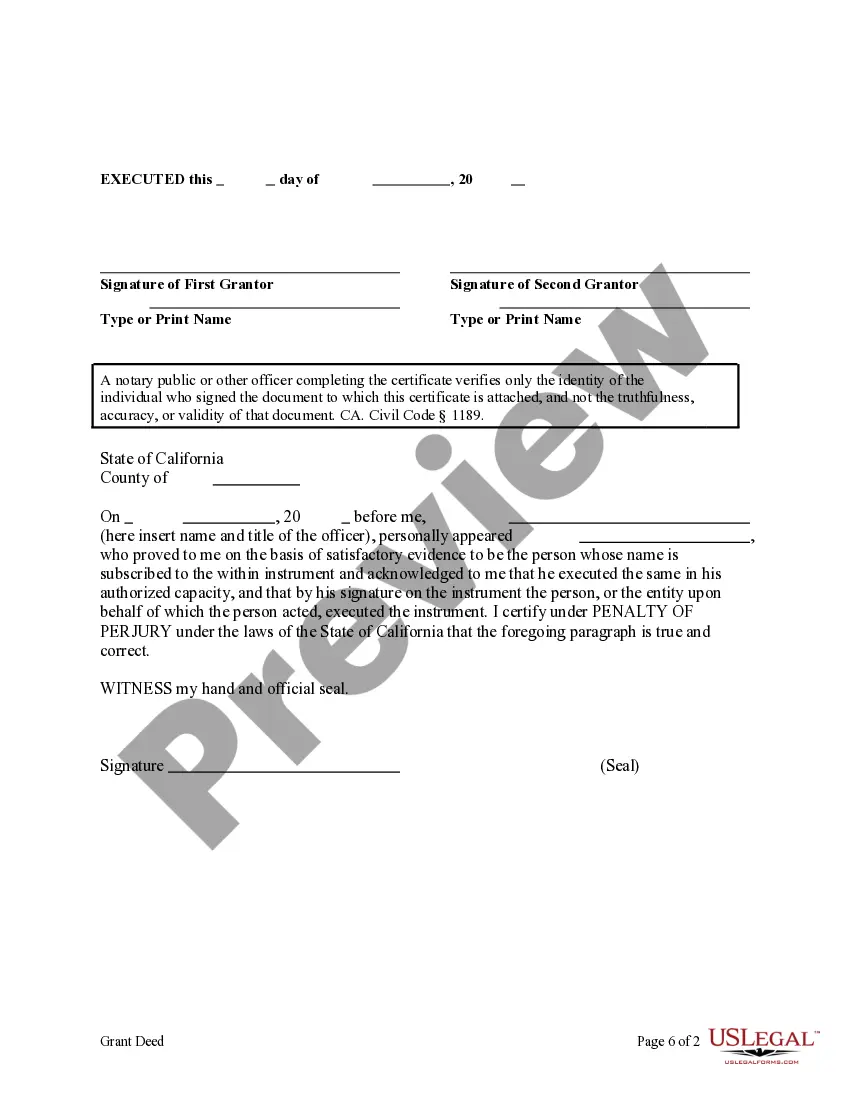

This form is a Grant Deed where the Gantors are two individuals and the Grantees are two individuals. Grantors convey and grant the described property to Grantees. The Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

A Thousand Oaks California Grant Deed refers to a legal document that facilitates the transfer of property ownership from two individuals, known as Granters, to two individuals, known as Grantees. This official record establishes a legally binding agreement, ensuring that the title of the property is effectively transferred to the deserving recipients. The Thousand Oaks California Grant Deed can come in several forms to meet specific requirements and circumstances. One such type is the Quitclaim Grant Deed, which transfers the Granters' interest in the property to the Grantees without any warranties or guarantees about the property's title. This type of deed is commonly used when the Granters are uncertain about the property's ownership and want to transfer their claim to the Grantees, who assume the same uncertainty. Another variant is the General Grant Deed, ensuring that the Granters possess a clear and marketable title to the property being transferred to the Grantees. This type of deed guarantees that no liens, encumbrances, or unforeseen claims exist against the property. When filling out a Thousand Oaks California Grant Deed, relevant details should be meticulously included. These may incorporate the full names and addresses of all Granters and Grantees involved, a detailed legal description of the property, and the specific terms and conditions agreed upon by both parties. It's necessary to ensure that the language used in the deed is precise and appropriately conveys the intentions of the Granters and Grantees while complying with local laws and regulations. Overall, a Thousand Oaks California Grant Deed serves as a vital legal instrument when transferring property ownership from two individuals as Granters to two individuals as Grantees. Whether it's a Quitclaim Grant Deed or a General Grant Deed, the process aims to ensure the smooth and transparent transfer of property rights while safeguarding the interests of all parties involved.