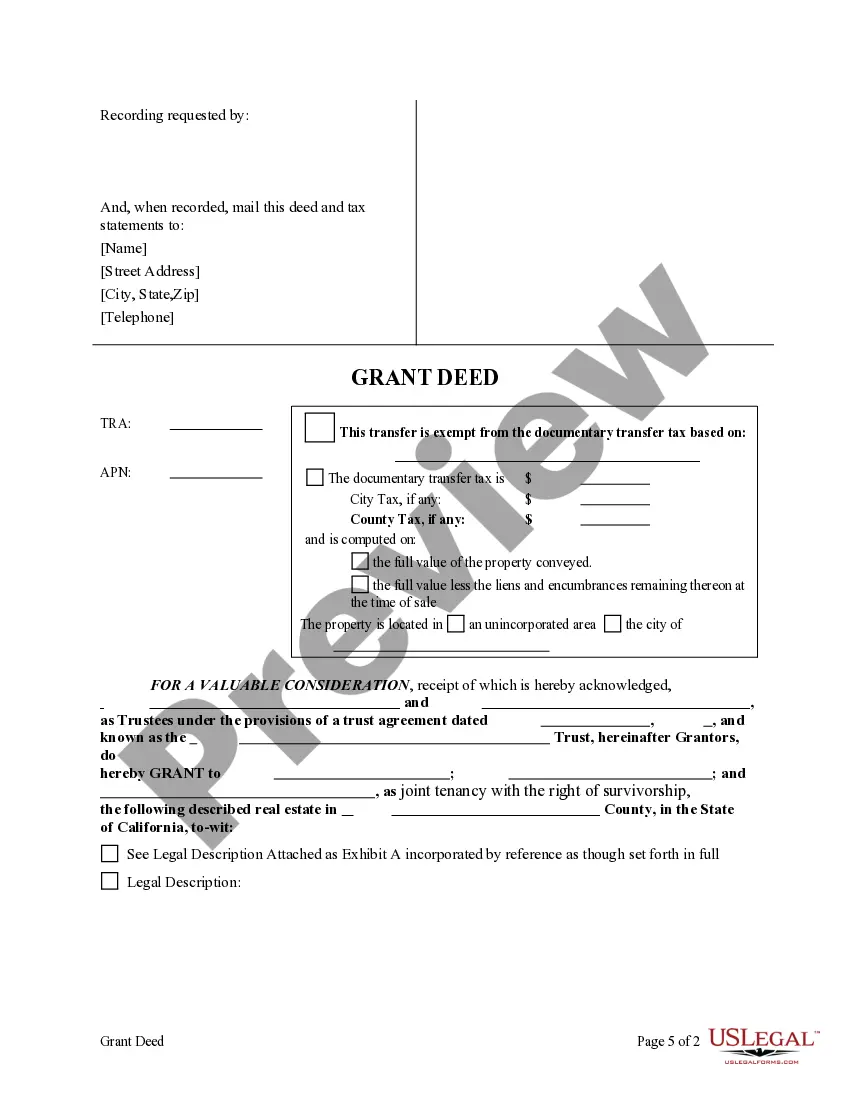

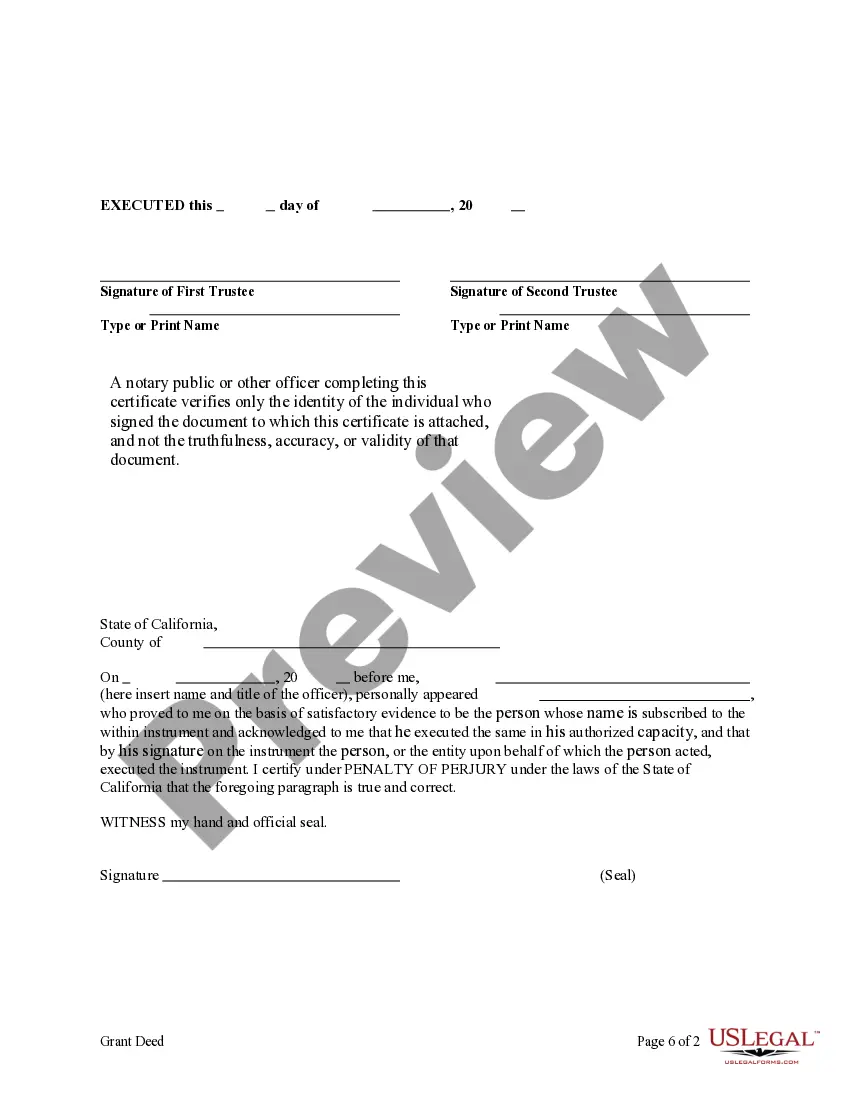

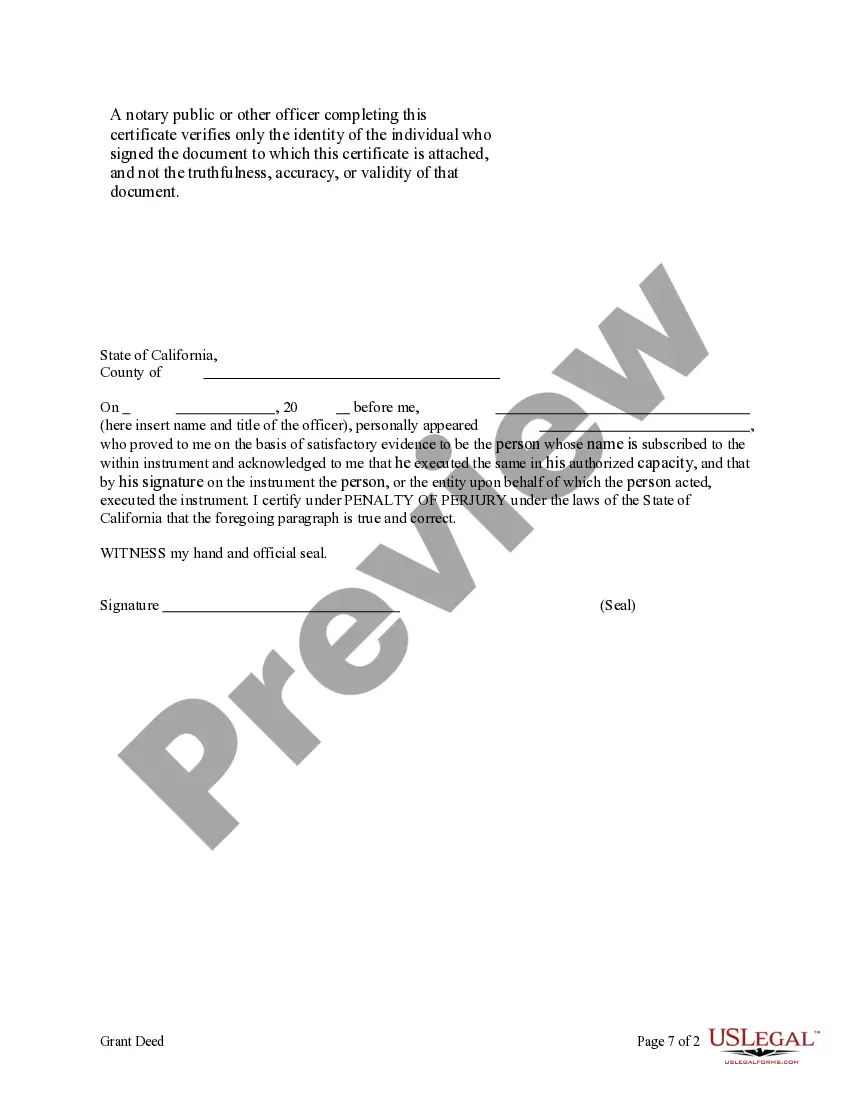

This form is a Grant Deed where the Grantor is a Trust, acting through two Trustees, and the Grantees are three individuals. Grantors convey and grant the described property to Grantees. Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

A Clovis California Grant Deed — Trust (Two Trustees) to Three Individuals is a legal document that conveys property ownership from the granter (the trust) to three specific individuals. This type of deed is often utilized when the property is owned by a trust, with two trustees acting as legal representatives. A grant deed is a common way to transfer real estate ownership, and it serves as evidence that the property has been legally transferred from one party to another. In this case, the grant deed involves a trust, which is a legal entity formed to hold assets on behalf of beneficiaries. The Clovis California Grant Deed — Trust (Two Trustees) to Three Individuals is specifically designed for situations where a trust with two trustees decides to distribute the property's ownership rights to three individuals. It outlines the legal transfer process and ensures clarity and transparency regarding the transaction. Some relevant keywords associated with this type of deed might include: 1. Clovis, California: Indicates the location where the property is situated, providing legal context and jurisdiction of the deed. 2. Grant Deed: Signifies the specific type of deed used to evidence the transfer of ownership rights. 3. Trust: Refers to the legal entity holding the property and designates how the property's ownership is vested. 4. Trustees: The individuals appointed to manage the trust and its assets, responsible for overseeing the property's distribution. 5. Three Individuals: Specifies the number of individuals who will be granted ownership rights to the property. Different types of Clovis California Grant Deed — Trust (Two Trustees) to Three Individuals may include variations for specific property types, such as residential, commercial, or vacant land. However, the overall purpose remains the same — to legally transfer ownership from a trust with two trustees to three designated individuals.