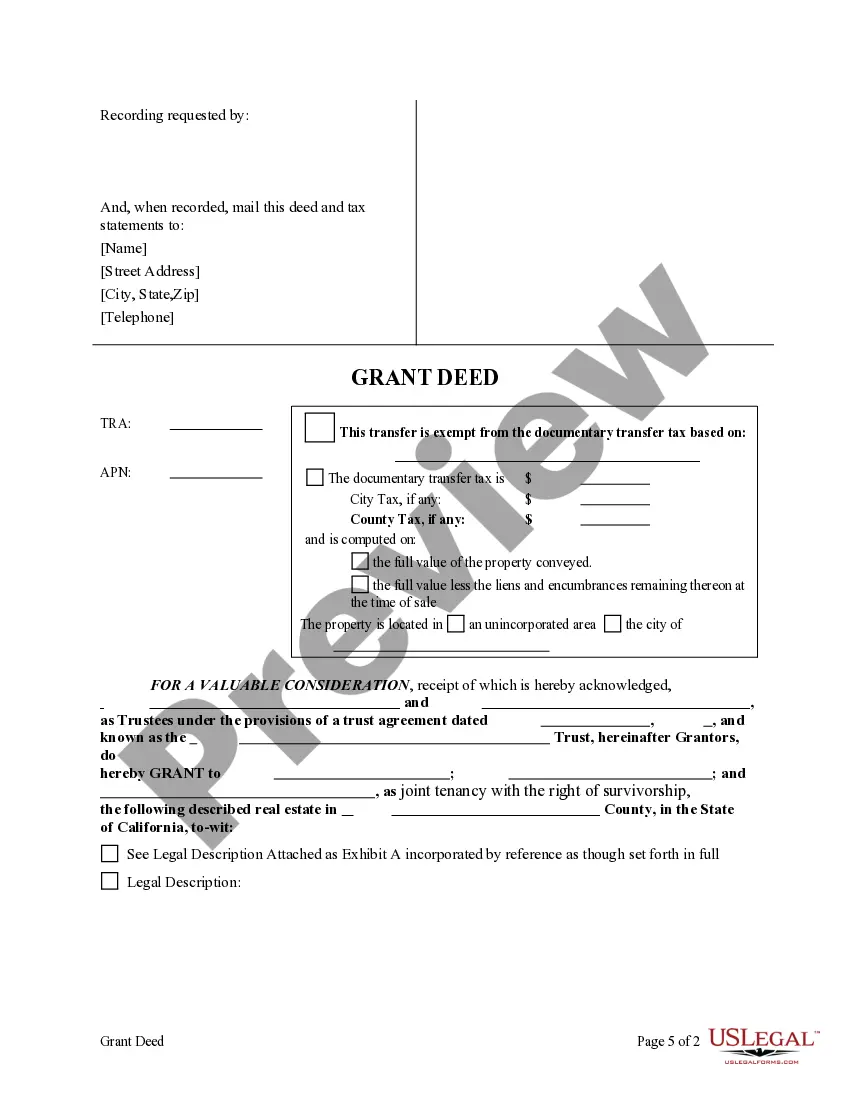

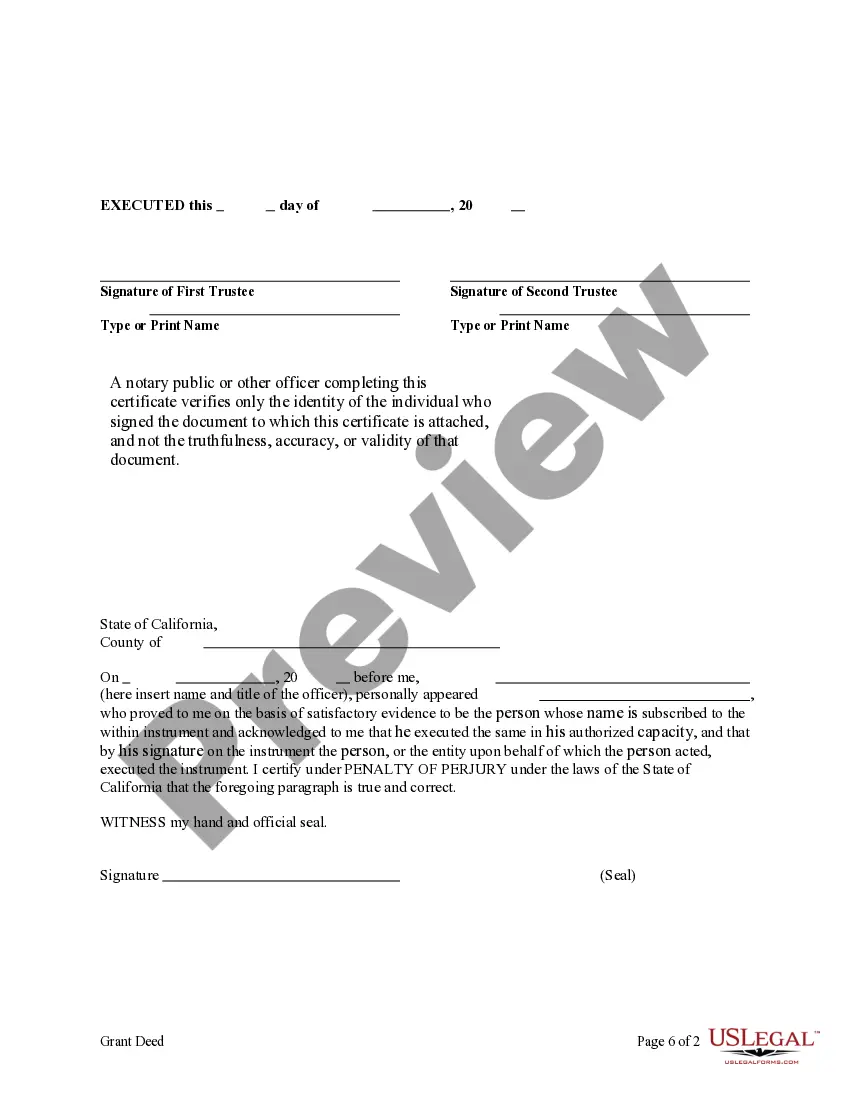

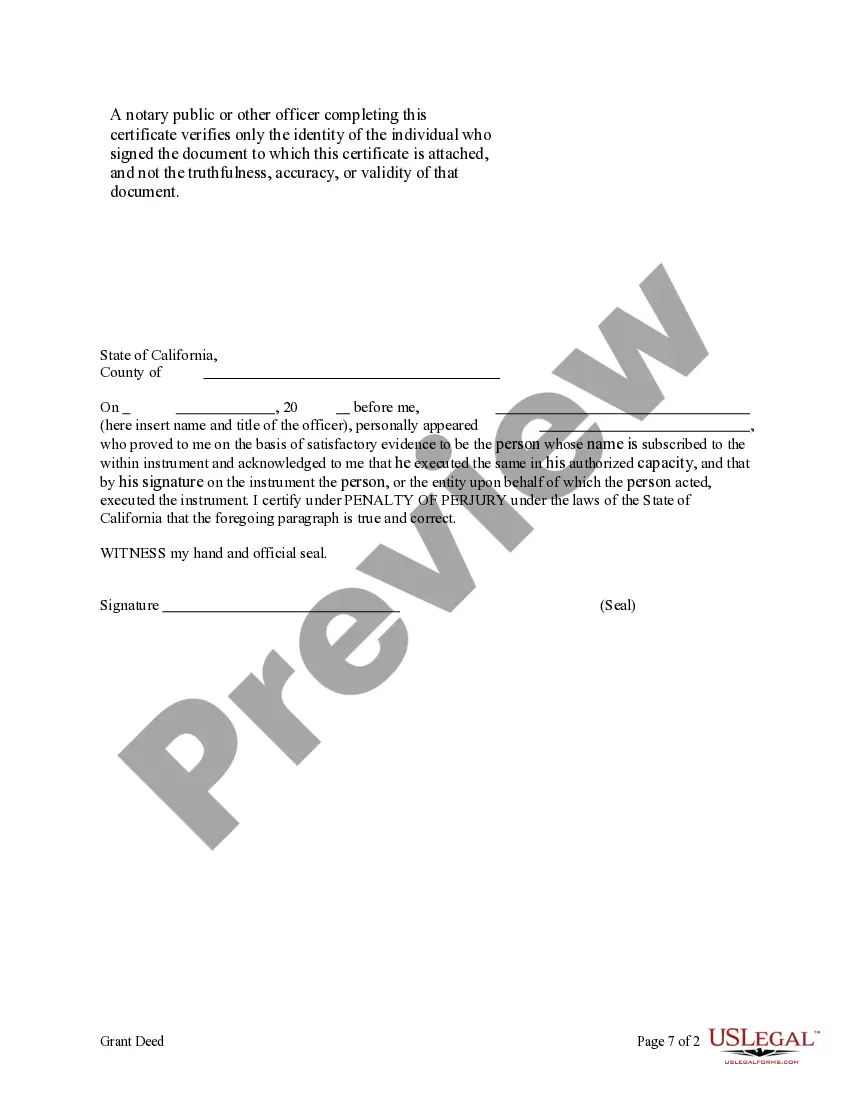

This form is a Grant Deed where the Grantor is a Trust, acting through two Trustees, and the Grantees are three individuals. Grantors convey and grant the described property to Grantees. Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

El Monte California Grant Deed — Trust (Two Trustees) to Three Individuals is a legal document used for transferring ownership of property in El Monte, California. This type of grant deed involves two trustees transferring the property to three individuals. In this scenario, the granter appoints two trustees to hold the property in trust, while the beneficiaries are the three individuals who will receive ownership rights. The granter, who can be an individual or an entity, conveys the property to the trustees, who then act as the legal owners of the property on behalf of the beneficiaries. The use of a trust in this grant deed offers certain advantages, such as potential tax benefits and the ability to control how the property is managed and distributed among the beneficiaries. Different types of El Monte California Grant Deed — Trust (Two Trustees) to Three Individuals may include: 1. Revocable Living Trust: This type of trust allows for changes and modifications by the granter during their lifetime. It ensures the property avoids probate and provides flexibility in the distribution of assets to the three beneficiaries. 2. Irrevocable Trust: In this type of trust, the granter relinquishes control over the property and cannot make changes or revoke the trust without the consent of all parties involved. It offers potential tax advantages but lacks flexibility. 3. Special Needs Trust: This trust is designed to benefit individuals with special needs. It can provide for their care and support without impacting their eligibility for government assistance programs. 4. Charitable Remainder Trust: A granter may establish this trust to benefit a charitable organization while providing income to the three beneficiaries during their lifetime. Upon their passing, the property will be donated to the designated charity. 5. Family Trust: This trust is created by a family to safeguard and distribute assets to three members while minimizing estate taxes and avoiding probate. When using an El Monte California Grant Deed — Trust (Two Trustees) to Three Individuals, it is crucial to seek professional legal advice to ensure compliance with local laws and regulations. This detailed description sheds light on the different types of grant deeds involving trusts and multiple trustees, providing valuable insights for anyone involved in property transfers in El Monte, California.El Monte California Grant Deed — Trust (Two Trustees) to Three Individuals is a legal document used for transferring ownership of property in El Monte, California. This type of grant deed involves two trustees transferring the property to three individuals. In this scenario, the granter appoints two trustees to hold the property in trust, while the beneficiaries are the three individuals who will receive ownership rights. The granter, who can be an individual or an entity, conveys the property to the trustees, who then act as the legal owners of the property on behalf of the beneficiaries. The use of a trust in this grant deed offers certain advantages, such as potential tax benefits and the ability to control how the property is managed and distributed among the beneficiaries. Different types of El Monte California Grant Deed — Trust (Two Trustees) to Three Individuals may include: 1. Revocable Living Trust: This type of trust allows for changes and modifications by the granter during their lifetime. It ensures the property avoids probate and provides flexibility in the distribution of assets to the three beneficiaries. 2. Irrevocable Trust: In this type of trust, the granter relinquishes control over the property and cannot make changes or revoke the trust without the consent of all parties involved. It offers potential tax advantages but lacks flexibility. 3. Special Needs Trust: This trust is designed to benefit individuals with special needs. It can provide for their care and support without impacting their eligibility for government assistance programs. 4. Charitable Remainder Trust: A granter may establish this trust to benefit a charitable organization while providing income to the three beneficiaries during their lifetime. Upon their passing, the property will be donated to the designated charity. 5. Family Trust: This trust is created by a family to safeguard and distribute assets to three members while minimizing estate taxes and avoiding probate. When using an El Monte California Grant Deed — Trust (Two Trustees) to Three Individuals, it is crucial to seek professional legal advice to ensure compliance with local laws and regulations. This detailed description sheds light on the different types of grant deeds involving trusts and multiple trustees, providing valuable insights for anyone involved in property transfers in El Monte, California.