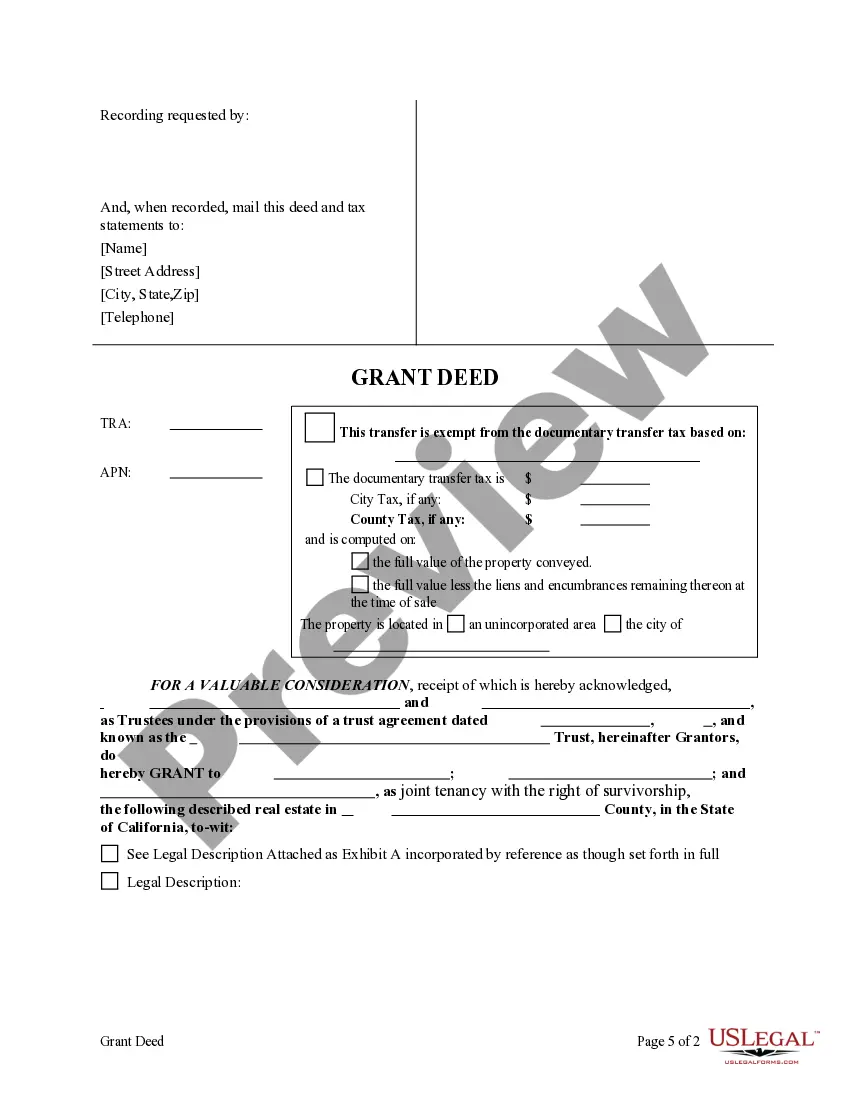

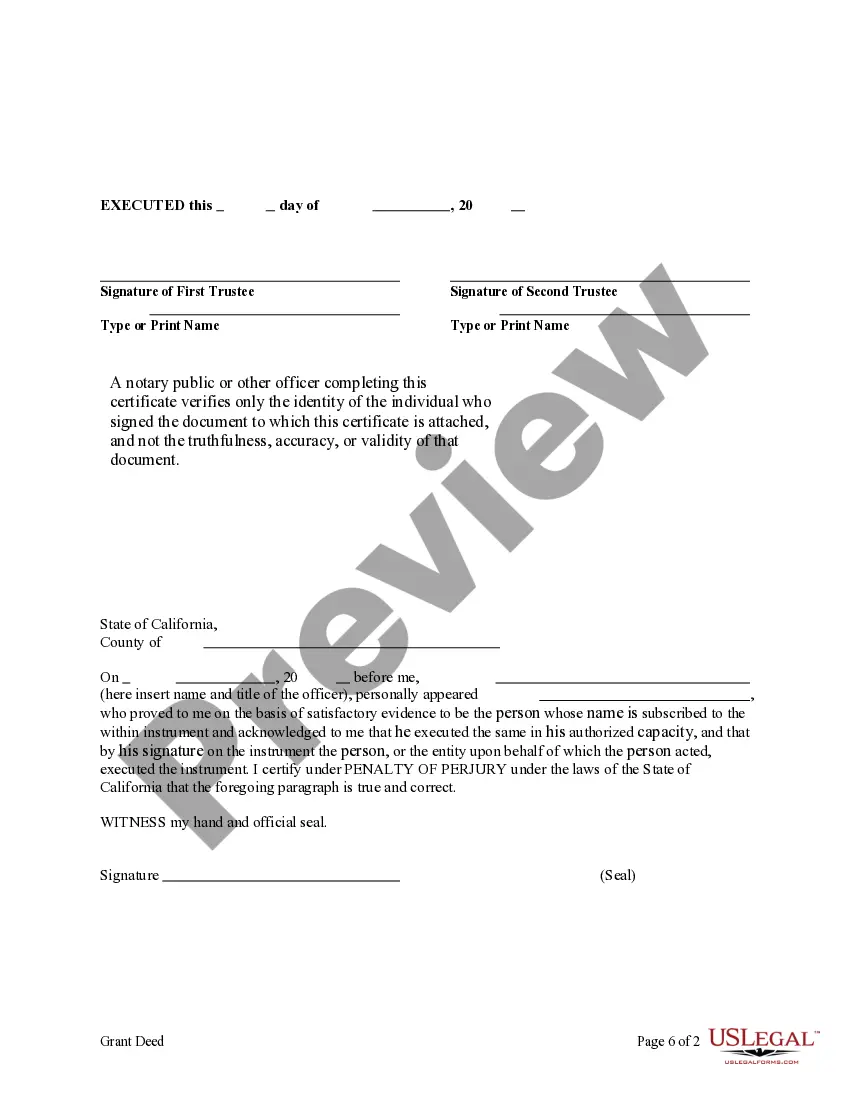

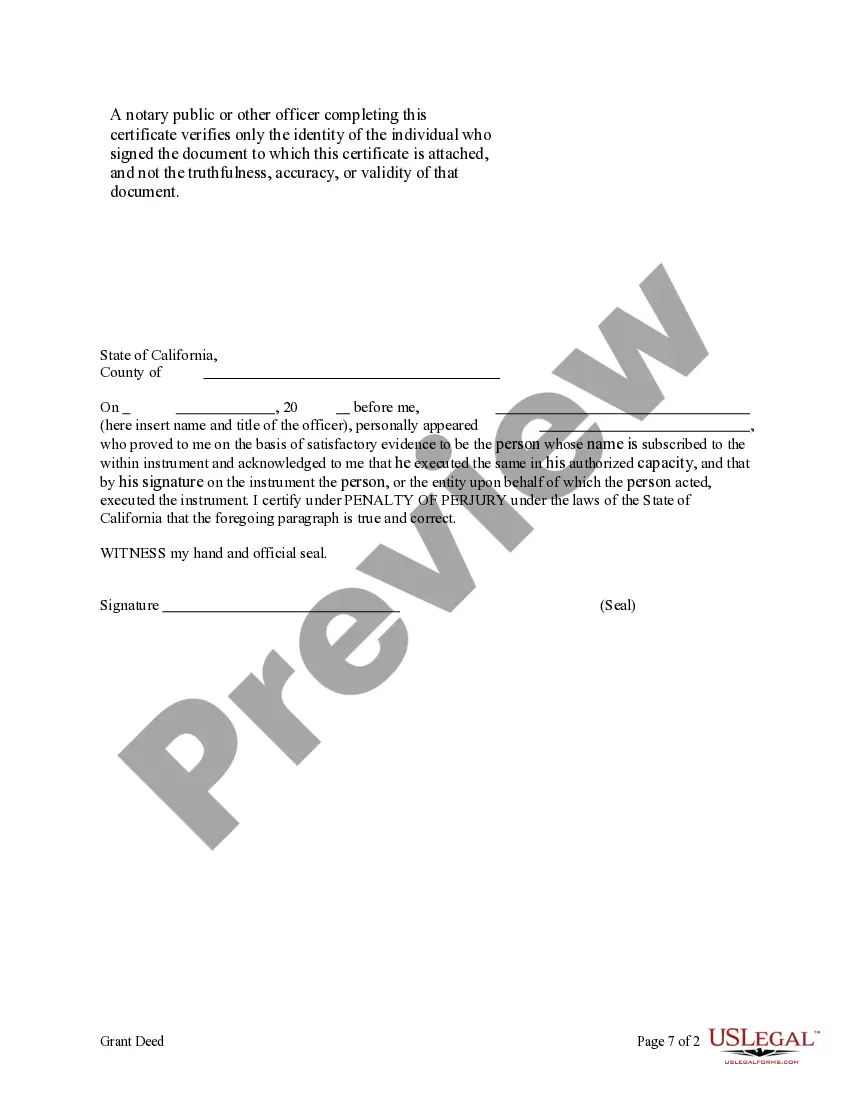

This form is a Grant Deed where the Grantor is a Trust, acting through two Trustees, and the Grantees are three individuals. Grantors convey and grant the described property to Grantees. Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

A Santa Ana California Grant Deed — Trust (Two Trustees) to Three Individuals is a legal document that transfers ownership of a property from a trust to three individuals. This type of deed is commonly used when a property held in a trust is being distributed to specific beneficiaries. The Santa Ana California Grant Deed — Trust (Two Trustees) to Three Individuals can be drafted in different variations depending on the specific circumstances and requirements. Some key types include: 1. Revocable Trust Grant Deed: This type of grant deed is used when the trust is revocable, meaning that the granter retains the right to amend or revoke the trust during their lifetime. It allows the granter to transfer the property to the three individuals as beneficiaries while maintaining control over the trust assets. 2. Irrevocable Trust Grant Deed: In contrast to a revocable trust, an irrevocable trust cannot be modified or terminated by the granter without the consent of the beneficiaries. This type of grant deed is used when the granter intends to permanently transfer ownership to the three individuals and relinquish control over the trust assets. 3. Testamentary Trust Grant Deed: A testamentary trust is established through a will and only takes effect after the granter's death. This type of grant deed is used to distribute the property held in the testamentary trust to the three individuals as specified beneficiaries, according to the terms of the granter's will. 4. Living Trust Grant Deed: A living trust is created during the granter's lifetime and allows them to transfer assets, including real estate, into the trust for management and distribution purposes. The Santa Ana California Grant Deed — Trust (Two Trustees) to Three Individuals may be used to transfer the property held in a living trust to the designated beneficiaries. The Santa Ana California Grant Deed — Trust (Two Trustees) to Three Individuals serves as formal documentation of the transfer of property rights and ensures legal protection for both the granter and the beneficiaries. It typically includes information such as the legal description of the property, details of the trust agreement, identification of the trustees and beneficiaries, and any specific terms or conditions attached to the transfer. It is important to consult with a qualified attorney or legal professional specializing in estate planning and real estate law to ensure the proper preparation and execution of a Santa Ana California Grant Deed — Trust (Two Trustees) to Three Individuals.