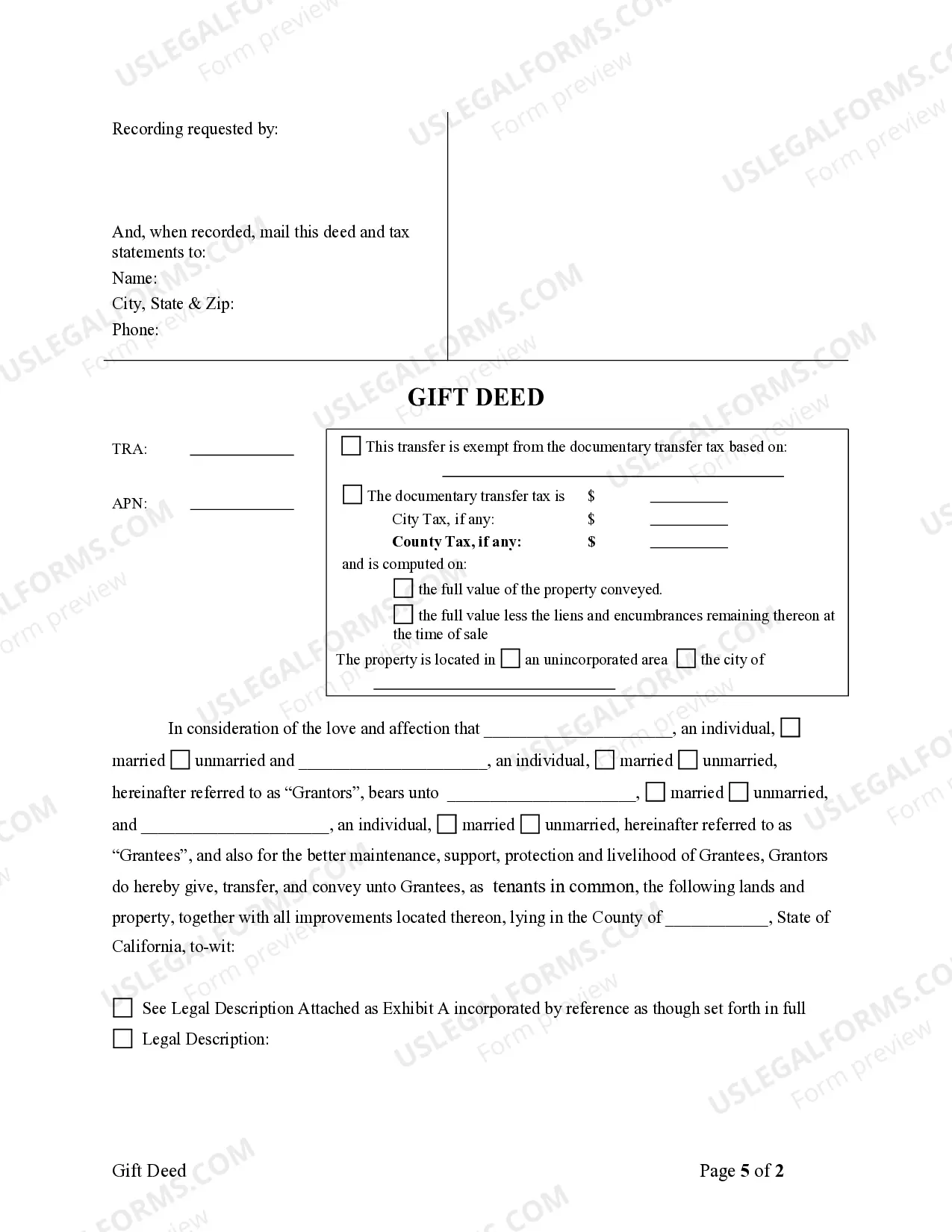

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Clovis California Gift Deed - From Two Individual Grantors to Two Individual Grantees

Description

How to fill out California Gift Deed - From Two Individual Grantors To Two Individual Grantees?

We consistently aim to minimize or avert legal complications when navigating intricate legal or financial issues.

To achieve this, we engage attorney services that are often quite expensive. However, not every legal issue is of the same complexity; many can be resolved independently.

US Legal Forms is a digital repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Our platform empowers you to manage your affairs without needing to consult a lawyer. We offer access to legal document templates that are not always readily available.

The procedure is just as simple for those who are unfamiliar with the platform; you can create your account in just a few minutes.

- Our templates are specific to states and regions, which greatly streamlines the search process.

- Utilize US Legal Forms whenever you require to obtain and download the Clovis California Gift Deed - From Two Individual Grantors to Two Individual Grantees or any other document promptly and securely.

- Simply Log In to your account and click the Get button adjacent to it.

- If you misplace the form, you can always re-download it from within the My documents tab.

Form popularity

FAQ

No, a gift deed is not the same as a quitclaim deed. While both are methods to transfer property, a gift deed implies that the transfer is a gift, usually without consideration, guaranteeing that the grantor intends to give the property without financial return. Using a Clovis California Gift Deed - From Two Individual Grantors to Two Individual Grantees reinforces this intent and clarifies the nature of the transfer, which can simplify future legal matters.

The main disadvantage of a quitclaim deed is that it offers no protection to the grantee. If any liens or claims exist on the property, the grantee might inherit these issues without recourse. This lack of title warranty can create challenges during future sales or refinancing, making the Clovis California Gift Deed - From Two Individual Grantors to Two Individual Grantees a more secure option when you want to ensure a clear title transfer.

The best way to transfer property to a family member is often through a Clovis California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This deed allows you to transfer property without a financial exchange, simplifying the transaction. You should keep in mind that tax implications may arise, so consulting tax guidelines or professionals might be beneficial. Utilizing platforms like uslegalforms can make preparing the deed much easier for you.

Yes, you can transfer a deed without an attorney in California. For a straightforward transfer, such as a Clovis California Gift Deed - From Two Individual Grantors to Two Individual Grantees, individuals often handle it themselves. However, while it is possible, it is advisable to use resources that offer guidance to ensure all legal requirements are met. Uslegalforms provides templates and information that can help you through the process effectively.

The most common way to transfer ownership in California is through a deed, particularly a Clovis California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This deed allows individuals to transfer property without a monetary exchange, making it ideal for family members or friends. It is essential to ensure that the deed complies with local laws to avoid any future disputes. Using platforms like uslegalforms can simplify this process for you.

To transfer property from one person to another in California, you typically use a deed, often a Clovis California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This legal document outlines the details of the transfer and must be signed by the grantors. Once completed, the deed should be recorded with the county to ensure that the transaction is public record. This process provides clarity and protects the rights of both parties.

The optimal way to transfer a property title between family members is through a Clovis California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This method simplifies the process, as it avoids many complications associated with sales and loans. By documenting the transfer properly and ensuring it's recorded, families can peacefully maintain their ownership and strengthen generational ties.

Removing someone from a grant deed can be done by using a Clovis California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This legal document effectively transfers the ownership interest to the remaining grantee. To proceed smoothly, both parties should collaborate on the deed's preparation, and it's vital to file this document with the appropriate local office to validate the change in ownership.

To remove someone from a deed without refinancing, you can execute a Clovis California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This process involves drafting a deed that transfers the property interest from the grantor to the remaining owner. It's essential to ensure that both parties agree to this change, and the deed must be recorded with the county to reflect the new ownership.

The most basic form of concurrent ownership is tenancy in common, where two or more individuals own a property together, each with an undivided interest. Each owner can sell or transfer their share independently. This form is often highlighted when preparing a Clovis California Gift Deed - From Two Individual Grantors to Two Individual Grantees.