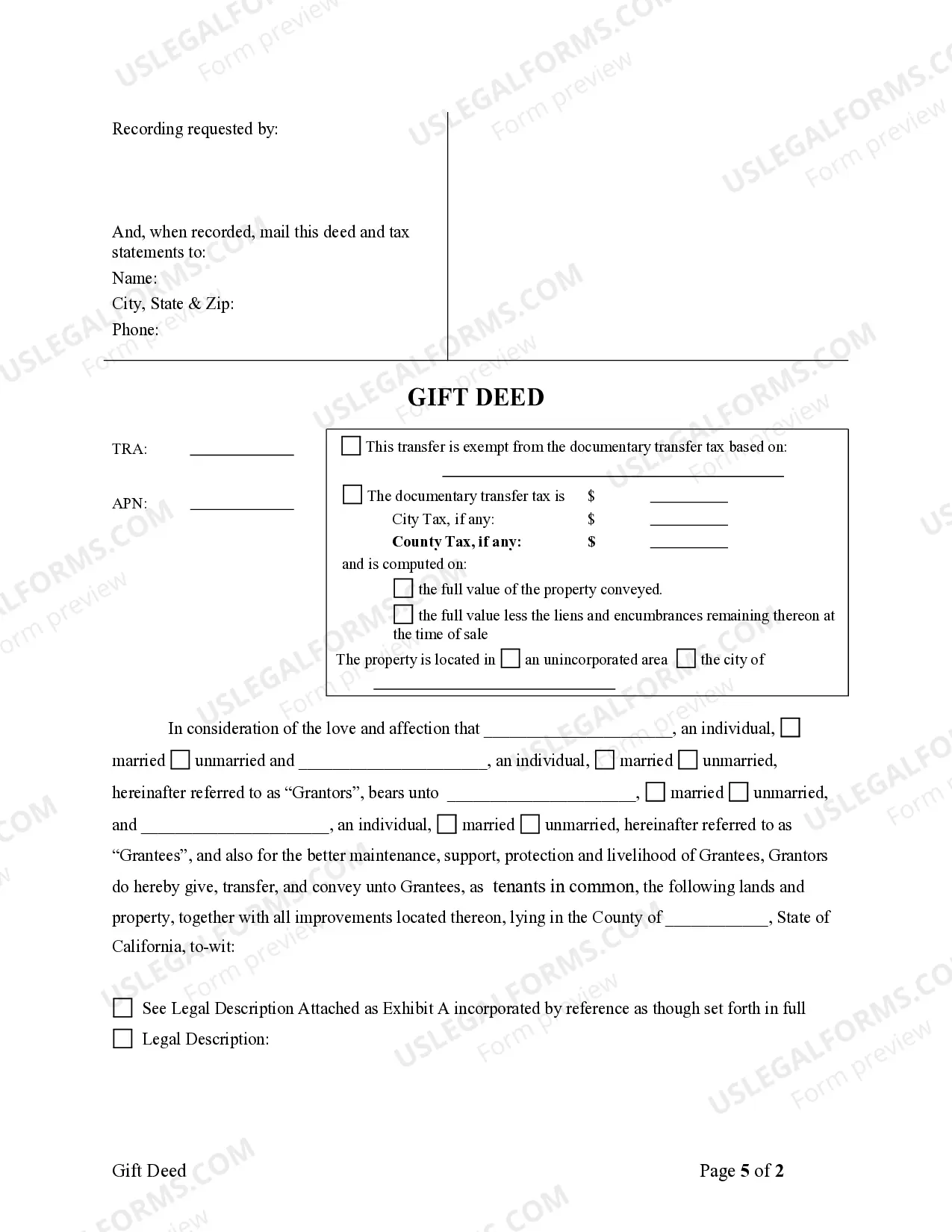

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

A Corona California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is a legal document that transfers ownership of a property from two individual granters to two individual grantees as a gift. This type of deed is commonly used when individuals wish to gift their property to specific individuals without any monetary exchange. The gift deed serves as a legal proof of the transfer of ownership and outlines the details of the property, including its legal description and any terms or conditions associated with the gift. It is important to note that a gift deed is irrevocable, meaning that once the transfer is complete, the granters cannot reclaim ownership of the property. In Corona, California, there may be different variations or types of gift deeds, depending on the specific circumstances or requirements involved. Some common types of Corona California Gift Deeds — From Two IndividuaGrantersrs to Two Individual Grantees may include: 1. Simple Gift Deed: This is the most basic type of gift deed, where the granters transfer ownership of the property to the grantees without any additional conditions or restrictions. 2. Conditional Gift Deed: This type of gift deed may include certain conditions or restrictions imposed by the granters on the grantees. For example, the granters may require that the property be maintained in a certain condition or used for specific purposes. 3. Remainder or Future Interest Gift Deed: This type of gift deed grants the remainder or future interest in the property to the grantees. This means that the granters retain the present interest in the property until a specific event occurs, such as their passing away. At that point, the grantees automatically gain ownership of the property. 4. Joint Tenancy Gift Deed: In this type of gift deed, the granters transfer ownership of the property to the grantees as joint tenants. This grants each grantee an equal share of ownership in the property, along with the right of survivorship. In case one joint tenant passes away, their share automatically transfers to the surviving joint tenant(s). When drafting a Corona California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees, it is recommended to consult with a qualified estate attorney or real estate professional to ensure compliance with California state laws and to address any specific requirements or concerns.A Corona California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is a legal document that transfers ownership of a property from two individual granters to two individual grantees as a gift. This type of deed is commonly used when individuals wish to gift their property to specific individuals without any monetary exchange. The gift deed serves as a legal proof of the transfer of ownership and outlines the details of the property, including its legal description and any terms or conditions associated with the gift. It is important to note that a gift deed is irrevocable, meaning that once the transfer is complete, the granters cannot reclaim ownership of the property. In Corona, California, there may be different variations or types of gift deeds, depending on the specific circumstances or requirements involved. Some common types of Corona California Gift Deeds — From Two IndividuaGrantersrs to Two Individual Grantees may include: 1. Simple Gift Deed: This is the most basic type of gift deed, where the granters transfer ownership of the property to the grantees without any additional conditions or restrictions. 2. Conditional Gift Deed: This type of gift deed may include certain conditions or restrictions imposed by the granters on the grantees. For example, the granters may require that the property be maintained in a certain condition or used for specific purposes. 3. Remainder or Future Interest Gift Deed: This type of gift deed grants the remainder or future interest in the property to the grantees. This means that the granters retain the present interest in the property until a specific event occurs, such as their passing away. At that point, the grantees automatically gain ownership of the property. 4. Joint Tenancy Gift Deed: In this type of gift deed, the granters transfer ownership of the property to the grantees as joint tenants. This grants each grantee an equal share of ownership in the property, along with the right of survivorship. In case one joint tenant passes away, their share automatically transfers to the surviving joint tenant(s). When drafting a Corona California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees, it is recommended to consult with a qualified estate attorney or real estate professional to ensure compliance with California state laws and to address any specific requirements or concerns.