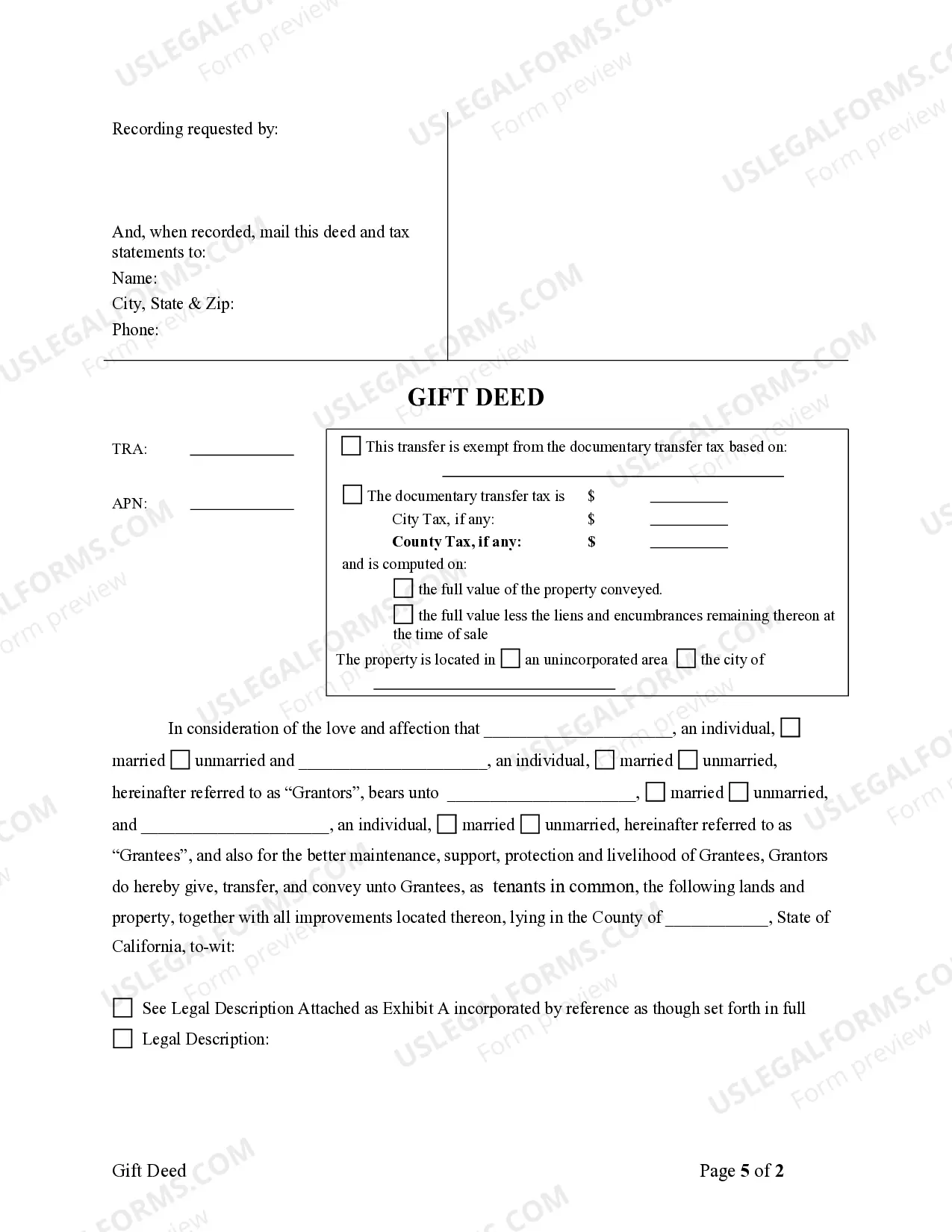

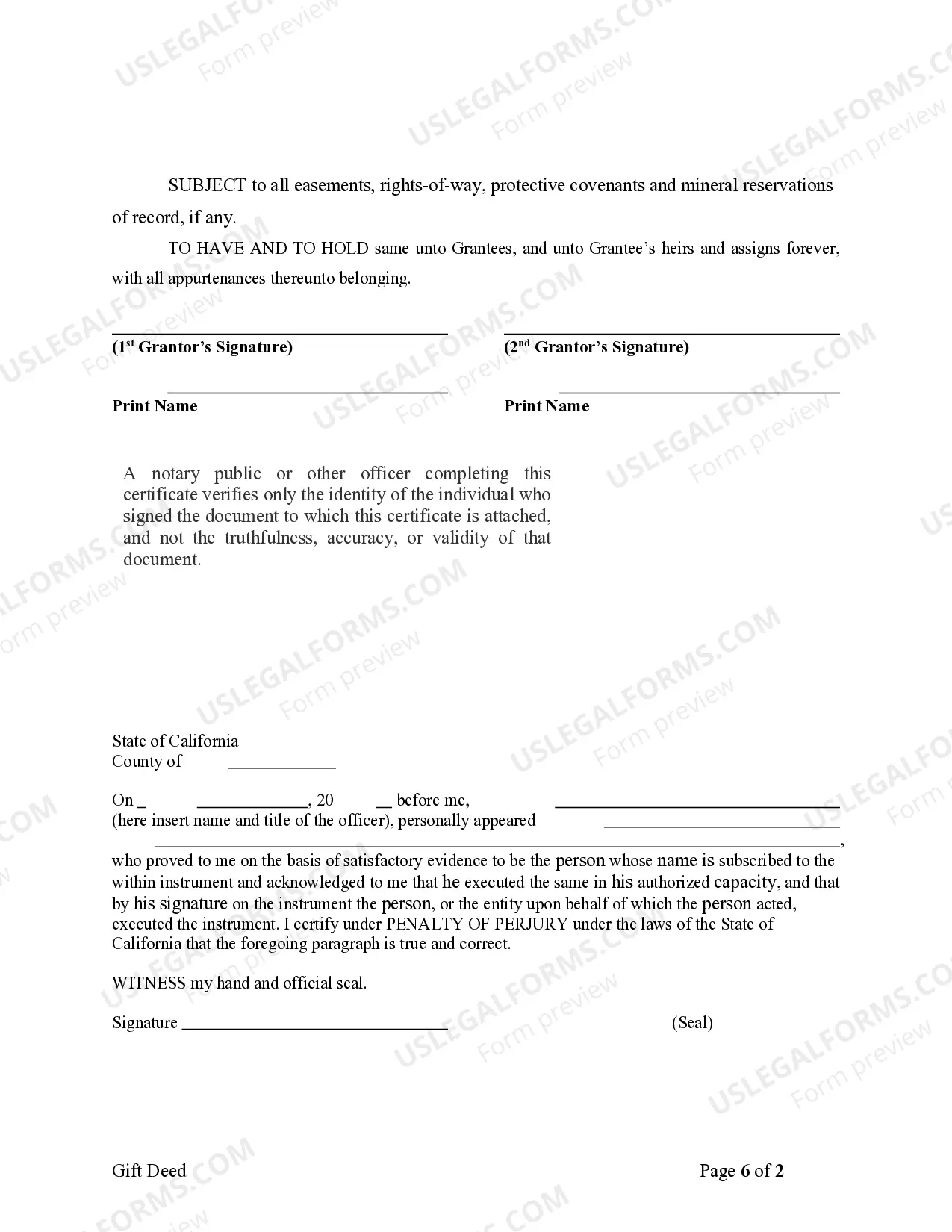

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Fontana California Gift Deed - From Two Individual Grantors to Two Individual Grantees

Description

How to fill out California Gift Deed - From Two Individual Grantors To Two Individual Grantees?

If you are looking for a legitimate form template, it’s challenging to select a superior service than the US Legal Forms website – arguably the most extensive collections available on the web.

With this collection, you can obtain a multitude of form samples for business and personal uses categorized by types and states, or keywords.

With our top-notch search capability, locating the latest Fontana California Gift Deed - From Two Individual Grantors to Two Individual Grantees is as simple as 1-2-3. Additionally, the accuracy of each document is confirmed by a group of skilled attorneys who routinely evaluate the templates on our platform and update them according to the latest state and county requirements.

Acquire the document. Choose the format and save it to your device.

Modify the document. Complete, amend, print, and sign the acquired Fontana California Gift Deed - From Two Individual Grantors to Two Individual Grantees.

- If you are already familiar with our system and possess an account, all you need to obtain the Fontana California Gift Deed - From Two Individual Grantors to Two Individual Grantees is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have selected the sample you require. Review its details and utilize the Preview feature (if available) to view its content. If it doesn’t satisfy your requirements, make use of the Search bar at the top of the page to find the appropriate document.

- Validate your selection. Click on the Buy now button. Following that, choose your desired subscription plan and enter your information to create an account.

- Complete the payment. Use your credit card or PayPal account to conclude the registration process.

Form popularity

FAQ

Transferring a grant deed in California begins with drafting a new deed that specifies the transfer from the grantor to the grantee. Both parties need to sign this document in front of a notary public. Finally, submit the deed to the County Recorder's Office for recording, thereby maintaining a clear record of ownership. Consider using a platform like uslegalforms to streamline the process of creating the necessary documents.

To add someone to your deed in California, you need to execute a new deed that includes both your name and the name of the person you wish to add. This deed should clearly indicate the nature of the new ownership. Subsequently, record the new deed to formalize the addition, ensuring it aligns with the principles of the Fontana California Gift Deed - From Two Individual Grantors to Two Individual Grantees.

To change a grant deed in California, you must draft a new deed that reflects the desired changes. This may include updating names or altering how the property is held. After executing the new deed, record it with the County Recorder's Office to ensure that the changes are legally recognized, including any reference to the Fontana California Gift Deed - From Two Individual Grantors to Two Individual Grantees.

Yes, a grant deed serves as proof of ownership in California. When executed properly, it conveys a clear title from the grantors to the grantees. Thus, a Fontana California Gift Deed - From Two Individual Grantors to Two Individual Grantees establishes legal ownership for the intended grantees.

The fastest way to transfer a deed, specifically a Fontana California Gift Deed - From Two Individual Grantors to Two Individual Grantees, typically involves preparing the deed documentation and having it signed by both grantors. Once signed, it should be notarized to ensure its validity. Finally, record the deed with the County Recorder's Office to complete the process.

To file an interspousal transfer deed in California, you need to complete the deed form that specifies the transfer between spouses. Both spouses must sign the document, and then it should be filed with the county recorder's office. This deed allows for a transfer of ownership without the need for sales tax, making it a beneficial option for married couples. For a seamless experience, explore US Legal Forms for available resources.

Yes, you can remove a co-owner from property in California, typically through a quitclaim deed. This method transfers the co-owner's interest to the remaining owner. Both parties must agree to this decision and sign the necessary documents before filing them with the county recorder’s office. US Legal Forms can help you navigate this process effectively.

Amending a grant deed in California requires creating a new deed that reflects the changes. The original owners must sign this new deed, which should then be recorded with the county recorder’s office. It's important to ensure all legal requirements are met to maintain the validity of the document. For efficient solutions, check out US Legal Forms to find the necessary forms and guidance.

To fill out a grant deed in California, start by downloading a PDF template that meets state requirements. Input the required information, including the grantors' and grantees' names, property description, and signing details. Be sure to follow all instructions carefully, as any errors could delay the transfer process. US Legal Forms provides user-friendly templates and resources to help you complete this task smoothly.

Adding a person to a deed in California involves creating a new deed that includes the additional person as a co-owner. This deed must be signed by the current owner(s) and then recorded with the county recorder's office. This process, often called a 'quitclaim deed,' ensures the new grantee officially receives ownership rights. Consider US Legal Forms for guidance on drafting this document.