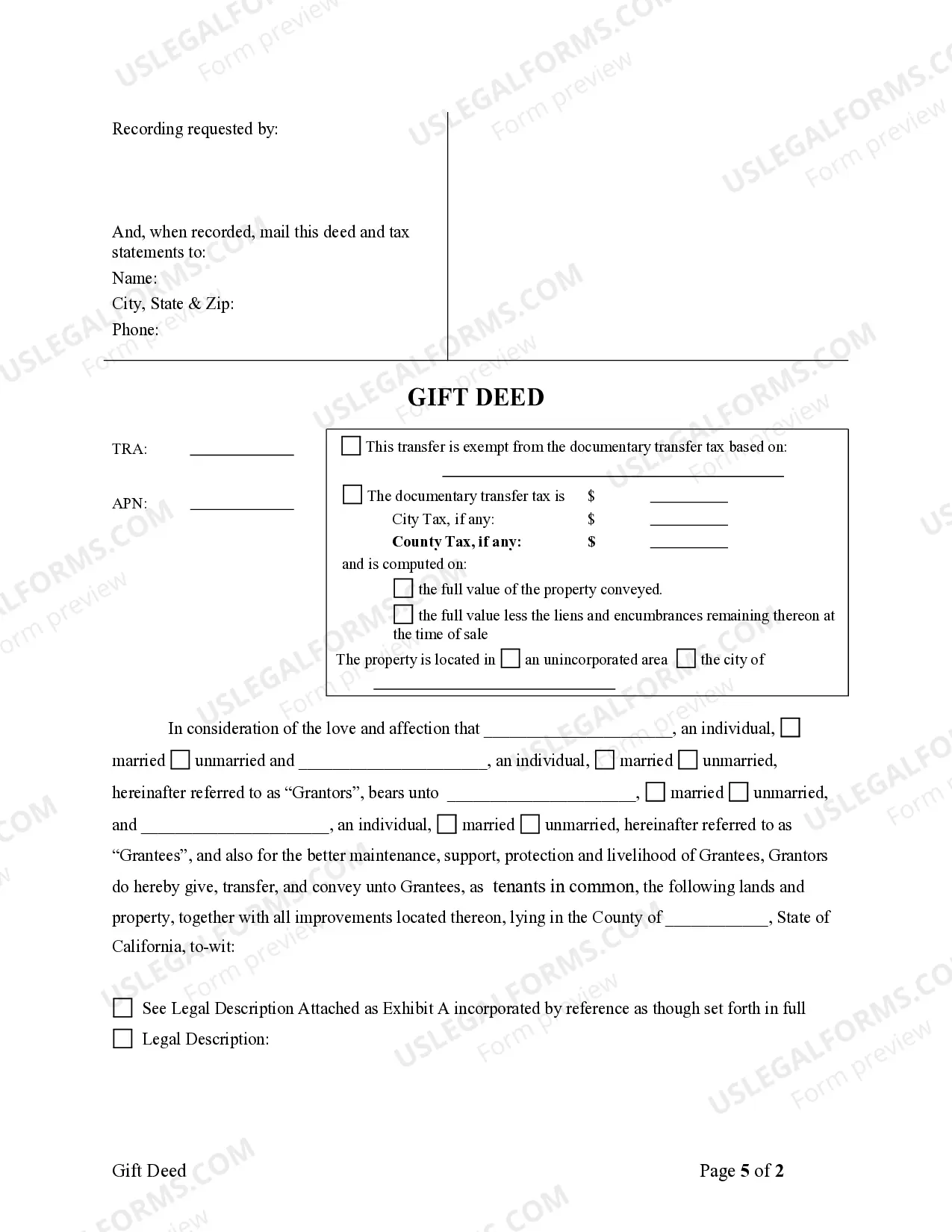

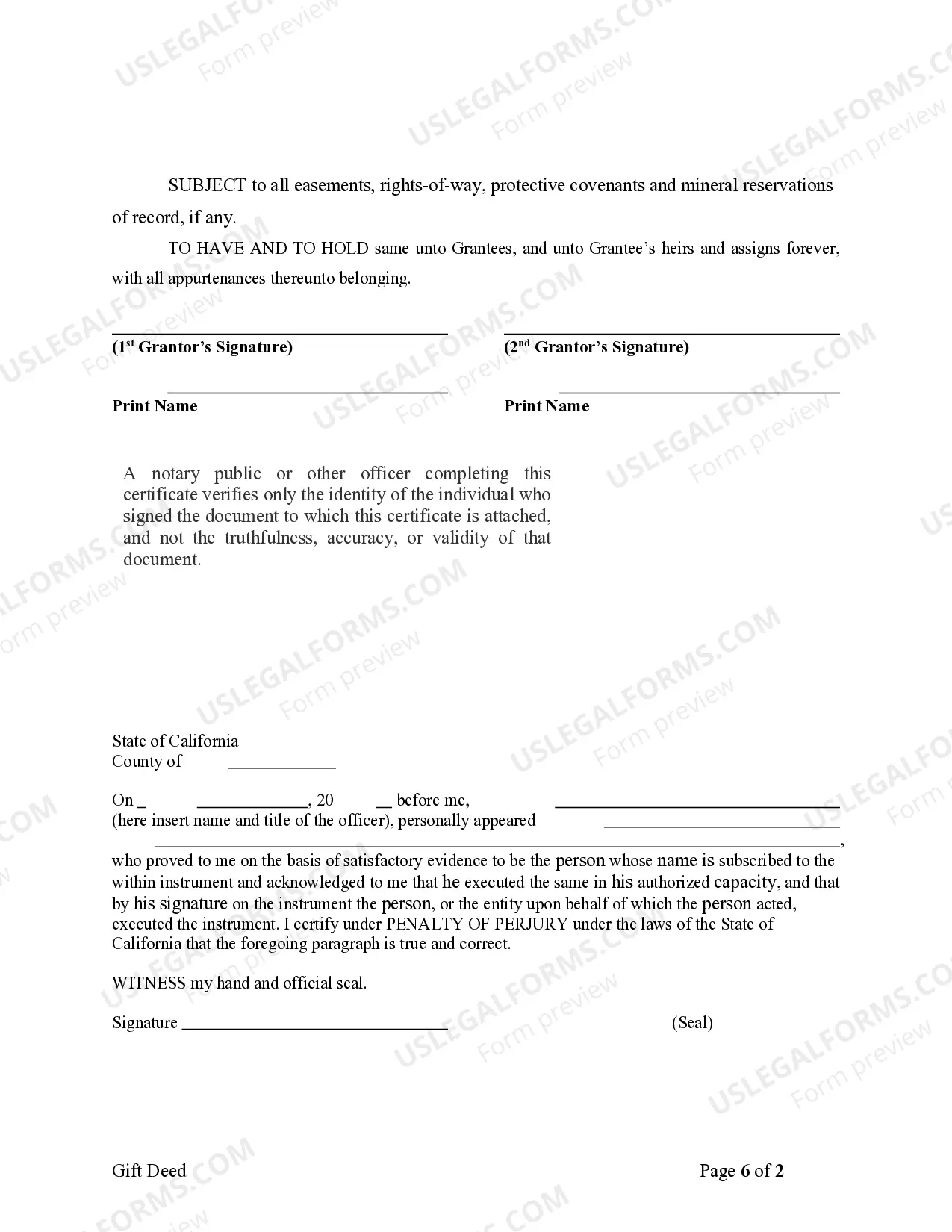

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Description: An Inglewood California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is a legal document that transfers ownership of a property as a gift from two individual granters to two individual grantees in Inglewood, California. This type of gift deed is commonly used when donors wish to relinquish their ownership rights and transfer the property to the recipients without any financial consideration. In this gift deed, the granters (property owners) voluntarily give up their rights to the property and transfer it to the grantees (receivers) without any payment involved. It is a non-sale transaction that denotes a gesture of goodwill, generosity, or estate planning strategy. Keywords: Inglewood California, gift deed, individual granters, individual grantees, property transfer, ownership rights, non-sale transaction, goodwill, generosity, estate planning. Different types of Inglewood California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees can include: 1. Inglewood California Inter Vivos Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees: This type of gift deed is executed during the granter's lifetime, allowing them to transfer ownership of the property to the grantees immediately. 2. Inglewood California Testamentary Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees: This gift deed takes effect upon the death of the granters and is typically mentioned in their last will and testament. It ensures the transfer of the property to the grantees as a gift upon the granters' demise. 3. Inglewood California Charitable Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees: This specific gift deed involves the donation of property to a charitable organization. The granters willingly transfer ownership rights to the grantees who represent the charity. It is often done to support a philanthropic cause or obtain tax benefits. 4. Inglewood California Gift Deed with Retained Life Estate — From Two IndividuaGrantersrs to Two Individual Grantees: This gift deed allows the granters to transfer ownership of the property to the grantees while retaining the right to live on or use the property until their death or a specified period. The grantees gain ownership rights only after the granters' life estate ends. Keywords: Inter Vivos Gift Deed, Testamentary Gift Deed, Charitable Gift Deed, Gift Deed with Retained Life Estate, property transfer, ownership rights, lifetime transfer, last will and testament, charitable organization, philanthropic cause, tax benefits.Description: An Inglewood California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is a legal document that transfers ownership of a property as a gift from two individual granters to two individual grantees in Inglewood, California. This type of gift deed is commonly used when donors wish to relinquish their ownership rights and transfer the property to the recipients without any financial consideration. In this gift deed, the granters (property owners) voluntarily give up their rights to the property and transfer it to the grantees (receivers) without any payment involved. It is a non-sale transaction that denotes a gesture of goodwill, generosity, or estate planning strategy. Keywords: Inglewood California, gift deed, individual granters, individual grantees, property transfer, ownership rights, non-sale transaction, goodwill, generosity, estate planning. Different types of Inglewood California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees can include: 1. Inglewood California Inter Vivos Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees: This type of gift deed is executed during the granter's lifetime, allowing them to transfer ownership of the property to the grantees immediately. 2. Inglewood California Testamentary Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees: This gift deed takes effect upon the death of the granters and is typically mentioned in their last will and testament. It ensures the transfer of the property to the grantees as a gift upon the granters' demise. 3. Inglewood California Charitable Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees: This specific gift deed involves the donation of property to a charitable organization. The granters willingly transfer ownership rights to the grantees who represent the charity. It is often done to support a philanthropic cause or obtain tax benefits. 4. Inglewood California Gift Deed with Retained Life Estate — From Two IndividuaGrantersrs to Two Individual Grantees: This gift deed allows the granters to transfer ownership of the property to the grantees while retaining the right to live on or use the property until their death or a specified period. The grantees gain ownership rights only after the granters' life estate ends. Keywords: Inter Vivos Gift Deed, Testamentary Gift Deed, Charitable Gift Deed, Gift Deed with Retained Life Estate, property transfer, ownership rights, lifetime transfer, last will and testament, charitable organization, philanthropic cause, tax benefits.