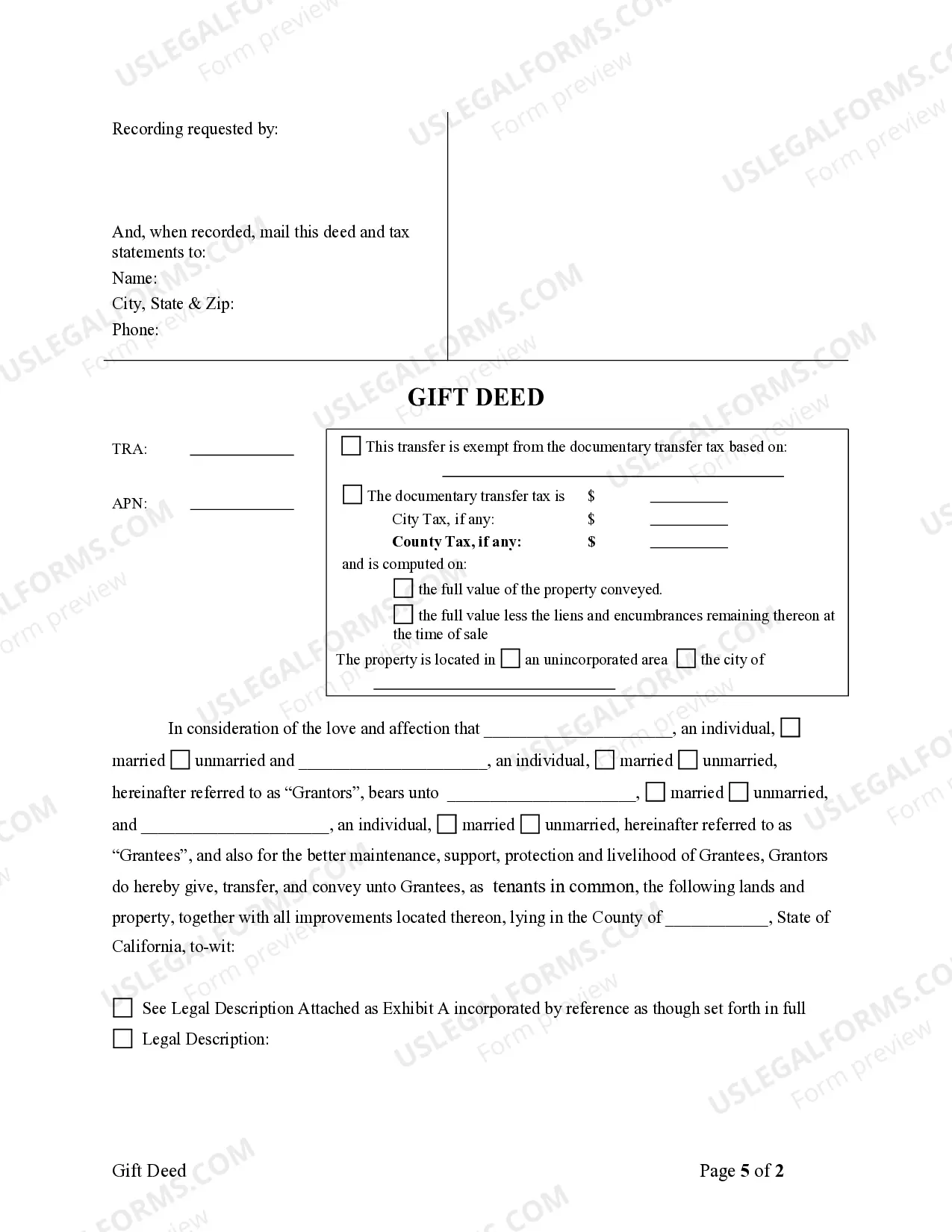

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

A Murrieta California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is a legal document used to transfer real property ownership from two individuals (referred to as "granters") to two other individuals (referred to as "grantees") as a gift. This type of deed serves as evidence of a voluntary transfer of property without any consideration or payment in return. The Murrieta California Gift Deed typically includes detailed information such as the legal description of the property being transferred, the names and addresses of the granters and grantees, and the date of the transfer. It also outlines the specific terms and conditions of the gift, including any limitations, conditions, or restrictions that may apply. There may be different variations or types of Murrieta California Gift Deeds — From Two IndividuaGrantersrs to Two Individual Grantees, depending on specific circumstances or requirements. Some of these variations may include: 1. Conditional Gift Deed: This type of gift deed may include specific conditions that must be met by the grantees for the transfer to be valid. For example, the granters may require the grantees to maintain the property in a certain condition or use it for a specific purpose. 2. Joint Tenancy Gift Deed: In this variation, the property is transferred to the grantees as joint tenants, meaning they share an undivided interest in the property. Upon the death of one of the grantees, the surviving grantee automatically becomes the sole owner of the property. 3. Tenancy in Common Gift Deed: Unlike joint tenancy, this type of gift deed allows each grantee to have a separate and distinct ownership interest in the property. Each co-owner has the right to sell, transfer, or mortgage their individual share without the consent of the other co-owners. 4. Life Estate Gift Deed: In this scenario, the granters transfer the property to the grantees while retaining the right to use and occupy the property for the duration of their lives. After their death, the property automatically passes to the grantees. When preparing a Murrieta California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees, it is crucial to consult a real estate attorney to ensure compliance with all applicable laws and regulations. It is also recommended having the deed properly recorded with the Riverside County Recorder's Office to establish the grantees' ownership rights and protect against any future claims or disputes.A Murrieta California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is a legal document used to transfer real property ownership from two individuals (referred to as "granters") to two other individuals (referred to as "grantees") as a gift. This type of deed serves as evidence of a voluntary transfer of property without any consideration or payment in return. The Murrieta California Gift Deed typically includes detailed information such as the legal description of the property being transferred, the names and addresses of the granters and grantees, and the date of the transfer. It also outlines the specific terms and conditions of the gift, including any limitations, conditions, or restrictions that may apply. There may be different variations or types of Murrieta California Gift Deeds — From Two IndividuaGrantersrs to Two Individual Grantees, depending on specific circumstances or requirements. Some of these variations may include: 1. Conditional Gift Deed: This type of gift deed may include specific conditions that must be met by the grantees for the transfer to be valid. For example, the granters may require the grantees to maintain the property in a certain condition or use it for a specific purpose. 2. Joint Tenancy Gift Deed: In this variation, the property is transferred to the grantees as joint tenants, meaning they share an undivided interest in the property. Upon the death of one of the grantees, the surviving grantee automatically becomes the sole owner of the property. 3. Tenancy in Common Gift Deed: Unlike joint tenancy, this type of gift deed allows each grantee to have a separate and distinct ownership interest in the property. Each co-owner has the right to sell, transfer, or mortgage their individual share without the consent of the other co-owners. 4. Life Estate Gift Deed: In this scenario, the granters transfer the property to the grantees while retaining the right to use and occupy the property for the duration of their lives. After their death, the property automatically passes to the grantees. When preparing a Murrieta California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees, it is crucial to consult a real estate attorney to ensure compliance with all applicable laws and regulations. It is also recommended having the deed properly recorded with the Riverside County Recorder's Office to establish the grantees' ownership rights and protect against any future claims or disputes.