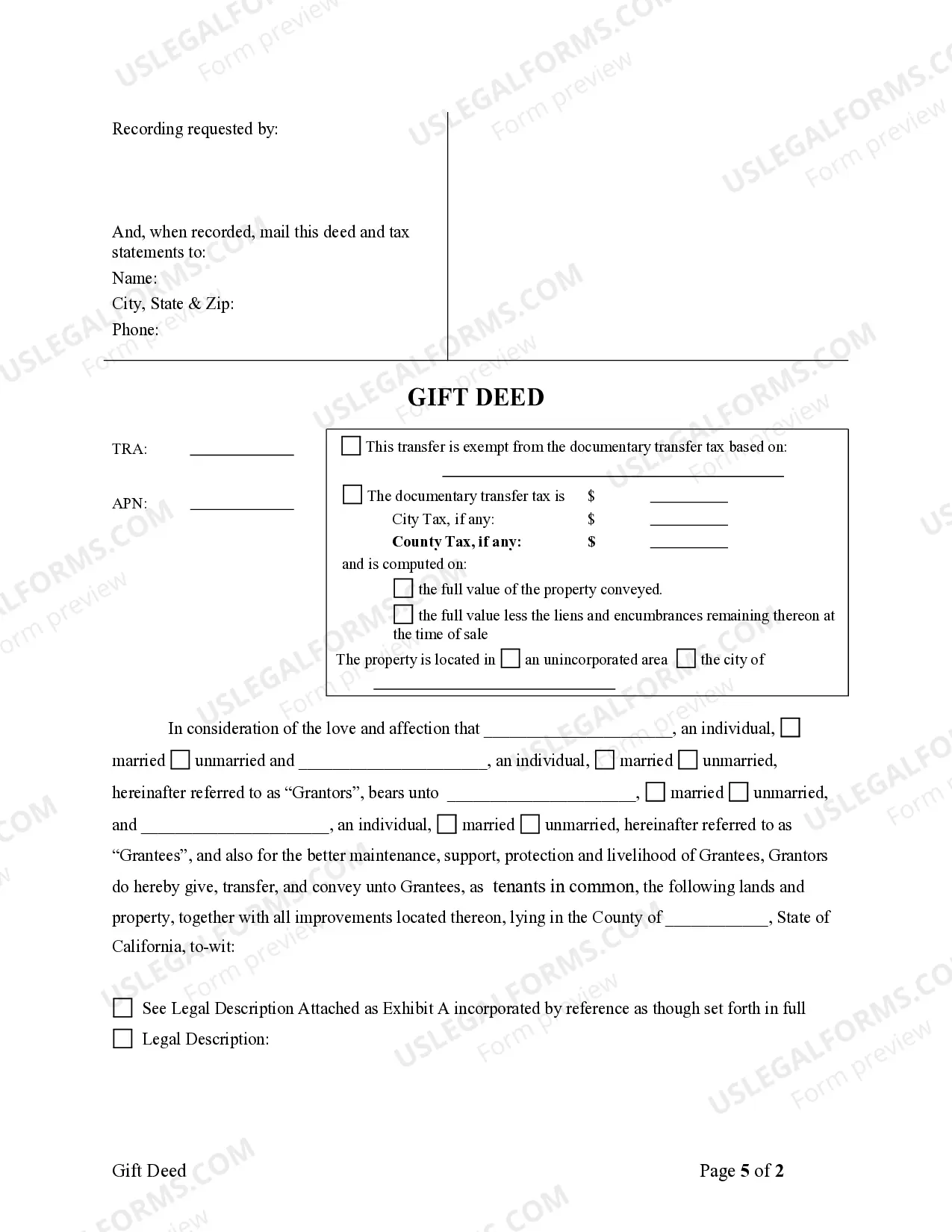

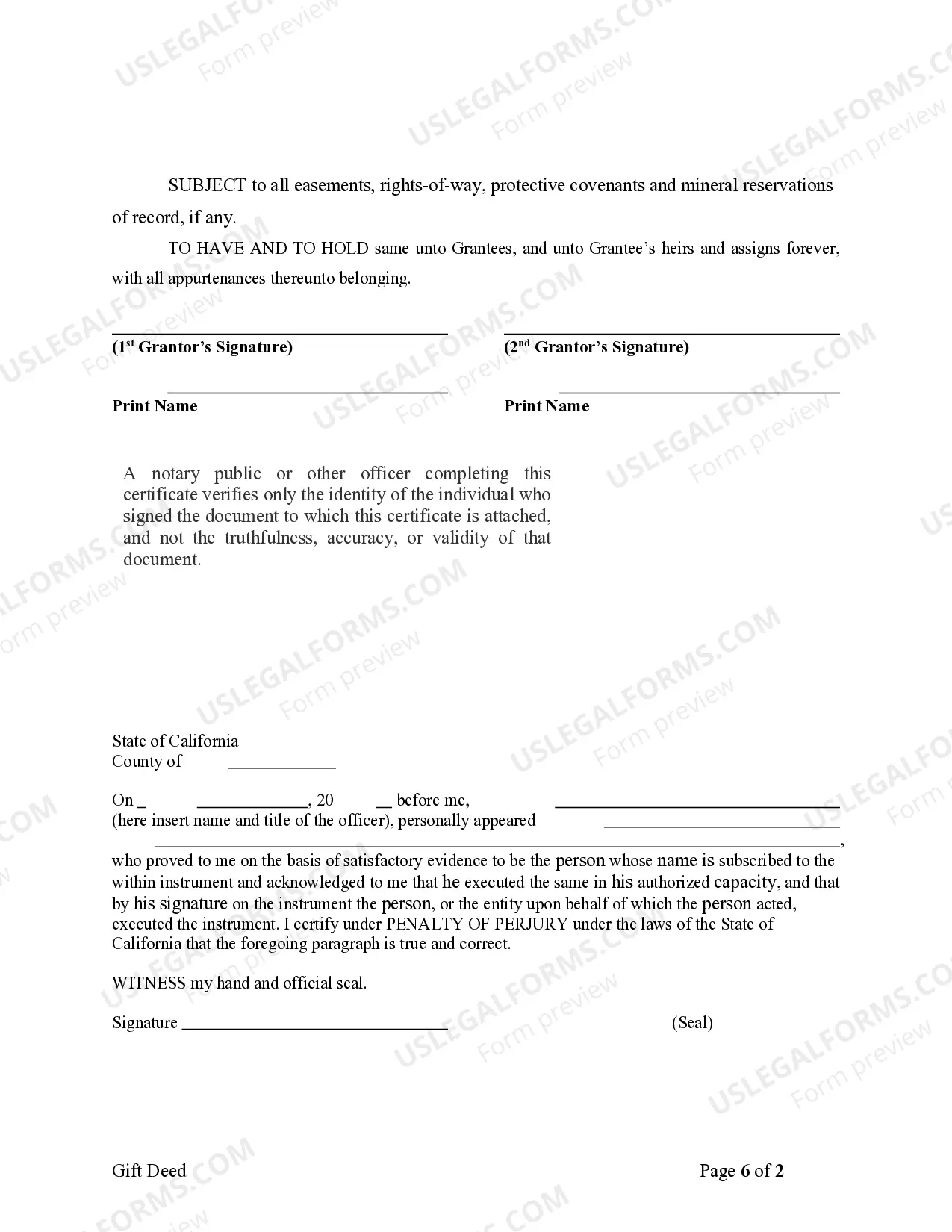

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees

Description

How to fill out California Gift Deed - From Two Individual Grantors To Two Individual Grantees?

Are you searching for a dependable and affordable legal documents provider to purchase the Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees? US Legal Forms is your ideal answer.

Whether you require a simple agreement to establish guidelines for living with your partner or a collection of forms to facilitate your separation or divorce through the court, we’ve got you covered. Our site offers over 85,000 current legal document templates for personal and business use. All templates that we provide are not generic and structured in line with the requirements of individual states and counties.

To acquire the form, you must Log In to your account, find the required template, and click the Download button next to it. Please consider that you can download your previously acquired form templates anytime from the My documents section.

Are you unfamiliar with our platform? No problem. You can create an account with great ease, but before that, ensure to do the following.

Now you can create your account. After that, select the subscription option and proceed to payment. Once the transaction is completed, download the Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees in any provided file format. You can revisit the website at any time and redownload the form at no additional cost.

Acquiring up-to-date legal forms has never been simpler. Try US Legal Forms today, and put an end to spending hours researching legal documents online once and for all.

- Verify if the Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees aligns with the regulations of your state and local jurisdiction.

- Review the form’s specifics (if available) to understand who and what the form benefits.

- Restart the search if the template is not suitable for your particular circumstances.

Form popularity

FAQ

Adding someone to a house deed in California starts with preparing a new deed that identifies both parties clearly. Utilizing a Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees streamlines this process. Once you complete the deed, ensure to get it notarized and filed with the appropriate county authority. This action will legally update the ownership of your property.

To add a person to a deed in California, you'll need to complete a new deed that accurately reflects the changes. You can use a Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees to simplify the process. After drafting the deed, you must sign it before a notary and then record it with the county recorder's office. This step makes the change official and legally binding.

When you add someone to a deed in California, it can trigger tax implications, including potential gift taxes, depending on the value of the property. Specifically, the California Gift Deed - From Two Individual Grantors to Two Individual Grantees may be subject to federal gift tax rules. It's crucial to consult with a tax professional to understand how this action may affect your finances. Understanding these implications will help ensure you make informed decisions.

The main difference lies in the intent and conditions of the transfer. A gift deed indicates a voluntary transfer of property without payment, emphasizing the donative intent, while a grant deed conveys property and typically includes implied warranties. Understanding these distinctions can help individuals choose the right instrument for their needs, especially when dealing with the Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees.

The strongest form of deed is typically a warranty deed, which provides the highest level of protection to the grantee. This type guarantees that the grantor holds clear title to the property and has the right to sell it. However, in situations where property is gifted, the Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees is a reliable option that highlights the intent behind the transfer.

In many cases, using a gift deed, like the Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees, offers a straightforward way to transfer property titles among family members. This approach ensures that the transfer is clear and official, often minimizing tax consequences. It's wise to consult with a legal expert to ensure everything is done correctly.

One disadvantage of a grant deed is that it may not provide as extensive protection as other types of deeds, such as warranty deeds. While it does imply ownership, it does not guarantee it against all claims. Users should understand these limitations when engaging in property transfers, especially when considering the Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees.

No, a grant deed and a gift deed serve different purposes. A grant deed conveys property with certain guarantees, while a gift deed specifically denotes a voluntary transfer with no exchange of payment. Understanding these differences is essential for making informed property decisions, especially in contexts like the Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees.

One major disadvantage of a gift deed, such as the Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees, is that it transfers ownership immediately. This means that the granters give up control and cannot revoke the deed later. Additionally, any potential creditor claims against the grantee might affect the property, which could risk the donor's interests.

Yes, your parents can put you on the deed to their house, and this can often be done through a gift deed. This action allows you to have shared ownership and could also help avoid probate later on. Utilizing a Palmdale California Gift Deed - From Two Individual Grantors to Two Individual Grantees can help streamline this process, ensuring all legal aspects are properly addressed.