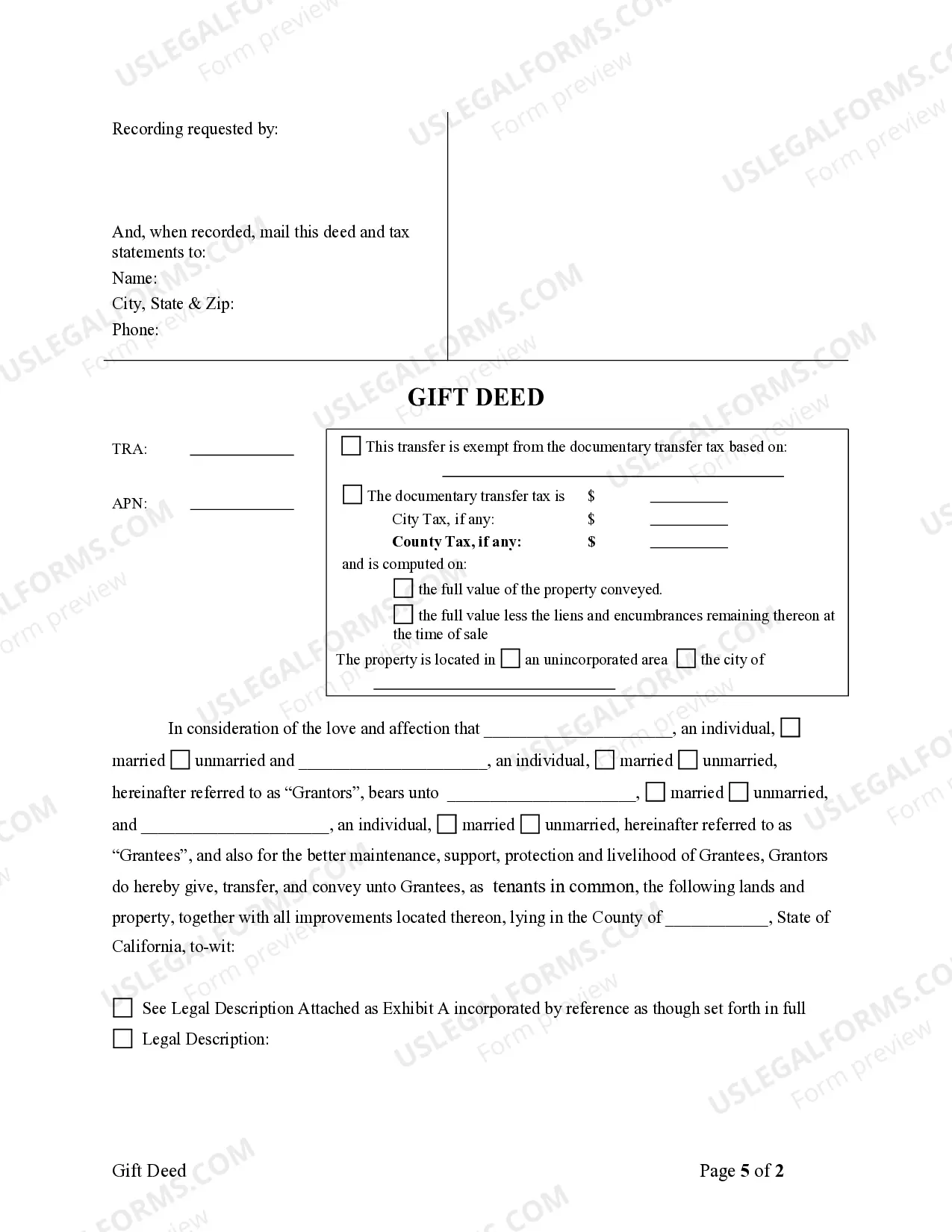

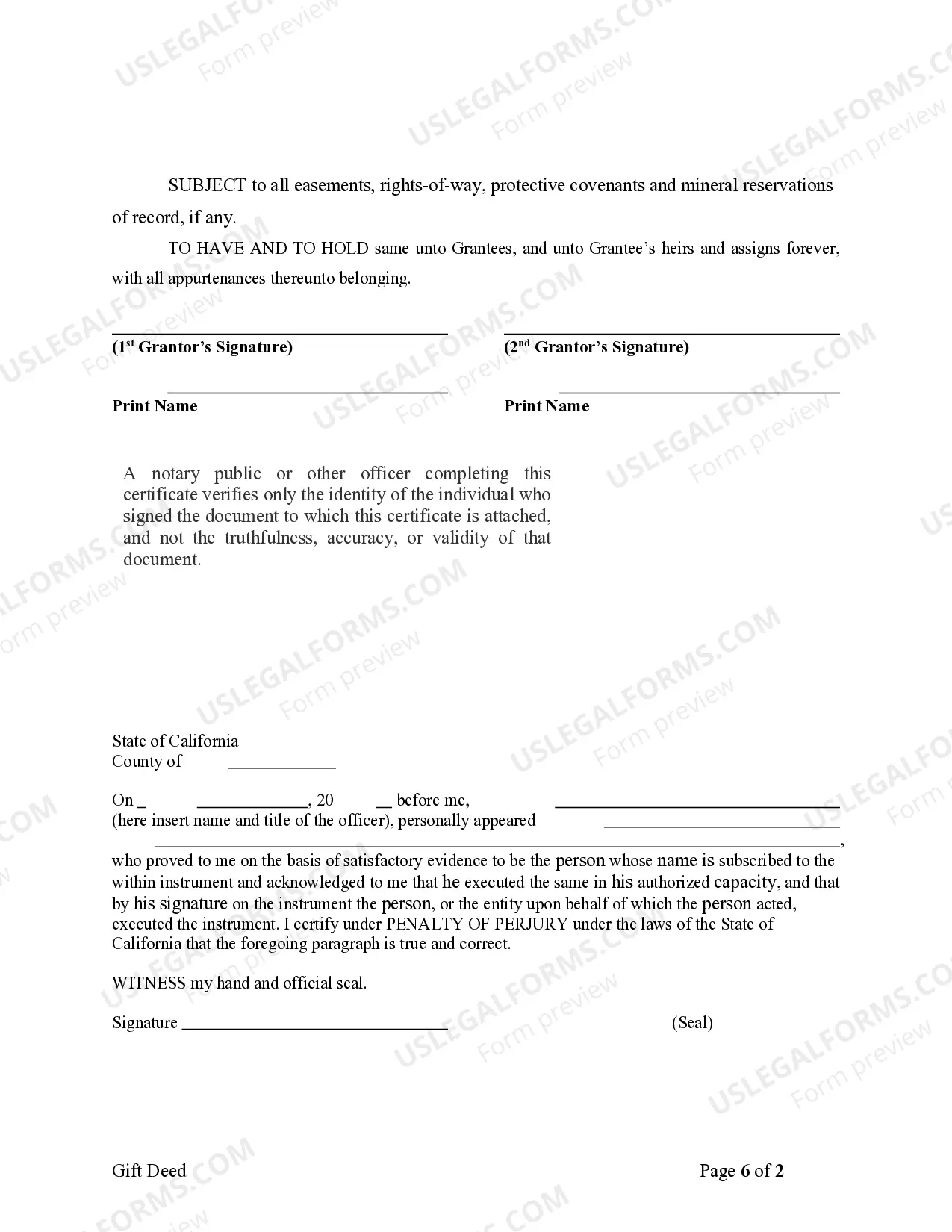

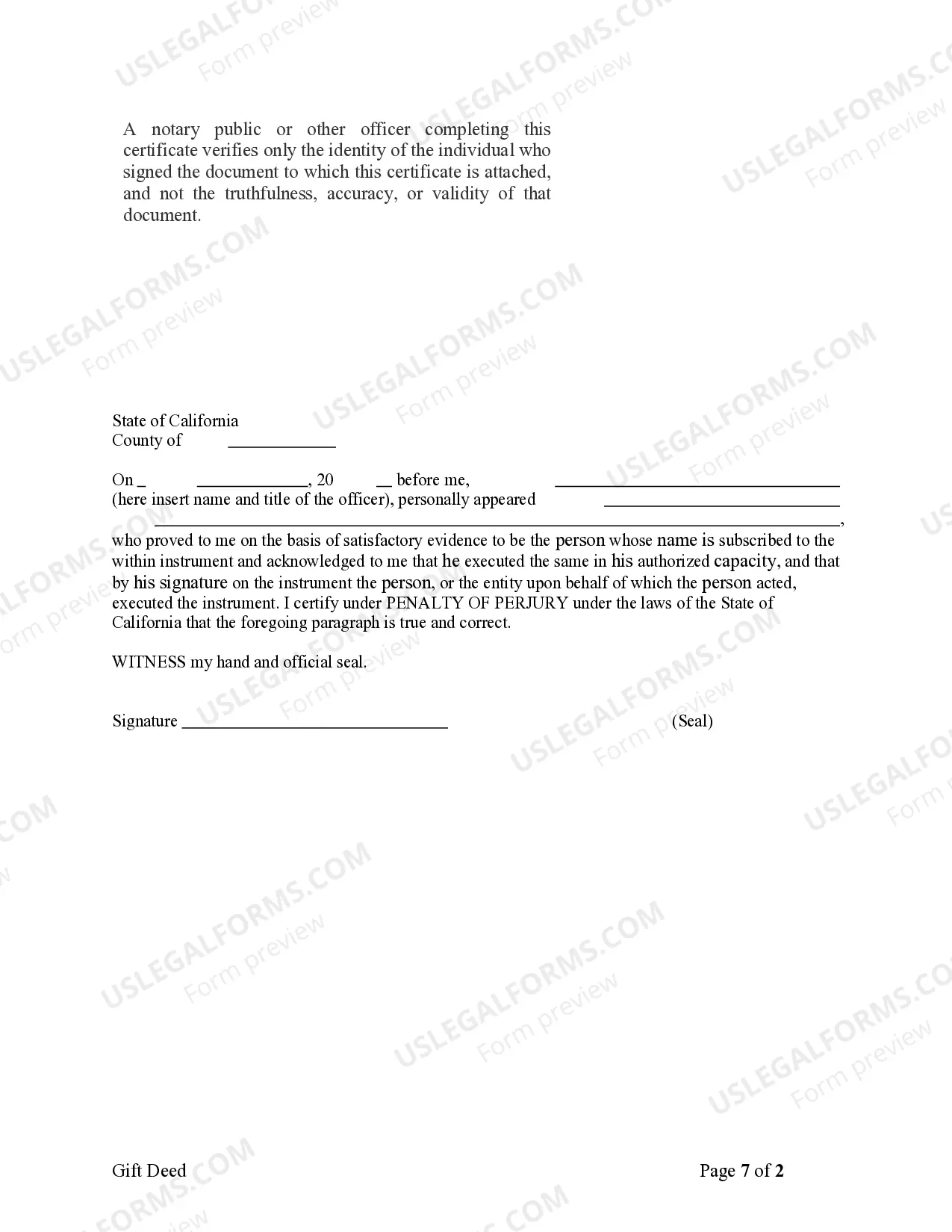

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

The Rialto California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is a legal document that transfers ownership of a property from two individual granters to two individual grantees in the city of Rialto, California. This type of deed is commonly used when individuals want to gift a property to others without any purchase involved. A gift deed is a legally binding instrument that conveys the property rights without the exchange of money. It signifies the intention of the granters to transfer the ownership of the property as a voluntary gift to the grantees. The gift can be given for various reasons, such as family transfers, estate planning, or charitable donations. The Rialto California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees typically includes essential information, including the names and addresses of the granters and grantees, a detailed property description, and the declaration of the gift. It also requires the signatures of all parties involved, along with the acknowledgment of a notary public. Additional Rialto California Gift Deed variations may include: 1. Rialto California Gift Deed with Life Estate — From Two IndividuaGrantersrs to Two Individual Grantees: This type of gift deed grants ownership of the property to the grantees, while allowing the granters to retain a life estate, enabling them to live on or use the property until their death. 2. Rialto California Conditional Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees: In this variation, the gift of the property is conditional upon certain circumstances or events, which must occur or be fulfilled for the transfer to take effect. 3. Rialto California Gift Deed with Reservation of Rights — From Two IndividuaGrantersrs to Two Individual Grantees: This type of gift deed allows the granters to retain specific rights or interests in the property, such as the right to use certain portions or receive income from the property during their lifetime. When dealing with a Rialto California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees, it is crucial to consult with a real estate attorney or professional to ensure compliance with applicable laws and to address any specific circumstances or requirements.