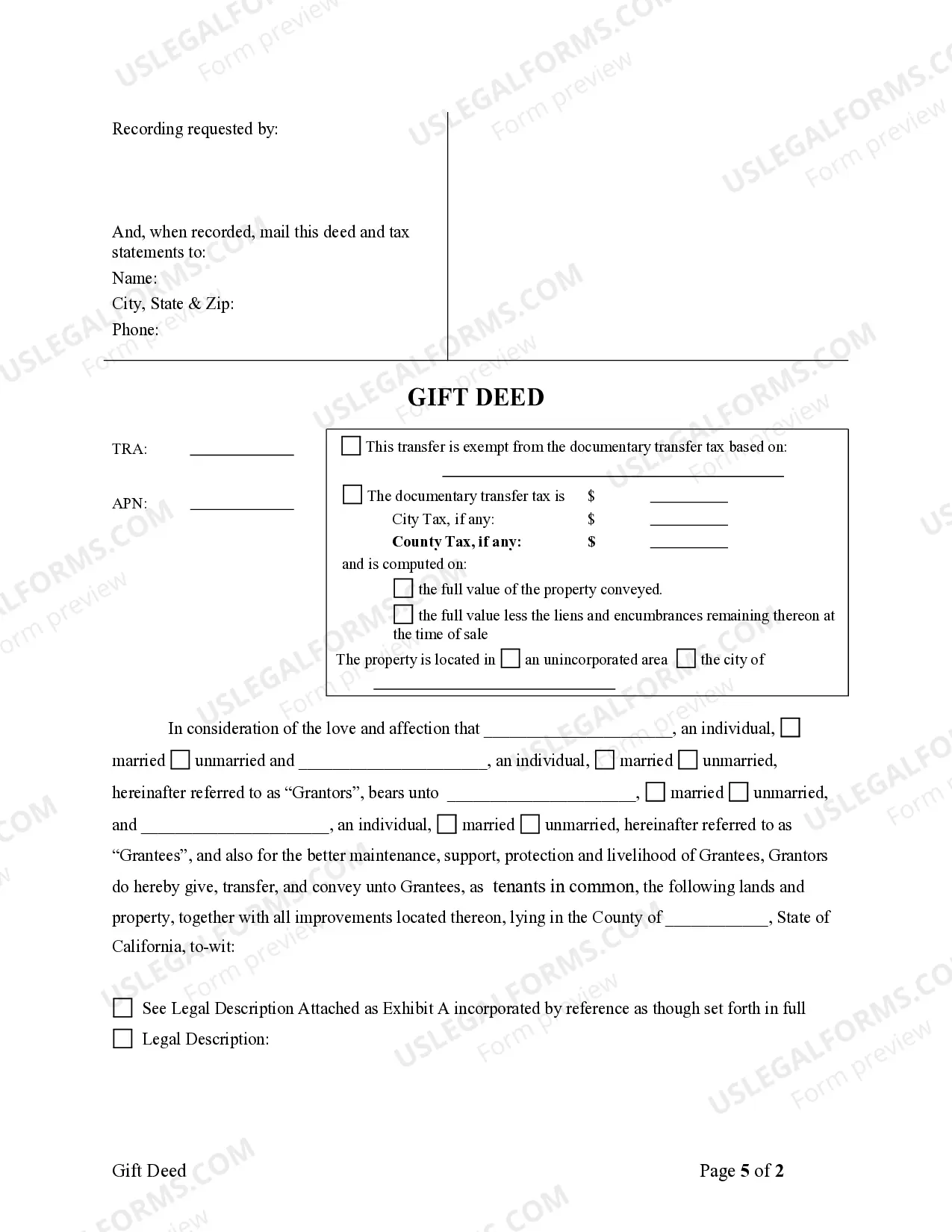

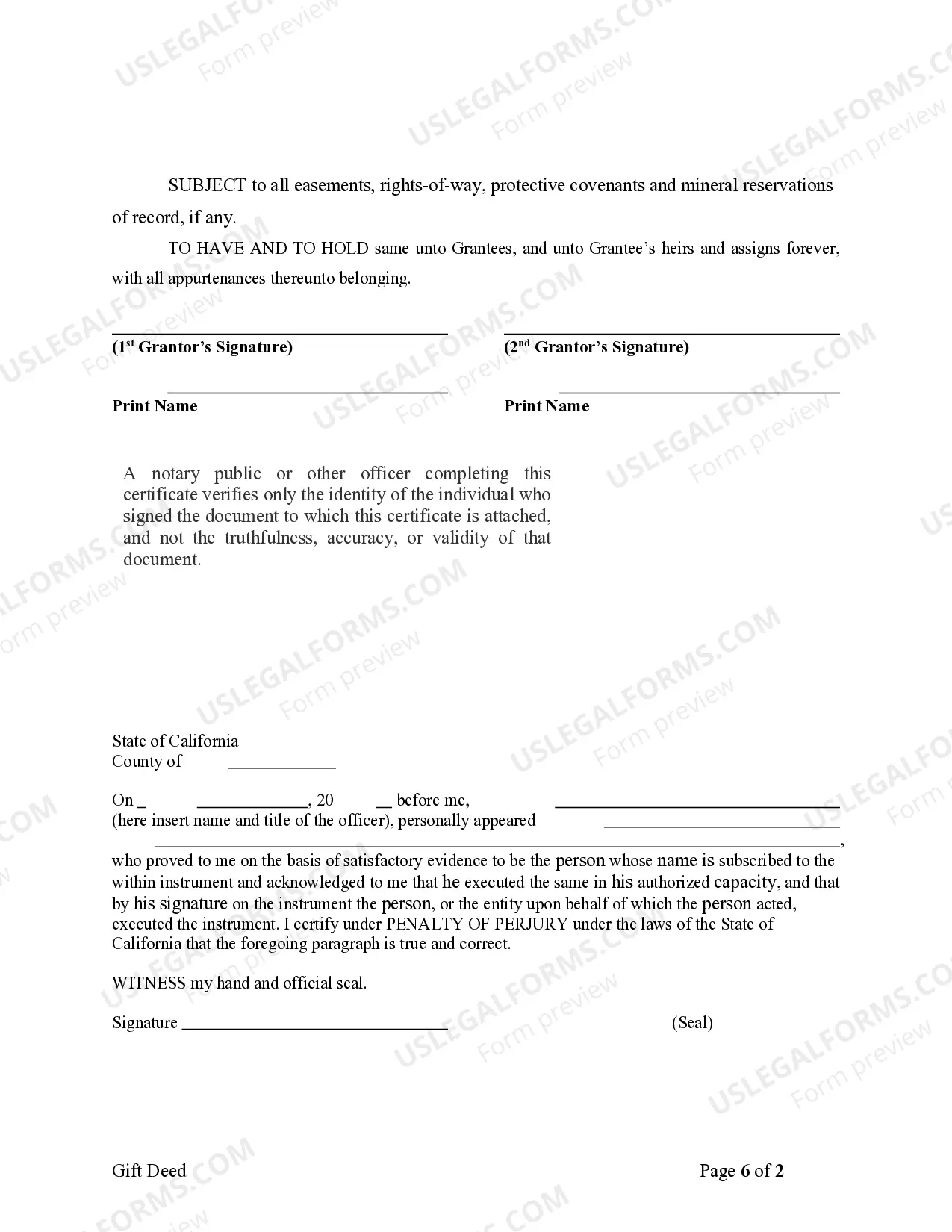

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees

Description

How to fill out California Gift Deed - From Two Individual Grantors To Two Individual Grantees?

Are you in search of a reliable and affordable provider of legal document templates to purchase the San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees? US Legal Forms is your ideal choice.

Whether you require a simple agreement to establish rules for living together with your partner or a collection of documents to facilitate your divorce through the legal system, we've got everything you need. Our service offers over 85,000 current legal document templates for personal and business purposes. All templates we provide are not generic but tailored to the specifications of individual states and counties.

To obtain the document, you need to Log In to your account, locate the desired template, and click the Download button adjacent to it. Please keep in mind that you can retrieve your previously purchased document templates at any time from the My documents section.

Is this your first visit to our platform? No problem. You can create an account in just a few minutes; however, before doing so, ensure you take the following steps.

Now you can establish your account. Then select the subscription plan and move forward with the payment. Once the payment is finalized, download the San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees in any available file format. You can revisit the site whenever necessary and redownload the document at no additional cost.

Acquiring current legal documents has never been more straightforward. Try US Legal Forms today and stop wasting your precious time searching for legal paperwork online once and for all.

- Check if the San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees meets the laws of your state and locality.

- Review the description of the form (if available) to understand who the document is suitable for and its purpose.

- Start your search again if the template does not align with your legal circumstances.

Form popularity

FAQ

The best way to transfer property to a family member often involves using a gift deed, especially a San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This method simplifies the transfer process and avoids potential complications associated with sales or other agreements. It is advisable to consult legal resources, like UsLegalForms, to ensure the transfer aligns with legal requirements.

A gift deed transfers property without monetary compensation, while a grant deed conveys property and typically includes warranties from the grantor. In the context of a San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees, the gift deed allows for seamless transfer between individuals without the need for payment. Understanding this difference is crucial when planning your property transfers.

To remove someone from a deed in California, you need to execute a new deed that reflects the change in ownership. Specifically, for a San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees, you should prepare the deed and have it signed by the grantor who is being removed. Then, file the new deed with the County Recorder's Office to make it official. Utilizing platforms like USLegalForms can simplify this process by providing you with templates and guidance tailored to your needs.

To fill out an interspousal transfer deed in California, start by obtaining the correct form from a reliable source, such as US Legal Forms. Ensure you include both individual grantors and grantees' details. Clearly describe the property being transferred to ensure no ambiguity. Finally, both spouses must sign the deed in front of a notary to validate the San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees.

When two or more individuals buy a property together using one deed with equal interest and right of survivorship, they create a joint ownership scenario. This means that each party has an equal share of the property, and if one owner dies, their interest passes directly to the surviving owner(s). This setup is often initiated through a San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees, ensuring a clear ownership structure.

The best way to transfer property title between family members often involves the use of a gift deed, specifically a San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This type of deed allows one family member to gift their interest in the property to another without incurring taxes. Ensure all necessary documentation is complete and consider consulting resources like uslegalforms for guidance.

'Jointly with right of survivorship' is a legal term describing ownership where two or more individuals hold title to a property. In this arrangement, if one owner passes away, their share automatically transfers to the surviving owner(s). This is an important aspect to consider if you plan to create a San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees.

When multiple individuals have ownership rights in the same property, it is commonly referred to as co-ownership. This arrangement can involve various forms, such as joint tenancy or tenancy in common. Understanding these distinctions is important, especially when preparing a San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees.

To transfer property from one person to another in California, the owner must execute a deed, such as a San Diego California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This deed needs to be signed by the grantor and should clearly identify both the property and the new owner. After signing, the deed must be recorded with the county recorder's office to finalize the transfer.