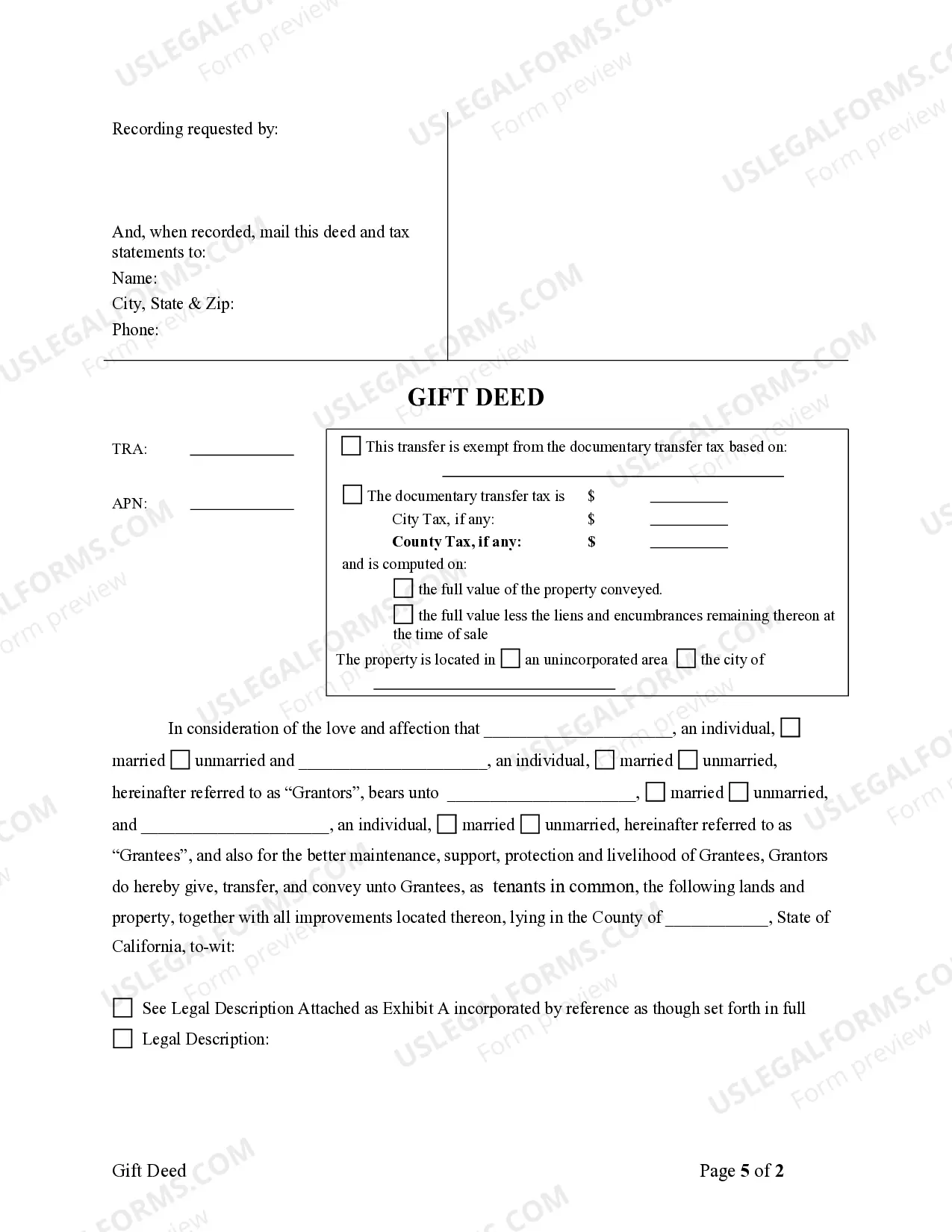

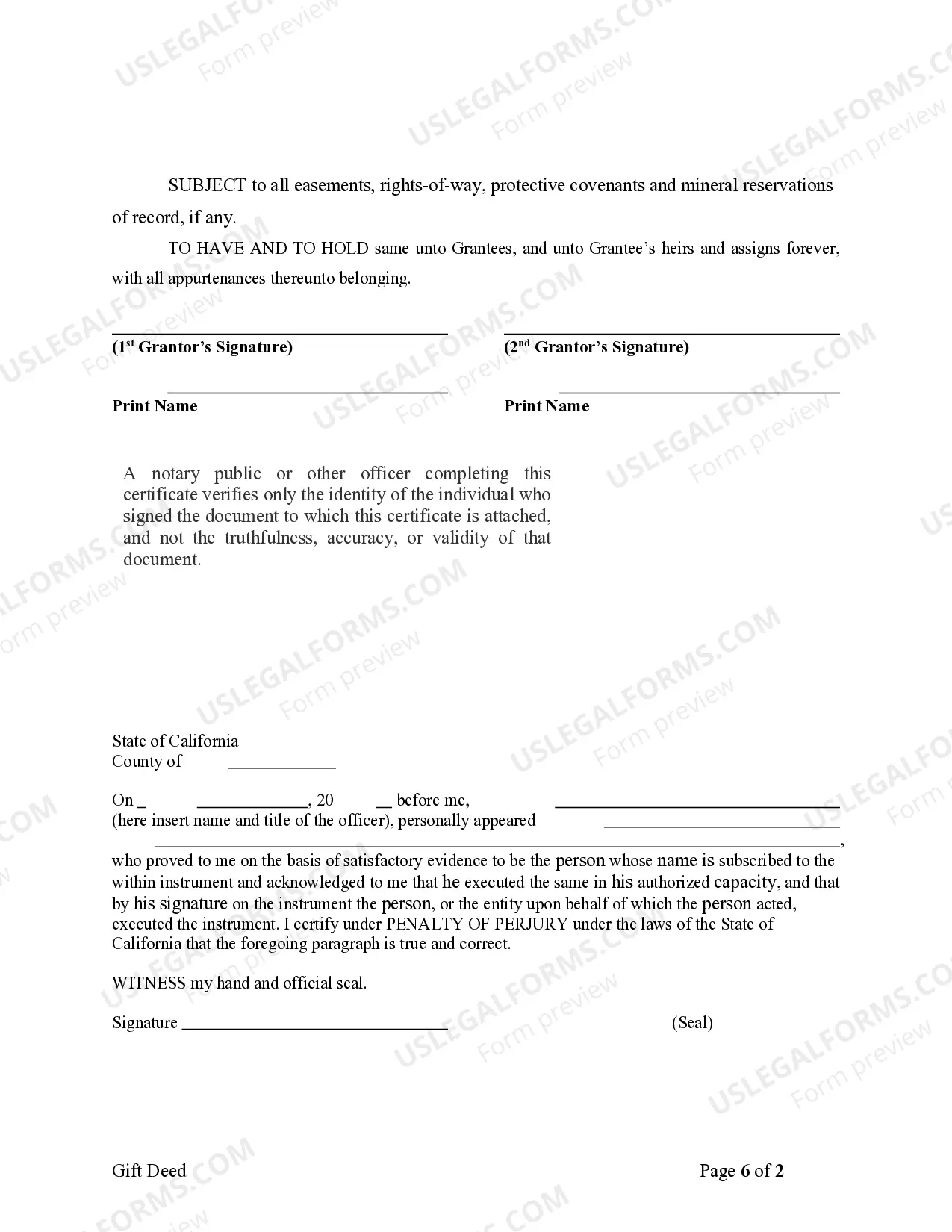

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

San Jose California Gift Deed - From Two Individual Grantors to Two Individual Grantees

Description

How to fill out California Gift Deed - From Two Individual Grantors To Two Individual Grantees?

Take advantage of the US Legal Forms and gain immediate access to any template you need.

Our helpful website featuring a vast collection of templates enables you to locate and acquire nearly any document sample you need.

You can download, fill out, and sign the San Jose California Gift Deed - From Two Individual Grantors to Two Individual Grantees in just a few minutes instead of spending hours online searching for an appropriate template.

Utilizing our library is an excellent method to enhance the security of your document submissions.

- Our knowledgeable legal experts consistently review all papers to ensure that the forms are suitable for a specific state and adhere to new laws and regulations.

- How can you acquire the San Jose California Gift Deed - From Two Individual Grantors to Two Individual Grantees.

- If you already possess a subscription, simply Log In to your account. The Download button will be visible on all documents you review. You can also access all previously saved documents in the My documents section.

Form popularity

FAQ

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word ?grant? is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

?Adding someone to a deed? means transferring ownership to that person. The transfer of ownership can occur during life (with a regular quitclaim deed, for example) or at death (using a lady bird deed, transfer-on-death-deed, or life estate deed).

You can arrange to legally transfer the deed to your house to your children before you die. To do so, you sign a deed transfer and record it with the county recorder's office. There are a few types of deeds that accomplish this in California, including a quitclaim deed, grant deed and transfer on death deed.

Adding a name to the deeds Equity transfer is not just about removing a name from the deeds. It also includes adding a name. For example, parents may want to add their children to the deeds of the family home. When someone marries their partner, they may want to add them to the deeds of the property they already owned.

You'll need to transfer an interest by writing up another deed with the person's name on it. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. Each one has its own requirements and works best in different circumstances.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.