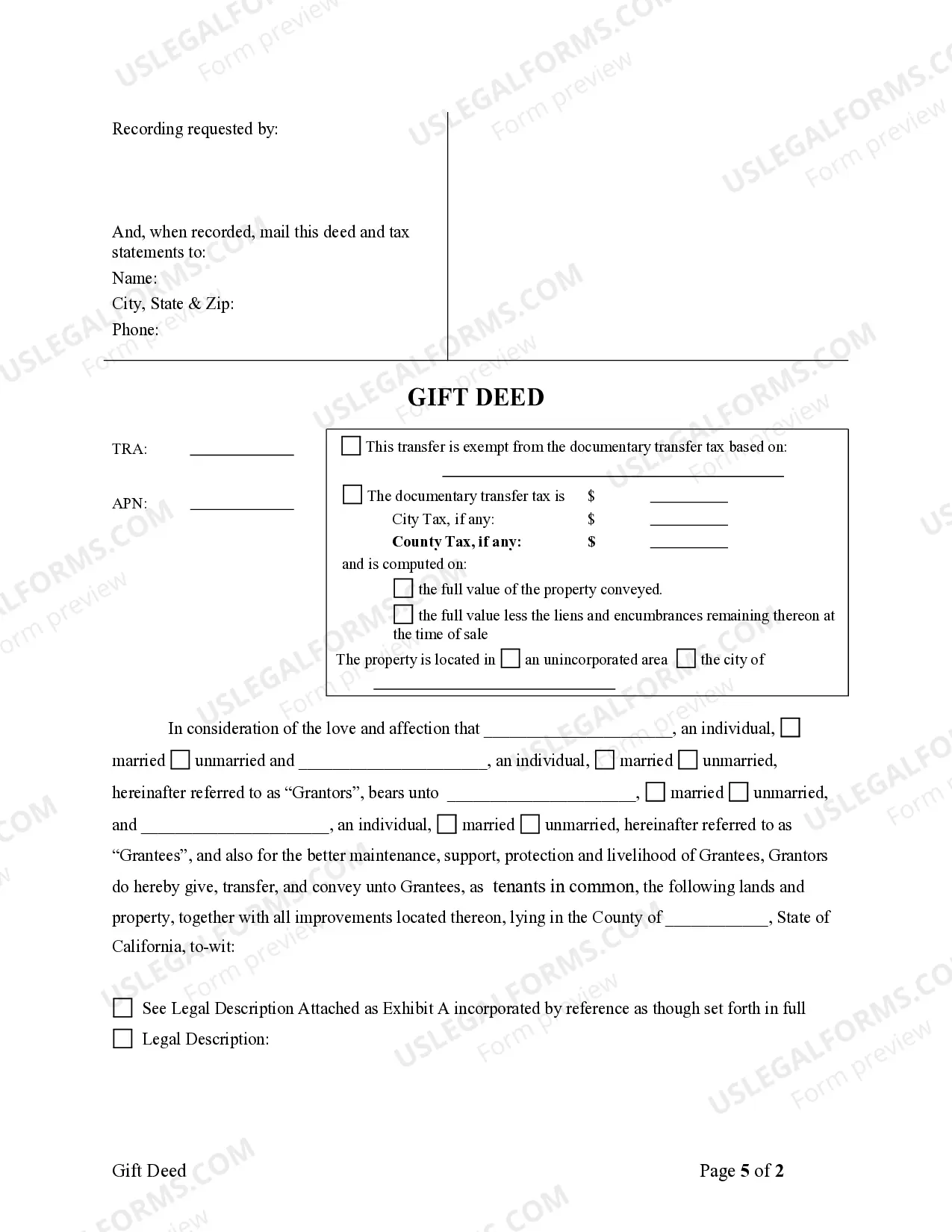

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

A Santa Clara California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is a legal document that transfers ownership of a property as a gift from two individual granters (the current owners) to two individual grantees (the new owners). This type of deed allows the granters to voluntarily give their property to the grantees without any monetary consideration. Gift deeds are commonly used when individuals want to transfer property as a gift to their loved ones, such as family members or friends. The deed serves as evidence of the transfer and ensures that the grantees have legal ownership rights to the property. A Santa Clara California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees should contain detailed information about the parties involved, including their full names and addresses. It should also describe the property being transferred, including its legal description, address, and any pertinent details or improvements. The deed must clearly state that the transfer is a gift, without any expectation of payment or consideration. It should also mention that the granters are transferring all their rights and interests in the property to the grantees, guaranteeing that the grantees will have full ownership without any liens or encumbrances. Additionally, a gift deed should include the signatures of the granters, acknowledging their intention to gift the property, as well as the signatures of the grantees, indicating their acceptance of the gift. It is crucial to have the document notarized to ensure its legality and enforceability. The Santa Clara California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is just one type of gift deed that can be used. Other variations may include gift deeds from an individual granter to a single grantee or those involving multiple granters and grantees. These variations differ based on the number of parties involved in the transfer. In summary, the Santa Clara California Gift Deed — From Two Individual Granters to Two Individual Grantees is a legal document that enables the voluntary transfer of property as a gift between two individual parties. It solidifies the transfer of ownership rights from the granters to the grantees and ensures a smooth and official transition of property ownership.