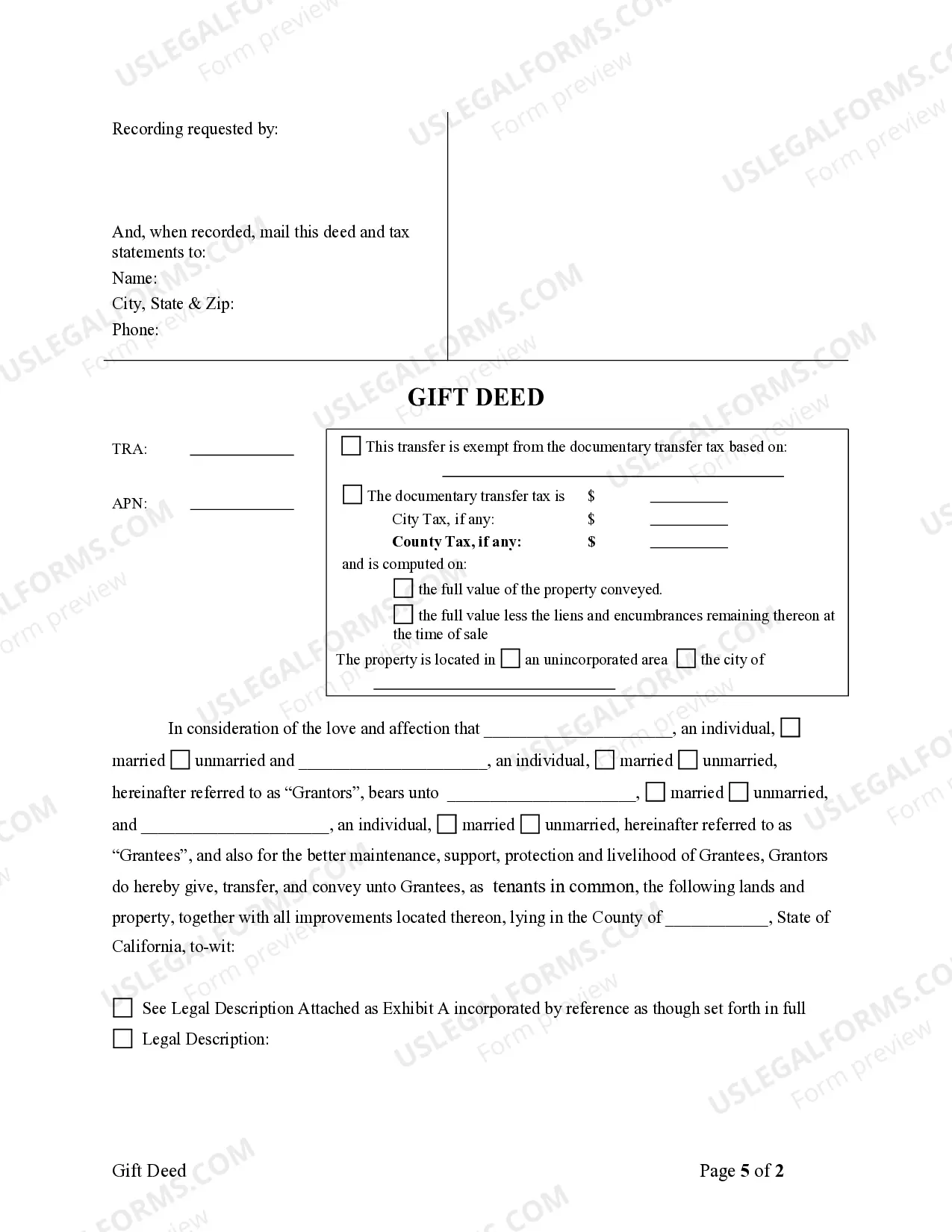

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Stockton California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees A Stockton California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is a legal document that allows the transfer of real property ownership from two individuals (granters) to two other individuals (grantees) as a gift. This specific type of gift deed is commonly used in Stockton, California, to transfer property ownership without any consideration or monetary exchange. In this gift deed, the granters relinquish their rights, title, and interest to the property, effectively making a voluntary transfer to the grantees. The grantees become the new owners of the property and assume all responsibilities and liabilities attached to it. Key features of Stockton California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees: 1. Voluntary Transfer: This gift deed is based on an unconditional and voluntary transfer of property ownership, where no payment is made in return. 2. Real Property Ownership: The gift deed specifically pertains to the transfer of ownership of a piece of real property, which may include land, buildings, structures, or any improvements on the property. 3. Two Individual Granters and Two Individual Grantees: This particular type of gift deed involves two individuals granting the property to another two individuals. It signifies a transaction between private parties and is often used for gifting property to family members or close friends. 4. Consideration and Tax Implications: Unlike a traditional property sale, where consideration (usually money) is involved, a gift deed is exempt from consideration. However, there may be tax implications associated with the transfer, such as potential federal gift tax or California state gift tax. 5. Legal Document: The gift deed is a legally binding document that must be properly executed and recorded with the relevant county recorder's office in Stockton, California, to establish the transfer of ownership. Different types of Stockton California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees include variations based on property types, interests involved, or additional conditions set by the granters. Some examples may include: 1. Residential Gift Deed: Specifically designed for the transfer of ownership of residential properties, such as houses, apartments, or condos. 2. Vacant Land Gift Deed: Used when gifting parcels of vacant land, such as agricultural land, lots, or undeveloped property. 3. Joint Tenancy Gift Deed: Involves the transfer of ownership to grantees as joint tenants, giving them equal rights and interests in the property. Ultimately, a properly executed Stockton California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is a legal instrument that facilitates the transfer of property ownership as a gift, ensuring a transparent and legally compliant transaction between the parties involved.Stockton California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees A Stockton California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is a legal document that allows the transfer of real property ownership from two individuals (granters) to two other individuals (grantees) as a gift. This specific type of gift deed is commonly used in Stockton, California, to transfer property ownership without any consideration or monetary exchange. In this gift deed, the granters relinquish their rights, title, and interest to the property, effectively making a voluntary transfer to the grantees. The grantees become the new owners of the property and assume all responsibilities and liabilities attached to it. Key features of Stockton California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees: 1. Voluntary Transfer: This gift deed is based on an unconditional and voluntary transfer of property ownership, where no payment is made in return. 2. Real Property Ownership: The gift deed specifically pertains to the transfer of ownership of a piece of real property, which may include land, buildings, structures, or any improvements on the property. 3. Two Individual Granters and Two Individual Grantees: This particular type of gift deed involves two individuals granting the property to another two individuals. It signifies a transaction between private parties and is often used for gifting property to family members or close friends. 4. Consideration and Tax Implications: Unlike a traditional property sale, where consideration (usually money) is involved, a gift deed is exempt from consideration. However, there may be tax implications associated with the transfer, such as potential federal gift tax or California state gift tax. 5. Legal Document: The gift deed is a legally binding document that must be properly executed and recorded with the relevant county recorder's office in Stockton, California, to establish the transfer of ownership. Different types of Stockton California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees include variations based on property types, interests involved, or additional conditions set by the granters. Some examples may include: 1. Residential Gift Deed: Specifically designed for the transfer of ownership of residential properties, such as houses, apartments, or condos. 2. Vacant Land Gift Deed: Used when gifting parcels of vacant land, such as agricultural land, lots, or undeveloped property. 3. Joint Tenancy Gift Deed: Involves the transfer of ownership to grantees as joint tenants, giving them equal rights and interests in the property. Ultimately, a properly executed Stockton California Gift Deed — From Two IndividuaGrantersrs to Two Individual Grantees is a legal instrument that facilitates the transfer of property ownership as a gift, ensuring a transparent and legally compliant transaction between the parties involved.