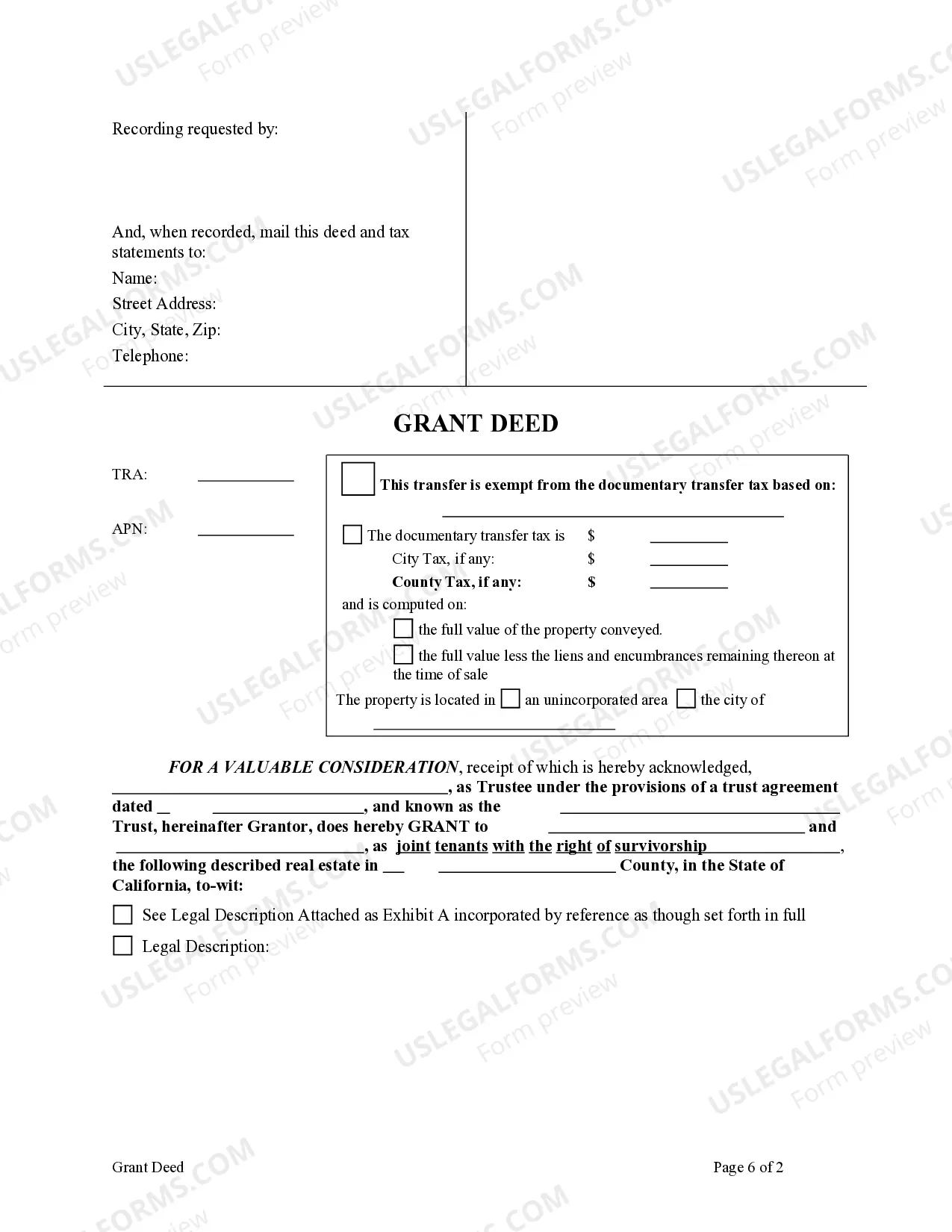

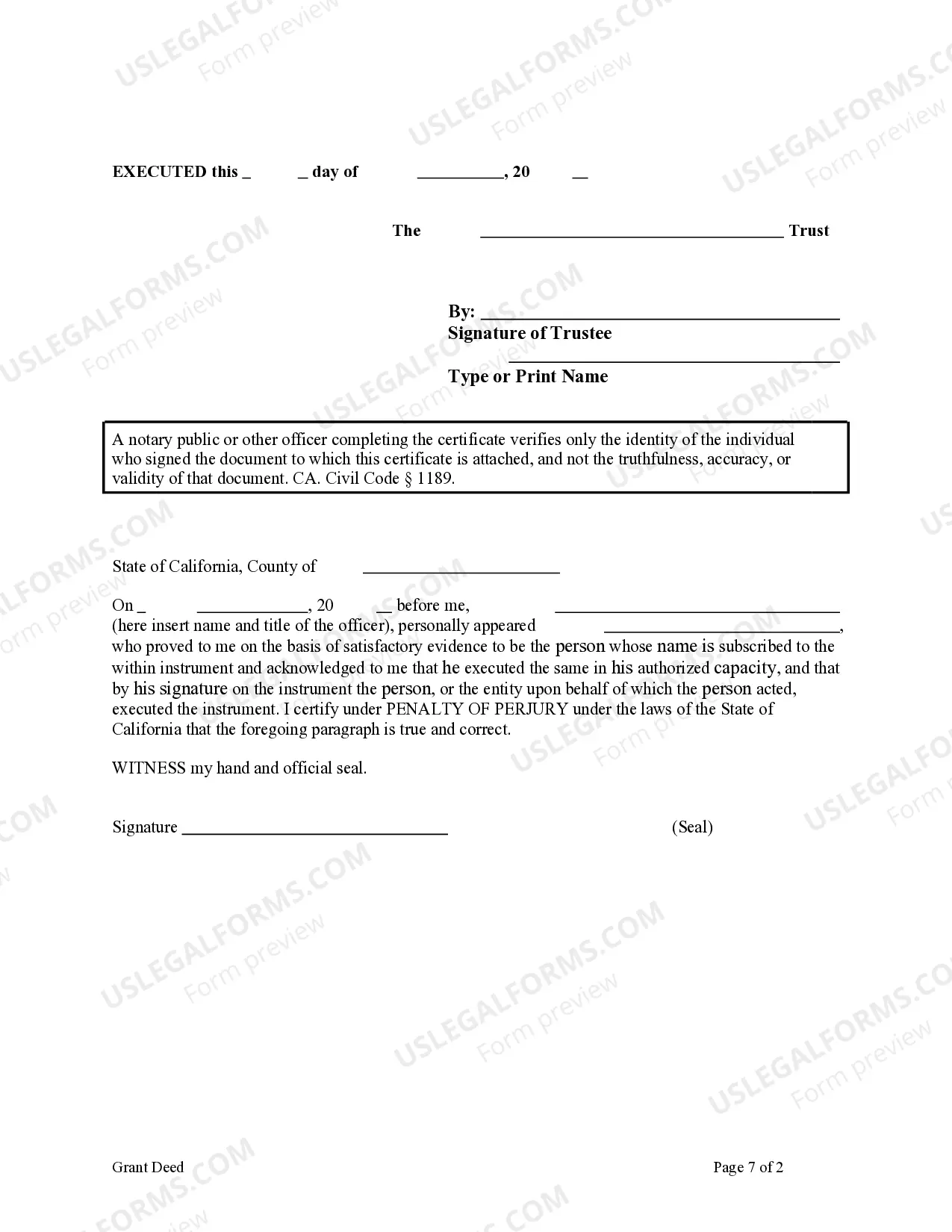

This form is a Grant Deed where the Grantor is a Trust and the Grantees are two individuals. This deed complies with all state statutory laws.

Title: Alameda California Grant Deed from Trust to Two Individuals: Explained in Detail Introduction: In Alameda, California, a Grant Deed from Trust to Two Individuals is a legal document that allows the transfer of rights and ownership of property held in a trust to two specific individuals. This article provides a comprehensive overview of the Alameda California Grant Deed, highlighting its definition, purpose, key elements, and possible variations. What is an Alameda California Grant Deed from Trust to Two Individuals? An Alameda California Grant Deed from Trust to Two Individuals is a legally binding document that facilitates the transfer of property ownership from a trust to two named individuals. This type of transfer is typically used when the trust's beneficiaries are to be changed, and the specified individuals will assume sole ownership over the property. Key Elements of an Alameda California Grant Deed from Trust to Two Individuals: 1. Trust or and Trustees: A Grant Deed from Trust will clearly state the names and roles of the trust or(s) who created the trust, and the trustees who currently manage the trust and are authorized to execute the transfer of property. 2. Property Description: The document includes a detailed and accurate description of the property being transferred, including its address, legal description, and any relevant parcel numbers. 3. Grantees: The two individuals who are designated as the new owners of the property are clearly identified as the grantees in the Grant Deed from Trust. 4. Consideration: The consideration section states the value exchanged for the property, which could be a monetary figure or confirmation that the property is being transferred as a gift. Different Types of Alameda California Grant Deed from Trust to Two Individuals: 1. Revocable Trust Grant Deed: This type of Grant Deed from Trust allows the trust or(s) to retain the ability to amend or revoke the trust during their lifetime. It facilitates the transfer of property ownership to the two named individuals but keeps the flexibility for changes until the trust or's passing. 2. Irrevocable Trust Grant Deed: An Irrevocable Trust Grant Deed is used when the trust or(s) intend to give up their rights to alter or revoke the trust. It enables the seamless transfer of property ownership to the two designated individuals, and once executed, the trust or(s) cannot change the terms without the grantees' consent. 3. Joint Tenancy Grant Deed: In the case where the two individuals are married or intend to hold the property with survivorship rights, a Joint Tenancy Grant Deed may be used. This type of Grant Deed establishes co-ownership, ensuring that if one person passes away, the surviving person automatically becomes the sole owner of the property. Conclusion: The Alameda California Grant Deed from Trust to Two Individuals is a critical legal document that allows for the transfer of a property's ownership from a trust to specifically named individuals. Understanding the key elements and different types of Grant Deeds can help individuals ensure a smooth and accurate transfer of property rights in compliance with Alameda County and California's regulations. Always consult with a legal professional to properly execute this process.