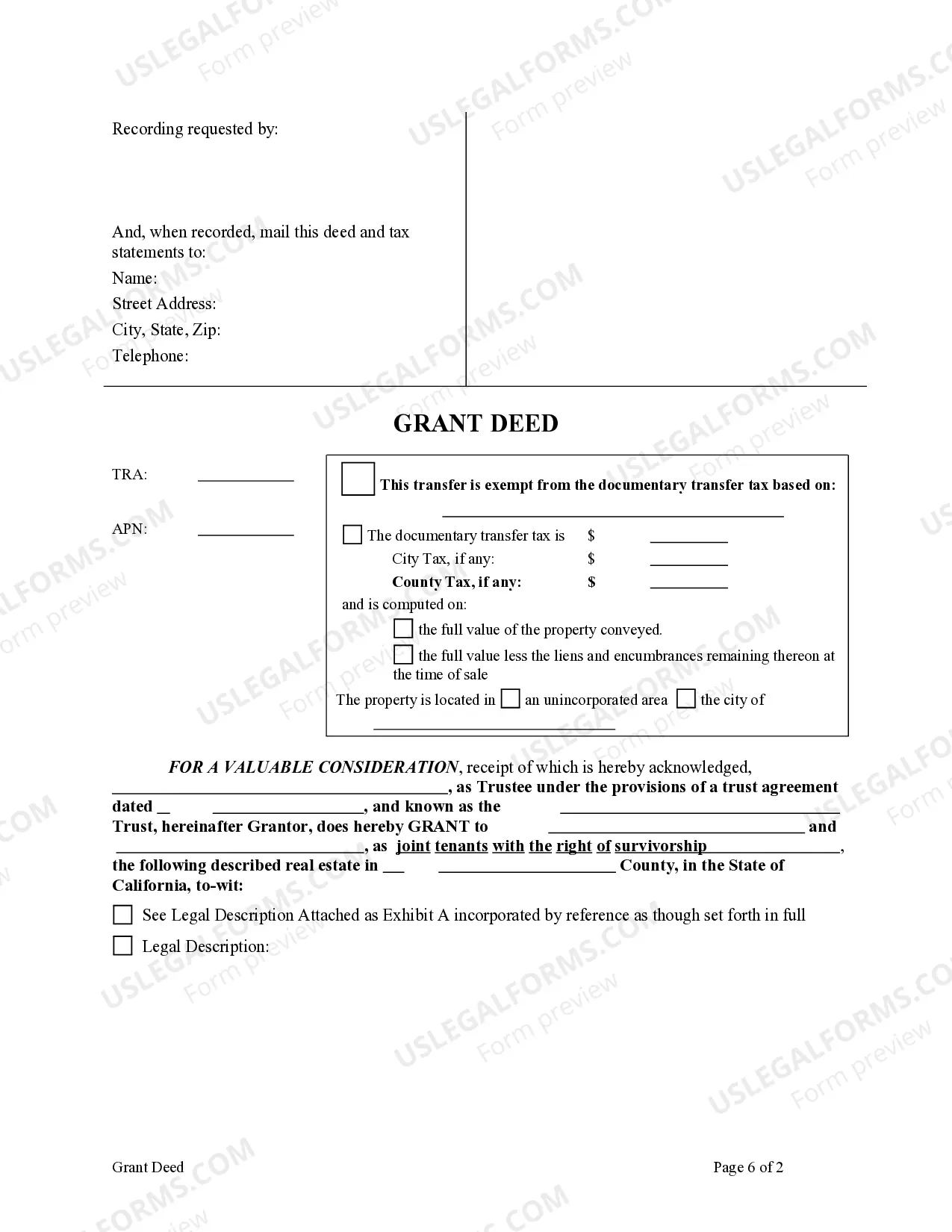

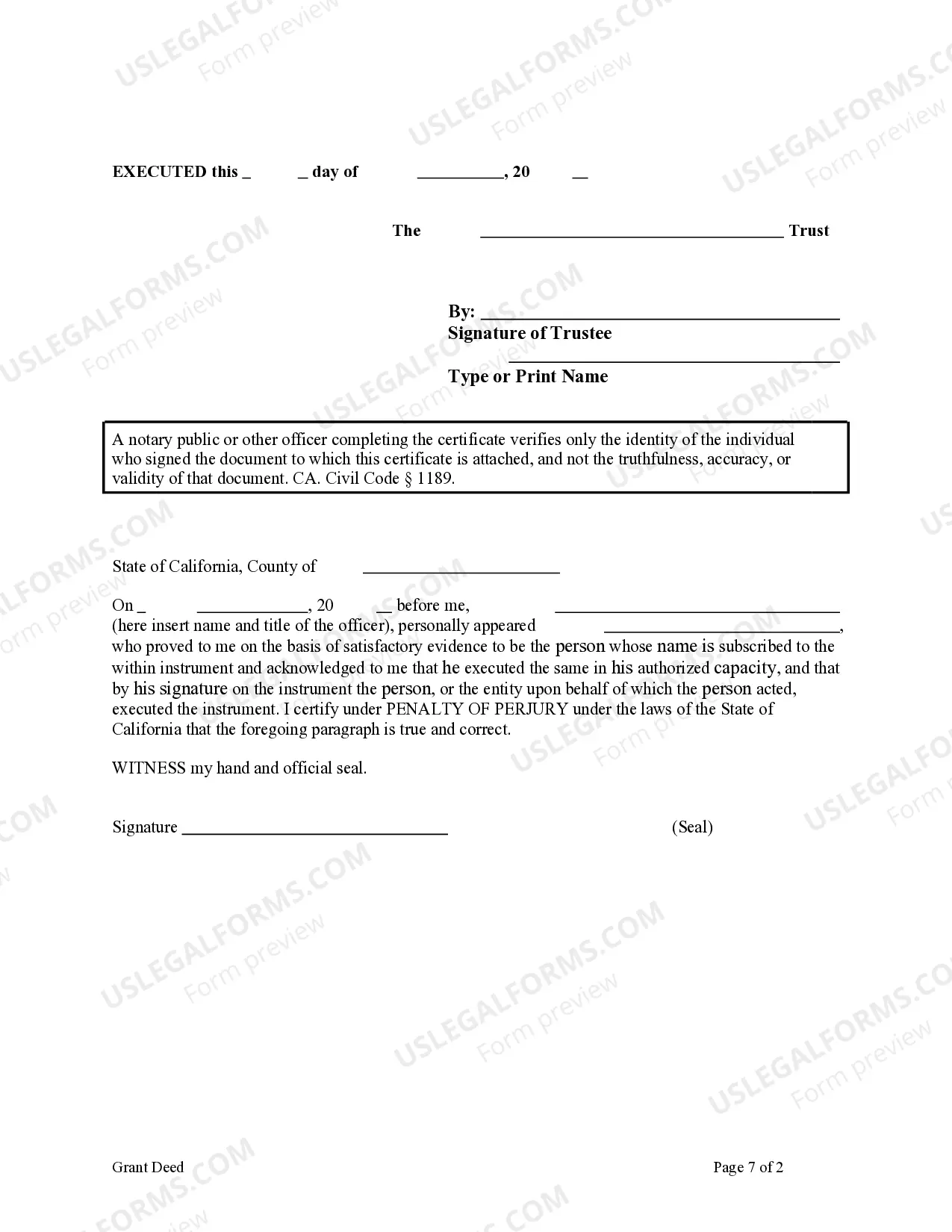

This form is a Grant Deed where the Grantor is a Trust and the Grantees are two individuals. This deed complies with all state statutory laws.

Title: Understanding Chico California Grant Deed from Trust to Two Individuals Introduction: A Chico California Grant Deed from Trust to Two Individuals is a legal document used to transfer real estate ownership from a trust to two individuals. It provides a structured framework to ensure the smooth transfer of property rights, often occurring when a trust is dissolved or when the beneficiaries want to take ownership of the property. This article will explore the specifics of this deed, highlighting its purpose, key components, and the different types available. 1. Purpose of a Chico California Grant Deed from Trust to Two Individuals: A Chico California Grant Deed from Trust to Two Individuals serves to transfer ownership of real estate property held in a trust to two individuals, typically named beneficiaries or heirs. The purpose is to provide a clear and legally binding mechanism for the transfer of property rights while ensuring compliance with state-specific regulations. 2. Key Components of a Chico California Grant Deed from Trust to Two Individuals: a) Property Description: The deed must include a detailed description of the property, including its legal description, the city or county where it is situated, and its address. b) Granter and Grantee Information: The names, addresses, and legally recognized identification details of the granter(s) and the two individuals (grantees) must be explicitly mentioned. c) Transfer Language: The deed must contain precise terms conveying the property from the granter(s) to the two individuals, such as "conveys," "grants," or "transfers." d) Signature and Notarization: The deed should bear the signatures of the granter(s), two witnesses, and ideally be notarized to ensure its validity. 3. Types of Chico California Grant Deed from Trust to Two Individuals: a) Interspousal Grant Deed: Used when transferring property between married individuals, this grant deed facilitates the transfer of property interests from one spouse to both spouses as joint owners. b) Joint Tenancy Grant Deed: Enables the transfer of property to two individuals, typically family members or business partners, who hold equal ownership interests in the property. Should one person pass away, their share automatically transfers to the surviving owner(s). c) Community Property Grant Deed: Pertaining to married couples, this grant deed ensures equal ownership between spouses, acknowledging the community property laws of California. Conclusion: A Chico California Grant Deed from Trust to Two Individuals is a crucial legal document that facilitates the transfer of property ownership from a trust to two individuals. By adhering to state-specific guidelines and incorporating accurate information, this deed enables a smooth and secure transfer of real estate rights. Ensuring a comprehensive understanding of the different types of grant deeds that can be used, such as the Interspousal Grant Deed, Joint Tenancy Grant Deed, and Community Property Grant Deed, ensures individuals can choose the most suitable mechanism for their specific circumstances.