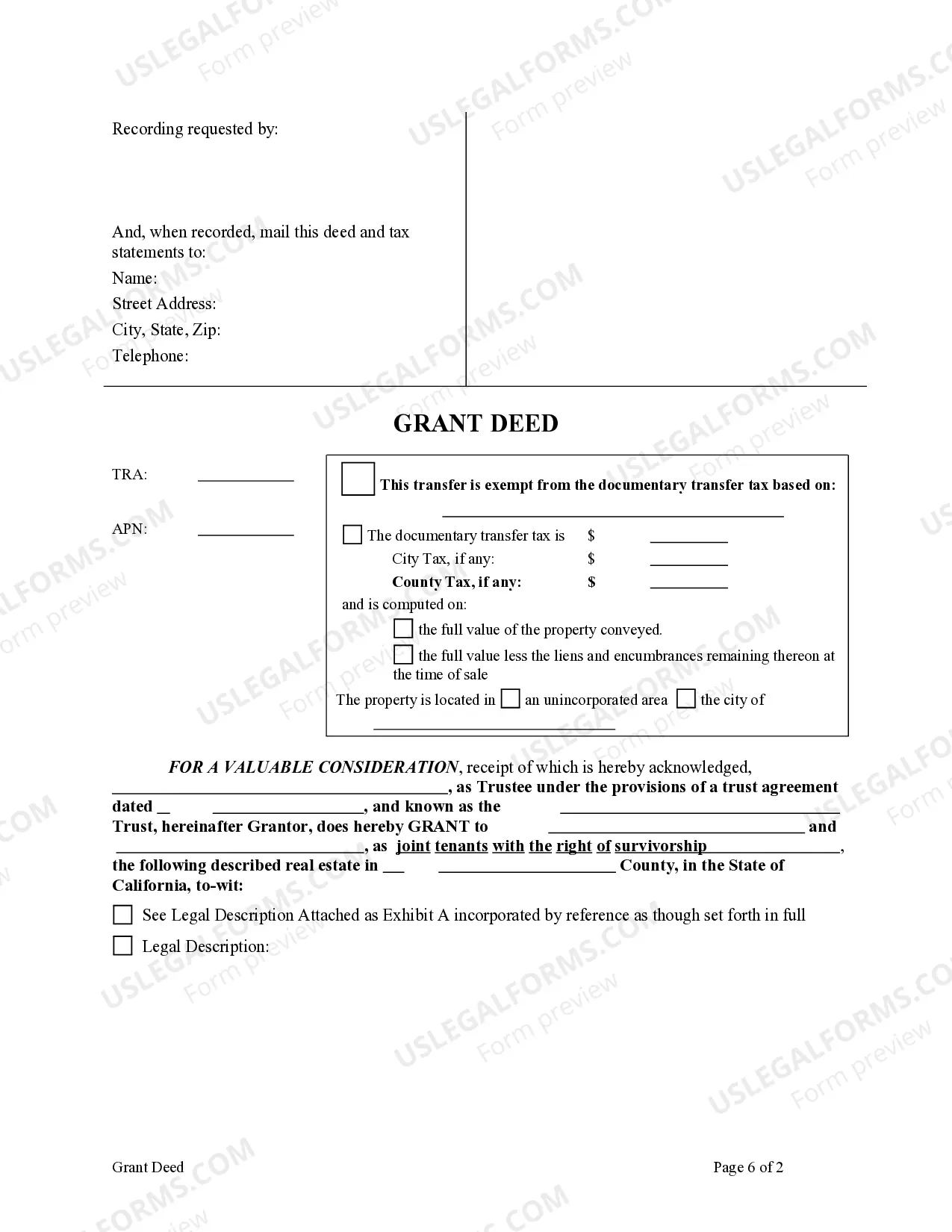

This form is a Grant Deed where the Grantor is a Trust and the Grantees are two individuals. This deed complies with all state statutory laws.

Los Angeles California Grant Deed from Trust to Two Individuals

Description

How to fill out California Grant Deed From Trust To Two Individuals?

If you are looking for an appropriate form template, there’s no better place to choose than the US Legal Forms website – likely the most extensive libraries on the internet.

With this collection, you can discover thousands of document examples for both business and personal use by categories, states, or keywords.

Using our sophisticated search capabilities, locating the latest Los Angeles California Grant Deed from Trust to Two Individuals is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and download it to your device.

- Moreover, the relevance of each document is confirmed by a team of expert lawyers who routinely assess the templates on our site and update them according to current state and county requirements.

- If you are already familiar with our system and hold a registered account, all you need to obtain the Los Angeles California Grant Deed from Trust to Two Individuals is to Log In to your profile and click the Download button.

- If this is your first time using US Legal Forms, just follow these steps.

- Ensure you have accessed the sample you need. Review its description and make use of the Preview feature to examine its content. If it doesn’t meet your requirements, utilize the Search bar at the top of the page to find the suitable document.

- Confirm your choice. Click the Buy now button. Then, select your desired subscription plan and provide information to create an account.

Form popularity

FAQ

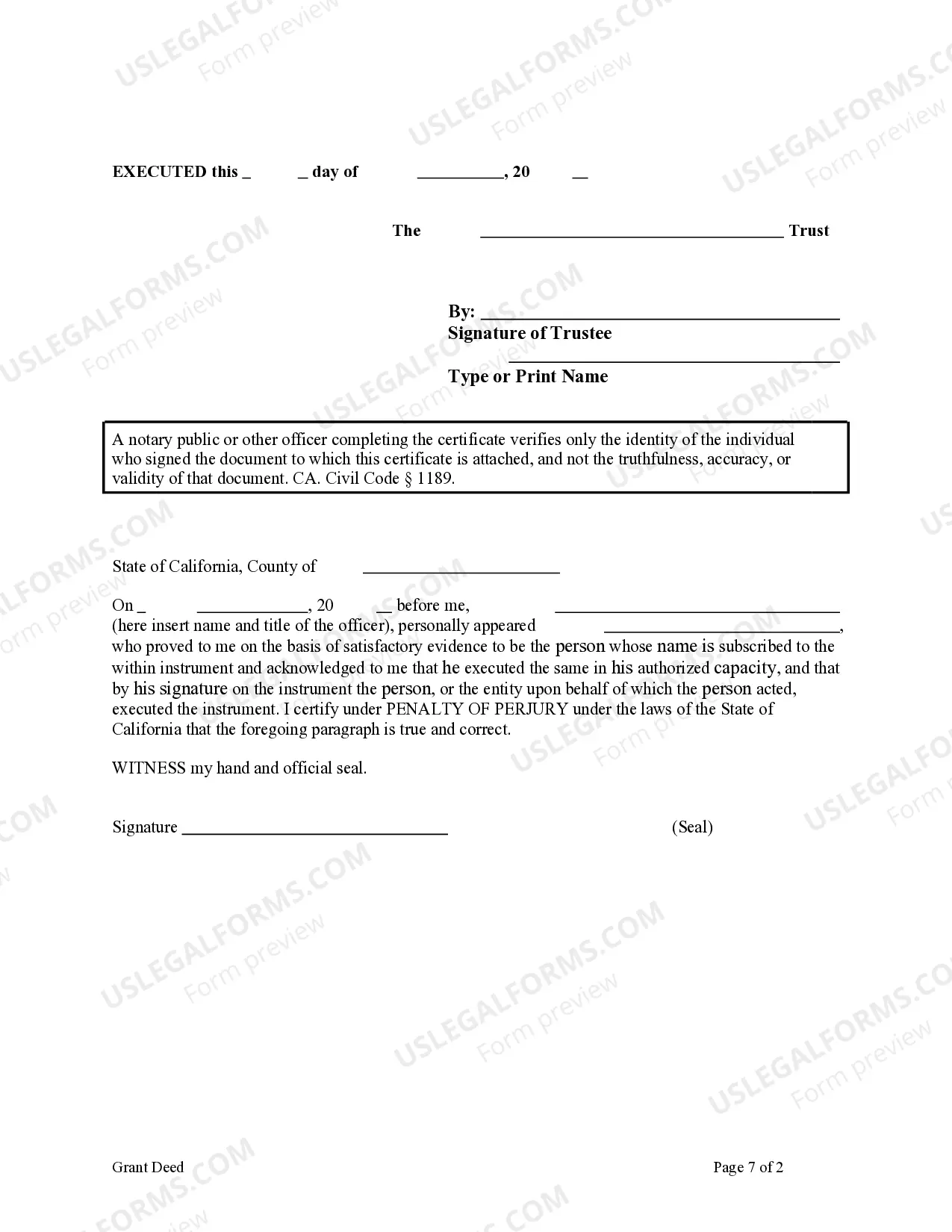

The requirements for a grant deed in California include the presence of competent grantors, proper identification of the grantees, a clear legal description of the property, and the statement of consideration. Additionally, the grant deed must be signed by the grantor and notarized before being recorded at the County Recorder's office. This process is vital for a smooth transfer in a Los Angeles California Grant Deed from Trust to Two Individuals.

No, a grant deed is not the same as a title in California. A grant deed serves as a legal document transferring ownership of real property, while the title represents legal ownership and the right to property. In a transaction involving a Los Angeles California Grant Deed from Trust to Two Individuals, it’s crucial to understand this distinction to ensure proper legal ownership is established.

To fill out a deed, begin by identifying the parties involved, including grantors and grantees. You should provide necessary legal property descriptions to avoid ambiguity, along with the consideration amount, which reflects the value exchanged. After filling it out, ensure that all parties sign before a notary to formalize the transfer of ownership, especially important when handling a Los Angeles California Grant Deed from Trust to Two Individuals.

To correct a grant deed in California, you typically need to prepare a new grant deed that includes the correct information. You should reference the previous deed to maintain clarity, and it is advisable to record this new deed with the County Recorder's office. This can help clarify ownership and rectify any mistakes, such as those that may occur during the transfer of a Los Angeles California Grant Deed from Trust to Two Individuals.

To fill out a California grant deed, first, obtain the proper form from a reliable source. You should clearly state the names of the grantors and grantees, the property description, and include the phrase 'convey and grant' to establish transfer of ownership. Ensure that you also provide the legal description of the property, and remember to sign the document in front of a notary. This process becomes essential when transferring a Los Angeles California Grant Deed from Trust to Two Individuals.

To transfer property from a trust to an individual in California, first, check the trust's terms to ensure the transfer is permissible. Prepare a change of ownership form and a grant deed that specifies the trust and the new owner's details. Both the trustee and the new owner should sign this document in front of a notary. Finally, file the necessary documents with the county recorder's office to formalize the transfer of the Los Angeles California Grant Deed from Trust to Two Individuals.

While it is not legally required to hire a lawyer to add someone to a deed, having one can simplify the process significantly. A lawyer can ensure all legal documents are correctly prepared and comply with local laws. This can prevent future disputes or issues that could arise from improperly executed deeds. If you prefer a DIY approach, using platforms like USLegalForms can also guide you through the steps.

To add someone to a grant deed in California, you should draft a new grant deed document reflecting the current owners and the new owner. After preparing the new deed, both parties need to sign it in front of a notary public. Once the signing is complete, file the new grant deed with your local county recorder’s office. This process ensures that the change is legally recognized.

The most effective way to transfer property title between family members is through a grant deed. This legally formalizes the transfer and ensures that all family members agree to the terms. Working with a legal professional can help navigate any complexities involved in the process, particularly for properties held in trust. For a streamlined solution, consider using online platforms like USLegalForms.

Adding someone to a deed in California can trigger potential property tax reassessment. However, if the transfer occurs between parents and children, certain exclusions may apply under Prop 58. It's essential to review the specifics of your situation to understand potential tax consequences. Consulting a property expert can clarify the implications of your specific circumstances.