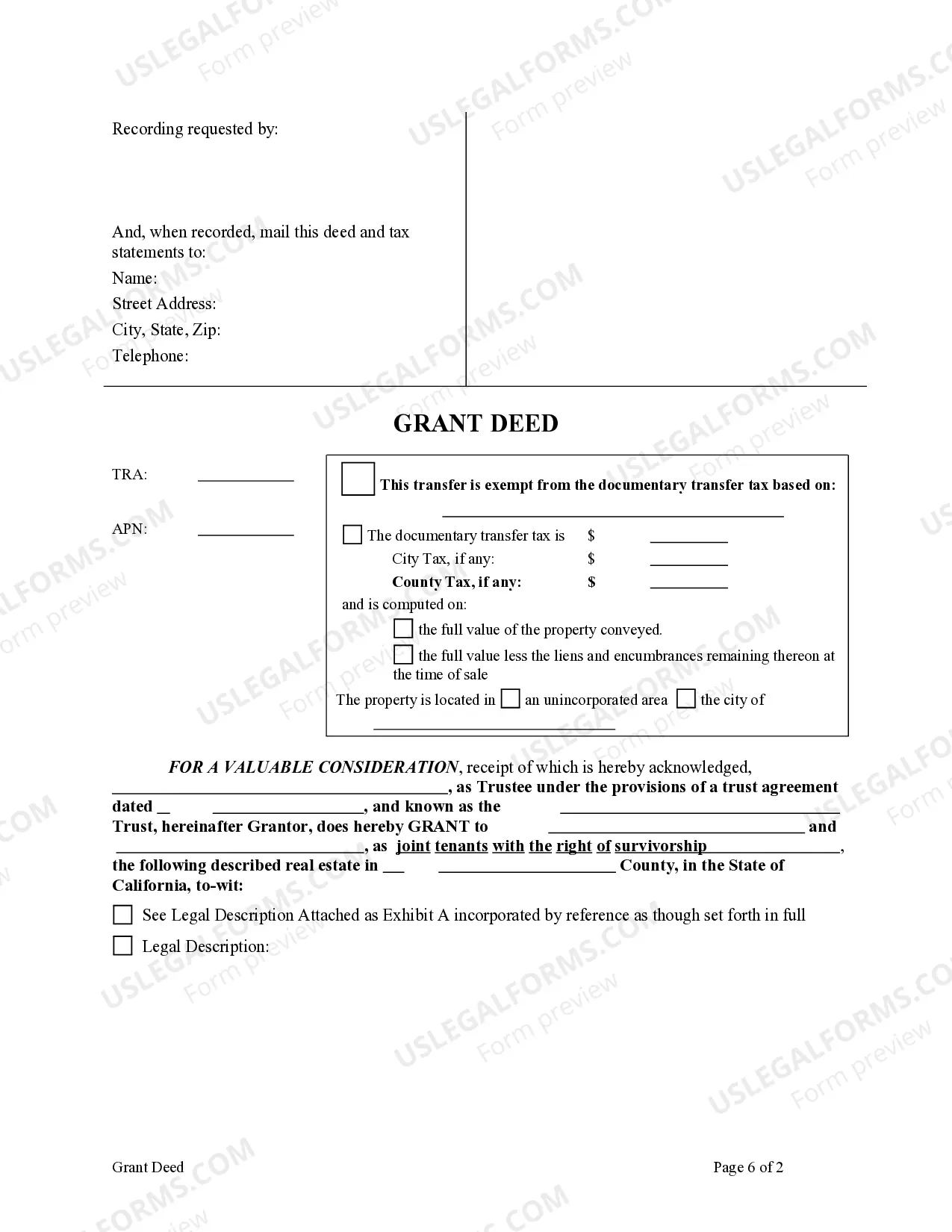

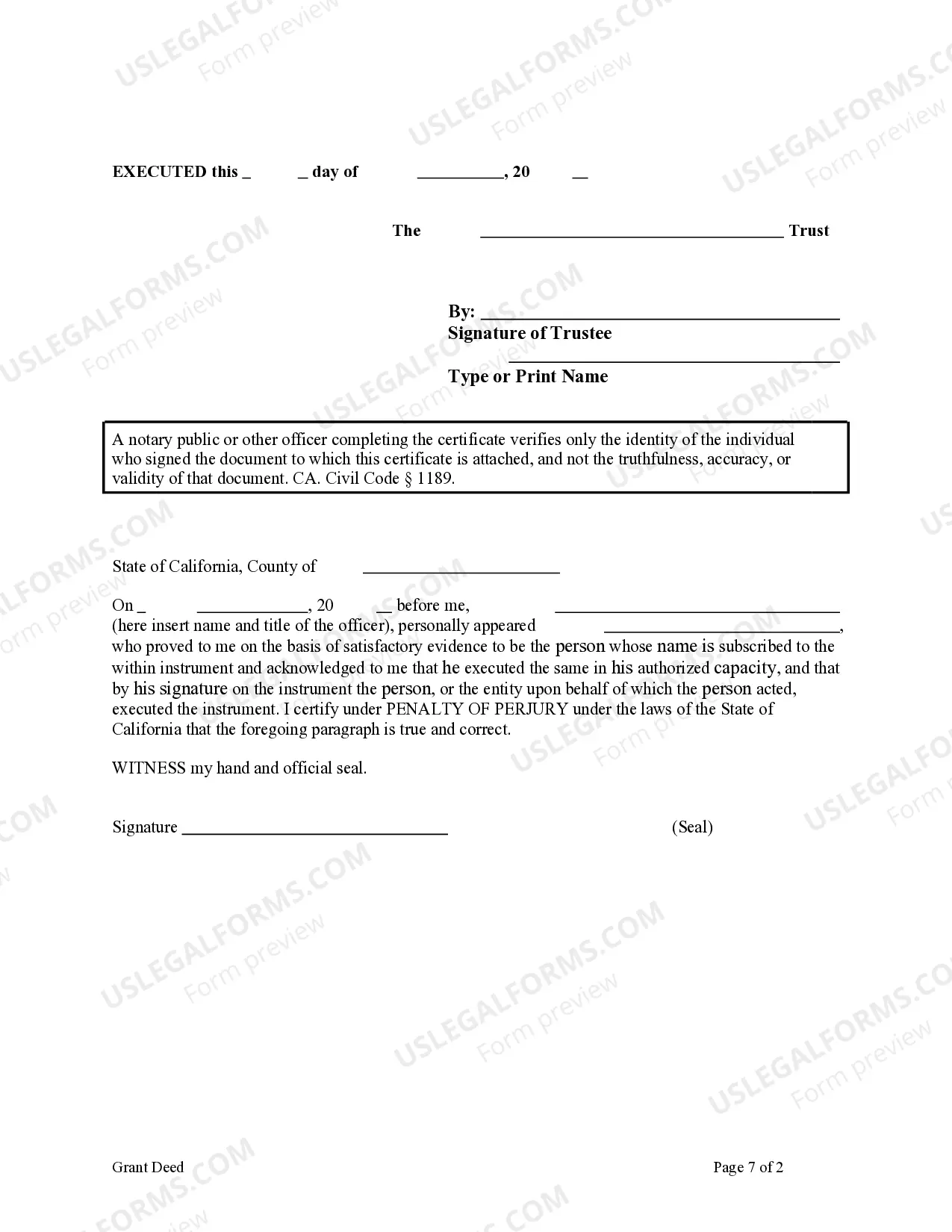

This form is a Grant Deed where the Grantor is a Trust and the Grantees are two individuals. This deed complies with all state statutory laws.

A San Bernardino California Grant Deed from Trust to Two Individuals serves as a legal document that transfers the ownership of a property held in a trust to two individuals as joint owners. This type of transfer is often seen in situations where the property is being distributed among beneficiaries or when the trust is being dissolved. The grant deed is a crucial legal instrument used to facilitate the change of property ownership. It outlines the details of the transfer and ensures that all parties involved are aware of their rights and responsibilities. By employing a specific form of grant deed that incorporates the trust aspect and the involvement of two individuals, this document legally secures the transfer process. In San Bernardino, California, there are various types of grant deeds that are used for transferring property ownership. These may include: 1. San Bernardino California Grant Deed from Trust to Two Individuals with Survivorship: This grant deed ensures that if one of the two individuals passes away, their share of the property automatically transfers to the surviving individual without the need for probate. It establishes a joint tenancy with right of survivorship (TWOS) between the two parties, providing a seamless transfer of ownership. 2. San Bernardino California Grant Deed from Trust to Two Individuals as Tenants-in-Common: This grant deed defines the ownership of the property as a tenancy in common between the two individuals. This means that each person possesses a distinct share of the property, either equal or in predetermined proportions. In the event of one individual's demise, their share does not automatically transfer to the other; instead, it becomes part of their estate and may pass to their designated beneficiaries. 3. San Bernardino California Grant Deed from Trust to Two Individuals with Restrictions: This grant deed pertains to situations where certain restrictions or conditions are imposed on the property. For instance, it may state that the property can only be used for residential purposes or that it cannot be sold for a specific period. Such restrictions are legally binding, and failure to comply may result in legal consequences. In all these types of San Bernardino California Grant Deeds from Trust to Two Individuals, it is crucial to consult an attorney or legal professional well-versed in property law to ensure that the document complies with state laws and accurately reflects the agreed-upon terms of the transfer.