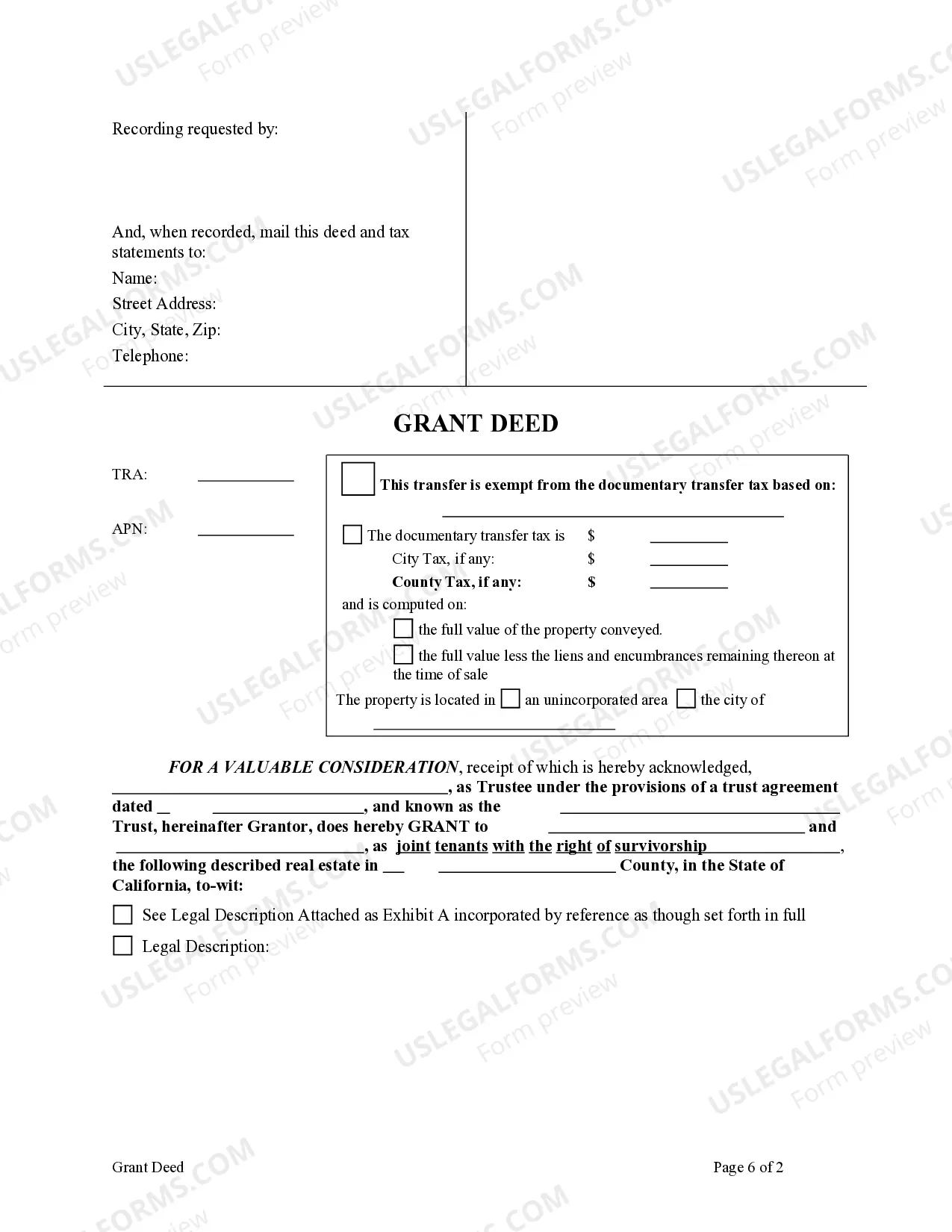

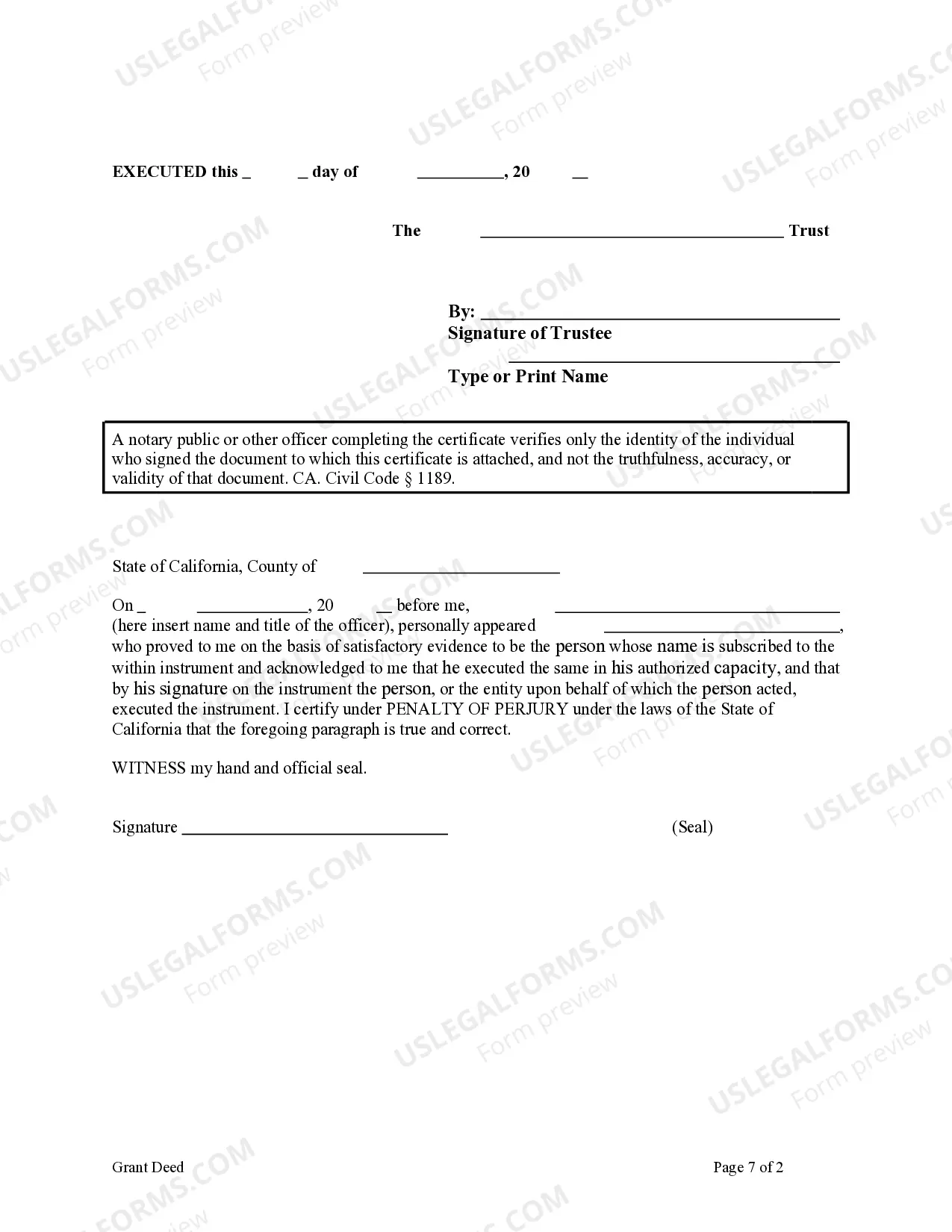

This form is a Grant Deed where the Grantor is a Trust and the Grantees are two individuals. This deed complies with all state statutory laws.

A San Jose California Grant Deed from Trust to Two Individuals is a legal document that transfers ownership of real estate property located in San Jose, California, from a trust to two individuals. This type of grant deed is commonly used when there is a trust arrangement involved and the beneficiaries named in the trust need to gain ownership of the property. The granter, who is the trustee of the trust, executes the grant deed to convey the property to the grantee(s) who are the two individuals entitled to the ownership. The deed includes specific language indicating that the transfer is being made from the trust to the individuals. This type of transfer is often used to distribute assets from a trust to beneficiaries or to facilitate a change in ownership. There are no specific variations of San Jose California Grant Deed from Trust to Two Individuals, as the purpose and process remain the same. However, there may be additional clauses or terms that can be tailored to suit the unique circumstances of each transfer. These clauses can be added to the grant deed to protect the interests of both the granter and the grantees. Some relevant keywords related to this type of grant deed include: property transfer, San Jose, California, granter, grantee, trustee, trust arrangement, beneficiaries, ownership, real estate, distribution of assets, change in ownership, legal document, deed execution, and specific language. It is important to note that while this description provides an overview of a San Jose California Grant Deed from Trust to Two Individuals, it is essential to consult with a qualified attorney or a legal expert to ensure compliance with local laws and regulations, and to address any specific requirements or variations that may exist within this jurisdiction.