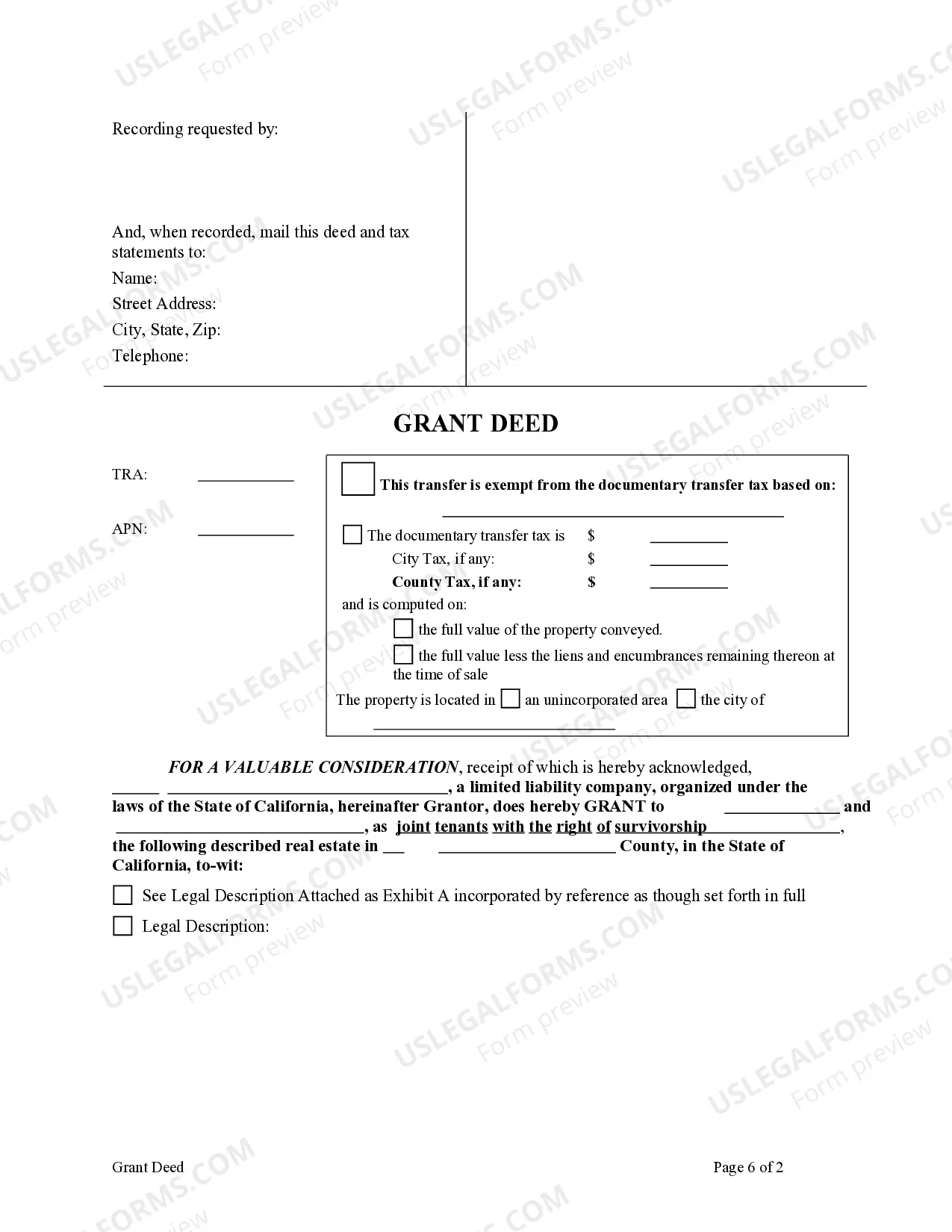

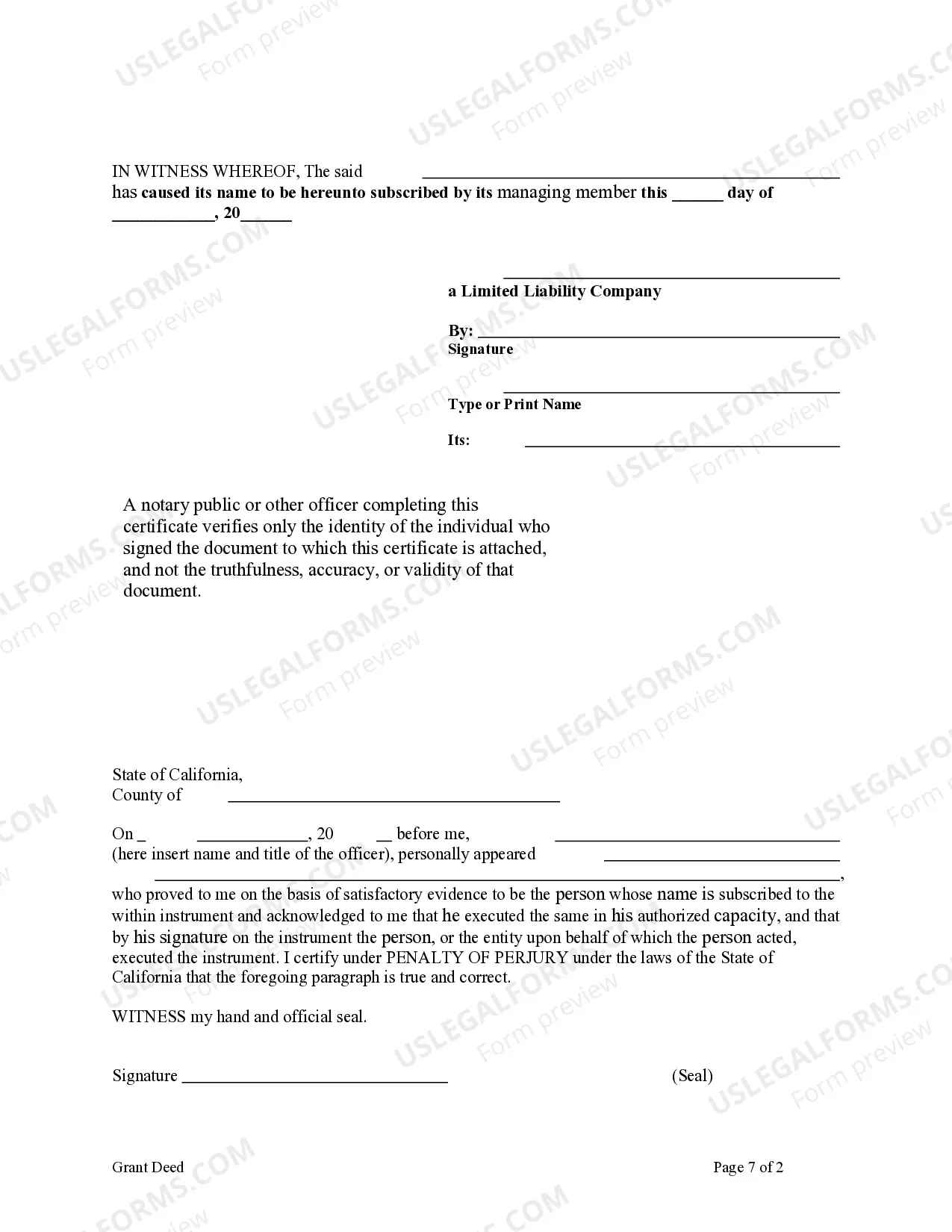

This form is a Grant Deed where the Grantor is a limited liability company and the Grantees are two individuals. This deed complies with all state statutory laws.

Title: Inglewood California Grant Deed — Limited Liability Company to Two Individuals: Explained Introduction: Inglewood, California, being a vibrant city with a growing real estate market, involves various types of grant deeds involving limited liability companies (LCS) granting property rights to two individuals. This article aims to provide a detailed description of Inglewood California Grant Deed — Limited Liability Company to Two Individuals, including the different types that can be encountered. 1. Inglewood California Grant Deed — Single-Member LLC to Two Individuals: In this type of grant deed, a single-member LLC transfers property rights to two individuals. The LLC, being the sole owner of the property, executes the deed, conveying ownership to the two individuals. This type of grant deed is common when individuals want to establish joint ownership while maintaining some property separation through the LLC structure. 2. Inglewood California Grant Deed — Multi-Member LLC to Two Individuals: A multi-member LLC is an LLC that has more than one owner. In this case, the LLC executes the grant deed, conveying the property rights to two individuals. This type of grant deed is useful when multiple individuals, as part of an LLC, wish to collectively own a property while enjoying limited liability and tax benefits. 3. Inglewood California Grant Deed — Transfer from a Sole Proprietorship to Two Individuals via an LLC: This type of grant deed involves the transfer of property from a sole proprietorship to two individuals through the use of an LLC as an intermediary. The property rights are transferred to the LLC, which in turn grants ownership to the two individuals. This allows for the conversion of a sole proprietorship's ownership structure into an LLC while maintaining the same level of ownership for the involved individuals. 4. Inglewood California Grant Deed — Conversion of Joint Tenancy to an LLC Interest: In certain situations, two individuals may convert their joint tenancy property ownership into an LLC interest. The grant deed is executed to reflect the transfer of the property rights into the LLC, with the two individuals becoming members of the LLC. This type of grant deed is useful when joint owners wish to take advantage of the benefits provided by an LLC, such as limited liability and centralized management. Conclusion: Inglewood, California, witnesses various types of grant deeds involving limited liability companies granting property rights to two individuals. Whether it is transferring property from a single-member or multi-member LLC, converting a sole proprietorship to an LLC, or changing from joint tenancy to an LLC interest, these grant deeds provide flexibility and asset protection to the involved individuals. Understanding the different types of grant deeds involving an LLC and two individuals is essential for navigating the Inglewood real estate market.Title: Inglewood California Grant Deed — Limited Liability Company to Two Individuals: Explained Introduction: Inglewood, California, being a vibrant city with a growing real estate market, involves various types of grant deeds involving limited liability companies (LCS) granting property rights to two individuals. This article aims to provide a detailed description of Inglewood California Grant Deed — Limited Liability Company to Two Individuals, including the different types that can be encountered. 1. Inglewood California Grant Deed — Single-Member LLC to Two Individuals: In this type of grant deed, a single-member LLC transfers property rights to two individuals. The LLC, being the sole owner of the property, executes the deed, conveying ownership to the two individuals. This type of grant deed is common when individuals want to establish joint ownership while maintaining some property separation through the LLC structure. 2. Inglewood California Grant Deed — Multi-Member LLC to Two Individuals: A multi-member LLC is an LLC that has more than one owner. In this case, the LLC executes the grant deed, conveying the property rights to two individuals. This type of grant deed is useful when multiple individuals, as part of an LLC, wish to collectively own a property while enjoying limited liability and tax benefits. 3. Inglewood California Grant Deed — Transfer from a Sole Proprietorship to Two Individuals via an LLC: This type of grant deed involves the transfer of property from a sole proprietorship to two individuals through the use of an LLC as an intermediary. The property rights are transferred to the LLC, which in turn grants ownership to the two individuals. This allows for the conversion of a sole proprietorship's ownership structure into an LLC while maintaining the same level of ownership for the involved individuals. 4. Inglewood California Grant Deed — Conversion of Joint Tenancy to an LLC Interest: In certain situations, two individuals may convert their joint tenancy property ownership into an LLC interest. The grant deed is executed to reflect the transfer of the property rights into the LLC, with the two individuals becoming members of the LLC. This type of grant deed is useful when joint owners wish to take advantage of the benefits provided by an LLC, such as limited liability and centralized management. Conclusion: Inglewood, California, witnesses various types of grant deeds involving limited liability companies granting property rights to two individuals. Whether it is transferring property from a single-member or multi-member LLC, converting a sole proprietorship to an LLC, or changing from joint tenancy to an LLC interest, these grant deeds provide flexibility and asset protection to the involved individuals. Understanding the different types of grant deeds involving an LLC and two individuals is essential for navigating the Inglewood real estate market.