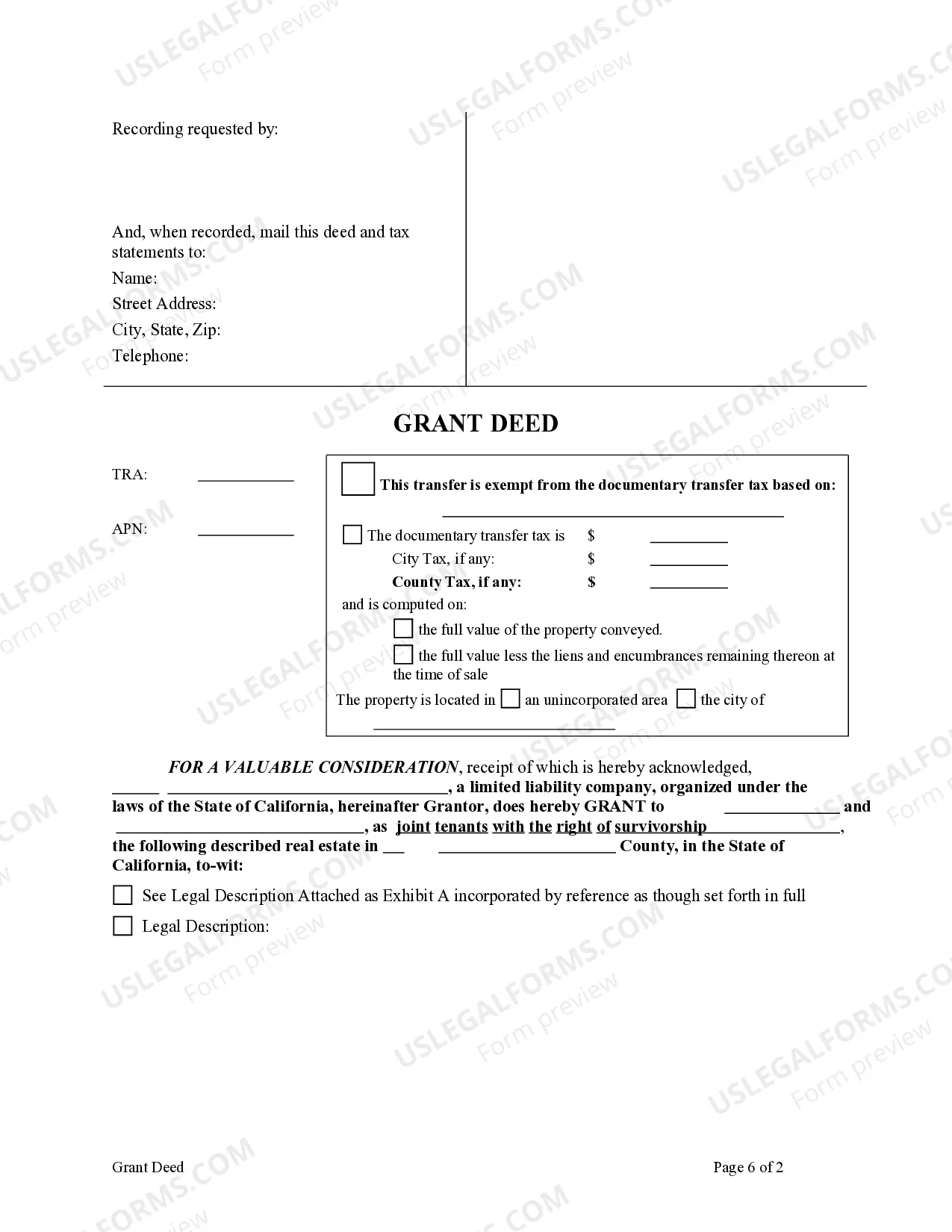

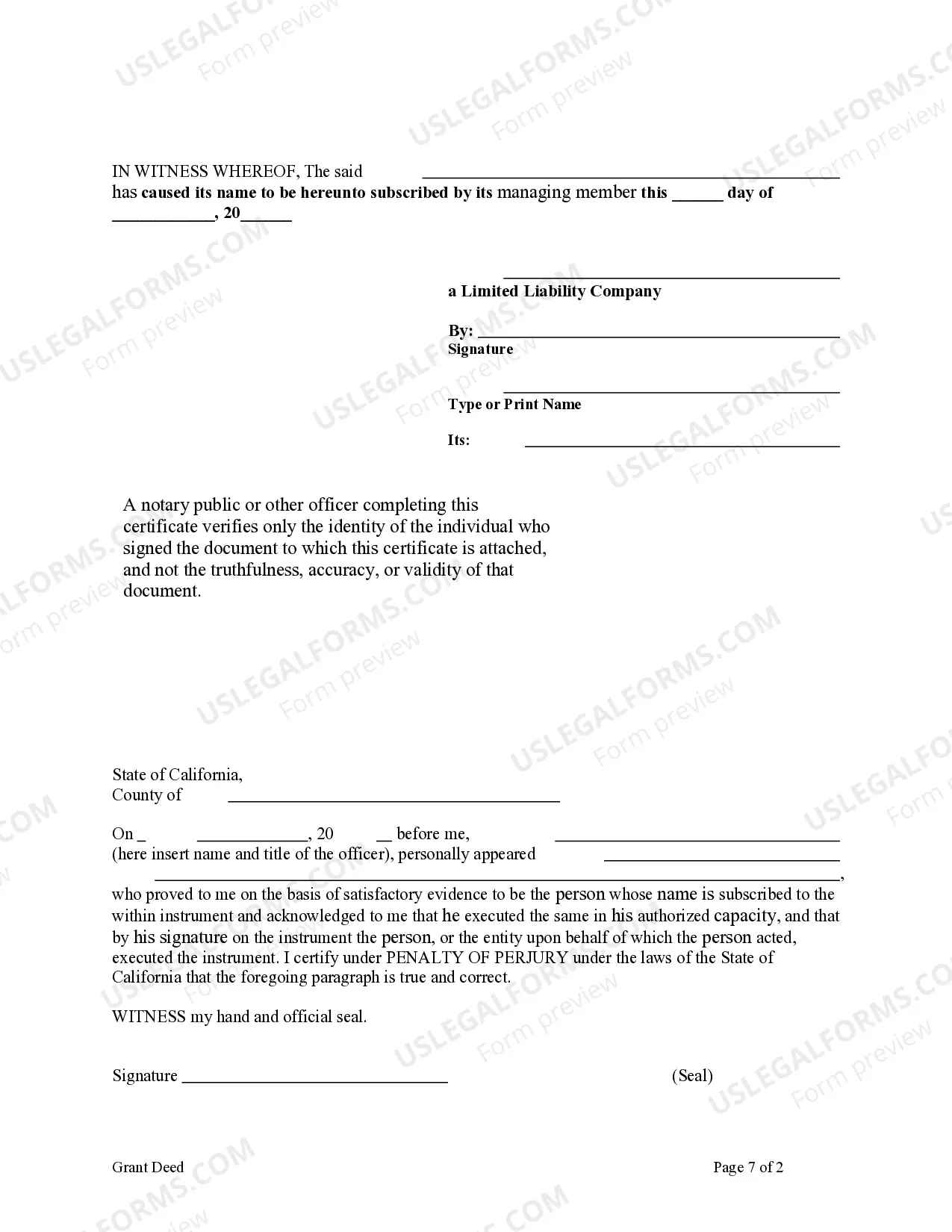

This form is a Grant Deed where the Grantor is a limited liability company and the Grantees are two individuals. This deed complies with all state statutory laws.

A grant deed is a legal document used to transfer ownership of real estate property from one party to another. In the case of Rancho Cucamonga, California, a Grant Deed — Limited Liability Company (LLC) to Two Individuals is a specific type of grant deed where a property held by an LLC is being transferred to two individual owners. Rancho Cucamonga, a vibrant city located in San Bernardino County, California, has become a sought-after destination for homebuyers and real estate investors. When an LLC decides to transfer property ownership to two individuals, a Grant Deed — Limited Liability Company to Two Individuals is necessary to officially document the change of ownership. In Rancho Cucamonga, there might be variations or subtypes of this grant deed based on specific circumstances. Some examples of these variations could include: 1. Joint Tenancy Grant Deed — Limited Liability Company to Two Individuals: In this scenario, the property is transferred from an LLC to two individuals who hold the property as joint tenants. Joint tenancy implies that both individuals have an equal share in the property, and in case of one person's death, the surviving tenant automatically inherits their share. 2. Tenancy in Common Grant Deed — Limited Liability Company to Two Individuals: This type of grant deed is used when the LLC transfers ownership to two individuals as tenants in common. Unlike joint tenancy, the tenants in common may hold unequal shares in the property, and their shares can be passed on to their respective heirs or beneficiaries upon death. 3. Community Property Grant Deed — Limited Liability Company to Two Individuals: If both individuals are married, this form of grant deed may be used to transfer the property from an LLC to the couple as community property. In community property states like California, each spouse typically has an equal undivided interest in the property acquired during marriage. The use of a Grant Deed — Limited Liability Company to Two Individuals is crucial to provide a clear legal record of the property transfer. Specific details pertaining to the property, LLC, individuals, and any relevant terms or conditions, would be included in the grant deed to ensure accuracy and transparency. When dealing with real estate transactions, it is always recommended consulting with a qualified attorney or real estate professional to ensure the correct form of grant deed is used and all legal requirements are met. The intricacies of property law and the specific situation should be carefully evaluated to avoid any future disputes or complications.A grant deed is a legal document used to transfer ownership of real estate property from one party to another. In the case of Rancho Cucamonga, California, a Grant Deed — Limited Liability Company (LLC) to Two Individuals is a specific type of grant deed where a property held by an LLC is being transferred to two individual owners. Rancho Cucamonga, a vibrant city located in San Bernardino County, California, has become a sought-after destination for homebuyers and real estate investors. When an LLC decides to transfer property ownership to two individuals, a Grant Deed — Limited Liability Company to Two Individuals is necessary to officially document the change of ownership. In Rancho Cucamonga, there might be variations or subtypes of this grant deed based on specific circumstances. Some examples of these variations could include: 1. Joint Tenancy Grant Deed — Limited Liability Company to Two Individuals: In this scenario, the property is transferred from an LLC to two individuals who hold the property as joint tenants. Joint tenancy implies that both individuals have an equal share in the property, and in case of one person's death, the surviving tenant automatically inherits their share. 2. Tenancy in Common Grant Deed — Limited Liability Company to Two Individuals: This type of grant deed is used when the LLC transfers ownership to two individuals as tenants in common. Unlike joint tenancy, the tenants in common may hold unequal shares in the property, and their shares can be passed on to their respective heirs or beneficiaries upon death. 3. Community Property Grant Deed — Limited Liability Company to Two Individuals: If both individuals are married, this form of grant deed may be used to transfer the property from an LLC to the couple as community property. In community property states like California, each spouse typically has an equal undivided interest in the property acquired during marriage. The use of a Grant Deed — Limited Liability Company to Two Individuals is crucial to provide a clear legal record of the property transfer. Specific details pertaining to the property, LLC, individuals, and any relevant terms or conditions, would be included in the grant deed to ensure accuracy and transparency. When dealing with real estate transactions, it is always recommended consulting with a qualified attorney or real estate professional to ensure the correct form of grant deed is used and all legal requirements are met. The intricacies of property law and the specific situation should be carefully evaluated to avoid any future disputes or complications.