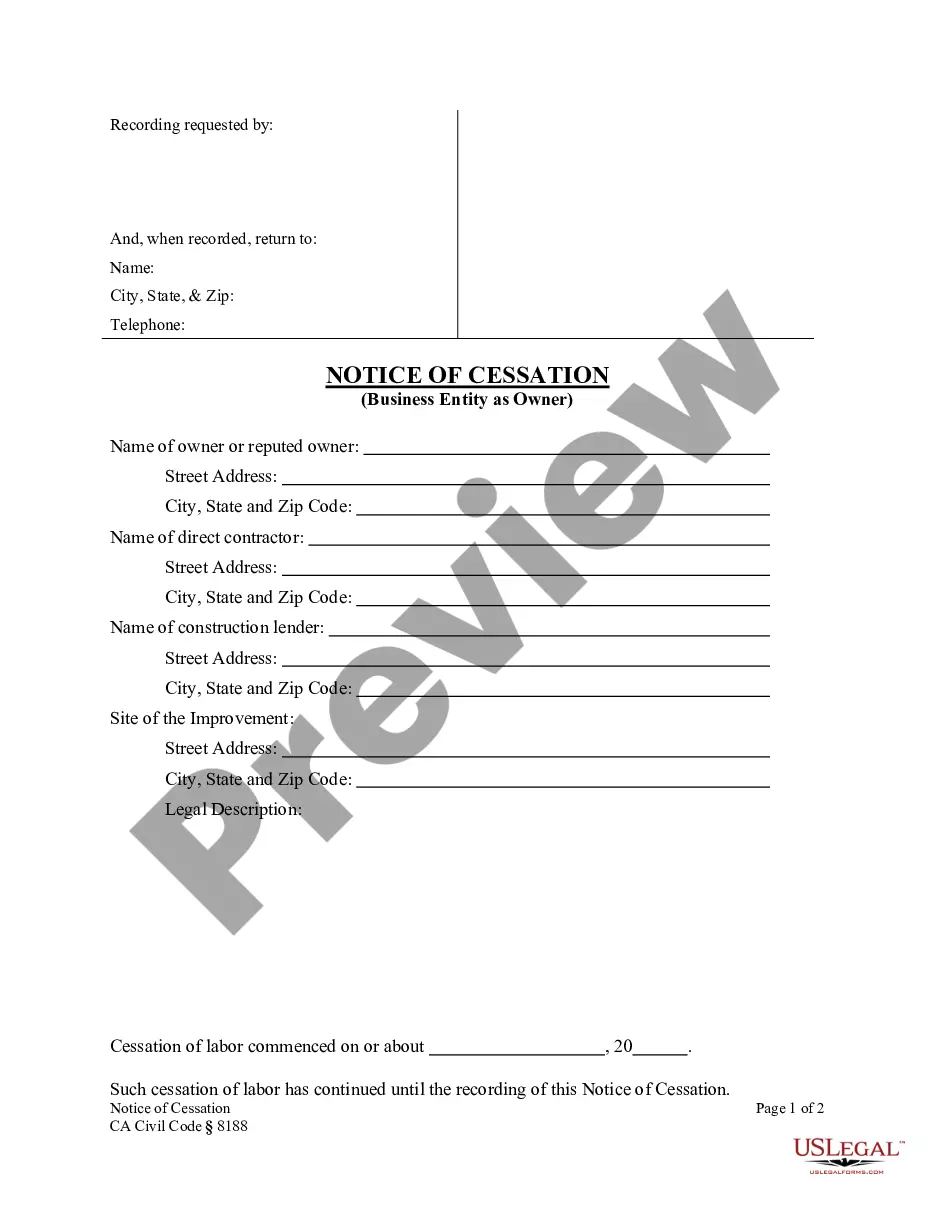

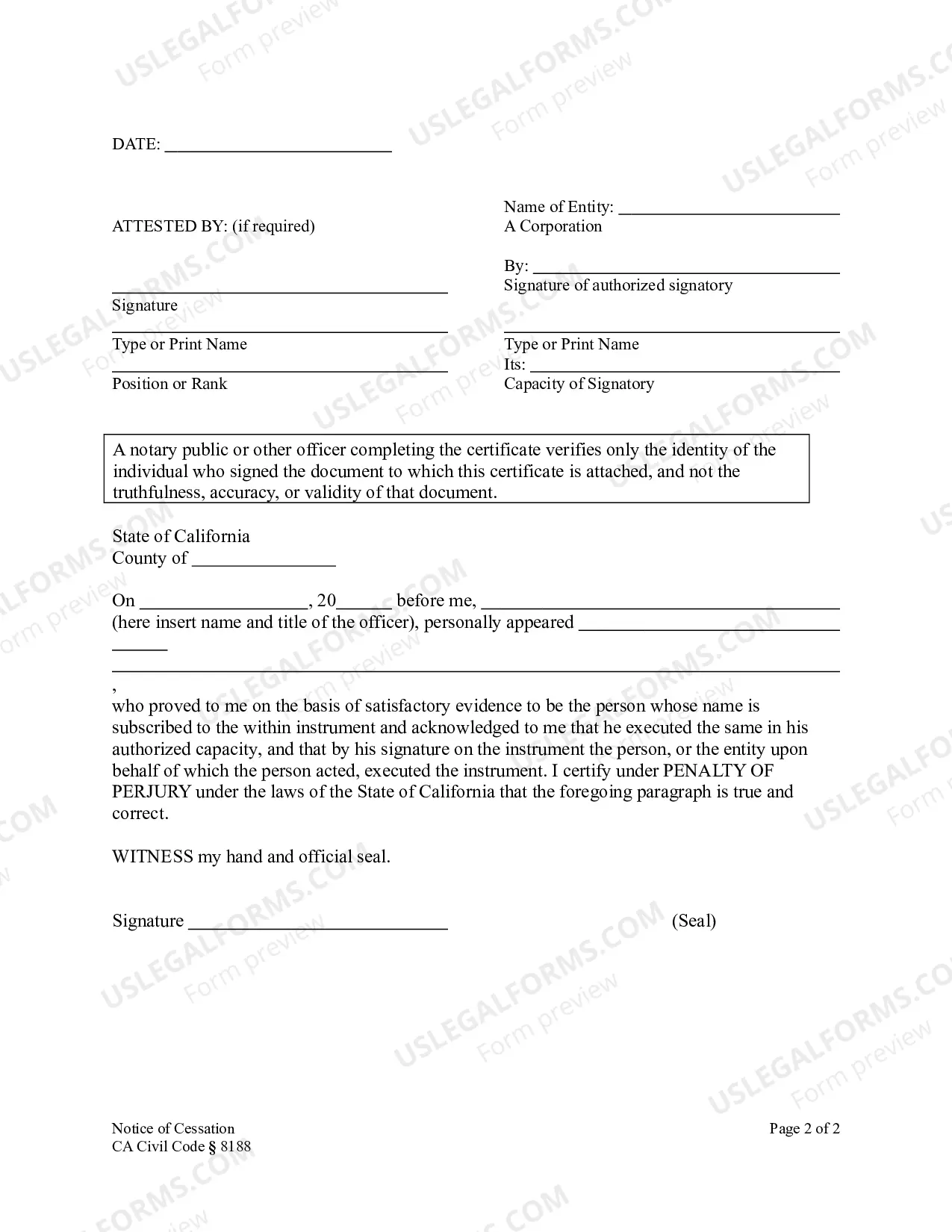

This form is used by an individual owner to record notice that there has been a continuous cessation of labor on a work of improvement for at least 30 days prior to the date of the notice and continuing through the date of notice. The form is formatted for use by a business entity - corporation or limited liability company.

The Alameda California Notice of Cessation is a legal document governed by the CA Civil Code Section 8188 that pertains to construction liens in relation to business entities such as LCS or corporations. This notice serves as a formal announcement or declaration by the business entity that all construction activities on a specific project have ceased or will be temporarily halted for a specified period. The purpose of filing a Notice of Cessation is to provide notice to all parties involved, including contractors, subcontractors, suppliers, and other potential lien claimants, that the business entity responsible for the project has stopped work temporarily or permanently. This notice is essential for protecting the rights and interests of both the business entity and the parties involved in the construction project. By filing a Notice of Cessation, the business entity aims to limit its liability and mitigate potential construction lien claims that may arise from unpaid work, materials, or services provided by contractors or subcontractors. This notice acts as a safeguard, preventing any future claims for construction liens for work performed after the stated cessation date. If there are different types of Alameda California Notice of Cessation — Construction Lien— - Business Entity (LLC or Corp), they may include: 1. Temporary Notice of Cessation: This type of notice is filed when construction activities are temporarily halted for a specific period, such as due to unforeseen circumstances, delays, or project-related issues. It indicates that work will resume after the specified period. 2. Permanent Notice of Cessation: This notice is filed when construction activities have ceased permanently, often due to project cancellation, completion, or other factors. It signifies that there will be no resumption of work on the project. 3. Revised Notice of Cessation: In some cases, a business entity may need to revise a previously filed Notice of Cessation to update information such as the cessation period, resumption date, or other relevant details. This ensures that all parties involved are aware of any changes or adjustments to the cessation status. It is crucial for business entities to understand and comply with the regulations outlined in CA Civil Code Section 8188 when filing a Notice of Cessation. Failure to file an accurate and timely notice can result in potential legal disputes, delays, and financial consequences. Therefore, it is recommended to consult with legal professionals or experts familiar with California construction lien laws to ensure full compliance in executing and filing the Notice of Cessation.