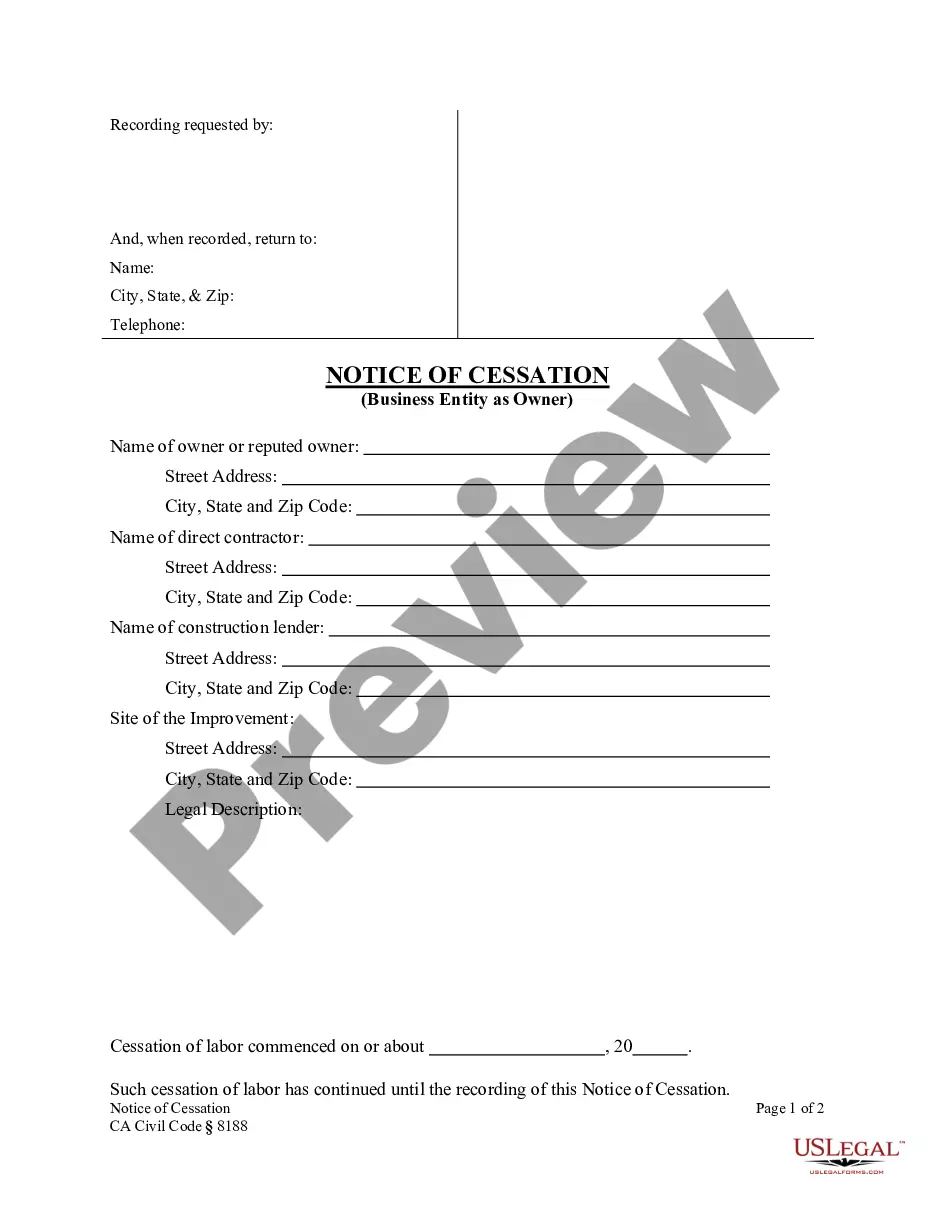

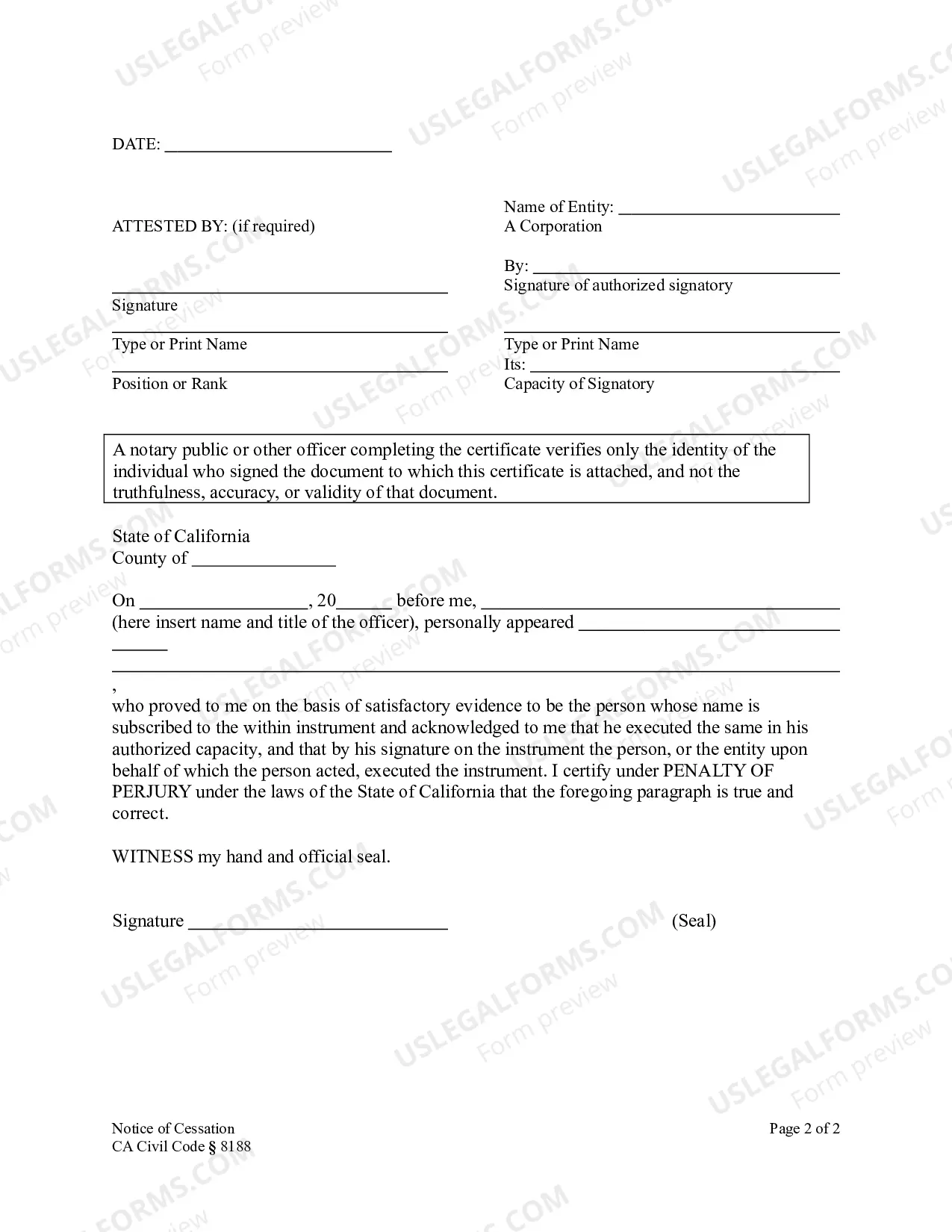

This form is used by an individual owner to record notice that there has been a continuous cessation of labor on a work of improvement for at least 30 days prior to the date of the notice and continuing through the date of notice. The form is formatted for use by a business entity - corporation or limited liability company.

Antioch California Notice of Cessation — Construction Lien— - Business Entity (LLC or Corp) — CA Civil Code Section 8188: A Comprehensive Overview In Antioch, California, the Notice of Cessation is a crucial legal document in the construction industry. Governed by the California Civil Code Section 8188, this notice serves as a notification to contractors, subcontractors, and material suppliers that a construction project has been temporarily or permanently halted. It is important for both business entities, such as LCS or corporations, and individuals to understand this process, as it directly impacts their rights and obligations in relation to construction liens. Let's explore the different types and key aspects of the Antioch California Notice of Cessation. 1. Temporary Cessation Notice: In certain circumstances, construction projects may face temporary delays due to various reasons, such as weather conditions, unexpected issues, or permit complications. When a temporary cessation occurs, the responsible party, whether it is the property owner or an authorized representative of the business entity (LLC or corporation), must file a Temporary Cessation Notice. This notice informs all interested parties that the construction project will resume within a specified period, allowing time for the resolution of issues causing the delay. 2. Permanent Cessation Notice: Sometimes, a construction project may be abandoned entirely due to financial constraints, legal disputes, or unforeseen circumstances. In such cases, the responsible party is obligated to file a Permanent Cessation Notice. This legal document notifies all parties with liens, potential lien claimants, and other contractors or suppliers involved that the project will no longer proceed. The Permanent Cessation Notice triggers specific timelines and procedures for lien claimants to protect their rights and claim compensation for work or materials provided prior to the cessation. Key Considerations for Business Entities (LCS or Corporations) Regarding Construction Liens: 1. Timely Filing: Business entities must ensure that the Notice of Cessation is properly and promptly filed with the appropriate authority, typically the county recorder's office or building department. Failure to file within the specified timeframes can have significant consequences, potentially jeopardizing the entity's position and rights. 2. Notifying Affected Parties: Alongside filing the notice, it is crucial for business entities to inform all contractors, subcontractors, and suppliers involved in the project about the cessation. This ensures that all relevant parties are aware and can respond within their legal rights and obligations. 3. Consultation with Legal Professionals: Given the complex nature of construction lien laws, business entities should seek legal advice from qualified professionals experienced in California Civil Code Section 8188. These experts can provide guidance on compliance, rights, and responsibilities, helping mitigate potential disputes or claims. 4. Documentation and Record-Keeping: Maintaining accurate records of all communications, agreements, invoices, and payments related to the construction project is essential for business entities. This documentation can be crucial in case of disputes or potential future claims. Understanding the Antioch California Notice of Cessation and its implications for business entities (LCS or corporations) is key to ensuring compliance with the law and protecting one's rights in construction projects. By filing the appropriate notice, notifying relevant parties, and seeking professional legal advice, business entities can navigate the complex landscape of construction lien laws while safeguarding their interests.