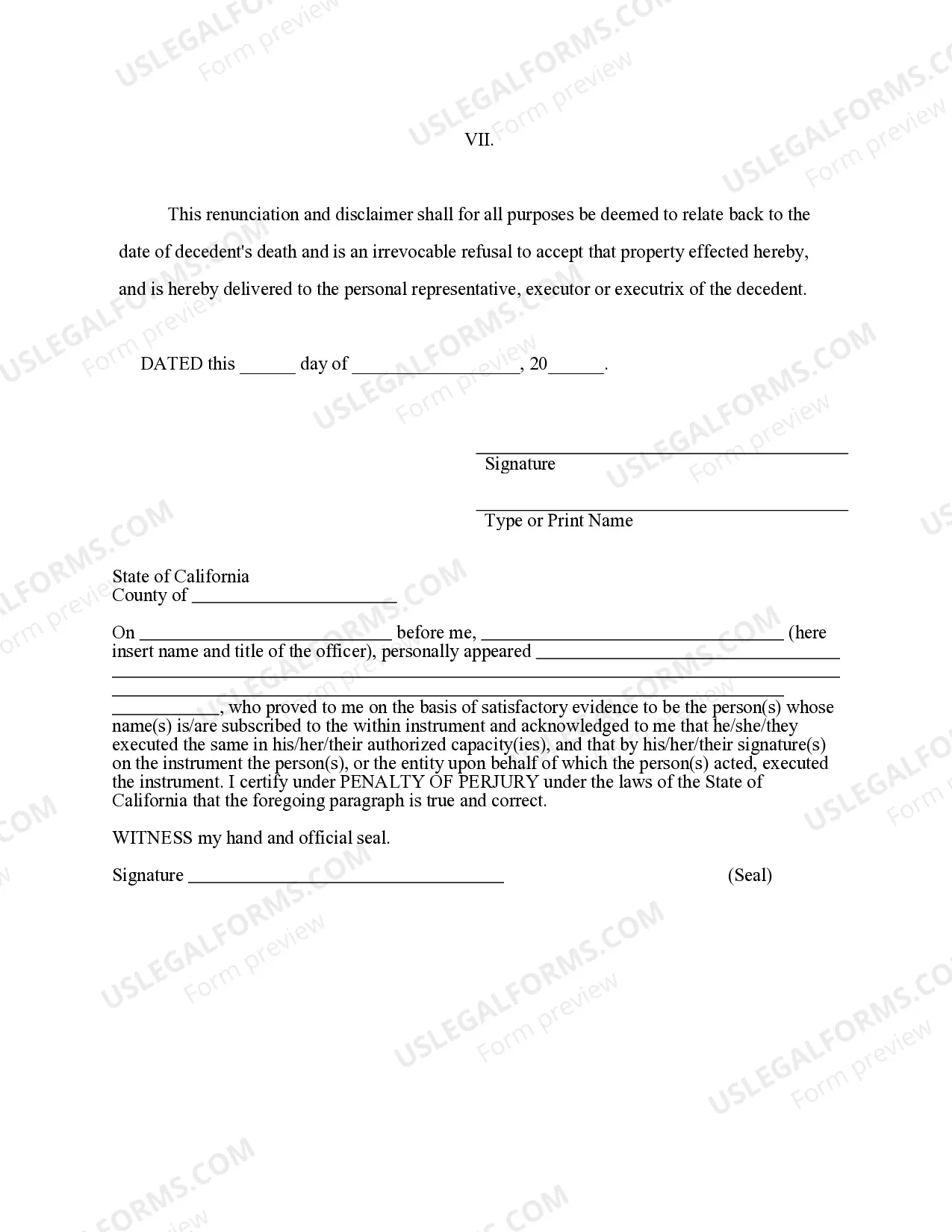

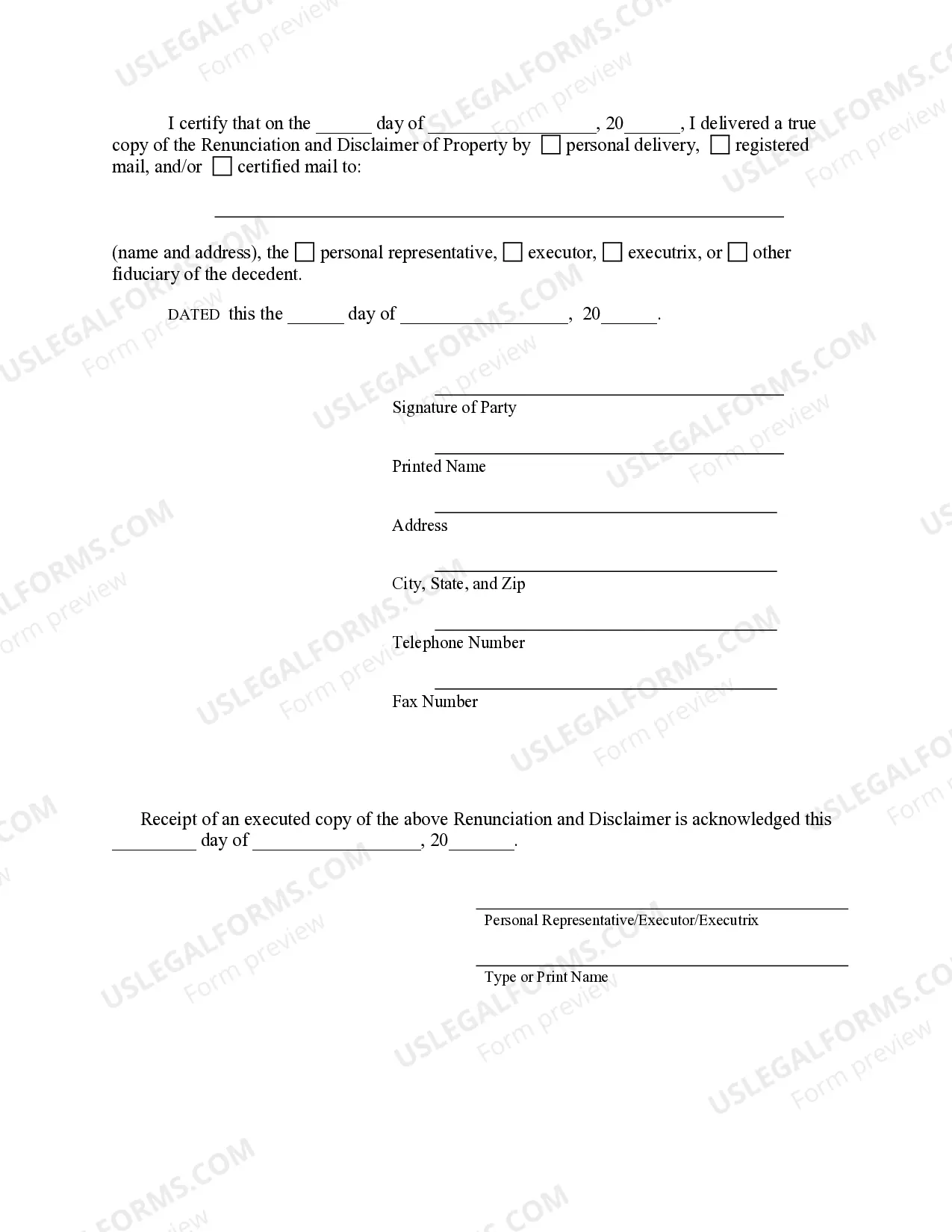

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Title: A Comprehensive Guide to Burbank California's Renunciation and Disclaimer of Property from Life Insurance or Annuity Contracts Introduction: In Burbank, California, individuals may face circumstances where they may need to renounce or disclaim their rights to property obtained through life insurance or annuity contracts. Renunciation and disclaimer procedures are crucial legal processes that enable individuals to surrender their claims to such property. This article aims to provide a detailed description of the Burbank California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, expounding on its types and key aspects. Keywords: Burbank California, renunciation, disclaimer, property, life insurance, annuity contract 1. Renunciation and Disclaimer Defined: Renunciation refers to the act of voluntarily surrendering one's rights to property, while the disclaimer is the legal process where an individual refuses to accept or inherit a certain property. In Burbank, California, these actions can pertain to assets derived from life insurance policies or annuity contracts. 2. Types of Burbank California Renunciation and Disclaimer: a. Renunciation of Life Insurance Property: This type of renunciation occurs when an individual willingly chooses to reject any claim or interest in the proceeds from a life insurance policy. The renounced must promptly notify the insurance company, stating their intention to renounce any rights to the property. b. Renunciation of Annuity Contract Property: Similar to life insurance renunciation, individuals can renounce their rights to any assets accrued through an annuity contract. This process involves notifying the annuity provider about the decision to renounce the property. c. Disclaimer of Life Insurance Property: In contrast to renunciation, a disclaimer occurs when an individual refuses to accept property bequeathed to them through a life insurance policy. The disclaimer must be made in writing, expressly stating the intention to disclaim any interest in the property. d. Disclaimer of Annuity Contract Property: Individuals may also choose to disclaim their rights to assets derived from an annuity contract. This involves formally expressing the intent to relinquish any claim over the annuity property. 3. Procedure for Renunciation and Disclaimer: a. Written Notification: The renunciation or disclaimer process typically begins with drafting a written statement, clearly stating the intention to renounce or disclaim the property. The document must include relevant details like policy or contract information and the renounced's identifying information. b. Timely Delivery: It is vital to deliver the renunciation or disclaimer document promptly to the relevant insurance company or annuity provider. It is recommended to send the document using registered mail or certified mail to ensure proper acknowledgment. c. Legal Considerations: When opting for renunciation or disclaimer, consulting an attorney who specializes in estate planning or insurance law is advisable. Legal counsel will guide individuals through the process, ensuring compliance with relevant laws and safeguarding their interests. Conclusion: The Burbank California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract provide individuals with the means to surrender their rights to property obtained through life insurance policies or annuity contracts. By understanding the various types and following the proper procedures, individuals can navigate this legal process effectively. Seeking professional legal advice is always recommended ensuring compliance and protect one's rights throughout the renunciation or disclaimer process. Keywords: Burbank California, renunciation, disclaimer, property, life insurance, annuity contractTitle: A Comprehensive Guide to Burbank California's Renunciation and Disclaimer of Property from Life Insurance or Annuity Contracts Introduction: In Burbank, California, individuals may face circumstances where they may need to renounce or disclaim their rights to property obtained through life insurance or annuity contracts. Renunciation and disclaimer procedures are crucial legal processes that enable individuals to surrender their claims to such property. This article aims to provide a detailed description of the Burbank California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, expounding on its types and key aspects. Keywords: Burbank California, renunciation, disclaimer, property, life insurance, annuity contract 1. Renunciation and Disclaimer Defined: Renunciation refers to the act of voluntarily surrendering one's rights to property, while the disclaimer is the legal process where an individual refuses to accept or inherit a certain property. In Burbank, California, these actions can pertain to assets derived from life insurance policies or annuity contracts. 2. Types of Burbank California Renunciation and Disclaimer: a. Renunciation of Life Insurance Property: This type of renunciation occurs when an individual willingly chooses to reject any claim or interest in the proceeds from a life insurance policy. The renounced must promptly notify the insurance company, stating their intention to renounce any rights to the property. b. Renunciation of Annuity Contract Property: Similar to life insurance renunciation, individuals can renounce their rights to any assets accrued through an annuity contract. This process involves notifying the annuity provider about the decision to renounce the property. c. Disclaimer of Life Insurance Property: In contrast to renunciation, a disclaimer occurs when an individual refuses to accept property bequeathed to them through a life insurance policy. The disclaimer must be made in writing, expressly stating the intention to disclaim any interest in the property. d. Disclaimer of Annuity Contract Property: Individuals may also choose to disclaim their rights to assets derived from an annuity contract. This involves formally expressing the intent to relinquish any claim over the annuity property. 3. Procedure for Renunciation and Disclaimer: a. Written Notification: The renunciation or disclaimer process typically begins with drafting a written statement, clearly stating the intention to renounce or disclaim the property. The document must include relevant details like policy or contract information and the renounced's identifying information. b. Timely Delivery: It is vital to deliver the renunciation or disclaimer document promptly to the relevant insurance company or annuity provider. It is recommended to send the document using registered mail or certified mail to ensure proper acknowledgment. c. Legal Considerations: When opting for renunciation or disclaimer, consulting an attorney who specializes in estate planning or insurance law is advisable. Legal counsel will guide individuals through the process, ensuring compliance with relevant laws and safeguarding their interests. Conclusion: The Burbank California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract provide individuals with the means to surrender their rights to property obtained through life insurance policies or annuity contracts. By understanding the various types and following the proper procedures, individuals can navigate this legal process effectively. Seeking professional legal advice is always recommended ensuring compliance and protect one's rights throughout the renunciation or disclaimer process. Keywords: Burbank California, renunciation, disclaimer, property, life insurance, annuity contract