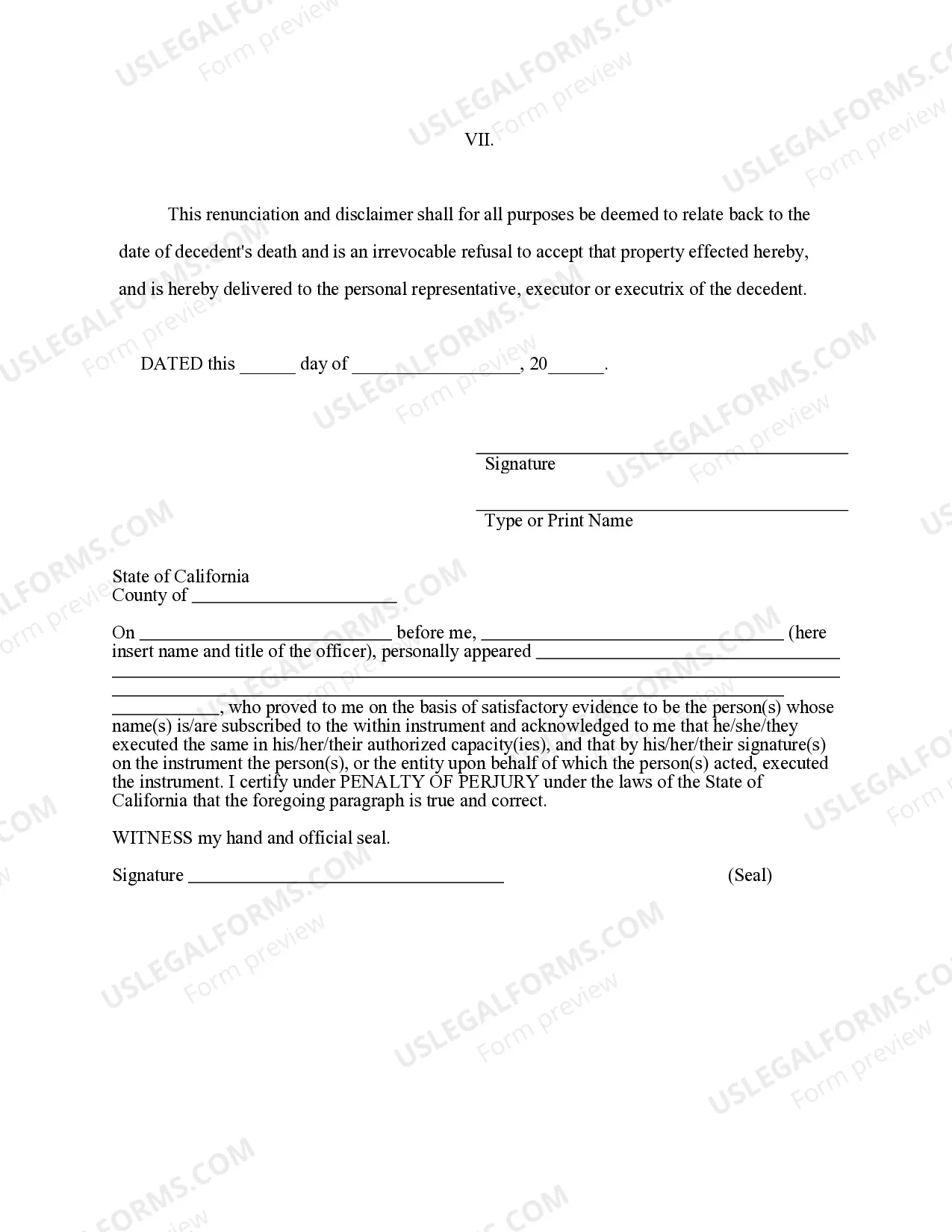

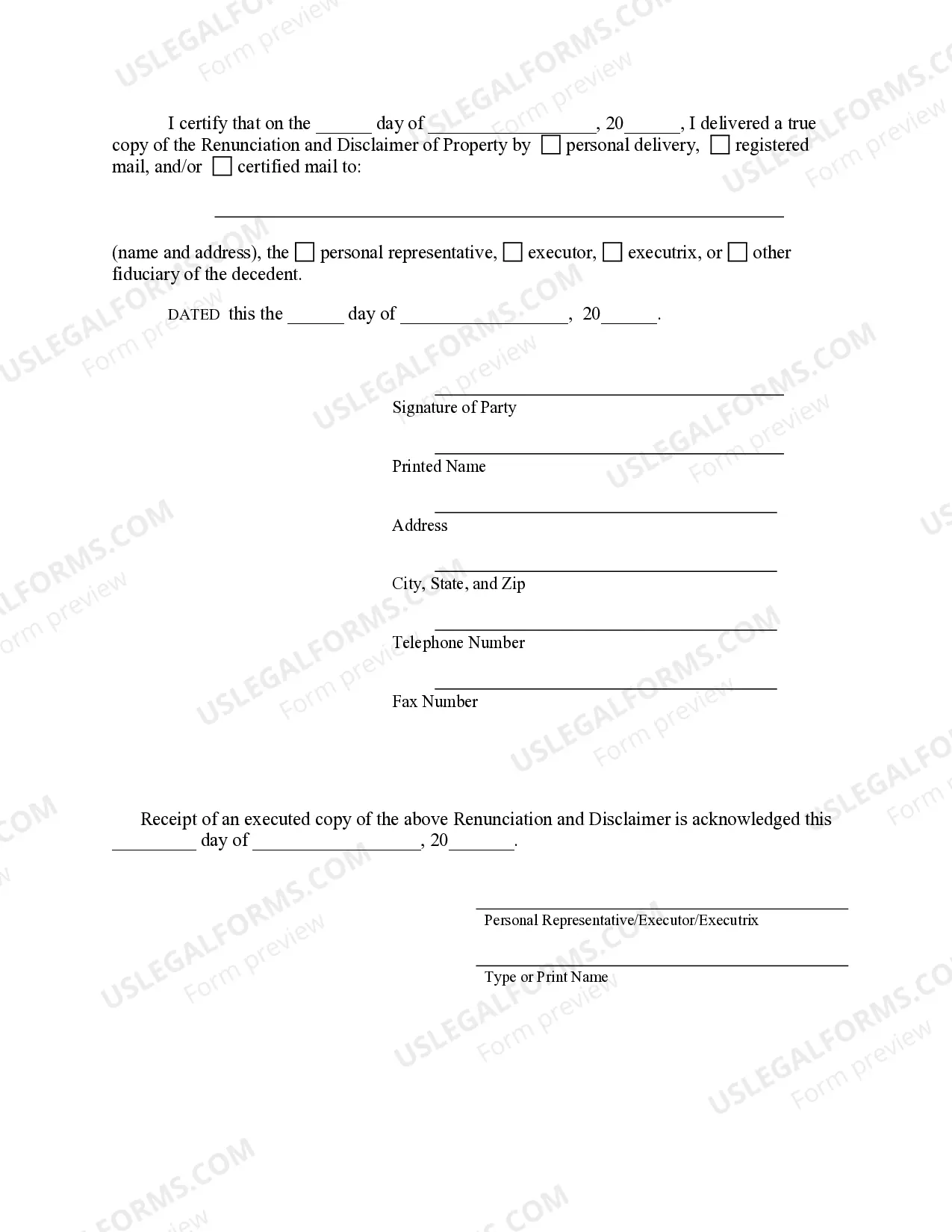

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Clovis California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal document that allows an individual to renounce their rights to claim any property or benefits derived from a life insurance or annuity contract. This document is used when an individual wishes to disclaim any interest in the property or proceeds and pass them on to an alternate beneficiary or not receive them at all. The Clovis California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract acts as a formal declaration stating that the individual does not wish to accept the property or benefits assigned to them under the insurance or annuity contract. By renouncing their rights, the individual permits the property or benefits to pass directly to an alternate beneficiary or follow the default beneficiary designation provided by the policy. This legal document holds significant importance in estate planning as it allows individuals to control the distribution of their assets and property, ensuring they are passed on to intended beneficiaries. Moreover, if the primary beneficiary is unable or unwilling to accept the property or benefits, the secondary beneficiary can benefit from the renunciation. Several types of Clovis California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract exist to cater to specific situations: 1. Traditional Renunciation: This type of renunciation is used when an individual voluntarily refuses the rights to receive any property or benefits from the life insurance or annuity contract. It is typically filed with the insurance company or annuity issuer and becomes effective upon acceptance. 2. Conditional Renunciation: Conditional renunciation occurs when an individual decides to renounce the property or benefits under certain conditions. These conditions may include specific events, timeframes, or the occurrence of certain circumstances. 3. Partial Renunciation: In cases where an individual wishes to renounce only a portion of the property or benefits assigned to them, a partial renunciation is utilized. This allows the individual to disclaim a specified amount or percentage and still retain the remaining property or benefits. 4. Survivorship Renunciation: Survivorship renunciation becomes relevant when an individual passes away before the primary beneficiary of the life insurance or annuity contract. In such cases, the right to renounce the property or benefits transfers to the surviving spouse or another designated individual. The Clovis California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a crucial legal document that ensures individuals have control over the distribution of their assets, allowing them to protect the interests of their loved ones. It enables them to renounce their rights to property or benefits while passing them on to alternate beneficiaries according to their wishes.Clovis California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal document that allows an individual to renounce their rights to claim any property or benefits derived from a life insurance or annuity contract. This document is used when an individual wishes to disclaim any interest in the property or proceeds and pass them on to an alternate beneficiary or not receive them at all. The Clovis California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract acts as a formal declaration stating that the individual does not wish to accept the property or benefits assigned to them under the insurance or annuity contract. By renouncing their rights, the individual permits the property or benefits to pass directly to an alternate beneficiary or follow the default beneficiary designation provided by the policy. This legal document holds significant importance in estate planning as it allows individuals to control the distribution of their assets and property, ensuring they are passed on to intended beneficiaries. Moreover, if the primary beneficiary is unable or unwilling to accept the property or benefits, the secondary beneficiary can benefit from the renunciation. Several types of Clovis California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract exist to cater to specific situations: 1. Traditional Renunciation: This type of renunciation is used when an individual voluntarily refuses the rights to receive any property or benefits from the life insurance or annuity contract. It is typically filed with the insurance company or annuity issuer and becomes effective upon acceptance. 2. Conditional Renunciation: Conditional renunciation occurs when an individual decides to renounce the property or benefits under certain conditions. These conditions may include specific events, timeframes, or the occurrence of certain circumstances. 3. Partial Renunciation: In cases where an individual wishes to renounce only a portion of the property or benefits assigned to them, a partial renunciation is utilized. This allows the individual to disclaim a specified amount or percentage and still retain the remaining property or benefits. 4. Survivorship Renunciation: Survivorship renunciation becomes relevant when an individual passes away before the primary beneficiary of the life insurance or annuity contract. In such cases, the right to renounce the property or benefits transfers to the surviving spouse or another designated individual. The Clovis California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a crucial legal document that ensures individuals have control over the distribution of their assets, allowing them to protect the interests of their loved ones. It enables them to renounce their rights to property or benefits while passing them on to alternate beneficiaries according to their wishes.