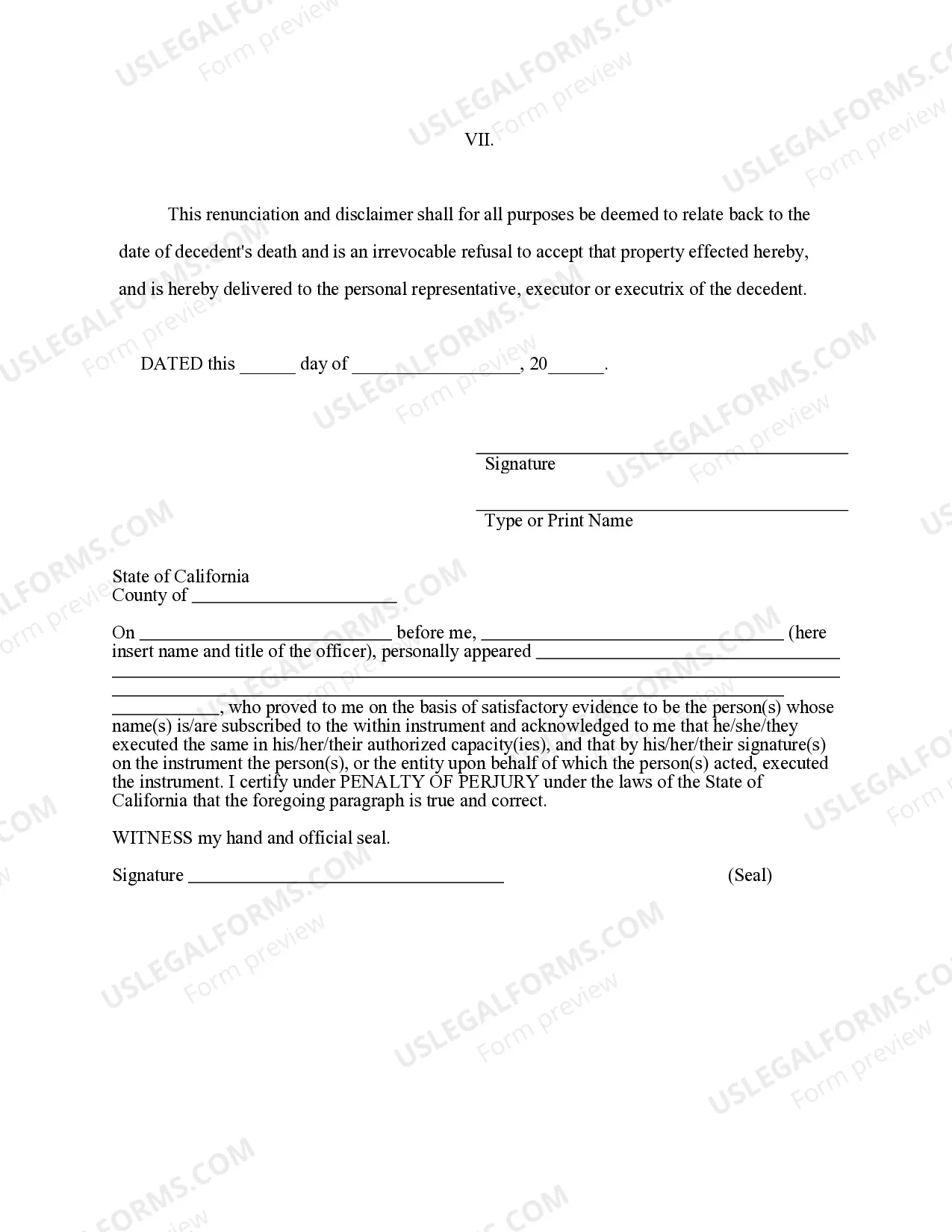

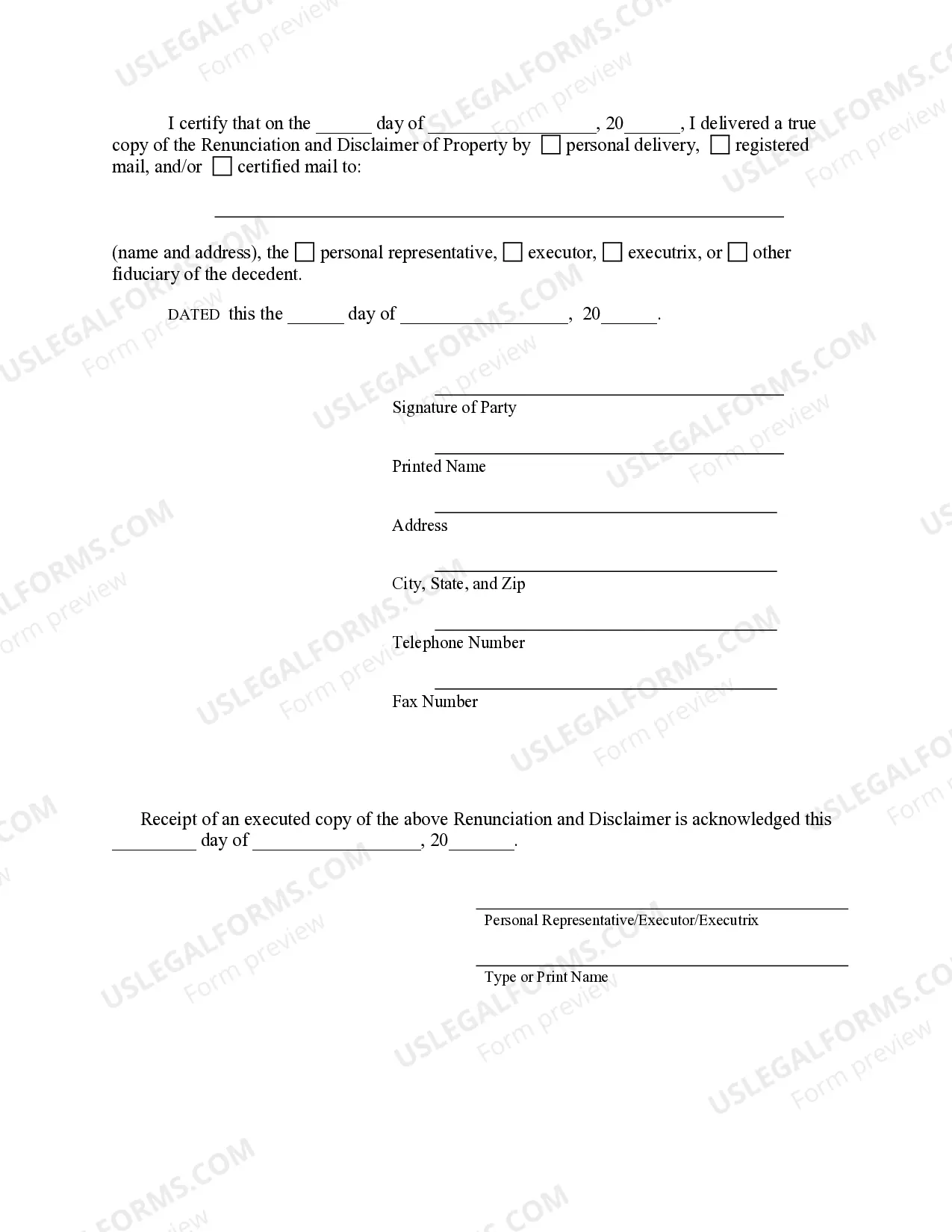

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Corona California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to waive their right to claim or inherit property from a life insurance or annuity contract. This renunciation and disclaimer is usually done when the beneficiary or potential heir does not wish to accept or receive the property. It is important to understand the various types and considerations associated with this process to ensure compliance with California state laws. 1. Voluntary Renunciation: This type of renunciation occurs when the beneficiary willingly and explicitly rejects their rights to receive the property from a life insurance or annuity contract. The renunciation is typically in writing and legally valid when accepted by the insurance company or annuity provider. 2. Involuntary Renunciation: In some cases, a renunciation may occur involuntarily, such as when a potential beneficiary passes away before the insured party. In such situations, the executor or administrator of the deceased's estate can renounce the claim to the property on behalf of the deceased beneficiary. 3. Legal Requirements: To renounce or disclaim property from a life insurance or annuity contract in Corona, California, certain legal requirements must be met. It is crucial to consult with an experienced attorney to ensure compliance with state laws, including specific procedures, time limits, and formalities for renunciation. 4. Impact on Estate Planning: Renunciation and disclaimer of property from life insurance or annuity contracts can have significant implications for estate planning. By renouncing the property, the potential beneficiary's share may pass to other designated beneficiaries, in accordance with the terms of the contract or the deceased's will. 5. Protecting the Renounced Property: Renouncing property from a life insurance or annuity contract does not automatically remove it from an individual's estate. Proper estate planning, such as establishing trusts or naming alternate beneficiaries, may be necessary to secure the renounced property and ensure it doesn't pass according to intestate succession laws. 6. Tax Considerations: It is crucial to consider potential tax consequences associated with renunciation and disclaimer of property. Consulting with a qualified tax professional is advisable to understand any potential impact on income tax, estate tax, or gift tax obligations. In summary, Corona California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract are legal processes that allow individuals to waive their rights to claim property from such contracts. The different types include voluntary and involuntary renunciations. Adhering to legal requirements, considering the impact on estate planning, protection of renounced property, and potential tax implications are crucial when navigating this complex process. Seeking guidance from legal and financial professionals is highly recommended for anyone considering renouncing property from a life insurance or annuity contract in Corona, California.Corona California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to waive their right to claim or inherit property from a life insurance or annuity contract. This renunciation and disclaimer is usually done when the beneficiary or potential heir does not wish to accept or receive the property. It is important to understand the various types and considerations associated with this process to ensure compliance with California state laws. 1. Voluntary Renunciation: This type of renunciation occurs when the beneficiary willingly and explicitly rejects their rights to receive the property from a life insurance or annuity contract. The renunciation is typically in writing and legally valid when accepted by the insurance company or annuity provider. 2. Involuntary Renunciation: In some cases, a renunciation may occur involuntarily, such as when a potential beneficiary passes away before the insured party. In such situations, the executor or administrator of the deceased's estate can renounce the claim to the property on behalf of the deceased beneficiary. 3. Legal Requirements: To renounce or disclaim property from a life insurance or annuity contract in Corona, California, certain legal requirements must be met. It is crucial to consult with an experienced attorney to ensure compliance with state laws, including specific procedures, time limits, and formalities for renunciation. 4. Impact on Estate Planning: Renunciation and disclaimer of property from life insurance or annuity contracts can have significant implications for estate planning. By renouncing the property, the potential beneficiary's share may pass to other designated beneficiaries, in accordance with the terms of the contract or the deceased's will. 5. Protecting the Renounced Property: Renouncing property from a life insurance or annuity contract does not automatically remove it from an individual's estate. Proper estate planning, such as establishing trusts or naming alternate beneficiaries, may be necessary to secure the renounced property and ensure it doesn't pass according to intestate succession laws. 6. Tax Considerations: It is crucial to consider potential tax consequences associated with renunciation and disclaimer of property. Consulting with a qualified tax professional is advisable to understand any potential impact on income tax, estate tax, or gift tax obligations. In summary, Corona California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract are legal processes that allow individuals to waive their rights to claim property from such contracts. The different types include voluntary and involuntary renunciations. Adhering to legal requirements, considering the impact on estate planning, protection of renounced property, and potential tax implications are crucial when navigating this complex process. Seeking guidance from legal and financial professionals is highly recommended for anyone considering renouncing property from a life insurance or annuity contract in Corona, California.