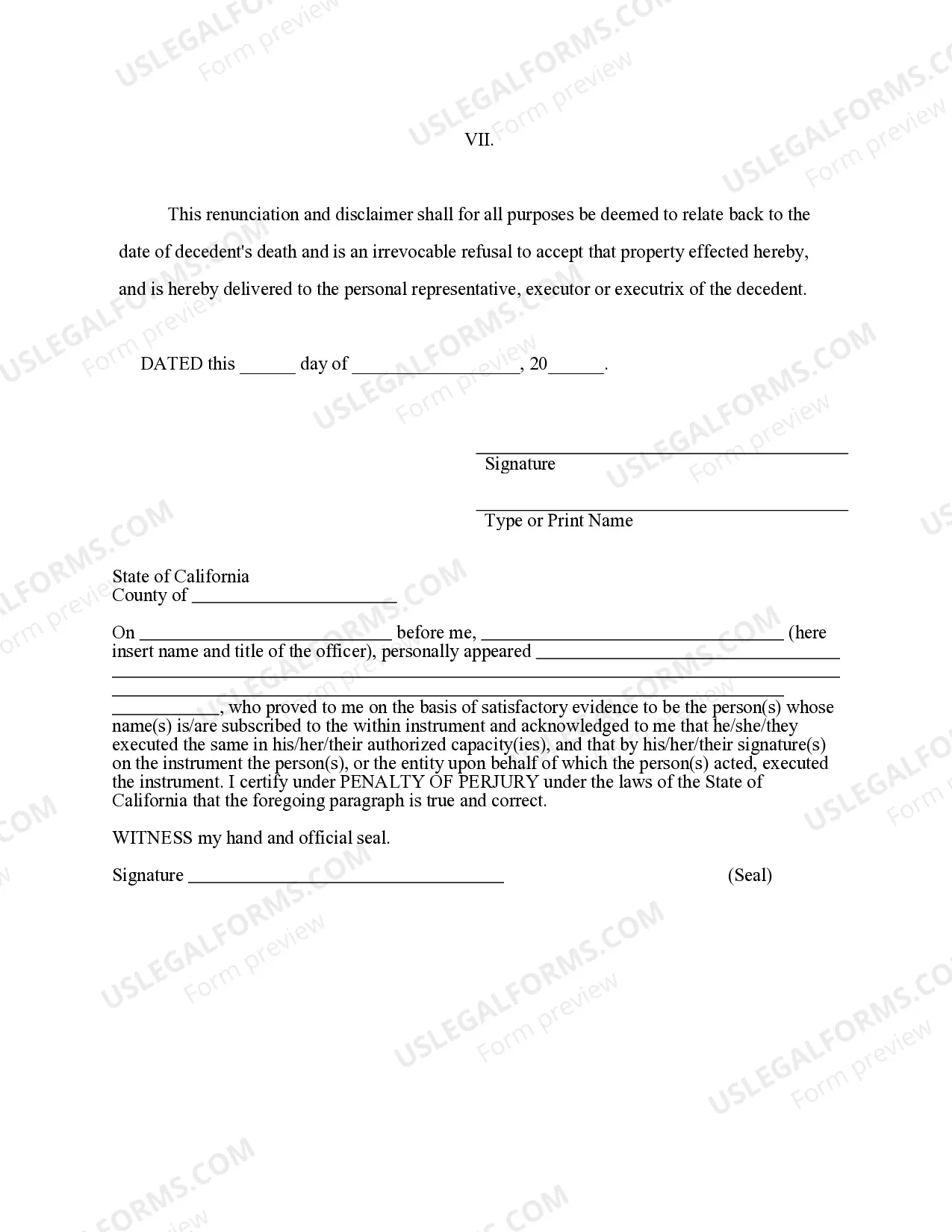

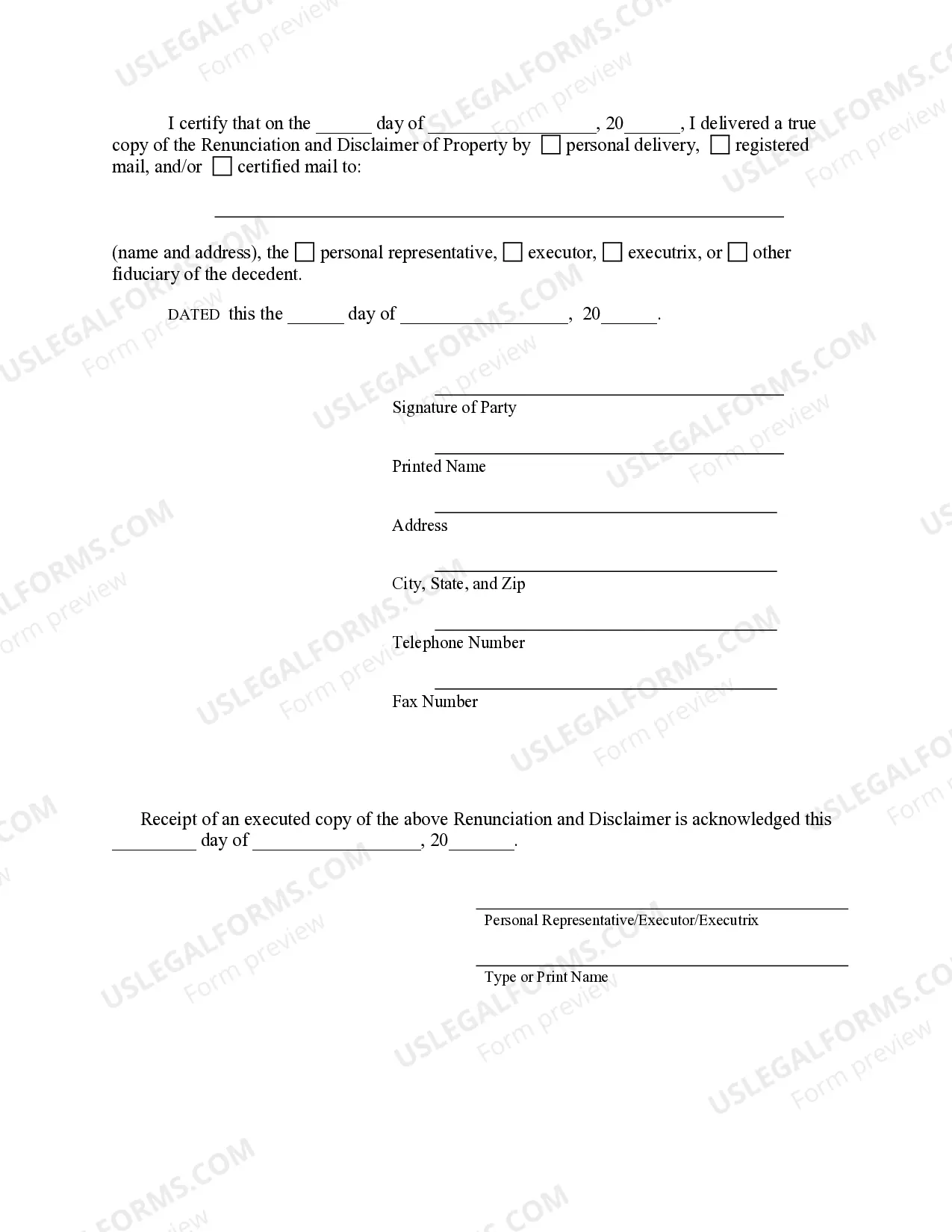

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

El Monte California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to disclaim or renounce their right to receive property from a life insurance or annuity contract in El Monte, California. This renunciation or disclaimer effectively transfers the property to another beneficiary or allows it to pass through intestate succession if no alternate beneficiary is named. The process of renouncing or disclaiming property from a life insurance or annuity contract involves the following steps: 1. Understanding the legal provisions: It is crucial to familiarize oneself with the specific laws governing renunciation and disclaimer of property in El Monte, California. These laws determine the eligibility, requirements, and consequences of such actions. 2. Identifying the property: The individual must identify the specific life insurance or annuity contract from which they wish to renounce or disclaim property. This includes providing details such as the policy number, insurance company, and policy owner's information. 3. Determining eligibility: Certain eligibility criteria may exist for individuals looking to renounce or disclaim property from a life insurance or annuity contract. These criteria may include the individual's relationship to the deceased or the terms outlined in the contract itself. 4. Filing a written disclaimer: The individual must file a written renunciation or disclaimer of property with the appropriate authority, such as the probate court or the insurance company. This document should clearly state their intent to renounce their right to the property. 5. Time limits: It is crucial to be aware of any time limits imposed by California law for filing a disclaimer. Generally, the disclaimer should be filed within a certain period after the death of the insured or the date the beneficiary became aware of their entitlement. Types of El Monte California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract: 1. Total renunciation: In this type, the individual renounces their entire interest in the life insurance or annuity contract, disclaiming any claim to the property. This allows the property to pass to the contingent beneficiary, the next eligible beneficiary named in the contract, or through the laws of intestate succession. 2. Partial renunciation: Sometimes, an individual may only wish to renounce a portion of the property received from a life insurance or annuity contract. In this case, they can renounce a specific amount or a percentage of the property while retaining the remaining portion. 3. Conditional disclaimer: This type of renunciation or disclaimer is contingent upon certain conditions being met. For example, an individual may declare their intent to renounce the property only if a specific event occurs or if certain prerequisites are met. 4. Beneficiary substitution disclaimer: This form of disclaimer allows the individual to redirect the property to an alternate beneficiary of their choice. Instead of renouncing the property completely, they can choose to substitute a named beneficiary in their place. El Monte California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is an essential legal process that provides individuals with the ability to renounce or disclaim their right to receive property from a life insurance or annuity contract. By understanding the process and different types of renunciation, individuals can effectively manage their assets and ensure the property is transferred according to their wishes.El Monte California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to disclaim or renounce their right to receive property from a life insurance or annuity contract in El Monte, California. This renunciation or disclaimer effectively transfers the property to another beneficiary or allows it to pass through intestate succession if no alternate beneficiary is named. The process of renouncing or disclaiming property from a life insurance or annuity contract involves the following steps: 1. Understanding the legal provisions: It is crucial to familiarize oneself with the specific laws governing renunciation and disclaimer of property in El Monte, California. These laws determine the eligibility, requirements, and consequences of such actions. 2. Identifying the property: The individual must identify the specific life insurance or annuity contract from which they wish to renounce or disclaim property. This includes providing details such as the policy number, insurance company, and policy owner's information. 3. Determining eligibility: Certain eligibility criteria may exist for individuals looking to renounce or disclaim property from a life insurance or annuity contract. These criteria may include the individual's relationship to the deceased or the terms outlined in the contract itself. 4. Filing a written disclaimer: The individual must file a written renunciation or disclaimer of property with the appropriate authority, such as the probate court or the insurance company. This document should clearly state their intent to renounce their right to the property. 5. Time limits: It is crucial to be aware of any time limits imposed by California law for filing a disclaimer. Generally, the disclaimer should be filed within a certain period after the death of the insured or the date the beneficiary became aware of their entitlement. Types of El Monte California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract: 1. Total renunciation: In this type, the individual renounces their entire interest in the life insurance or annuity contract, disclaiming any claim to the property. This allows the property to pass to the contingent beneficiary, the next eligible beneficiary named in the contract, or through the laws of intestate succession. 2. Partial renunciation: Sometimes, an individual may only wish to renounce a portion of the property received from a life insurance or annuity contract. In this case, they can renounce a specific amount or a percentage of the property while retaining the remaining portion. 3. Conditional disclaimer: This type of renunciation or disclaimer is contingent upon certain conditions being met. For example, an individual may declare their intent to renounce the property only if a specific event occurs or if certain prerequisites are met. 4. Beneficiary substitution disclaimer: This form of disclaimer allows the individual to redirect the property to an alternate beneficiary of their choice. Instead of renouncing the property completely, they can choose to substitute a named beneficiary in their place. El Monte California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is an essential legal process that provides individuals with the ability to renounce or disclaim their right to receive property from a life insurance or annuity contract. By understanding the process and different types of renunciation, individuals can effectively manage their assets and ensure the property is transferred according to their wishes.