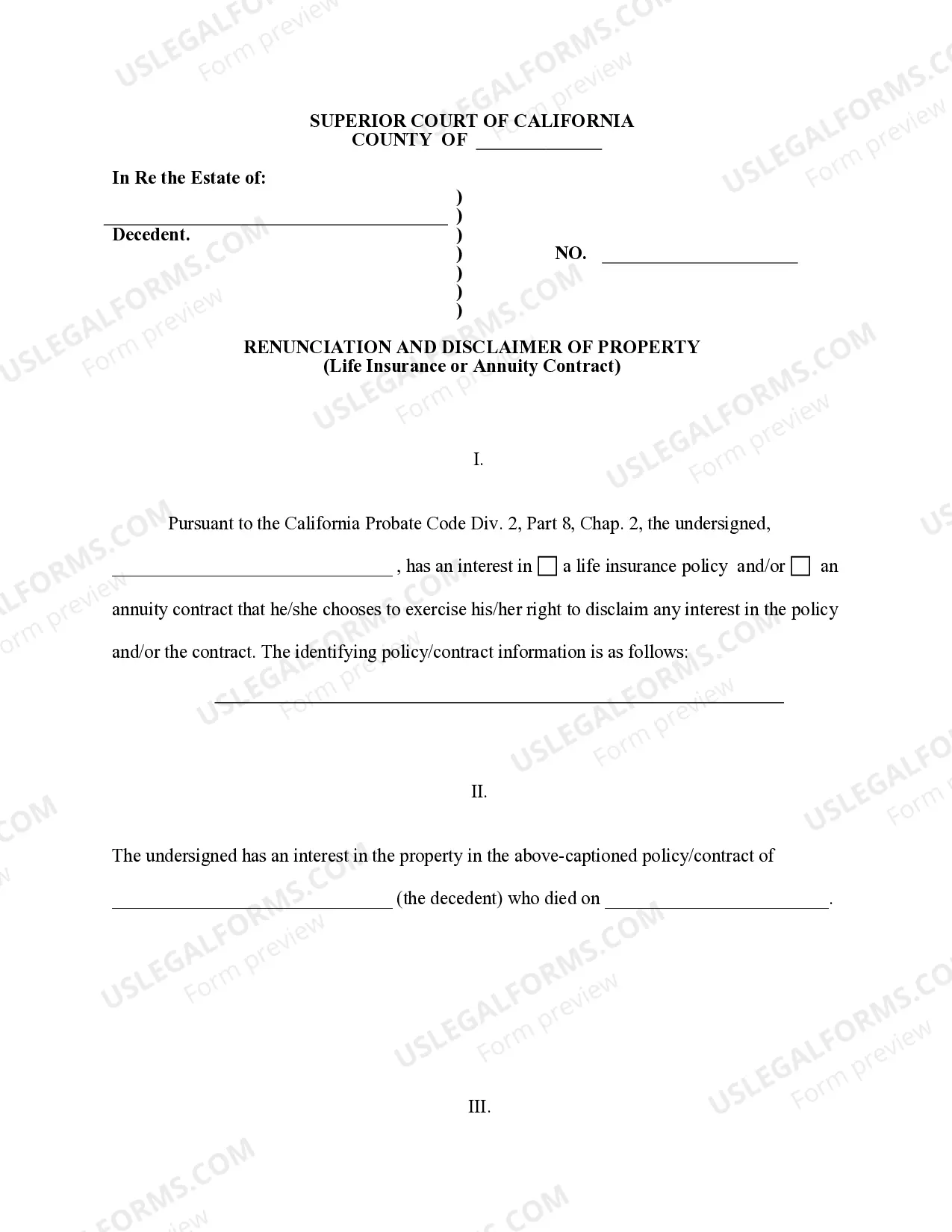

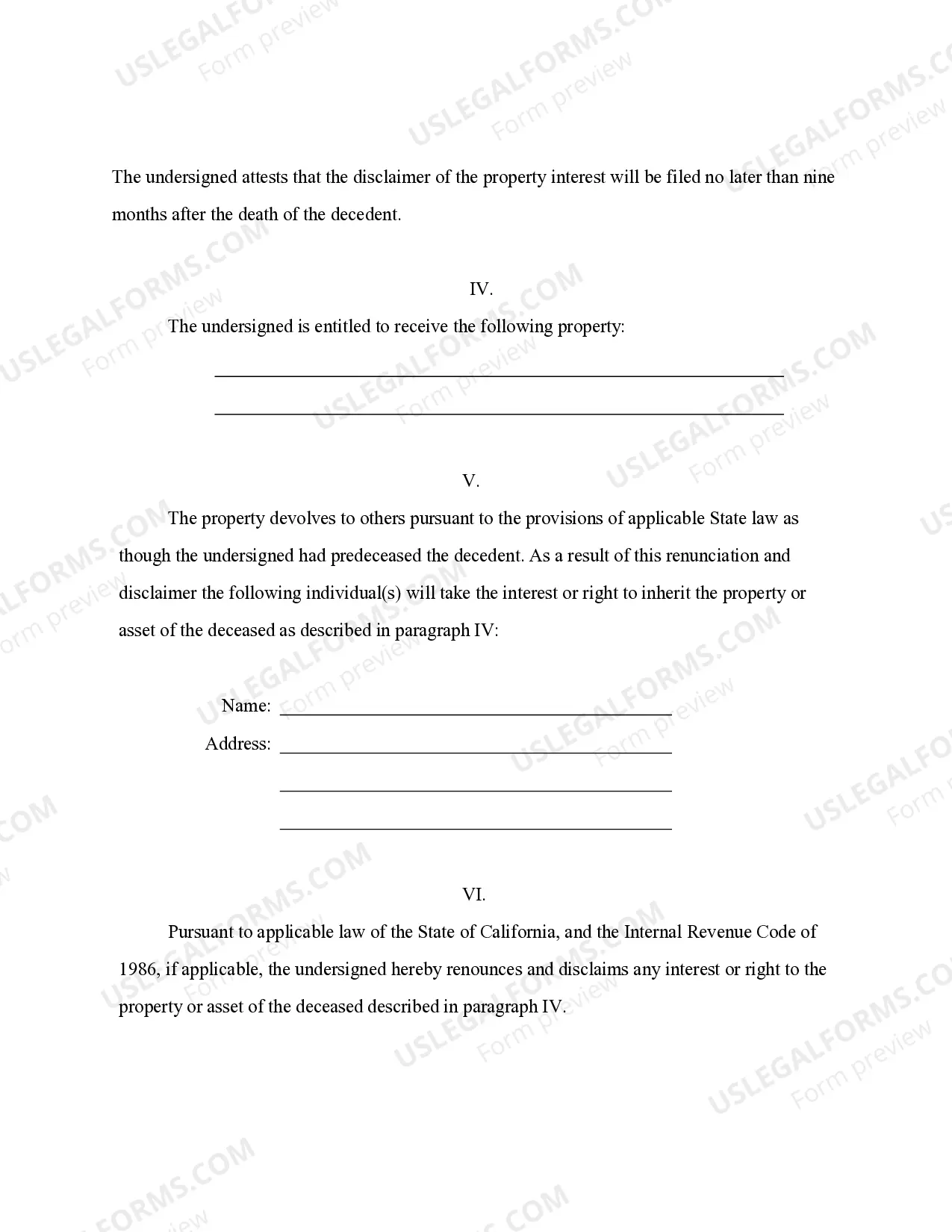

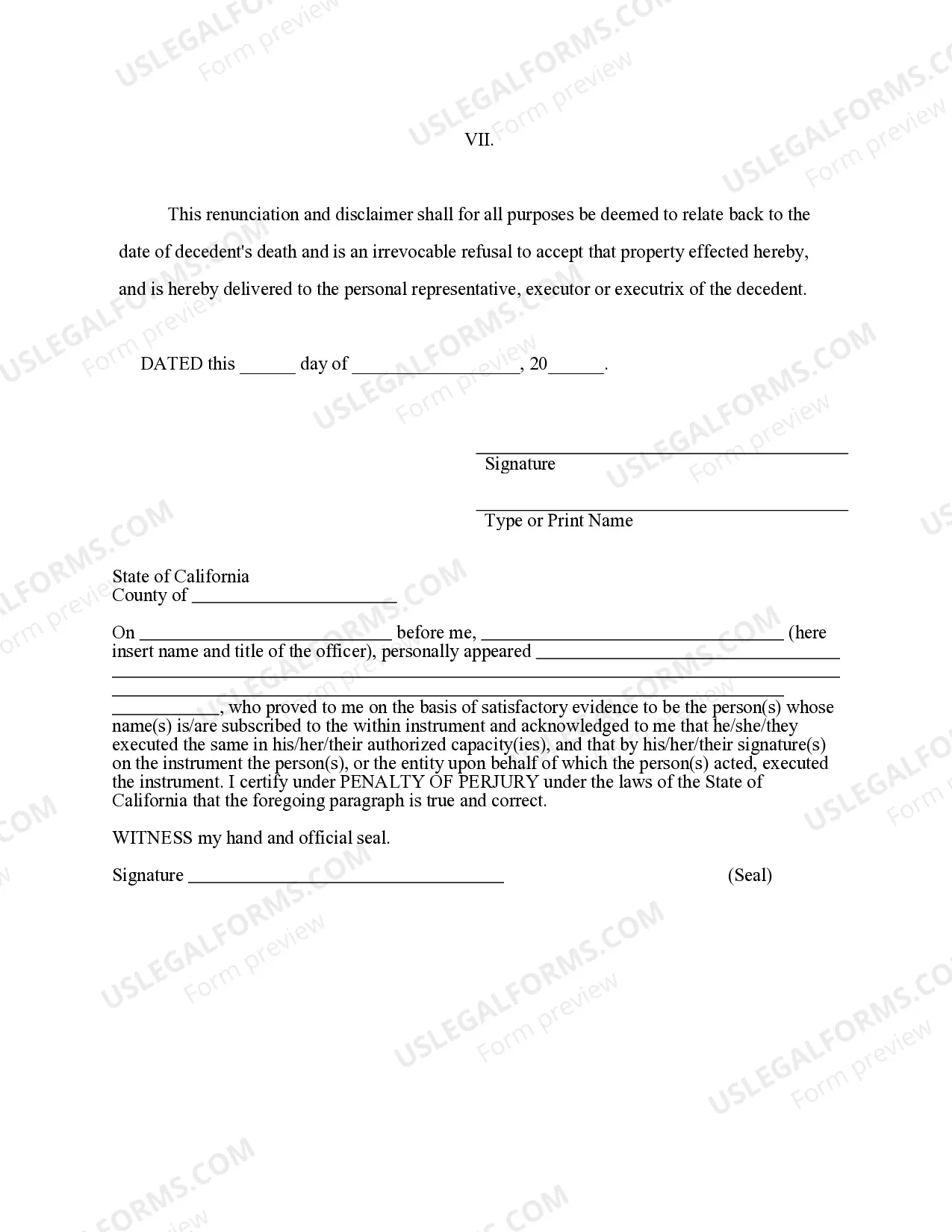

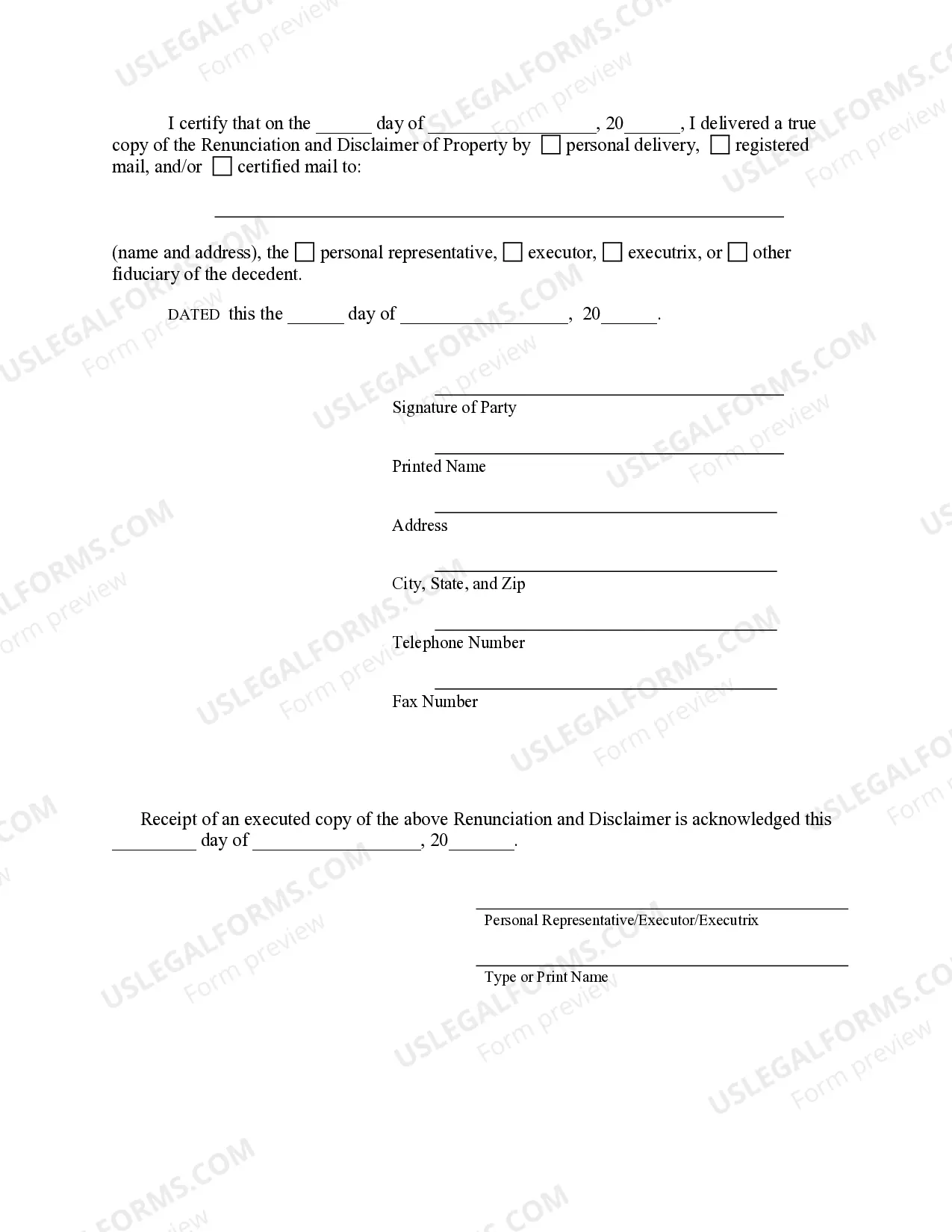

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Palmdale California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract In Palmdale, California, the process of renunciation and disclaimer of property from life insurance or annuity contracts holds significant importance. This legal procedure allows individuals to relinquish their rights to receive assets or proceeds from such contracts. Renunciation and disclaimer of property may occur for various reasons, such as estate planning, tax considerations, or personal preferences. When initiating a renunciation or disclaimer of property from a life insurance or annuity contract in Palmdale, it is crucial to understand the different types available. These include: 1. Partial Renunciation: This type involves renouncing or disclaiming only a portion of the property or assets held in the life insurance or annuity contract. It allows individuals to retain some benefits while relinquishing others. 2. Complete Renunciation: Complete renunciation refers to renouncing or disclaiming the entire property or assets associated with the life insurance or annuity contract. By doing so, the individual forfeits all rights to receive any benefits or proceeds from the contract. 3. Conditional Renunciation: Conditional renunciation is a type where individuals renounce or disclaim the property or assets under specific circumstances. This condition can be based on certain events, such as the occurrence of a particular date, the completion of a designated task, or the satisfaction of specific terms. To initiate the renunciation and disclaimer of property process in Palmdale, California, certain steps must be followed: 1. Consultation with an Attorney: It is advisable to seek legal guidance from an experienced attorney specializing in estate planning or insurance law. They can provide personalized advice and ensure compliance with relevant laws and regulations. 2. Review Contract Terms: The individual must thoroughly review the life insurance or annuity contract and understand its provisions, rights, and obligations. This allows them to make an informed decision about renunciation and disclaimer. 3. Drafting and Execution of Renunciation Document: The attorney will assist in drafting a legal document, commonly known as a Renunciation and Disclaimer of Property form. This document explicitly states the individual's intention to renounce or disclaim the property or assets from the life insurance or annuity contract. It needs to be executed as per California's legal requirements, such as witnessing and notarization. 4. Submission to Relevant Parties: The renunciation document, once executed, must be submitted to the appropriate parties involved. This includes the insurance company, the policyholder, and any other relevant stakeholders mentioned in the contract. 5. Recording and Documentation: It is crucial to maintain proper records and documentation of the renunciation and disclaimer of property process. These records serve as proof of the individual's intent and protect their interests. By understanding the different types and following the necessary steps, residents of Palmdale, California can effectively renounce and disclaim property from life insurance or annuity contracts. Seeking professional advice and adhering to legal procedures ensures a smooth and legally compliant process for renunciation and disclaimer.Palmdale California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract In Palmdale, California, the process of renunciation and disclaimer of property from life insurance or annuity contracts holds significant importance. This legal procedure allows individuals to relinquish their rights to receive assets or proceeds from such contracts. Renunciation and disclaimer of property may occur for various reasons, such as estate planning, tax considerations, or personal preferences. When initiating a renunciation or disclaimer of property from a life insurance or annuity contract in Palmdale, it is crucial to understand the different types available. These include: 1. Partial Renunciation: This type involves renouncing or disclaiming only a portion of the property or assets held in the life insurance or annuity contract. It allows individuals to retain some benefits while relinquishing others. 2. Complete Renunciation: Complete renunciation refers to renouncing or disclaiming the entire property or assets associated with the life insurance or annuity contract. By doing so, the individual forfeits all rights to receive any benefits or proceeds from the contract. 3. Conditional Renunciation: Conditional renunciation is a type where individuals renounce or disclaim the property or assets under specific circumstances. This condition can be based on certain events, such as the occurrence of a particular date, the completion of a designated task, or the satisfaction of specific terms. To initiate the renunciation and disclaimer of property process in Palmdale, California, certain steps must be followed: 1. Consultation with an Attorney: It is advisable to seek legal guidance from an experienced attorney specializing in estate planning or insurance law. They can provide personalized advice and ensure compliance with relevant laws and regulations. 2. Review Contract Terms: The individual must thoroughly review the life insurance or annuity contract and understand its provisions, rights, and obligations. This allows them to make an informed decision about renunciation and disclaimer. 3. Drafting and Execution of Renunciation Document: The attorney will assist in drafting a legal document, commonly known as a Renunciation and Disclaimer of Property form. This document explicitly states the individual's intention to renounce or disclaim the property or assets from the life insurance or annuity contract. It needs to be executed as per California's legal requirements, such as witnessing and notarization. 4. Submission to Relevant Parties: The renunciation document, once executed, must be submitted to the appropriate parties involved. This includes the insurance company, the policyholder, and any other relevant stakeholders mentioned in the contract. 5. Recording and Documentation: It is crucial to maintain proper records and documentation of the renunciation and disclaimer of property process. These records serve as proof of the individual's intent and protect their interests. By understanding the different types and following the necessary steps, residents of Palmdale, California can effectively renounce and disclaim property from life insurance or annuity contracts. Seeking professional advice and adhering to legal procedures ensures a smooth and legally compliant process for renunciation and disclaimer.