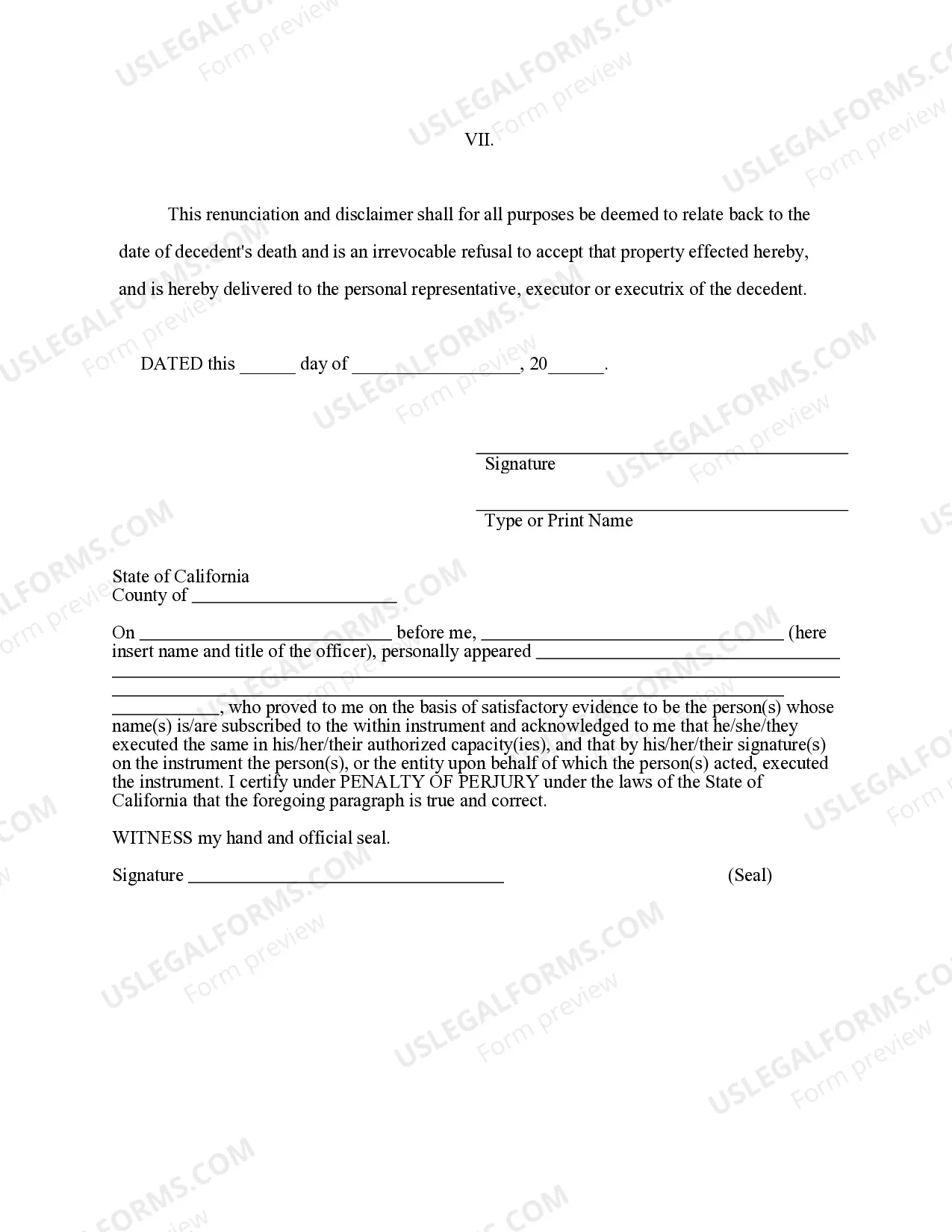

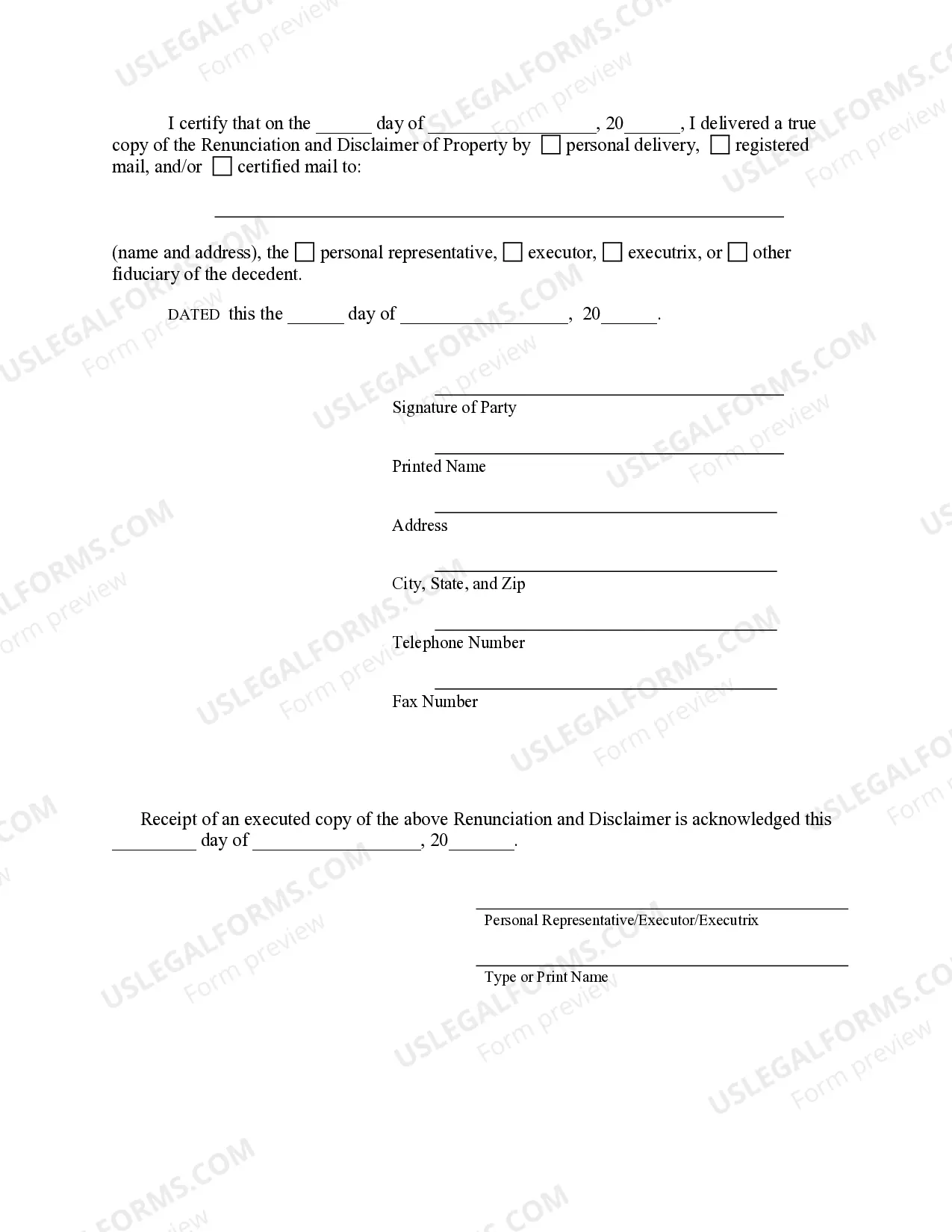

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Title: Salinas California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract: Explained Introduction: In Salinas, California, the process of renouncing and disclaiming property from a life insurance or annuity contract is governed by specific laws and regulations. This legal procedure allows individuals to relinquish their rights to inherit property associated with such contracts. This article will provide a detailed description of the Salinas California renunciation and disclaimer process, including its significance and potential types. Types of Salinas California Renunciation and Disclaimer of Property: 1. Voluntary Renunciation: Under certain circumstances, an individual may choose to voluntarily renounce their rights to property from a life insurance or annuity contract. This process generally occurs when a beneficiary wishes to disclaim their inheritance due to personal reasons such as tax liabilities, financial considerations, or potential conflict with other beneficiaries. 2. Statutory Renunciation: In other instances, renunciation of property may be required by law. For example, if the beneficiary is a minor or deemed legally incompetent to handle the assets, a statutory renunciation can be initiated to transfer the property to an alternate beneficiary or trustee, ensuring proper management of financial assets. 3. Involuntary Renunciation: In some situations, the renunciation and disclaimer of property from a life insurance or annuity contract may occur involuntarily. This can happen when a beneficiary fails to comply with specified legal obligations or meet certain criteria required to receive the benefits. In such cases, the renunciation is often seen as a consequence of non-compliance rather than a deliberate choice by the beneficiary. Importance of Renunciation and Disclaimer: Understanding the significance of renunciation and disclaimer of property in Salinas, California, is crucial for beneficiaries of life insurance or annuity contracts. Some key benefits include: 1. Flexibility and Asset Management: Renunciation and disclaimer allow beneficiaries to exercise control over their financial situation, enabling them to make informed decisions about their inheritance. By renouncing property, individuals can ensure that the assets are properly managed or allocated in alignment with their specific financial objectives. 2. Tax Planning: In certain cases, renouncing or disclaiming property from an insurance or annuity contract may serve as a tax planning strategy. By relinquishing the property, beneficiaries can minimize their tax liabilities and avoid potential estate tax complications. 3. Avoiding Legal Issues: Renouncing and disclaiming ownership rights early on can help beneficiaries avoid legal entanglements associated with managing and distributing complex financial assets. This proactive approach helps prevent potential conflicts or disputes among beneficiaries, fostering a smoother estate administration process. Conclusion: Salinas, California, provides a structured framework for the renunciation and disclaimer of property from life insurance or annuity contracts. Whether it is a voluntary, statutory, or involuntary renunciation, understanding the types and implications of this process is crucial for beneficiaries seeking to effectively manage their assets. By utilizing the renunciation and disclaimer provisions, individuals can optimize their inheritance, minimize tax burdens, and ensure a seamless administration of their financial affairs.Title: Salinas California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract: Explained Introduction: In Salinas, California, the process of renouncing and disclaiming property from a life insurance or annuity contract is governed by specific laws and regulations. This legal procedure allows individuals to relinquish their rights to inherit property associated with such contracts. This article will provide a detailed description of the Salinas California renunciation and disclaimer process, including its significance and potential types. Types of Salinas California Renunciation and Disclaimer of Property: 1. Voluntary Renunciation: Under certain circumstances, an individual may choose to voluntarily renounce their rights to property from a life insurance or annuity contract. This process generally occurs when a beneficiary wishes to disclaim their inheritance due to personal reasons such as tax liabilities, financial considerations, or potential conflict with other beneficiaries. 2. Statutory Renunciation: In other instances, renunciation of property may be required by law. For example, if the beneficiary is a minor or deemed legally incompetent to handle the assets, a statutory renunciation can be initiated to transfer the property to an alternate beneficiary or trustee, ensuring proper management of financial assets. 3. Involuntary Renunciation: In some situations, the renunciation and disclaimer of property from a life insurance or annuity contract may occur involuntarily. This can happen when a beneficiary fails to comply with specified legal obligations or meet certain criteria required to receive the benefits. In such cases, the renunciation is often seen as a consequence of non-compliance rather than a deliberate choice by the beneficiary. Importance of Renunciation and Disclaimer: Understanding the significance of renunciation and disclaimer of property in Salinas, California, is crucial for beneficiaries of life insurance or annuity contracts. Some key benefits include: 1. Flexibility and Asset Management: Renunciation and disclaimer allow beneficiaries to exercise control over their financial situation, enabling them to make informed decisions about their inheritance. By renouncing property, individuals can ensure that the assets are properly managed or allocated in alignment with their specific financial objectives. 2. Tax Planning: In certain cases, renouncing or disclaiming property from an insurance or annuity contract may serve as a tax planning strategy. By relinquishing the property, beneficiaries can minimize their tax liabilities and avoid potential estate tax complications. 3. Avoiding Legal Issues: Renouncing and disclaiming ownership rights early on can help beneficiaries avoid legal entanglements associated with managing and distributing complex financial assets. This proactive approach helps prevent potential conflicts or disputes among beneficiaries, fostering a smoother estate administration process. Conclusion: Salinas, California, provides a structured framework for the renunciation and disclaimer of property from life insurance or annuity contracts. Whether it is a voluntary, statutory, or involuntary renunciation, understanding the types and implications of this process is crucial for beneficiaries seeking to effectively manage their assets. By utilizing the renunciation and disclaimer provisions, individuals can optimize their inheritance, minimize tax burdens, and ensure a seamless administration of their financial affairs.