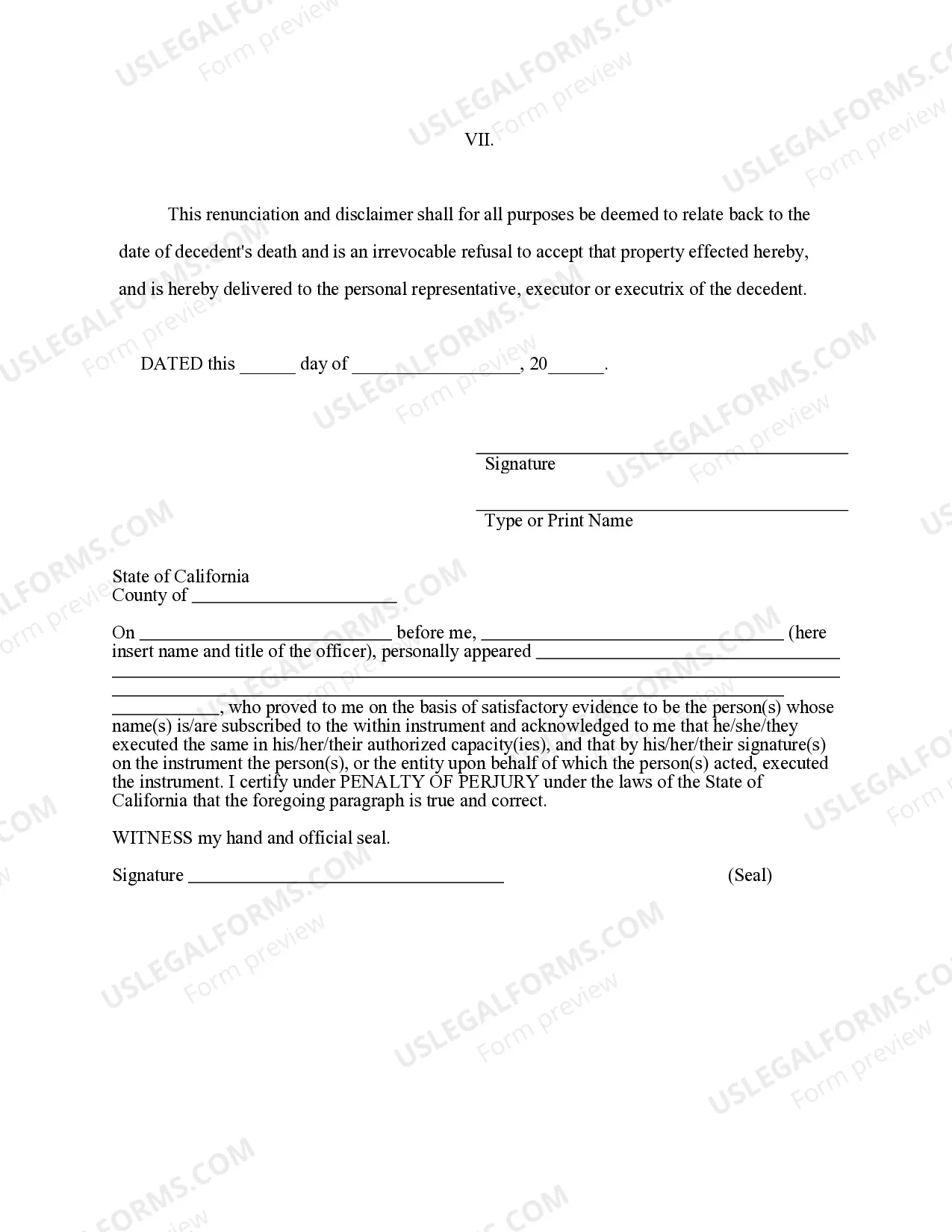

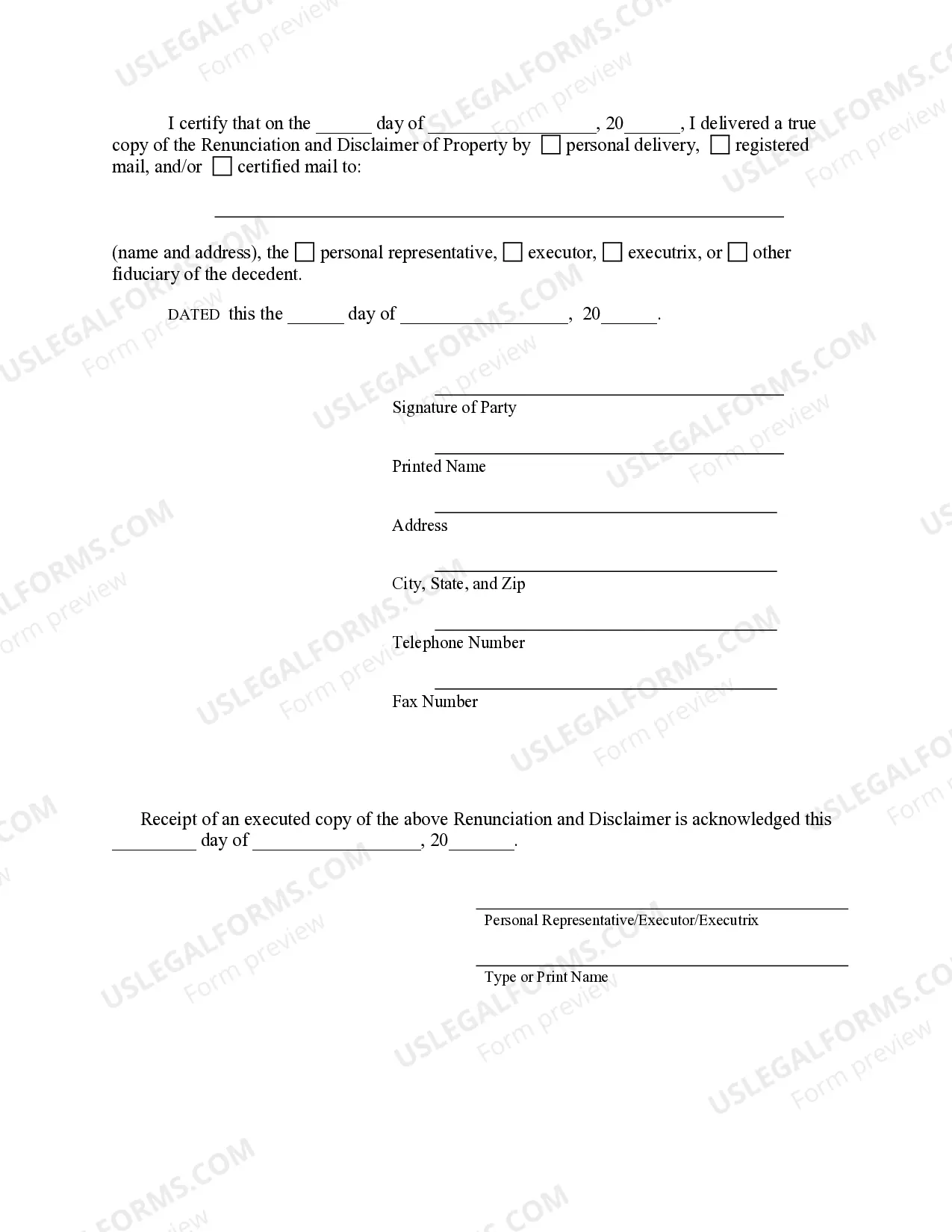

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Thousand Oaks California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract A renunciation and disclaimer of property from a life insurance or annuity contract in Thousand Oaks, California is a legal document used to relinquish one's claim to the benefits of such policies. This document allows an individual to waive their rights to receive any proceeds from a life insurance policy or annuity contract, effectively disowning their stake in the associated property. In Thousand Oaks, California, there are different types of renunciation and disclaimer of property from life insurance or annuity contracts, each serving varied purposes. These include: 1. Voluntary Renunciation and Disclaimer: This type of renunciation occurs when an individual willingly surrenders their right to receive any property from a life insurance or annuity contract. It is essential to understand the implications of renouncing these benefits before signing a voluntary renunciation and disclaimer. 2. Involuntary Renunciation and Disclaimer: Sometimes, certain circumstances may force an individual to renounce their claim to the property from a life insurance or annuity contract. These situations could include legal disputes, creditor claims, or other compulsory actions that leave no other option but to disclaim the benefits. 3. Partial Renunciation and Disclaimer: In certain cases, an individual may wish to renounce only a portion of their rights to the property from a life insurance or annuity contract. This partial renunciation allows individuals to retain some benefits while rejecting others, based on their specific preferences or needs. The Thousand Oaks, California renunciation and disclaimer of property from life insurance or annuity contract document must satisfy legal requirements set forth by the state. It should include the following key elements: 1. Identifying Information: The document must mention the full legal name, address, and contact details of both the disclaiming party and the life insurance or annuity contract provider. 2. Description of Property: A detailed description of the life insurance policy or annuity contract should be included, specifying the account or policy number, effective date, and any other pertinent information that helps identify the property being renounced. 3. Intention to Renounce: The document should clearly state the renouncing party's intention to disclaim any interest, right, or claim to the benefits arising from the life insurance or annuity contract. 4. Legal Acknowledgment: It is crucial to acknowledge that the renouncing party fully understands the consequences of renouncing the benefits and that it is a voluntary act done without any form of coercion or intimidation. 5. Signatures: Both the renouncing party and a witness should sign and date the document. The witness should not be a beneficiary of the property being renounced. When renouncing and disclaiming property from a life insurance or annuity contract in Thousand Oaks, California, it is advisable to consult with an attorney to ensure compliance with state laws and to understand the potential ramifications of this legal action. This detailed description provides an overview of the various types and key elements associated with Thousand Oaks California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.Thousand Oaks California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract A renunciation and disclaimer of property from a life insurance or annuity contract in Thousand Oaks, California is a legal document used to relinquish one's claim to the benefits of such policies. This document allows an individual to waive their rights to receive any proceeds from a life insurance policy or annuity contract, effectively disowning their stake in the associated property. In Thousand Oaks, California, there are different types of renunciation and disclaimer of property from life insurance or annuity contracts, each serving varied purposes. These include: 1. Voluntary Renunciation and Disclaimer: This type of renunciation occurs when an individual willingly surrenders their right to receive any property from a life insurance or annuity contract. It is essential to understand the implications of renouncing these benefits before signing a voluntary renunciation and disclaimer. 2. Involuntary Renunciation and Disclaimer: Sometimes, certain circumstances may force an individual to renounce their claim to the property from a life insurance or annuity contract. These situations could include legal disputes, creditor claims, or other compulsory actions that leave no other option but to disclaim the benefits. 3. Partial Renunciation and Disclaimer: In certain cases, an individual may wish to renounce only a portion of their rights to the property from a life insurance or annuity contract. This partial renunciation allows individuals to retain some benefits while rejecting others, based on their specific preferences or needs. The Thousand Oaks, California renunciation and disclaimer of property from life insurance or annuity contract document must satisfy legal requirements set forth by the state. It should include the following key elements: 1. Identifying Information: The document must mention the full legal name, address, and contact details of both the disclaiming party and the life insurance or annuity contract provider. 2. Description of Property: A detailed description of the life insurance policy or annuity contract should be included, specifying the account or policy number, effective date, and any other pertinent information that helps identify the property being renounced. 3. Intention to Renounce: The document should clearly state the renouncing party's intention to disclaim any interest, right, or claim to the benefits arising from the life insurance or annuity contract. 4. Legal Acknowledgment: It is crucial to acknowledge that the renouncing party fully understands the consequences of renouncing the benefits and that it is a voluntary act done without any form of coercion or intimidation. 5. Signatures: Both the renouncing party and a witness should sign and date the document. The witness should not be a beneficiary of the property being renounced. When renouncing and disclaiming property from a life insurance or annuity contract in Thousand Oaks, California, it is advisable to consult with an attorney to ensure compliance with state laws and to understand the potential ramifications of this legal action. This detailed description provides an overview of the various types and key elements associated with Thousand Oaks California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.