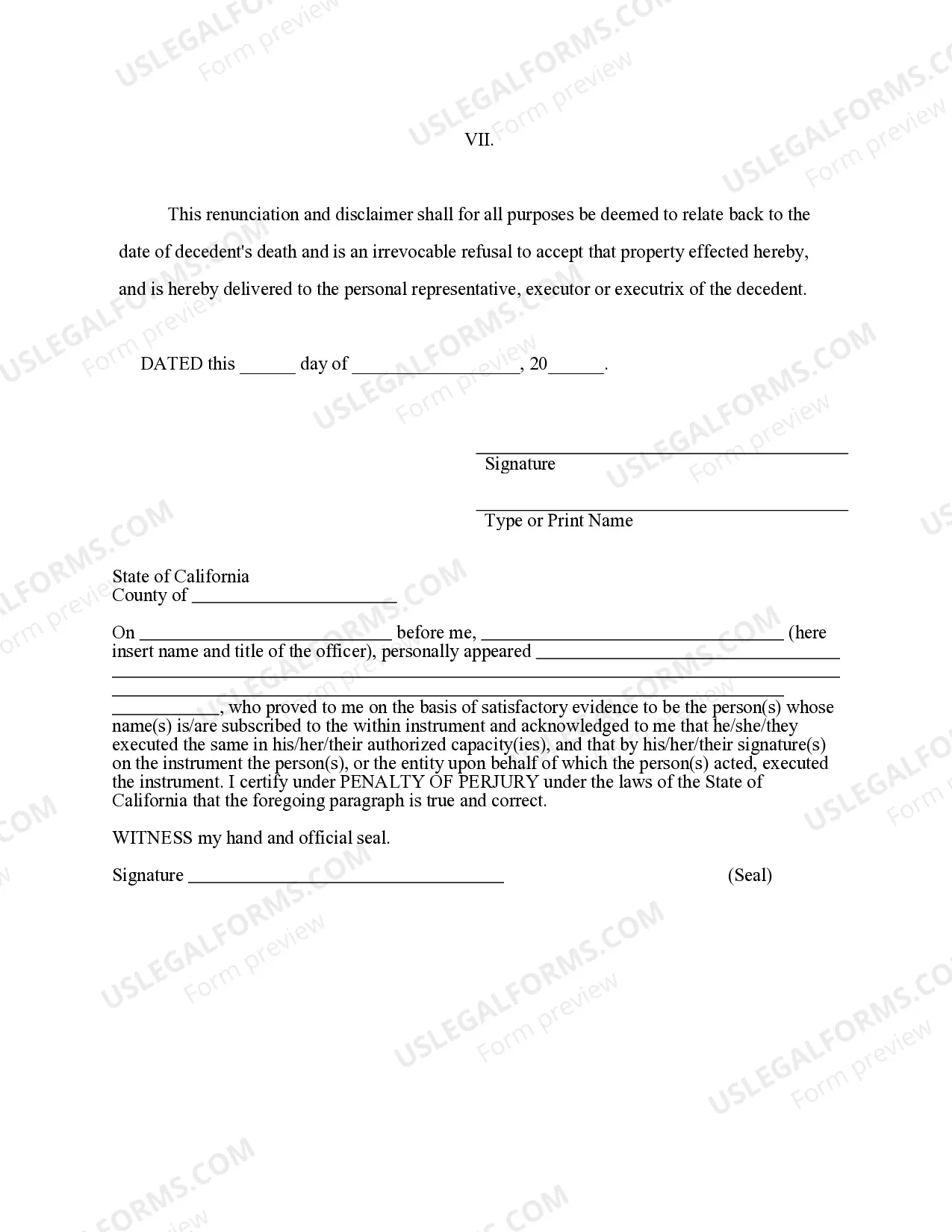

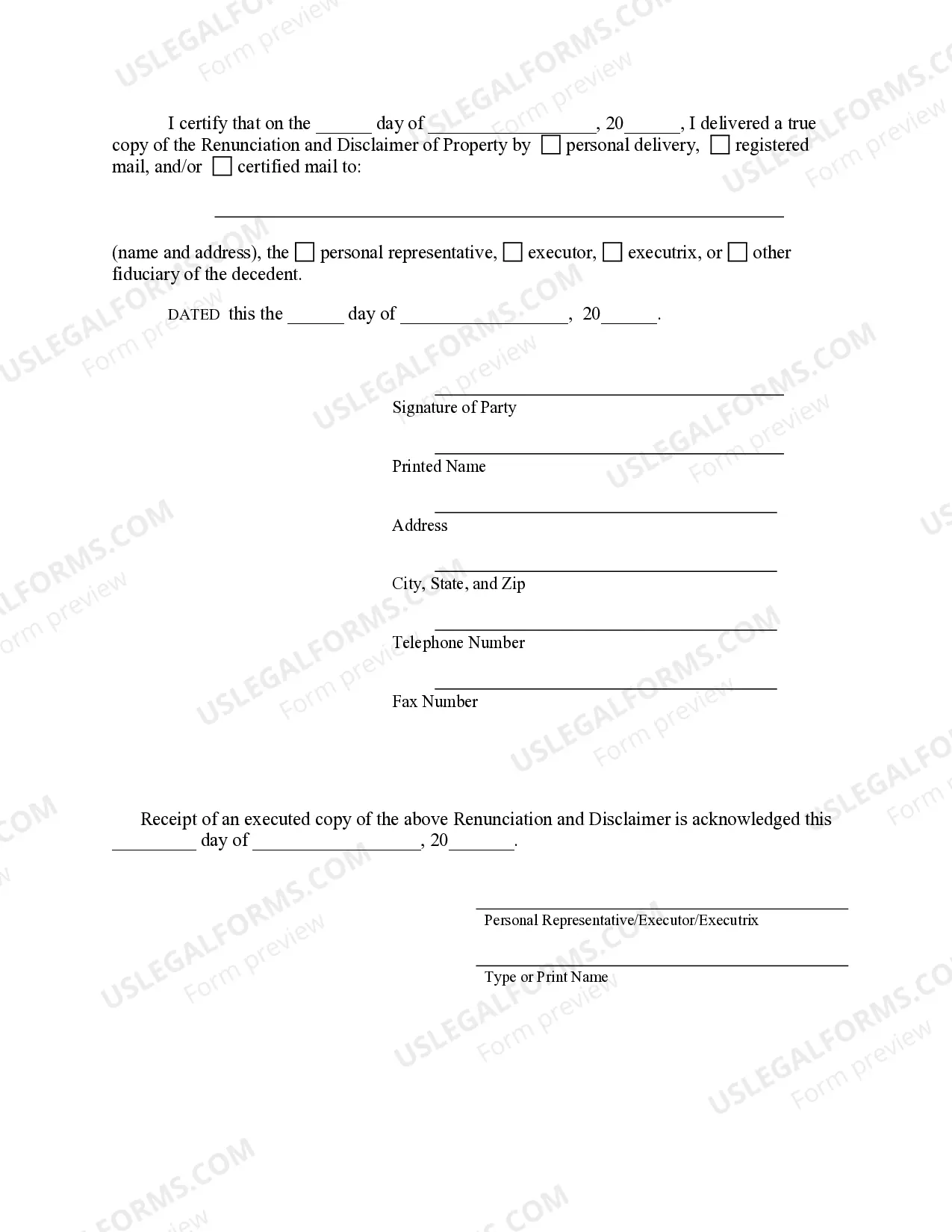

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Victorville California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract: If you find yourself in a situation where you need to disclaim or renounce property from a life insurance or annuity contract in Victorville, California, it's essential to understand the details of this legal process. Renunciation and disclaimer refer to actions taken by a beneficiary who voluntarily chooses to give up or refuse their rights and interests in an inheritance or a specific asset. Types of Renunciation And Disclaimer: 1. Renunciation of Property: Renunciation is the process where a beneficiary decides to decline their rights to property received through a life insurance or annuity contract. In Victorville, California, this renunciation must be done with a written statement explicitly stating the intent to renounce the property. The renounced property will then be treated as if the beneficiary predeceased the policyholder or annuity owner. 2. Disclaimer of Property: The disclaimer of property is another option available for beneficiaries in Victorville, California. This process involves issuing a written document stating that the beneficiary does not wish to accept the property offered in a life insurance or annuity contract. By disclaiming the property, the beneficiary effectively refuses any claims or interests in the asset, allowing it to pass to the next eligible beneficiary or as per the terms of the contract. Steps for Renunciation And Disclaimer in Victorville, California: 1. Understand the Legal Requirements: Before proceeding with renunciation or disclaimer, it is crucial to familiarize yourself with the legal requirements in Victorville, California. Research the state laws, consult with an attorney, or seek professional advice to ensure compliance with the governing regulations. 2. Review the Life Insurance or Annuity Contract: Carefully review the terms and conditions of the life insurance or annuity contract in question to understand your rights, responsibilities, and the process involved in renouncing or disclaiming any property. Make note of any specific instructions or deadlines outlined in the contract. 3. Consult an Attorney: It is highly advisable to seek legal counsel to navigate the renunciation or disclaimer process. An attorney experienced in estate planning or probate matters can provide guidance, help prepare the necessary documents, and ensure compliance with all legal requirements. 4. Prepare a Written Statement: To officially renounce or disclaim property from a life insurance or annuity contract, a written statement must be drafted. Include your full name, details of the contract, specific property or assets being renounced or disclaimed, and clearly express your intent to renounce or disclaim the property. 5. File the Written Statement: After preparing the written statement, file it with the appropriate authorities as per the instructions provided in the contract or state laws. This may involve submitting the statement to the insurance company, executor, or the probate court overseeing the administration of the estate. 6. Seek Professional Advice for Tax Implications: Renunciation or disclaimer of property may have tax implications. To understand the potential tax consequences or any impact on your own financial situation, it is essential to consult with a tax professional or financial advisor who can guide you through the process. Renouncing or disclaiming property from a life insurance or annuity contract in Victorville, California, requires careful consideration and adherence to legal procedures. Seek professional advice, understand the implications, and ensure compliance with all applicable laws to navigate this process successfully.Victorville California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract: If you find yourself in a situation where you need to disclaim or renounce property from a life insurance or annuity contract in Victorville, California, it's essential to understand the details of this legal process. Renunciation and disclaimer refer to actions taken by a beneficiary who voluntarily chooses to give up or refuse their rights and interests in an inheritance or a specific asset. Types of Renunciation And Disclaimer: 1. Renunciation of Property: Renunciation is the process where a beneficiary decides to decline their rights to property received through a life insurance or annuity contract. In Victorville, California, this renunciation must be done with a written statement explicitly stating the intent to renounce the property. The renounced property will then be treated as if the beneficiary predeceased the policyholder or annuity owner. 2. Disclaimer of Property: The disclaimer of property is another option available for beneficiaries in Victorville, California. This process involves issuing a written document stating that the beneficiary does not wish to accept the property offered in a life insurance or annuity contract. By disclaiming the property, the beneficiary effectively refuses any claims or interests in the asset, allowing it to pass to the next eligible beneficiary or as per the terms of the contract. Steps for Renunciation And Disclaimer in Victorville, California: 1. Understand the Legal Requirements: Before proceeding with renunciation or disclaimer, it is crucial to familiarize yourself with the legal requirements in Victorville, California. Research the state laws, consult with an attorney, or seek professional advice to ensure compliance with the governing regulations. 2. Review the Life Insurance or Annuity Contract: Carefully review the terms and conditions of the life insurance or annuity contract in question to understand your rights, responsibilities, and the process involved in renouncing or disclaiming any property. Make note of any specific instructions or deadlines outlined in the contract. 3. Consult an Attorney: It is highly advisable to seek legal counsel to navigate the renunciation or disclaimer process. An attorney experienced in estate planning or probate matters can provide guidance, help prepare the necessary documents, and ensure compliance with all legal requirements. 4. Prepare a Written Statement: To officially renounce or disclaim property from a life insurance or annuity contract, a written statement must be drafted. Include your full name, details of the contract, specific property or assets being renounced or disclaimed, and clearly express your intent to renounce or disclaim the property. 5. File the Written Statement: After preparing the written statement, file it with the appropriate authorities as per the instructions provided in the contract or state laws. This may involve submitting the statement to the insurance company, executor, or the probate court overseeing the administration of the estate. 6. Seek Professional Advice for Tax Implications: Renunciation or disclaimer of property may have tax implications. To understand the potential tax consequences or any impact on your own financial situation, it is essential to consult with a tax professional or financial advisor who can guide you through the process. Renouncing or disclaiming property from a life insurance or annuity contract in Victorville, California, requires careful consideration and adherence to legal procedures. Seek professional advice, understand the implications, and ensure compliance with all applicable laws to navigate this process successfully.